Sometimes when I’m feeling a little unmotivated, I like to daydream about what I’ll use my retirement fund for.

To be honest, when I first opened my Roth IRA, I used to mutter “Old Mel will be happy you’re doing this” as I transferred over large chunks of my paychecks. It was the only financial things I did for myself during the years of paying back student loans. It was really painful, quite honestly, to max that sucker out.

I opened my Roth IRA at 25, but have managed to max it out every years since 27. A mere 6 years after opening, Older than 25 Mel is already happy it exists. It is the largest chunk of my net worth and watching it grow makes me pretty proud.

Assuming a 6% annual return, that I continue to max it out each year, and that I don’t retire until 68, from my Roth IRA alone, I should have a little over $962,000 (I used this cool calculator from BankRate to figure that number out).

Not too shabby from $225,500 of actual contributions.

But when I’m looking at the $458.33 that I monthly have to transfer into this account to max it out each year, there are times when I think about all the other things I could do with that money.

So my responsible brain battles back and reminds me that Old Mel will like to buy things too, and here are some of the things we can buy with that nearly million dollars.

- Food, Shelter and Clothing (Old Mel brain is very practical).

- A vacation to Antarctica or Asia, assuming we haven’t made it there yet (all 7 continents or bust!).

- An annual vacation to pretty much anywhere in the world for 10-15 years.

- Tons and tons of plane tickets to visit any imaginary kids or grandkids – or, more likely, to visit my brother’s kids and grandkids because I will be their favorite crazy aunt who spoils them rotten.

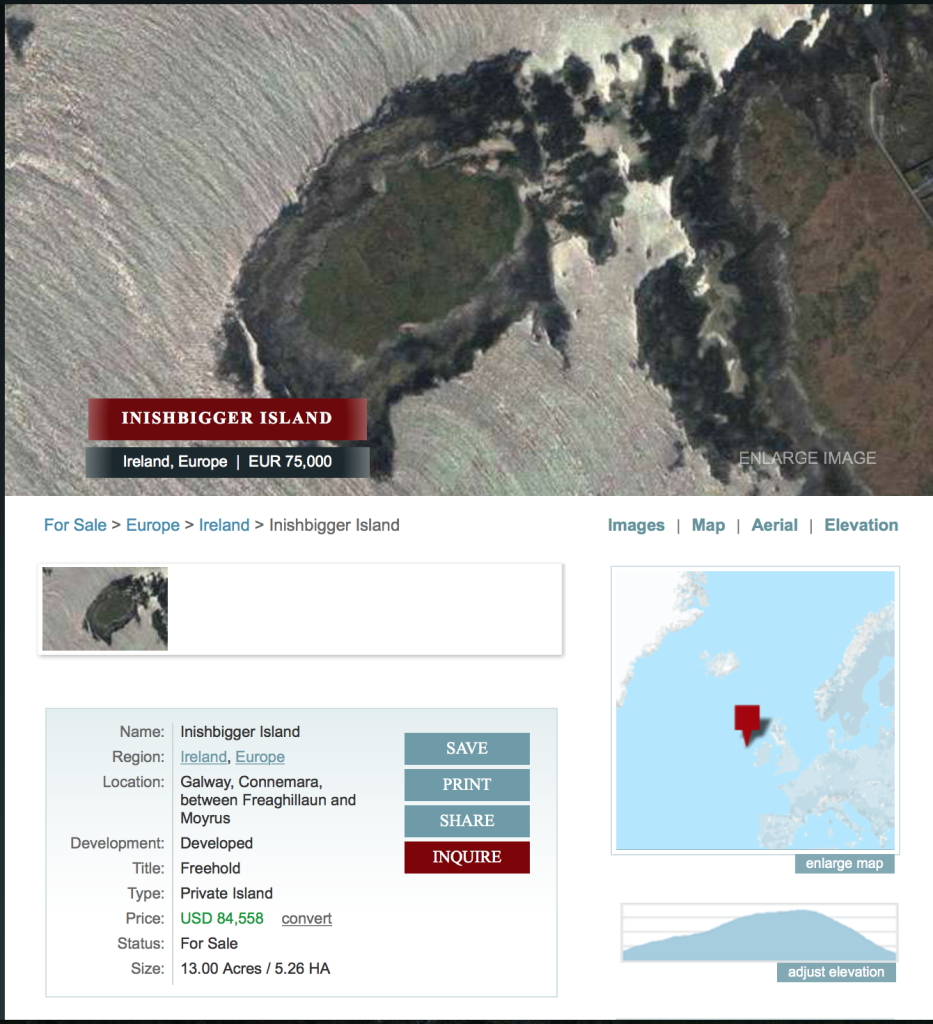

- My own island in Ireland (this is actually way cheaper than I thought it would be).

On the flip side, things I would probably do with an extra $458.33 this month:

- Eat out more often.

- Buy several ModCloth dresses.

- Go to the movies with friends.

- Make random impulse buys.

- Maybe invest a little of it or sock it away for a different savings goal.

As we can clearly see – Old Mel is wiser and makes much cooler decisions, like buying her own Gaelic island. Clearly, she should be the one allowed to make the money decisions.

What do you want to do with your IRA?

Ha, yes, Old Mel is definitely a wise little lady. I haven’t came up with any lofty goals for those retirement years, but I do know that I want to be able to take off at the drop of a hat when my kids need me, so I’ll definitely need funds for that. There’s no telling what I’ll be doing, but I’d bet I’d enjoy it.

Latoya @ Femme Frugality recently posted…403(b) from a previous employer? Roll it over.

That’s a pretty cool goal. My grandparents used to jet down to Florida all the time and see my aunt and cousins. I’m sure it cost a bit, but they were in a position to be able to do it easily.

Always good to dream. I guess this is a point in life that I’ve not gotten to in terms of planning or imagining. I wonder what that means, LOL.

Money Beagle recently posted…We Finally Tried Qdoba For The First Time

What? Seize your island-owning dreams, man!

The Roth IRA is my second favorite financial tool behind the Health Savings Account. When we retire, we definitely have big travel plans, but we plan to have a small home and the money to be able to hire someone to do everything for us to maintain our home and our day to day living. It’s also extremely important to us to never end up in nursing homes, so we plan to save a couple hundred thousand just for that goal alone. And lastly, we hope to be able to set aside money for each of our kids when we pass away.

Those are a bunch of really awesome plans!

That’s a fun idea to keep motivated! Who knew islands we so affordable?!

Heather @ Simply Save recently posted…Best Financial Decisions: What’s Yours?

I know, right? I suspect just to buy – who knows what the upkeep on a flipping island is though?!?

I think about this a lot too. Honestly, for Millennials and other younger Americans, the nature of work going forward might make true “retirement” a bit obsolete. I mean, think about it: already, Americans make more money than ever before from the “gig economy,” including things like blogging! I’ll probably still be able to maintain a blog when I’m 75. Or 80! It’s not certain to me that true retirement — earning absolutely no income — will exist in the future, so we might get lucky and get to spend down our IRA’s on island vacations!

Frank Facts recently posted…How Does Your Net Worth Stack Up? 3 New Ways to Measure Your Net Worth

That’s true. I do think we’re all likely to pick up forms of side hustles that carry over into “retirement” in ways previous generations didn’t.

What an awesome post! I want to buy my own Norwegian island now for Old Lindsay. I better start saving up.

Seriously, though, this is a great post to convince people why saving is important. I’m sorry, but a a Norwegian island beats a giant house and a fancy car any day.

Lindsay @ the Notorious D.E.B.T. recently posted…Cooking Tips For People Who Hate Cooking: Find And Collect Recipes

Oh, yeah, totally.

Awesome post! It is so easy to think of all the things we would do with our money now instead of living the life we want later. This really puts it in to perspective.

Tia @ financiallyfitandfab recently posted…3 Apps to Start Investing with $5 or Less

Old Gary (yeah, that’s me, I’m old already) is spending his IRA money on food, shelter, regular expenses, a reasonably small amount of entertainment, and a vacation every year or so. Oh and healthcare costs. Lots and lots of healthcare costs. It’s not exactly fun to dream of spending money on medical issues, but it’s a reality many of us have to face. I’m just glad I don’t have to choose between buying my medications and having a reasonable standard of living.

Gary @ Super Saving Tips recently posted…9 More Unusual Ways to Earn Extra Money

I love old versus young me, and wish young me had socked away a bit more instead of eating out so much and buying so many video games and books. Middle aged me is torn between saving more for retirement or saving more for college tuition, since Little Bit starts college the year I turn 61 (and Jon turns 69). While I’d love to be saving for my own beach front home, I’m pretty sure I’m saving for food, shelter, and medical care…with occasional trips to the beach.

Emily @ JohnJaneDoe recently posted…Riding on Moonshine: Our Energy Savings Update

That’s funny, we have been looking at some islands recently. Not as a serious option of course, but we were indeed surprised by the prices. Pleasantly surprised!

I would probably try to get my hands on a tropical island and live off coconuts and fish. Go all Survivor.

Mrs. CTC recently posted…How Personal Finance Blogs Ruined My Career

i can imagine it was painful transferring money to your IRA a few years back when your finances weren’t in quite so good shape each month. And the amount you’ll get at the end is amazing!

Out of interest, how does an IRA work if the worst happens (sorry, I know no-one likes to think of this) – if you don’t get chance to spend your retirement money. Can you leave it to someone in a will? Things seem a bit complicated in the UK when it comes to leaving your pension to a beneficiary, there are rules around tax for example.

Hayley @ Disease Called Debt recently posted…Financially Savvy Saturdays #139

You do set a beneficiary on it and they would receive it. You do still have to pay some kind of estate tax on it, but the withdraws are still tax free. There would also be additional taxes if you haven’t had that Roth IRA open for 5 years, but mine is 7 years old, so it’s past that issue.

Pingback: 5 Ways To Motivate Yourself To Save For Retirement - Notorious D.E.B.T.