Struggling with debt? Here are a few methods to help get your Pete under control and on his way to the curb.

1.) Snowballer – this is Dave Ramsey’s extremely popular method of ranking all of your debts from highest to lowest, start with the lowest one and direct all the extra cash you can find towards it while still making minimum payments on any others. Once that bill is paid off, redirect the money you were using on that payment and any additional money you can scrounge up towards the next lowest bill. You continue until all your bills are paid off. This is a great method for people who need to see some progress happening pretty quickly. It definitely makes you feel like all your work is making a difference.

2.) Avalanche Avenger – the debt avalanche is a different take on Dave Ramsey’s debt snowball that is actually the most cost effective way to pay off your debt, however, it may take a little longer to start seeing the effects of all your hard work. To use this method, you’ll rank your debt by interest rates instead of the overall total of the debt and begin by putting all extra cash towards paying off the debt with the highest interest rates. Once the credit card or loan with the highest interest rate is paid off, move onto the next highest interest rate. This is a great method for people who feel confident in committing to their budget repayment goals and can feel good about their efforts just by seeing the balances begin to drop.

3.) Become a Budget Bombshell – This is probably a method you’ll want to use in conjunction with #1 or #2, but really getting your budget in order and then slicing out as much as you can to put towards debt repayment will really help you out. Figure out how much money you owe and then figure out how long it will take you to pay it off using your current payment system. If you’re happy with that number, great (or maybe not happy, but it’s a number you can live with)! If not, you’ll need to figure out how to increase your payments. If you cancel the cable TV, how much does adding that to your payments shorten your time in debt? Gym memberships? Buying lunch at the office? Cut it down as much as you can stand. I really think it helps to see how much time it’ll save you on your debt repayment plan. I’d even recommend writing it down somewhere prominently so on mornings when you think “I can’t eat peanut butter and jelly one more time this week!!” You remember that packing your own lunch is getting you out of debt 3 months sooner overall… and the jelly tastes a little more tolerable.

4.) Side Hustlin’ Superstar – Perhaps you’ve cut down your budget to the bare bones, now it’s time to become a side hustlin’ superstar. For YEARS, I thought I could never be a side hustler, only to realize lately that I already was. On vacations from school I would substitute teach. In NJ it takes a whopping 60 college credits (I started college with around 40 from AP courses) and passing a criminal background check. By my second semester of college, I could substitute teach during holidays and other school breaks and pick up some extra cash outside of my student worker job. Side hustling encompasses so much more than I think we start out thinking it does. Is it tough to get your foot in the door as a freelance writer? It sure is. Does it require some amount of artistic craftiness to start a successful Etsy store? Yup. Are you up against thousands upon thousands of people on Fiverr? Sure are. But there’s more to side hustling than these often toted practices. The Penny Hoarder has an incredible collection of side hustle ideas and J. Money has a whole series on side hustling over at Budgets Are Sexy. Got a free hour five days a week when most people are at work? You could probably be a pet walker. Not scared of snot and Cheerios? Baby-sitting is probably one of the oldest side hustles there is. SAHM who runs a lot of errands anyway? Maybe secret shopper is the side hustle for you. Work a typical 9 to 5? Now might be the time to look into waitressing, bartending, any sort of second job that’ll bring in some more income to chip down at your debt. Even if you don’t like it, you won’t have to do it forever… or you may find bartending is a blast (seriously, several of my friends actually love being bartenders and they make bank, especially in big cities. You may need experience or to pass a class, but Living Social and Groupon always have deals and if you’re going to commit to doing it, you’ll make the money back soon enough).

5.) Balance Transformer – So you’ve chosen #1 or #2, nailed #3 and moved onto #4 and you are trucking away at blowing that debt out of the water. Now is the time to research the benefits of balance transfers. There are many times where if you’re sure you can get a debt repaid within a certain amount of time, transferring the balance can save you a good chunk on interest fees. If you’re going to do this though, you want to be sure that you’ll have that sucker paid off before any benefits you get from the balance transfer end. On the flip side, it’s also worth researching debt consolidation companies or debt management programs to see if their benefits can help you any at the start of your debt repayment journey

Bonus: Radical Lifestyle Change

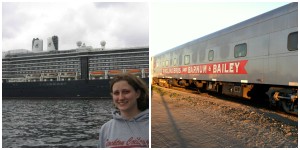

I’m adding this as a bonus because I realize most people are not in a position to use this system, but it is the one I went with. Also, it seems to work best for young, unattached folks, although it can work for anyone if you want it to (seriously, the circus is set up to house and educate families with kids of all ages – 4 teachers live on that train). What I consider a radical lifestyle change is taking a job where most of your bills are covered as part of your compensation package and you’re essentially able to turn over 80-90% of your income to your debt repayment plan. Personally, I went to work for a cruise line right after college and then I worked for the circus. In both cases, all of my living expenses were covered by my job – the cruise line even fed me – and most months I turned over about 80% of my paycheck to pay down my debt, which is how I paid off $30,000 in two and a half years while averaging a salary of about $32,000 (it would’ve gone even quicker except I have a bad travel habit and when I worked for the circus I brought my car on tour with me, which cost a pretty big chunk of money). There are other jobs that also minimize your living expenses, such as teaching English as a second language in foreign countries, working as a tour guide or at some vacation resorts. You can even join the military (which has a ton of overall benefits, but was just not for me – although thanks, veterans, I appreciate being free).

You can enter to win a copy of Suze Orman’s The Money Book for the Young, Fabulous & Broke until 12/31 for even better finance tips.

brokeGIRLrich readers, what’s the craziest thing you’ve done to pay down your debt?

This post is *Part of Financially Savvy Saturdays on Femme Frugality and Eve of Reduction* and:

All great tips! All about what works best for you, the key is to stop over spending.

If we didn’t have our dog, we would totally try working for a cruise line. I know of a ton of people who have been able to make and save so much money doing that!

We are bombshelling it over here. Hopefully to be credit card debt free by mid-2014.

Michelle @fitisthenewpoor recently posted…Cheap Wrapping Paper Alternatives

Yeah, lots of people seem to have anchors into their current life that make it difficult to just up and run off. I started so young doing these weird things that I just never developed any… it seems to have turned me into a rather strange gypsy-ish person.

And dang, way to go with your debt!

I love your ideas here. I’m really wanting to learn more about side hustles so I’ll be sure to check out the blogs you listed.

Now had I had the guts (and I didn’t. I did what was expected rather than what I wanted), I would have done what you did and took off right after college. Talk about adventure and experiences. Good for you for doing that!

Missy Homemaker recently posted…Mothering Boys: Sometimes I don’t look.

Thanks! The adventures were definitely incredible. I can’t imagine any way my 20’s could’ve been more awesome.

Great article and great ideas!

Bonnie @ Our Secondhand House recently posted…Instagram Photo Challenge

I definitely struggle with overspending…knowing I can’t afford it, but somehow justifying it anyway. I am currently working on getting my debt paid off, but it isn’t easy. I love these ideas!

It’s definitely difficult to get out of debt and stay out of it, but it’s totally worth it. It’s such a load off your mind once you don’t have to worry about how you’re going to make that bill payment every month.

We used the “Debt Snowball” method that Dave Ramsey advocates and we were able to pay off $52,000 in debt in 18 months. I highly recommend that method for people who are looking to get out of debt!

Deacon @ Well Kept Wallet recently posted…I’m a Stay at Home Husband, Well Sort of…

Great ideas. I have been working for 3 years to get out of debt from my divorce settlement. By March 2014 I will have achieved my goals. I will only have a car loan and mortgage left. It feels good to hit these benchmarks in my goal to be debt free by the time I retire. (BTW – Found your blog through the SITS girls Saturday Sharefest.)

http://www.LivingHappierAfter.com

Wilma Jones recently posted…5 Songs for December

Hey, thanks for stopping by – I love the Sharefest! And congrats on sticking to your goals! It feels great to finally achieve them.

I was into the whole post, but totally blown away by the bonus! Do you have posts about the cruiseline experience and circus job? If so, please show me where! If not, I would be so excited to read them! What a smart way to approach things! I had friends who went to China to teach English for the first year of their marriage. They had a stellar experience.

femmefrugality recently posted…Financially Savvy Saturdays: Seventeenth Edition

I haven’t really written anything about those jobs yet, but I guess I’ll add it to the docket.

Have you ever taken on more debt than you could pay off the next month? Why? Because I was ignorant to saving and spending money. I haven’t been stupid lately.

The Frugal Exerciser recently posted…Margarita Activewear

Pingback: Aspiring Blogger – Personal Finance Carnival #23 – December 20, 2013 | Aspiring Blogger

I recently decided I needed to pay down my credit card debts. I picked up Dave Ramsey’s book at the library. Now I need to get a budget together to get rid of my debt!

Well, hey, if you need a hand with that, I’ve got a bunch of posts about how I budget here.

You got some great tips here. I think this will work for me.

Thanks for sharing.

Good luck with your debt repayment!

Pingback: Carnival of Finanacial Camaraderie - Welcome To Winter Edition - MoneySmartGuides.com