Profile

I am thirty years old and this is the first accountability update of my thirties. I am so going to nail this decade. It’s the year of Mel. I work as an assistant production manager and to start out the year of Mel, my yearly salary increased to $53,560. Not a huge jump, but I’m not sneezing at the extra post-tax $20 a week.

Saving & Spending: The Good

July was a 5 paycheck month which has been super exciting. Along with my 3% yearly raise, I bumped up my 401(k) contributions to a whopping 3%. They were previously at 2% and, don’t get me wrong, I am all for always meeting your employer match, but my employer doesn’t have a match and the 2% contribution was required… that angered me a little. So I’d rather do my investing on my own.

I am also an idiot and can’t figure out how to log into my work 401(k) account and so my contributions are stuck in a default stable fund, which is the safest one with the least amount of growth. I prefer it be the other way around really, so one of my goals this month is to contact ING and get that fixed.

On the plus side, I did manage to put $1,200 into my Roth IRA, which puts me at $1,700 left to max it out for the year. Barring any unexpected madness, I should have it maxed out by October. Maybe even by the end of September if I pick up a few more side hustles.

This would put me on track to make my $1,000 stock purchase in November and then, fingers crossed, get my emergency savings up to $5,000 by the end December or the beginning of January at the latest.

…although when my financial plans start getting a little too on track, it’s usually proportionate with my restlessness in life and I start looking for a big upheaval. I’ve already got half an eye on either going back to work on cruise ships for a while or applying to grad school.

Either way, I’ve definitely come to the conclusion that New York is not for me for the long term… so we’ll see where I am come New Year’s Day 2015.

At least you can blog from anywhere ;o) I’ve also possibly got a really exciting opportunity brewing that I’ve wanted for years, so we’ll see if the time is finally right for that to come through.

My FinCon side hustling so far this month has been $171.88, bringing my grand total up to $1,016.24. However, since I already paid for my ticket in February and plan on using points from my United MileagePlus Explorer Visa card to fly there and my Barclay’s MasterCard for the hotel, hopefully I won’t tap into much of that at all. Still hoping to hit $1,500 altogether by September, but I’m not holding my breath. I actually got offered a stage management gig that definitely would’ve gotten me to that number, but it’s the same weekend as FinCon… kind of defeats the purpose.

This was a pretty good month for writing over at TravelBlueBook (which you should always check out for fun and interesting travel stories).

I received my first ever payment for ads on my site – $1.88, baby! Yeah, boy! I will probably never be that excited to see such a small amount turn up in my bank account, but I definitely giggled and did a little dance. It’s a payout from my VigLink plugin that I genuinely have no idea how it works…. pretty much it just seems to scan what I write and link to things that have websites (i.e. if I write about it eBay, it turns it into a link and I believe they are all pay per click. Don’t quote me on that though).

Furthermore in blog earnings, I got my first ever sponsored post for this nifty little app called Instant Rewards that brought in $40. I should receive that payout on the last day of the month.

Last month I was psyched to get a dividend payout from my Prudential stock and this month I raked in $6.20 from my 31 shares of Hillenbrand which reinvested itself right into being part of the future 32nd share.

I also had a very productive day off of my 9-to-5 on Monday, July 7th. I did my first excellent mystery shop where I evaluated the security officers at a building down by South Street Seaport. It took 25 minutes. I made $75 (granted, I won’t see that money until August). I then sat at the Starbucks next door and a tried out a chat app and chatted with the developer for another 25 minutes and made an additional $50. So that was a pretty awesome day for side hustling too.

Saving & Spending: The Bad

I did pretty well with hustling and saving this month, but I was also on the go a lot more than usual too.

I spent the weekend of the 4th of July in D.C., visiting one of my best friends from the circus days. I had never been there and she lives there now, so we tore up the town… and our wallets. It definitely could’ve been worse. One of my friend’s from high school actually works at a restaurant in D.C. now, so since we ate there so I could say hi to him our bill was a lot less than it should’ve been.

I’m also still waiting for the other foot to drop on an incident that happened on the way down. I stopped at a rest stop in Maryland, went to open my door and a big gust of wind ripped the blasted thing right out of my hand and slammed right into the car next to me. Leaving a lovely gash and a good sized dent. I left my contact info for the people, hoping maybe they just wouldn’t care (yeah, right), but they contacted me and let me know they were going to get it fixed, but they were headed out on vacation right then.

So, since then, I’ve been waiting for them to get back to me with the quote of what it will take to fix. If it’s astronomical, I have insurance, but I suspect it will be in the $300-700 range, which is less than my deductible anyway.

Sigh. There goes July’s extra paycheck. I have my fingers crossed it might be a super easy fix and only like $150.

The following weekend a good friend came to New York and we spent Sunday at Coney Island. $70 later we had ridden a ton of rides and eaten a bunch of crap. It was a fun day though.

An old ship friend also came through town this month, so that was another night out to dinner and several drinks at a pretty cool piano bar called Don’t Tell Mama.

This past week, I had a random Wednesday off and two of my cousins decided they were going to show up in NYC for restaurant week. So we met up for lunch at The Red Cat (where the panna cotta dessert was actually to die for) and a few drinks. Then a few more drinks. And by the time I stumbled home with one of them around 10 PM, my wallet was about $120 lighter and we needed drunk pizza.

All around, not the end of the world at all… especially since I’m pretty careful with my money and generally a reclusive hermit. But still, it was a lot more than I usually spend.

It was pretty easy to balance out though since for about 2 weeks, I tried to actually eat all the reject food in my apartment instead of going out or even going grocery shopping. I was about 80% successful, so those were two inexpensive weeks.

Goals

Same old, same old. Max out the Roth IRA, buy more stock and fatten up my emergency fund.

Additionally, I really want to start keeping my eyes out for a job that I would really enjoy and be a really good fit for. The job I’m currently in, I took to make it home before my grandma passed away. The job before that, I just followed an ex-boyfriend (minus the whole ex aspect back then). It’s been a long time since I did something because it was what I really wanted and because it would further my career aspirations.

But, like I mentioned above, fingers crossed. AND it’s the year of Mel, so everything is going to be awesome.

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money (I have no idea what to write to beat this post, but it’s one of my new goals)

My Favorite Post to Write This Month: Green Funeral Products: What Are They?

Elsewhere on the Web: Spending the Perfect Day in Sitka, Alaska at Travel Blue Book

Tracy’s King Crab Shack: Best Legs in Town at Travel Blue Book

~~*~~*~~

Finally, because my crazy best friend who lives in Las Vegas keeps sending me pictures of it, I have been hunting all over New York for this:

I just really want to eat it. Also, iBotta is even offering a coupon this week. And I can’t find it flipping anywhere. Sigh. #firstworldproblems

*Part of Financially Savvy Saturdays on Femme Frugality and A Disease Called Debt*

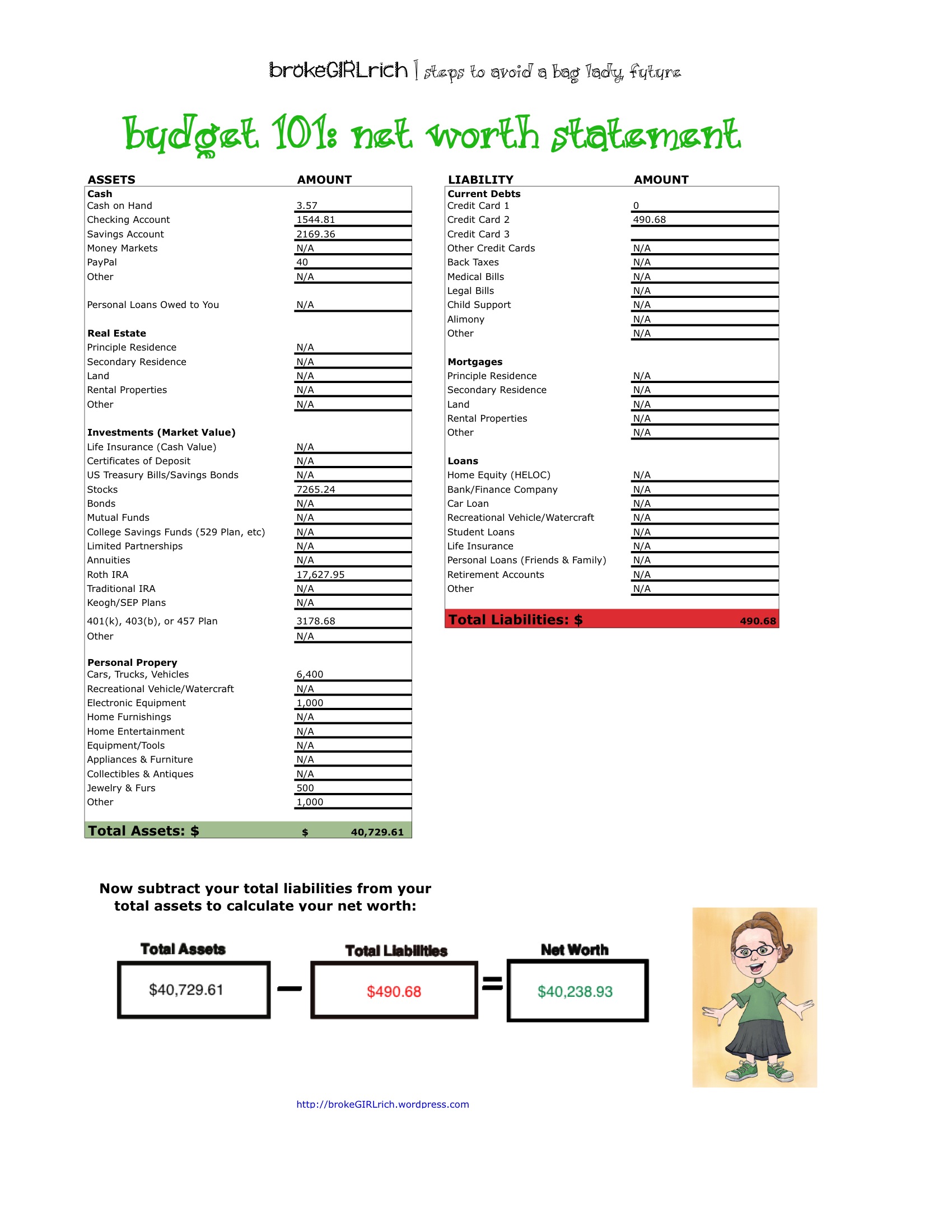

Yet another reminder to get in gear and throw together a net worth statement. It will be interesting to have everything laid out. As of now I honestly have no idea what the value of my investment in the farm is. Yay for not paying attention and holding off asking questions.

Good luck with the job hunt. By now us 30’s should have enough experience that we have a decent enough view of what we want in that area.

ThriftyHamster recently posted…Taking The Reigns Of My Life, Lets Get Farming.

Yeah, definitely get on your net worth statement! Honestly, as far as most financial stuff goes, I love doing a net worth statement because it’s so concrete and easy to do. Picking investments, trying to save, etc. are tough. Just tracking it only requires a few minutes of my time each month now that it’s pretty set up.

Mint is also terrific for keeping it up to date even easier!

Actually, last week I went and deleted my Mint account. Never did set the thing up completely. I have found I’m more a “build custom spreadsheet in LibreOffice” kinda guy. More hands on, which is what I like. Also, when brainstorming and building my spreadsheet I seem to get the same enjoyment I did from creating structures in

e-crackMinecraft. This is awesome since a budget will certainly pay infinity greater dividends down the road than my time invested in Minecrack. 🙂ThriftyHamster recently posted…Taking The Reigns Of My Life, Lets Get Farming.

Definitely nothing wrong with being even more hands on!

Congrats on your raise!! That’s like two extra beers a month! 🙂 And I have never heard of JC’s Pie Pops, but now I want one.

Shannon @ Financially Blonde recently posted…Grocery Store Challenge

I know right? We should all petition Whole Foods – that’s who is supposed to carry them.

You lead an exciting life Mel. Lot’s going on here and maybe some more changes for the future. Good luck with your investments. Every bit helps!

debt debs recently posted…Business Travel with Baby – Travels with my Aunt

No kidding, thank Debs! Good luck with yours too!

Wow – it sounds like July was pretty awesome for you (minus the whole car dinging thing). I didn’t put two and two together that you’re writing at travel blue book! Now I’m going to go see which ones you wrote!

I am impressed with all of your side hustling, that’s pretty sweet. Congrats on the first income from your blog, yay! Here’s to more in the future.

Thanks, Anne! It was definitely a pretty good month.

I think NY would be tough to make a forever place unless you had a boat load of cash coming in. Looks like this month was a little yin and a little yang for you…not too bad! Mine was all yang…ugh lol! I guess that happens sometimes! You’re doing great with your savings!

Tonya@Budget and the Beach recently posted…ASICS Challenge Team Recap

Ugh. Sorry about your yang year – hopefully you’re due for some ying then!

Happy Birthday Mel, missed it along the way. Not a bad month considering all things. Hope the car door thing works out for you.

Brian recently posted…Benefits Of Dividend Investing

Thanks, Brian! It has definitely been a good month… and my fingers are crossed about the car door too.

That’s awesome that you’re so on track financially! I can totally relate upheaval wise. I hope that opportunity works out!

femmefrugality recently posted…Financially Savvy Saturdays: Forty-Ninth Edition

Congrats on a great month! Hopefully the car door incident doesn’t turn into much!

PS – Love the Happy Ending gifs! Best show ever! 🙂

Thias @WealthHike recently posted…401k vs IRA: What’s the Difference?

I know, right? #cancelledtoosoon :/

I still haven’t worked out my net worth (too scared lol!) I should really do that though. Well done on your progress Mel, your savings seem to be going really well. Look forward to reading more accountability updates!

Hayley @ Disease Called Debt recently posted…Financially Savvy Saturdays Forty-Ninth Edition

I wish the internet existed in my early 30’s, I would not be clean up the mess I made in my 30’s. Keep up the good work and sometimes you have to enjoy your money and hang out with friends. Life is too short. #finsavsat

The Frugal Exerciser recently posted…The 30 Day Inner And Outer Thigh Challenge

Agreed. Other than the door snafu, it was all money well spent this month.

The roth ira is great. I’m going to try and max out the contribution this year since it has so many tax advantages.

Edwin @ Cash Syndrome recently posted…Cash Syndrome Monthly Stats Update July 2014

Good luck! It is awesome to think of getting all that money back tax free someday. I’d almost always rather pay now and coast later.

I love this! You’re doing great!

Keep it up and you’re going to nail your 30s!

Miss Millennial recently posted…August Budget: What’s the Plan?

Thanks! Here’s to hoping!

Maxing out the Roth IRA FTW!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Congrats on vowing to make this decade your best!

Will @firstqfinance recently posted…How I Spend $75 Per Month on (Healthy!) Groceries

I need to sit down and work out my own net worth. I have not done it in a while, and since we paid off a credit card, hopefully it is looking a little bit better. Great job in the month of July.

Thanks! Good luck with yours!

Hi Mel,

It sounds like you are doing a great job. It’s good to increase your contributions to the 401K (now just figure out how to choose alternate investments). Plus maxing out the IRA this year is great. At 30 years old you are kicking butt! I’m about to start a new decade myself (the 40’s – yikes!) and wish I was in as good a shape when I was 30.

Kay @ Green Money Stream recently posted…Frugal and Fun Summer Activities for Kids and Adults

I definitely tend to kick myself about how much money I’ve blown on school, but I know it could be a LOT worse. Thanks for the pep talk!

Hi Author,

Thanks for sharing such useful information with us. This blog really helps me.. Keep sharing!