Profile

I am thirty years old and where the heck did September go? I work as an assistant production manager and, my yearly salary is $53,560.

Saving & Spending

I managed to put a few hundred dollars more in my IRA, but not as much as I had hoped. On the plus side, I’m only $450 away from maxing it out for the year, which I will have no trouble hitting next month.

After that, the plan is to buy another $1,000 in stock and then start beefing up my emergency savings account again until it’s at $5,000. I have a goal of $10,000 overall, but I want to reassess how I’m prioritizing my savings once it hits $5,000.

Spending-wise, my net worth is a tiny bit more skewed than it should be. I picked up another side hustle this month shopping and making props for a production of Edward II. I have to turn in my receipts next weekend, and I won’t be reimbursed until then, so I’ve got about $400 extra on my credit card. But yay for essentially free points, right?

I picked up a new gig that pays a little making Pinterest pins for another website (do you hate making pinnable images? I could be making them for you! Let’s talk!).

Spending was again mostly based off of weekend jaunts to visit with friends. I headed out to Baltimore for the first weekend in September to hang out with one of my besties. From her apartment, we drove an hour on Saturday to a winery across the border of Pennsylvania for another friend’s birthday party. It really wasn’t a super expensive weekend.

The next weekend I headed out to Northern New Jersey to celebrate another good friend getting her Master’s degree. I picked up a $20 bottle of vodka as a gift and dropped about $20 in train tickets, but since we just spent the weekend at her and husbands house, that was it.

The big expense of the month was FinCon, but I was prepared for it. And it was awesome. I can’t wait for next year.

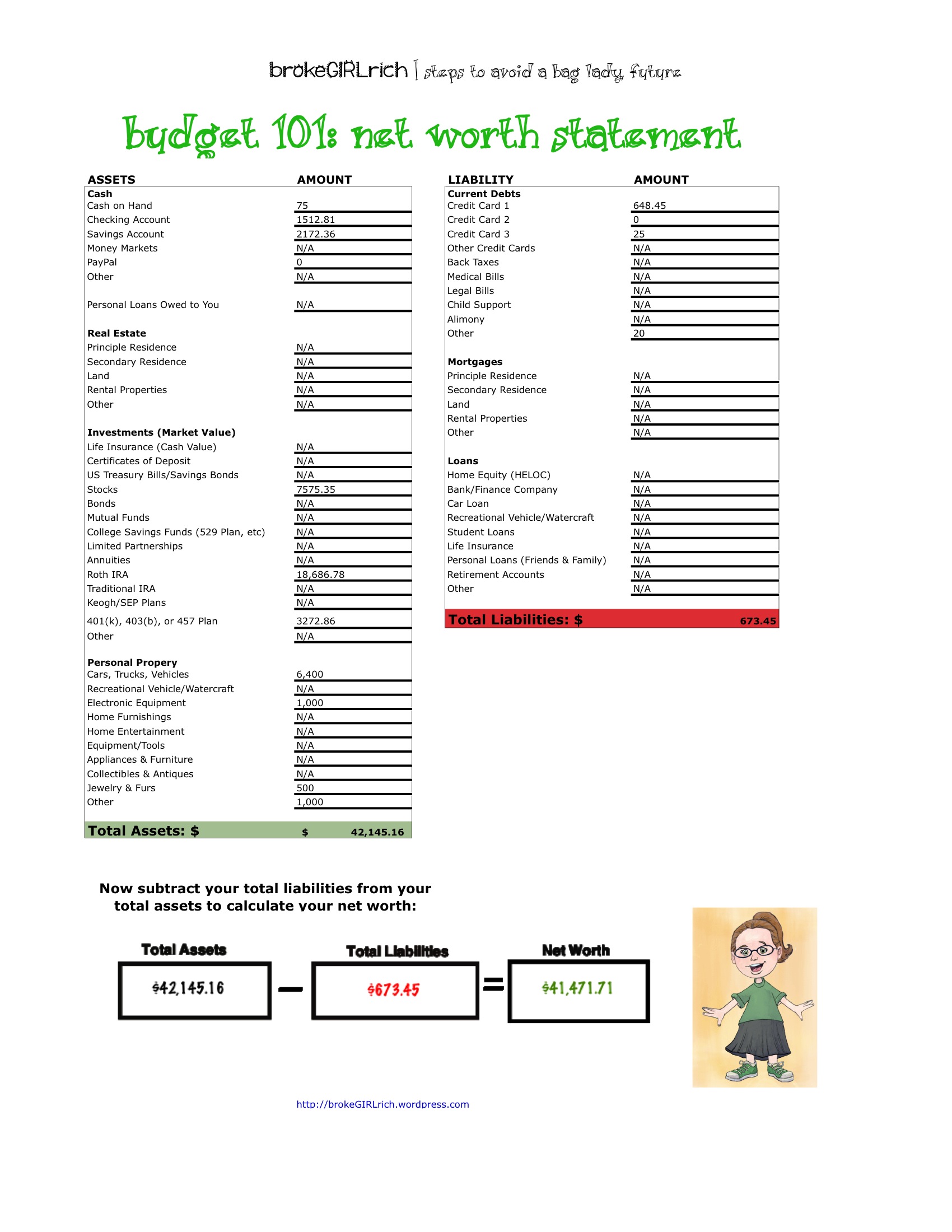

Anywhere, here’s the number breakdown. For some reason, I’m super disheartened that my net worth has increased a whopping $250 this month. But maybe next month will be better.

Some things entirely unrelated to personal finance that I’ve been into this month:

I’ve been reading Pride and Prejudice and Zombies and find it really irritating! I loved Abraham Lincoln: Vampire Hunter, so I had high hopes, but Seth Grahame-Smith is so blatantly disdainful of Jane Austin and high society it’s really irritating to read his take on her. I don’t recommend it (but do watch Abraham Lincoln: Vampire Hunter– it’s awesome!).

I’ve also been watching Ugly Betty (yes, I know I’m always massively behind whatever is actually on TV) and find it delightful and endlessly upbeat. Two thumbs up.

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money (duh)

My Favorite Post to Write This Month: My Top 10 Favorite Blog Articles

Elsewhere on the Web: Burger Queen: Best Burgers in Alaska at Travel Blue Book

Having a Ball on Lake Cumberland, KY at Travel Blue Book

Remember that goal to write a guest post somewhere each month? Apparently I totally slacked on that. Sigh. But FinCon definitely reminded to get on that goal and I’ve actually expanded it to try to write one for a personal finance site and one for a theater site each month… we’ll see how that goes.

Goals

Finish up contributing to my IRA for the year. Save up at least half of the money for the $1,000 stock purchase goal. Start following up on my stock research to confirm what I want to buy this time.

Increasing your network worth any amount is a good thing! My wife and I watched Abraham Lincoln: Vampire Hunter awhile back and we enjoyed it. We are True Blood fans too.

Brian @ Debt Discipline recently posted…Week End Round Up #50

It’s true. I guess I’m just feeling the frustration of slowly moving towards goals. Is it so bad to just want to hit the lottery? ;o)

I have wondered in Abraham Lincoln Vampire Hunter was worth the read. I will have to check it out. For me, I could never read anything that slighted my all time favorite book, Pride and Prejudice. A few years ago, I downloaded it for free on my Kindle and from time to time, I read it all over again and find myself lost in the story and falling in love with Darcy all over again.

Shannon @ Financially Blonde recently posted…Music Mondays – Fancy

I LOVE most of Jane Austen’s books, I think it’s why I’m so pissed off about Pride and Prejudice and Zombies – there was so much potential!

Do you get from traffic for this site from Pinterest? Michelle is doing well using that Platform for promotion.

I need to finish my ’14 IRA contributions as well! Where has the month/year gone?!?!

Will, yo recently posted…Side Hustle 1:1: Each Expense Gets Its Very Own Income Stream

I do use Pinterest, but I’m a little lazy about it. There are definitely certain kinds of posts that do better over there – anything thrifty/DIY and lists – like Top 10 Ways to Save on Laundry Detergent, etc.

My budget templates have been pinned on Pinterest for a while (it was how I first heard of the site). So I guess people like pictures of spreadsheets!

Leslie Beslie recently posted…September Monthly Spending in NYC 2014

Not sure if you already mentioned this in a prior post but what stock(s) do you currently invest in? Good job on being able to max out the IRA by next month. DH and I were able to max out ours in August and I also will max out the SEP-IRA this year – just need to know what will be the exact figure I’m allowed to contribute come tax time.

Kassandra recently posted…The Moment I Outgrew My Money

Exxon, Prudential and Hillenbrand. Hillenbrand is the only one I actually picked. My Exxon stocks were from my grandparents while I was growing up – my grandfather used to work there and apparently my dad bought a few of Prudential under my name when I was little and then just forgot all about it.

I’m leaning toward Dollar Tree next, but I need to do more research. I haven’t been watching too closely since I bought stock last year.

Mel,

Liked the blog post! (Have been reading quite a few since we met at FinCon and very impressed!)

One comment on the IRA and emergency savings. While reading the article I was hoping that indeed you were using a Roth IRA. At your income you are likely in about a 30-32% marginal tax bracket (25% federal and 5-7% new York I am guessing a bit here)., and thus contributing to a normal IRA would provide about $1,700 in tax savings now ($5,500 IRA limit * the 30-32% marginal tax rate). However, one reason I am a HUGE fan of Roth IRA’s is that they can be accessed without the 10% penalty if you needed them in the emergency.

So, while of course its great not to tap the $18k you have in there, in a true emergency, you really have that money to access. (Again there are some reasons it is not desirable to do so.. but in a true emergency it is fine too). Main reason I bring that up is for the psychological safety / happiness from feeling more protected in a downside situation.

(apologize for the long blabbing … lol) – basically – nice post and congrats on your savings!

Matt – FinDestiny

Hey Matt! Thanks – and it is a Roth IRA. I just like the simplicity of it, and that it can function as backup savings in a true emergency. Thanks for reading!

Wow.. was curious so had to check… marginal tax rate in new York city (assuming you are in the city) and state are pretty high:

Federal tax rate: 25%

State: 6.45% at your income

City: 3.6%

Total: 35.15%

As I was saying Ohio is great… at least $2,200 in tax savings alone 😉 even before cost of living.

LOL. Yes, NYC definitely does sort of suck. I lose about $25 a paycheck just to city taxes. I’m looking forward to heading back to NJ next year and hopefully somewhere even cheaper in the long run.

Where did September go? And love Ugly Betty. I wonder if it’s on Netflix, sounds like a good show to rewatch.

Jessica Moorhouse recently posted…The Versatile Blogger Award and 7 Secret Things About Me

I really love reading all of your FinCon posts and also your pictures! It’s really awesome looking at my favorite bloggers get together in the FinCon!

Kate @ Money Propeller recently posted…How to Make Sad Apples Happy Again

Congrats on only being $450 away from maxing out your IRA! I loved Ugly Betty and was so disappointed when it was cancelled. I don’t think people realized how funny yet dramatic and sincere that show was.

Tonya@Budget and the Beach recently posted…The Light in Their Eyes

Thanks! I know, right? I still can’t believe what they did to Santos… although Hilda bounced back pretty darn quickly.

ok Abraham Lincoln Vampire Hunter is amazing and I couldn’t even finish 5 pages of Pride & Prejudice and Zombies, it was HORRIBLE.

Nice work this month… good luck on getting that $1000 for stocks, LOVE investing in the market 😉

Bridget recently posted…The Calgary Real Estate Market

I know, right? What the heck. Clearly he should stay away from chick lit.

Fun post! But now I’m obsessing that I never saw Ugly Betty. My appetite has been whetted. It took me a long time to get my son to catch up on The Mindy Projects so that we could bond over it each week. On to Ugly Betty next! Thanks! 🙂

kayi recently posted…Hair ~ Or ~ The Winter of My Discontent 2013/14

Congrats! You’ve now jumped a few slots on our Net Worth Tracker 😉

http://rockstarfinance.com/blogger-net-worths/

J. Money recently posted…Net Worth Update: $456,140.18 [Down $3k]

Whoo! That’s pretty funny since it felt like such a spectacularly lame month.

At least your net worth went up this month.

I’m waiting for the day that my net worth will decrease but I think that kind of thing happens when you’re in the big numbers with the stock market fluctuations.

In regards to Pride & Prejudice and Zombies, I’ve read (what I know realise is fan fiction) books where they go further past the story. I can’t remember the names but some of them were worth the read. (Wouldn’t say they were good, but they were worth the read)

And I am always behind on tv shows. I always look at the ones that have good reviews and think “One day I will watch you. I will watch you, when I have time. And I will watch all of you. For now, you have been noted”

– Tania

Hah, yeah. One of the shows I was really into this year was Northern Exposure. I mentioned it to my mom, who laughed at me and told me she was the same age I am now when it was actually on the air. Whatever. It was awesome.

Pride and Prejudice and Zombies doesn’t actually go beyond the book, it sort of just restates the book and throws in zombies and ninjas. It’s really weird. It’s like a boy read it and thought “this sucks, I’m going to add zombies and see what happens.” Spoiler alert: Nothing good at all.