Did you guys know this is National Retirement Planning Week?

What a boring week name, #amiright? You know what’s not boring? Feeling secure. Compound interest. Life options.

Here are some names I think would be better for this week:

- How to Avoid Eating Cat Food in Your 60s, 70s & 80s

- How to Make Magic Money Appear Without Lifting a Finger

- Keeping Your Options Open – What to Do If You Don’t Want to Have to Work Till You Die

Maybe the last one is a little long.

The first version of brokeGIRLrich actually had the tagline “steps to avoid a bag lady future.” So, while I think National Retirement Planning Week is an incredibly boring name, planning for retirement actually isn’t.

Some words that do feel like they apply to retirement planning are:

- Overwhelming

- Confusing

- Terrifying

- Expensive

- Non-urgent

- Impossible

The thing is though, if you’re reading personal finance blogs in your free time, probably most of those words don’t need to apply to you. Of if they do, you can overcome them.

But this post isn’t about telling you what to do. I’m just going to tell you what worked for me. Do what you want with that info.

Step #1: Date a boy obsessed with personal finance.

Just kidding. Sort of.

My retirement planning started with Doug. Doug was a very sexy bass player, who didn’t speak much, but when he did it was teach me things like how he picked stocks or to tease me, actually make fun of me, for not having my own retirement account.

The same way most people might peer pressure you into playing drinking games, Doug pressured me into opening a Roth IRA.

He also put a strange amount of effort into getting me to learn the names of professional sports teams. While the relationship didn’t last long and most of those sports teams are long forgotten, the Roth IRA remains.

Step #2: Do a little research about different IRA companies.

Here’s where things could be a little easier for you than they were for me. I opened my IRA 9 years ago. There weren’t a ton of investment firms back then and all of them required $1,000 – $2,500 to start an IRA. I opened mine with Fidelity because they were a financial name I’d at least heard of, but I had to save up $2,500 to do it. That was no small amount at the time – like a month and a half’s take home pay.

Fortunately, there are a ton of places you can open an IRA now for a fraction of the cost. Some brokerage accounts like E*Trade, Merrill Edge, and TD Ameritrade have no minimum initial investment. If you feel better going with a bigger firm, Charles Schwab and Fidelity usually have options that waive the initial fee if you sign up for automatic contributions.

Step #3: How to fund this sucker?

If you’ve got a regular, steady job, automatic contributions really seem like the way to go, but I live the freelance life a lot of the time, and I was much happier to save up the lump sum, open the account with that and then invest when I could.

The first few years, I didn’t come close to maxing it out.

For me, investing in my retirement feels like I’m buying something. I suppose I am actually buying peace of mind.

It’s one of the first financial goals I try to achieve each year (let the compound interest roll), and now I funnel as much income as possible into it until it’s fully funded. Some years it takes me almost all year to manage it, most years it takes me about half the year to fund, once I funded it by the end of January and that was pretty darn magical.

I also like the feeling of achieving my savings goals. I find it very motivating. I probably would’ve been more of a debt snowballer than a debt avalanche, because psychological payoffs are no joke.

Step #4: What to buy?

This freaked me out at first. How on earth do you figure out what to invest in? Well rather than letting analysis paralysis get to me, I went with a target date fund.

I could freak out about all I’ve read about how a lot of options are better than target date funds, but you know what? A target date fund is better than no fund.

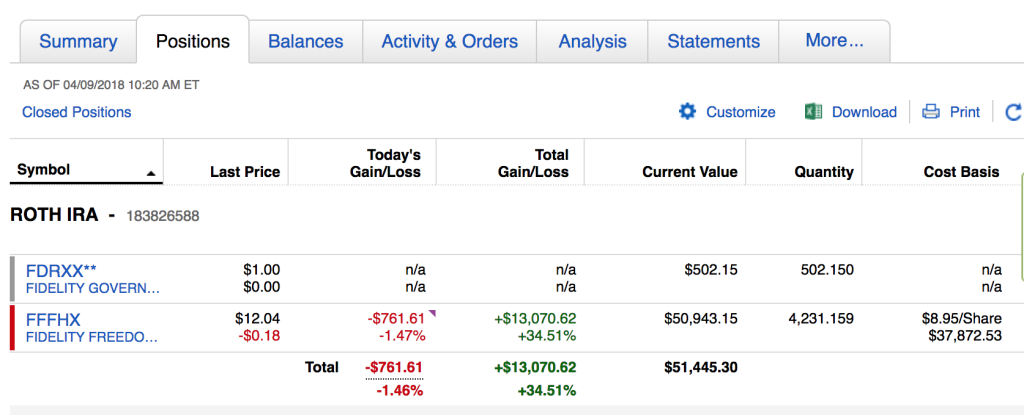

And as I’ve learned more about investing, I do invest in other things – outside my IRA. My Roth IRA is all target date fund. It was super easy to set up and for me it feels like it is pretty safely getting a nice investment return.

Step #5: How I Stay Motivated

Well, there’s that psychological payoff thing again. To be honest, fear motivates me a lot. I’ve read an alarming number of studies about how much more expensive life is if you’re single, and I’m not sure I’ll ever be willing to exchange my freedom for a relationship. And even if I am someday, it seems smarter to plan financially like I won’t.

It’s also easier to stay motivated over time when you watch the compound interest start to happen and things get a little more How to Make Magic Money Appear Without Lifting a Finger.

For instance, my total gain/loss is showing that my IRA has made more than two years worth of “contributions” on its own. Magic Money.

So if you’re putting off retirement planning – embrace National Retirement Planning Week in all it’s boringly named glory and get started today!

I had no idea there was such a thing as National Retirement Planning Week. Seems like a great idea. Not sure it makes a difference, but good initiative.

That’s a good story to put together sports teams and Roth IRA, must not happen often 😛

The Poor Swiss recently posted…The three pillars of Retirement in Switzerland – 1. The first pillar