Lately I’ve been thinking a lot about when it’s ok to indulge the urge to splurge. While I’ve come to the conclusion that there is only one hard and fast rule, it’s still a definite gray area.

#1 Urge to Splurge Rule: Only splurge when you can afford it!

This isn’t really a quality versus price debate. I learned early on it’s worth it to pay fifty cents extra for Heinz instead of any off-brand ketchups.

This is about those days when you just want a fancy chocolate bar or the adorable ModCloth dress or a night out drinking with friends where you don’t pay close attention to what you’re spending. It’s when you don’t want to think about how much something costs, you just want to do it!

Should you always budget for those moments? Can you? Sometimes the urge is pretty strong and comes out of seemingly nowhere.

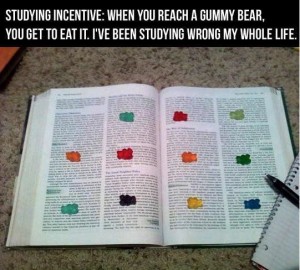

I’ll be the first to admit, an entitlement mentality can really bite you in the behind. I finished grad school with a whopping 15 pounds packed on over one year by bribing myself to read each chapter with a candy bar. I felt entitled to eat it because I had made it through an incredibly boring research project.

Financially, the candy bars weren’t a huge deal. And I was super cash strapped back then too, so they made sense to me as a reward. Health-wise though, that entitled feeling really bit me in the behind.

Even now, I spend most of my free time going home to New Jersey to help my mom with a really sick family member. The amount of Dunkin Donuts I have started to consume is ridiculous, but that same feeling of being entitled to splurge because of something I’m doing is totally connected to it. My best friend called and offered to get me out of the house for a few hours last weekend. We totally hit the mall and grabbed dinner and I can’t remember the last time I spent that much without a second thought.

Seriously, when I came to my senses the next day, I returned a bunch of stuff. But I was still a little astounded at how hard the urge to splurge can hit when you’re stressed out.

And while there’s a dark side to the splurge, it’s got its good moments too. I’ve planned trips with very budget conscious friends where I had to push them to spend more money, because, you know, if we’re going to pay to get over to England, we’re going to see some things properly. Even if it means spending a little while we’re over there.

Sometimes this works out. One friend never wanted to pay for the guided tour of anything. She took out two tour books from the library and read them on the plane and shared them with us. This actually turned out fine.

London is freaking big. Get a Tube pass. Also, don’t try to walk from the Louvre to the Eiffel Tower. It’s way farther than it looks.

Sometimes this does not work out. One friend was convinced we could walk almost everywhere and should not get a weekly subway pass. We wound up spending twice as much one several individual passes and the amount of time we wasted walking (and getting lost) was ridiculous.

I splurge on metropasses everywhere I go. It’s the only way I can save my legs.. otherwise it’s just too grueling to walk all that distance for 16 hours a day, for 3 months on vacation.

AS for clothes, I splurge on good stuff. Modcloth is full of cute dresses but if it’s polyester, I pass. It seems to have worked out really well.

save. spend. splurge. recently posted…Are you really as rich as you think you are?

Yeah, I’ve since learned that the weekly or whatever subway passes in different cities are almost always the way to go! And, honestly, they’re not that expensive. I think it also takes some time to learn the difference between something feeling like a splurge and something just being worth it’s cost.

If you’re buying quality clothes, I don’t think it’s a splurge. ModCloth definitely has some adorable stuff and some of it’s just such crap. I’ve learned that while I might love that dress on the site, once I get it and try it on, it’s likely to be pretty shoddily made. At least they have a great return policy.

I think the periodic “small” splurge keeps you motivated toward your goal. There are also the “once in a lifetime opportunities” that should be enjoyed. My wife and I are planning to take our son on a roadtrip (10-12 months) across North America. Will that year set back our saving and investing? Yes, but will it be a growing experience that we’ll never forget? Absolutely. Therefore, we just have to go!

-Bryan

Income Surfer recently posted…How SHOULD Aging Construction Workers be Treated?

That’s so cool! I LOVE road trips (and you should totally check out a twine ball if you go near Darwin, Minnesota or Cawker City, Kansas)!

Making memories like that together are pretty much always worth the cost. I’ve never regretted anything I’ve spent on traveling.

Great post! The occasional splurge can make you feel great, if, as you say you can afford it and it won’t break the budget or mean that something really important like ‘the rent’ doesn’t get paid. It is important to get the emotional triggers sorted out too, and to check we are not splurging to fill some emotional void.

It’s true. Emotions can definitely make your wallet take a hit.

I think it depends on your finances. If you can do it withing your budget or goals then I’m okay with it. I do think it’s important to reward or splurge on yourself from time to time, even if its something small like that Starbucks coffee or Ice cream. It will help keep you moving towards the bigger goal.

Brian@ Debt Discipline recently posted…Return on Investment

I agree, little splurges are definitely great motivators.

Whenever I do splurge a little and buy myself something unplanned, I hold on to the receipt for a few weeks. If I haven’t cut off the tags and started wearing or using the item, I know that I have the option to return it. A splurge for me these days is spending $20 or less, though, otherwise I feel too guilty!

Lauren recently posted…How to Get Around These Common Writer Roadblocks

That is an awesome idea!!

When traveling it’s hard to know when something will be worthwhile or not, simply because you don’t know the area as well as home. I do as much research ahead of time as possible, but there’s always something I know I could’ve gotten a better deal on.

Stefanie @ The Broke and Beautiful Life recently posted…I’m a Car Virgin: What To Know When Buying Your First Car

I agree, it’s definitely much easier to “waste” money on a vacation, but I’ve found that I’d rather waste a little bit than miss a lot of opportunities for fear of spending the money.

…and the blog about how awful experience X or Y was and why no one should ever spend their money on it 😉

I’ve totally read info on the plane to skip the tour guide. But then I’ve also had stress buys. I get really bad buyers remorse and return things like you did most of the time.

femmefrugality recently posted…Ruins & Tours in Tulum

Yeah, it’s not actually so bad as long as I make the return. I got the temporary high/stress relief and then fixed it when I returned to my senses. I’d almost say I’m worse about not keeping clothes when maybe it is time for some new ones.

I think the key to splurging is to be deliberate about it. Even if it’s on a random thing. Like, I know my need for a cold frosty drink will overtake me at some point this month, so I stock up on the stuff to make it at the beginning of the month and I know I only get the one hit before my famn damily sucks it all up.

Melissa French, The More With Less Mom recently posted…June Real Food Monthly Meal Plan

I think there always needs to be balance! If you can afford it, some things are certainly worth the splurge!

Rachel G recently posted…To Texas and Back

I think splurging every once in awhile – as long as you can afford it – is only healthy. I can’t imagine living my life never, ever splurging and only ever playing by the “rules” of how much I can spend on something.

Daisy @ Add Vodka recently posted…Tired of Buying Tires

I agree. I can’t imagine there’s someone who actually does budget everything down to the penny – even a candy bar at the checkout in the grocery store or a cute shirt when you’re strolling the mall.

Thank you for sharing this post at City of Creative Dream’s City of Links on Friday! I appreciate you taking the time to party with me. Hope to see you again this week 🙂

Shanice recently posted…Yummy Love Child Organics

AH! This strikes such a chord with me. When I have work that keeps me up late at night, or when I’m struggling to get through a tough project, I often set out food “rewards.” It motivates me to finish my work, but then the next day I feel crappy about eating food that I wouldn’t normally and I get stressed about having to work out extra…so really it’s just a destructive cycle!

Emma @ emmalincoln.com recently posted…how much does the american dream cost?

I know. It’s really tough to kick the food as a reward mentality. I sure haven’t managed to yet.