Profile

I am twenty-nine years old. I work as an assistant production manager and my yearly salary is $52,000.

Saving & Spending

Ugh. This is a month I don’t really ever want to repeat.

Financially, it’s actually been a good one. It was a 5 payday instead of 4 payday month and I wound up side hustling about the equivalent of an extra paycheck.

I managed to add some more to my IRA this month. Then I made a questionable money decision, that I realize is rooted way more in emotion than logic, and decided to renew the insurance on my car for another year.

I justified it in my head by thinking that I’d probably just move back to New Jersey anyway when my lease is up in January, and I’ll probably want my car then, but really, I think it’s just sort of a safety blanket. As long as I have my car, I can escape. From what, I don’t really know, but I’ve been a wanderer too long and 6 months in one place is really starting to get to me.

Whatever the reason, there goes $1,120 that I am well aware would be put to better use in my IRA.

Emotionally, this month is kicking my butt because my grandmother is really sick and I spend every day off at my parent’s house trying to help take care of her. This has led to thinking a lot more about life, death and what actually matters rather than money, but I’ve also thought about how useful it is to have plenty of it in this situation too. Maybe when it’s not so raw and I’m less exhausted, I’ll revisit the subject.

To compound that, while I did wind up making a fair bit of side hustle money this month, it was a really bad time to have so many extra things on my plate. I’ve definitely been re-thinking when side hustling is worth it. It’s not like I actively looked for most of these gigs either, they all just feel in my lap after sending out feelers months ago. The show I stage managed, I even offered to set them up with a replacement SM before I had attended a rehearsal or done any work for them, but they weren’t having it.

On the flip side, I also learned there are certain really useful side hustles, and I think freelance writing is one of them. When you’re taking care of someone who just sleeps for hours, having something like that to do while I sit in a chair near her bed is awesome. You can only blankly stare at Facebook so long…

Anyway. Back to finance. I checked out my credit score for the first time since opening that Barclay’s card a few months ago, expecting to see a small ding from the credit check. Wrong. It went up 20 points. This was exciting, because I was checking it so I could open an additional card – a Chase card linked to United Airlines. Newark airport is a United hub and I’m about 3,000 miles short on frequent flier miles for a plane ticket. The card attaches to your frequent flier number, so I’m actually thinking I’ll use that card to get to FinCon and then the Barclay’s card to cover my half of the hotel expenses (did you know the FinCon website has a way for you to find a roommate?).

I am also excited that my FinCon side hustle tally is up to $768.94. Competition aside, I’ve definitely been enjoying tracking how much I’m making with these side hustles. As someone who thought I couldn’t even manage a side hustle six months ago, I think I’m trudging along ok. If you are interested in joining the competition though, check out this post. It’s never too late!

I started trying to put 10 items up on eBay a week. I’ve got so much junk I just don’t need. Might as well try to turn it into some cash.

My spending has actually been down in all categories except NJ Transit tickets this month, but that’s not really surprising with all the time spent at my parents. It did help contribute to my ability to decide another year of insurance on the car was a go though. I looked at my bank account and realized the car insurance payment and the amount I planned to put in my IRA were both in it.

As for the birthday party plans, they’re a bit stalled. A friend of a friend heard about my idea to drunken roller skate and stole it. But she invited me along, so if it’s awesome maybe we’ll do it again. And if it’s a disaster – as I suspect drunken roller skating might be – at least someone will break their leg at her party instead of mine.

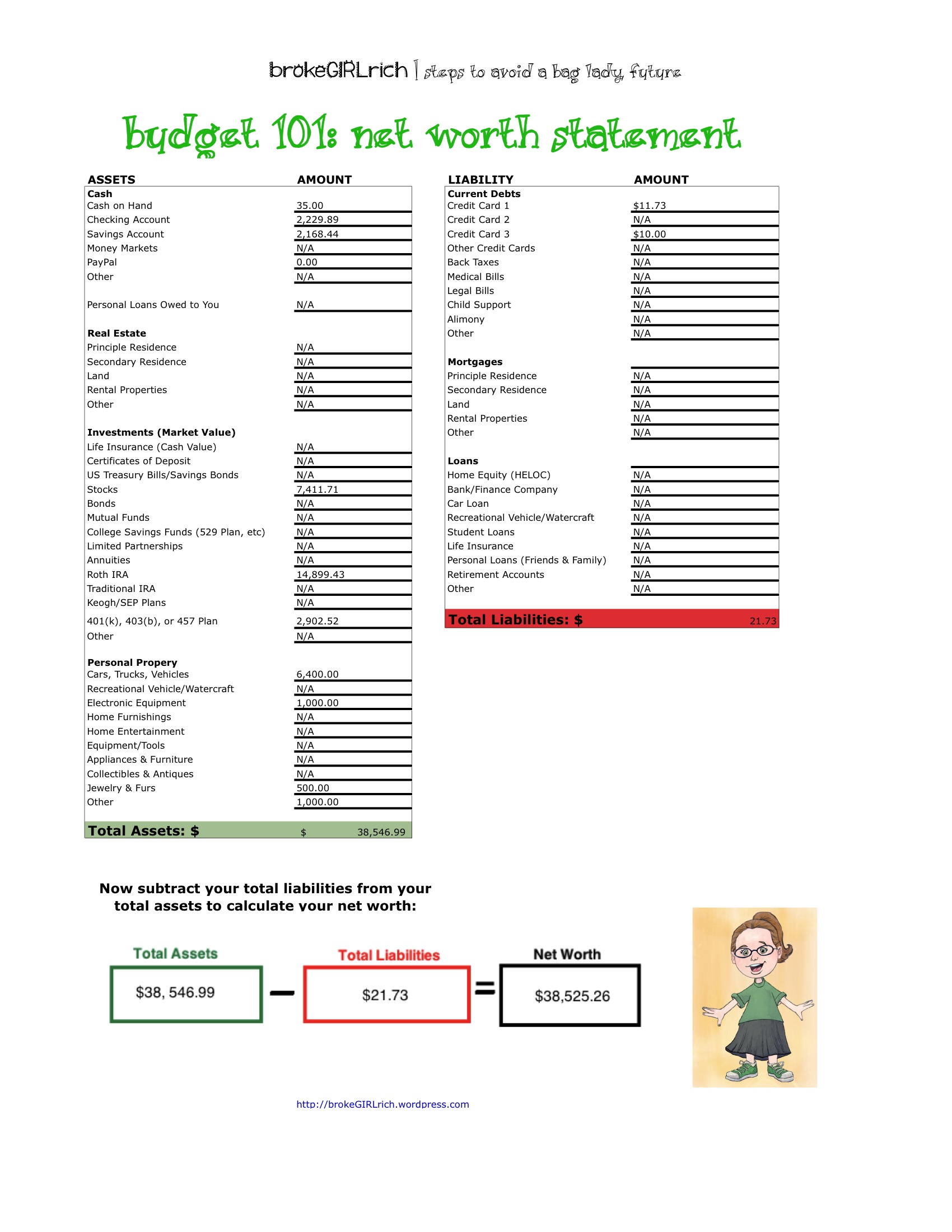

My goals are pretty much the same as last month. I’m still planning to contribute to my IRA, so I think I’ll be able to get that maxed out and I want to get my emergency savings up to at least $5,000 by the end of the year. I’d also like to invest in another stock.

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write this Month: Gift Card Swapping: “Why I ♥ the Latte Factor”

Guest Posts: True Story: I Lived on a Circus Train at Budgets Are Sexy

How to Make Money Being a Mystery Shopper at Vosa.com

European Budget Airlines at TravelBlueBook

*Part of Financially Savvy Saturdays on Femme Frugality and Monica on Money*

Let me know how the ebay listing goes. I tried to sell some of my unnecessary stuff a few months ago and failed miserably. Now I’ve got it sitting here in bags ready to go, but I really don’t want to just give it a way for free.

Stefanie @ The Broke and Beautiful Life recently posted…Tithing on Welfare

I often sell things on Ebay for extra cash. I cleaned out my closet a few weeks ago and listed some of my clothing on Ebay, which has been a nice way to bring in some extra cash lately. I’m impressed (and envious!) at how little debt you have!

Dee @ Color Me Frugal recently posted…Weekly Money Roundup #27

It wasn’t always that way, Dee! But I am reveling in the debt free status these days… I’ve got to admit, grad school is start to whisper my name again though and that’s never a good sign for my bank account.

I am so sorry to hear about your grandmother! Watching someone we love go through such a hard time definitely puts perspective on our life. And I had a client who did the same thing with the car insurance. We actually “fought” about it for a while because she never uses her car, but it was a safety net thing for her and she cut her costs in other areas to make it a financially viable choice.

Shannon @ Financially Blonde recently posted…Top Ten Military Movies

Yeah, I am pleased it was financially viable… also a persuasive example of what I can pull off if I’m really motivated. Coming up with an extra $1,120 was nothing to sneeze at.

Best wishes for your grandmother. Nice job on FinCon comp. Your halfway there. Keep up the great work!

Brian@ Debt Discipline recently posted…Week End Round Up #34.

I hope your grandma feels better soon! I’m always worried about my grandma now that I’ve moved away. She can be really stubborn when it comes to her health. Nice job on the side hustling for FinCon! I’m trying to figure out a way to get there via travel hacking.

E.M. recently posted…Pushing the Boundaries

Yeah, being away from family is definitely much harder than people who never leave think it is. Especially when something is going wrong at home.

I have 2 Barclay’s cards…one for united airlines. Got 40000 bonus miles at sign up. Don’t know if that’s better or worse than chase but thought I’d let you know! Can you cancel the insurance if you end up giving up the car and get a refund? I pay monthly since I have no financial incentive to pay all at once and can cancel at any time, but I’m not familiar with other policies as I’ve only been with one insurer my whole life though I’ve compared rates periodically

femmefrugality recently posted…Financially Savvy Saturdays: Fortieth Edition

I’m pretty sure you can get a refund if you cancel early, which helped influence my decision too. The financial incentive for paying it all at once isn’t huge, it’s only $30, but I like knowing it’s taken care of for the whole year.

Well $30 is $30! And its good to know that you have the options. I hear you on being a little stir crazy after 6 months …that’s always a struggle for me every time I resettle in Pittsburgh. I’m sorry about your grandma, too. Just went through something similar. It’s overwhelming on the emotions…so sad and hard. I’m thinking of you.

femmefrugality recently posted…Financially Savvy Saturdays: Fortieth Edition

When you apply for a credit card, you get a small ‘hit’ from the credit inquiry. But the increased amount of credit adds to your score. Also, at 29 years of age, you are probably still getting points for credit longevity. Assuming you are paying you bills, you should have well over 700 always.

No Nonsense Landlord recently posted…How to Get Rid of a Mattress for Free

I am. It was at 754 when I applied for the card and jumped up to 778 after getting it, but it also came with a surprisingly high limit.

I am so sorry to hear about your Grandmother. My grandmother has been sick recently as well, and it really puts things into perspective, doesn’t it? I love side hustling, but it’s super busy and not for everyone. Especially at certain times, it can be quite exhausting.

Daisy @ Prairie Eco Thrifter recently posted…Save Money – Make Shoes Last

Thanks. It sure does put things into perspective – from how little so many things actually matter to why it’s important to be financially secure so that you can just up and leave and afford train or plane tickets. Even to why it matters to be financially secure when you’re older, because being able to afford good health care and medical help at home is really important.

I think it’s so thoughtful of you to see your grandmother and try to help out your family every day. I hope she gets better!

Lisa E. @ Lisa vs. the Loans recently posted…Links Lisa Likes – Adobo Cook Off