Profile

I am thirty one years old and I am the Production Stage Manager/Production Manager for The Marriage of Figaro! I will receive a $3,500 stipend at the end of my contract and a $300 travel stipend (hopefully that check should turn up by the first week of July).

Saving & Spending

After finishing up Clifford on May 3rd, I headed back to my parent’s casa and have been commuting into New York City from New Jersey since then. I have a 7 week contract with an opera company there.

Commuting has actually been my biggest regular expense this month, but I’ll get $300 of it back when I’m paid at the end of this show. Also, I realized right after buying a 10 pack of tickets to Penn Station that it’s $9 a day cheaper to take the train to Newark NJ and then hop on the PATH, so I switched to doing that and have 9 tickets to Penn Station left to use at any date in the future.

Nearly half of my food expenses came from eating out the last few days of tour. I spent the month doing a Whole 30 cleanse and expected that to be pretty expensive, but I was free to pilfer the fruits and veggies at my parents house and only really had to buy some cooking substitutes, so it wasn’t that costly. Even if I’d been buying everything myself all month, it still would’ve been a lower food spend since that crazy cleanse made eating out a real pain in the butt – it was just easier to always bring my own food.

I also got hit with a NJ driving surcharge because that ticket I got in April pushed me up over 6 points on my license and so I’ll get a $175 fine from the state for the next 3 years. That’s awesome.

And my favorite expense of the month was the subscription I have to Kiplinger’s that was first purchased with airline miles has somehow auto-renewed on a credit card I don’t use often and I missed paying it. So I got hit with a non-payment fine and that is my first missed credit card payment ever. Ugh.

One of those entertainment items was making it to one of the last elephant performances on my old unit!

As for irregular expenses, I bought everything for that Hawaiian vacation at the end of June/beginning of July and that cost a pretty penny, but I’m pretty excited that I managed to knock off $1039.84 of that with credit card rewards and my best friend and I haven’t totally reconciled how much we owe each other, so I’m still going to wind up with a $300-500 check from her.

I finally used my healthcare company and went to an urgent care for a sinus infection. It was a flat $35 co-payment and after the receptionist went “what the heck is this?” and I said “they said you guys are providers” and she called them, there were no issues with using my Medical Sharing Ministry. It was just like regular insurance.

My spending breakdown this month:

- Gym – $10.70

- Food – $245.35

- Stage Management Expenses – $47.95 (to be reimbursed in July)

- Healthcare – $221.07

- Gifts – $52.83

- Car – $384.56

- Commuting – $404.75

- Entertainment – $156.45

- Hawaii – $3285.29

- Credit Card Rewards – (-$1039.84)

- Miscellaneous – $8.44

Total Spending in March – $3,777.55

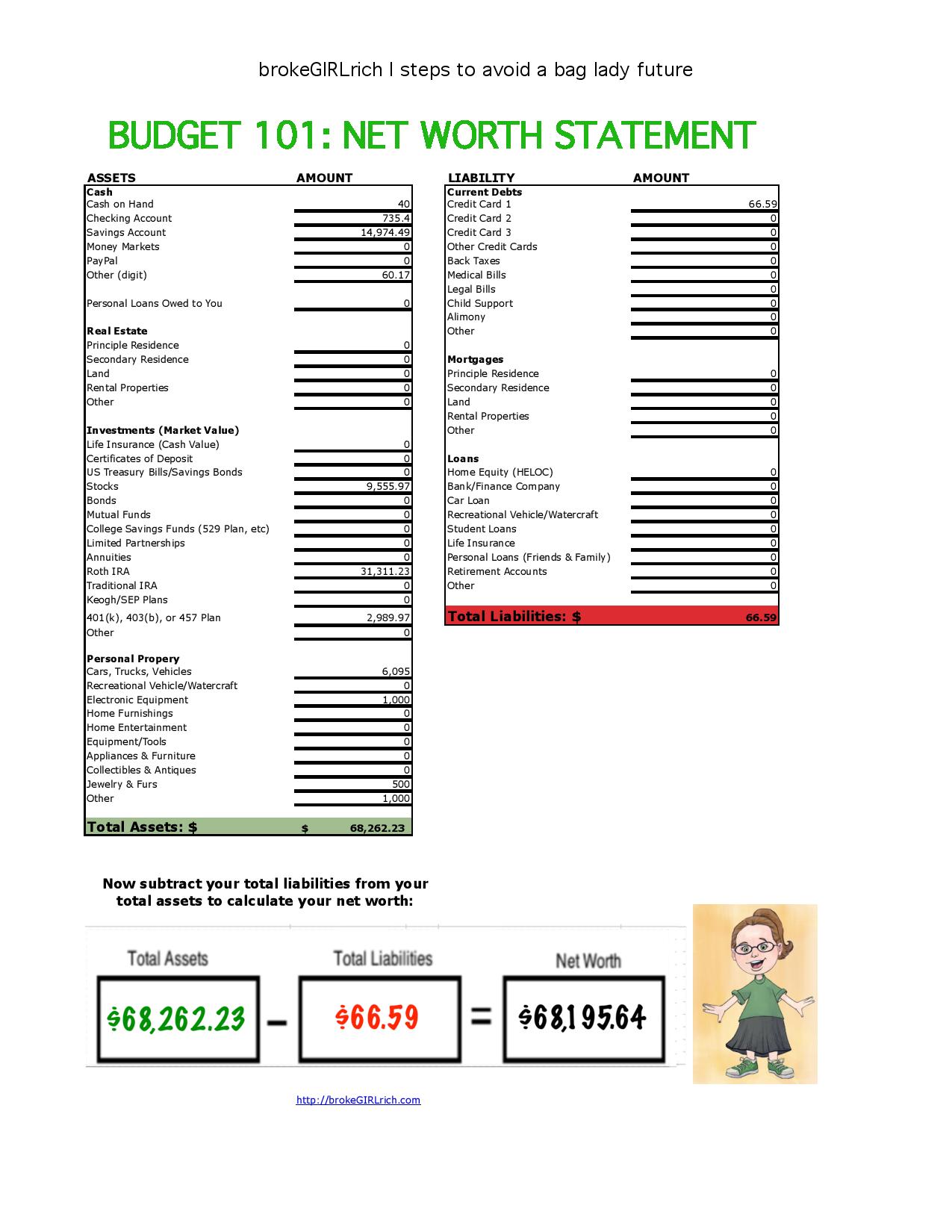

Clearly not at the $500 mark, even disregarding Hawaii and the things like commuting and stage management that will be (mostly) reimbursed in July, but maybe next month will go a little better. At least my net worth hit wasn’t quite as bad as I thought it might be. There’s still a solid hope of hitting $75,000 by the end of the year!

Hustling

My income this month was made up of Clifford paychecks, brokeGIRLrich, and UserTesting.

- Stage Managing – $768.42

- brokeGIRLrich – $593.81

- Red Bull Settlement – $4.50

- Dividends – $21.15

- eBay – $6.74

Income This Month: $1,394.62

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: What’s In Your Financial Toolbox?

Elsewhere on the Web: For Arts Majors, How to Get Ahead Money Under 30

Entirely Unrelated to Personal Finance

So maybe it’s not entirely unrelated to personal finance, because I noticed (and plan to write about) a ton of parallels, but I rocked the Whole 30 this month, which is like a healthy eating cleanse, and it was pretty effective. I have no idea what I weighed before, but I went in 4 notches on my belt, have a lot more energy and my stomach is a lot less upset than it usually is, all of which is pretty cool. I’m not gonna lie though, I was super excited to go eat a donut on day 31.

The worst part of the Whole 30 was trying to learn how to cook – but this white chicken chili actually turned out awesome.

Goals

- Contribute $1,000 to my Emergency Savings Account– Done.

- Max out my Roth IRA– Done. DONE. Does a little dance, done, done, done.

- Contribute $3,000 to my Down Payment Fund– Still at $2,650 to go.

- Contribute $2,000 to my New Car Fund– Still at $950 to go.

- Have a $1,000 Best Friend’s Wedding Fund– Done. Now I’m starting to deplete it.

- Buy $1,000 of stock– Nothing on this front yet.

- Develop 2 new resume skills– Nothing here yet either, though the goal is to achieve these is August.

- Track all the time I spent on my computer outside of work for 1 week and then go without a computer for a week and see how I use that time– the plan is to do this one in August too.

- Go on a vacation with a friend– woohoo! This time NEXT MONTH I will be in Oahu.

- Look for a big show to stage manage– Done.

- Run a 5k– I’ve been training all month to do this again this summer, but whether or not I’ll be able to find someone to run with me is kind of in the air.

Thanks for sharing again Mel! I particularly love the ‘Hawaii’-item on your spending breakdown, as if it’s just another regular monthly expense. The end of June is not that far away, you must be thrilled!

I would love to learn more about your Whole 30 experience too, sounds interesting.

Mrs. CTC recently posted…Monthly Report: May We Forget April

I wish Hawaii was a regular budget item!

Maybe. Maybe not – considering the expense. 😛

It’s amazing what a little flexibility of thought can produce. Those “extra” tickets can definitely help in a pinch. I’m looking forward to hearing about Hawaii.

ZJ Thorne recently posted…Financial Freedom Sneaks Into Every Conversation

Sounds like you had a few odd, assorted expenses this month, and I hate when those pile up together. On my own monthly budget report, I write in notes of things that were out of the ordinary, but I try not to have too many things I need to explain to myself. But personally I’d much rather write in Hawaii than NJ driving surcharge (I was a victim of that one myself a few years back). My May spending was over budget after several months of being under budget, but June looks like it will be a better month.

Gary @ Super Saving Tips recently posted…What Dad Really Wants for Father’s Day

Yeah, the surcharge seems so sketchy to me. The state has already fined me! If they think it should be more, they should just make the initial ticket more, not add a surcharge! I also don’t like that you accrue the surcharge for 3 years no matter what, even if your points drop below 6 (like mine will in October). Lame.

Wow, bet you can’t wait for your holiday! Thanks for sharing your breakdown, it always makes for interesting reading! Glad your medical insurance came through. Do you have more info on the Whole 30 cleanse you did?

Hayley @ Disease Called Debt recently posted…Financially Savvy Saturdays #145

Yeah, I wrote a whole post on it for next week, but it was absolutely worth it! I had way more energy by the end, my stomach was in much better shape and I lost about 10 pounds, but most of all I learned a lot about myself and my eating habits.

You have Hawaii in your budget? What???? I love this breakdown. I love that you include your net worth in here as well. It is a great way to look at assets versus liabilities and really track your financial progress. Great read. Enjoy Hawaii. If you need another blogger to tag along…. I am probably your girl. Just saying:)

Becky@Frametofreedom recently posted…The Best Stores to Find Affordable Clothing

Hahaha – sure, come join us! My best friend is pretty easy going, I don’t think she’d mind. Hawaii was actually a separate savings account more-so than being a budget line but I also wiped out most of my checking account in May to get there too.

Ouch! The driving surcharge hurts, but otherwise sounds like you had a pretty good month. Have a great Hawaii vacation!

Tre recently posted…Happy Memorial Day

Awesome May! You side hustle income is impressive! I normally don’t even hit 3 figures! Also you are rolling through your goals list so far this year. Great job!

Thias @It Pays Dividends recently posted…Stop Bad Money Habits With a Money Detox

YOWZA on that NJ ticket fee! That’s just harsh. Also, congrats on the Whole30! I’ve done that myself and it’s not an easy feat!

K @ One More BROKE TWENTY-SOMETHING recently posted…NYC 2016 – A cash vacation success!

Did you notice how horrible the people on the message boards are? Did they seem a little overly intense to you?

Wait a second, why are you getting fined for three years? That seems awfully harsh! Does your state offer the chance to reduce some of those point by doing traffic school?

Whoo hoo on Hawaii! I’ve been a few times before this year’s trip and this was the first time I managed to shave off as much expense as I did. To many more (affordable) trips, for both of us!

Revanche@AGaiShanLife recently posted…Finally Friday #6

No, which is ridiculous. I’ll probably do the traffic school thing anyway to lower my insurance, but the fine starts when you have more than 6 points on your license and continues for 3 years no matter what. It’s especially irritating because the ticket I just got was 5 points and I’m actually about 4 months away from an old 2 point violation that happened nearly 3 years ago falling off – despite the fact that I’ll be under 6 points as of October, I still have to pay the fine for 3 years. :o/

Uck we’ve had so many unexpected expenses this spring, too. I’m trying to figure out ways to cut them as it’s more than our slush fund can handle.

Like everyone else, I think that ticket situation is way harsh!

FF recently posted…Discounted Tutoring Sessions for #Pittsburgh Kids

I’m glad you found a cheaper way to commute. That can be a killer.

Catherine Alford recently posted…An Amazing Way to Capture Life’s Sweetest Memories