*Please note that while I was a licensed insurance agent for auto and home in the state of Virginia in 2008, it has been several years since I’ve used this knowledge. If you are in the process of purchasing auto insurance, please make sure to double check all information with your insurance provider. Coverage requirements also vary widely from company to company and definitely from state to state.

Oh, and Liberty Mutual is not sponsoring this post. I just liked the commercial and it illustrated a few types of coverage pretty well.*

This is Mona.

I LOVE Mona. Seriously, I’m not generally too attached to too many things, but I am emotionally attached to my car.

Mona and I have been on several amazing adventures. Mona was there when I decided on a whim that I was moving to San Francisco. So I piled up everything I owned and drove across the country.

Mona was also there when I stopped at my best friend’s house in Las Vegas and we decided to go on a road trip into the desert that literally led up off the road and into the middle of the desert, where there did not appear to be any sort of road to find the abandoned art city of Rhyolite.

We also got yelled at by the military that we were too close to Area 51 when we went looking for it.

Mona and I also headed back north a year later when it made no sense to pay San Francisco rent because I was living on a cruise ship. We saw Mt. Rushmore and the Corn Palace together.

Then Mona got me all over the East coast to catch up with all of my friends during my different cruise ship vacations.

Most recently, Mona traversed all of America again and survived each week’s train yard (which is no small feat – train yards are generally pretty horrible). Most of the time I drove her, but several times she got my friends from point A to point B so I could relax on the train and they could go see family or friends.

But now I live in New York City and it is not a Mona friendly place. I go to my parents in New Jersey like every weekend and I drive her then, but is that really worth $100 a month?

I didn’t think so, so I called my insurance company to see if we could put storage insurance on her instead.

When I was in grad school, I worked for Nationwide Insurance in Virginia and there you’re able to put insurance on your vehicle that pretty much keeps you covered if a tree falls through your garage, since you’re no longer covered by collision or liability or any other sort of insurance. It was about $5 a month circa 2008.

I figured I’d do the same thing and just drive one of my parent’s cars if I needed to go grab something, but when I talked with the good people of New Jersey, I learned that this is not an option here. You have to have liability here. Which brought my car insurance down to only $800. Seriously? ONLY? There’s barely any point in switching it then!

So I went back and forth on the matter in my head for several weeks and finally decided I was just going to reinsure my car like usual when the bill arrived this week. I mostly decided that because I’m actually able to afford it right now.

It’s both very fortunate and very frustrating that I seem to get hit by bills when I’m a little bit ahead financially. I feel like I never manage to get really ahead because of it, but on the flip side I’m very grateful I’m always able to get them paid.

Ever wonder what some of those terms on your auto policy mean?

Comprehensive Coverage – this means that some unfortunate thing has happened to your car other than a collision (which is why it is sometimes called “other than collision coverage”). That commercial with the guy who drops an air conditioner out of his window and onto a car? Well, hopefully that car owner had comprehensive. An angry squirrel shatters your windshield with an acorn? Hopefully you have comprehensive. It also covers you if your car is stolen or vandalized.

Most new cars have comprehensive coverage on them (it’s a requirement if you’re leasing the car). If you’re driving a clunker where the deductible costs more than your car, that’s when you can start to think about taking it off your policy, but think carefully before you do because even if you have a great car accident lawyer on your side when the worst happens, comprehensive coverage can be a godsend.

Collision Coverage – this is another coverage you may consider dropping once the value of your car considerably depreciates.

Collision coverage is exactly what it sounds like, it covers you if you hit another vehicle or object. In that commercial, it’s what the gentlemen who drives into the garage hopefully has. For a new car, collision coverage makes a lot of sense. My car is currently worth $6,400 based on Kelly’s Blue Book and I still think it’s worth it. I bought my first car, a 1993 Mazda MX-3 for about $1,800 and it was never worth it to me back then.

Liability Insurance – all but 3 states require you to at least have liability insurance. California and Wisconsin will waive this requirement if you can provide “proof of financial responsibility.” This usually involves placing a very large deposit with the DMV (between $30,000-$60,000, depending on the state). New Hampshire does not require any proof of financial responsibility.

Liability insurance protects your from lawsuits related to any car accident up to the amount of coverage you’ve chosen.

Personal Injury Protection (PIP) Coverage – this coverage is for medical bills and lost wages sustained as the result of an accident. It can also be used to cover funeral expenses. In No-Fault states (Delaware, Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, Pennsylvania, Texas, Utah and D.C.), there is a minimum amount of coverage required and then you can sign a waiver to opt out of higher coverage.

Shouldn’t insurance just cover that? Well, yeah. It sort of does. But you have to figure out whose fault the accident was, so that their insurance company pays for what happened. That could involve years of legal battles and all the accompanying fees. PIP insurance means that your medical bills are just paid (up to the coverage limit), regardless of whose fault the accident was. Unfortunately, it also really limits your ability to take a case to court, if you felt that was necessary.

If you have excellent health insurance, it’s usually worth looking into if they cover auto accidents. If you can supply documents proving they do to your auto insurance company, they will often lower or waive the PIP requirement. PIP is often a fairly expensive aspect of your insurance premium, so this can save you a good deal of money over time.

Uninsured Motorist Coverage – It could be just me, but this one irritates me a little. It shouldn’t be my job to pay for the idiots who just didn’t get insurance, especially since that’s illegal every except New Hampshire. Nonetheless, that’s pretty much what this premium covers.

If you’re hit by someone who is not carrying insurance and is broke, you can’t squeeze water from a stone. Granted, you can sue and garnish the stone’s wages for the rest of their life, but that’s not going to get you a new car to get to work next week. Uninsured Motorist coverage will. It will also help cover medical bills (especially if you don’t have PIP coverage). Uninsured Motorist coverage is often paired with Underinsured Motorist coverage, which means exactly what it says – the person at fault did not have enough insurance coverage to cover what occurred and cannot afford to pay for the damages.

This coverage also covers hit and runs, since you’d be unable to find the at fault party in those situations.

Fun Fact: When I was working as an insurance agent, a person once called to try to cover their motorized wheelchair on their auto insurance policy. Since I was new, that call was forwarded right onto my supervisor after a few flabbergasted minutes together trying to figure out how to make that request work in our obnoxious, super specific computer system. I imagine it actually became a floater on her homeowner’s policy… but I sure didn’t know that back then.

Additionally, I made a man very angry when I wouldn’t insure his parade float. Life in a call center… nothing will make you get your act together quicker to GTFO that kind of job.

Wondering where the best and worst car insurance premiums can be found?

Top 5 Highest Average Car Insurance Premiums:

- 5. Rhode Island – $2,020

- 4. Washington, D.C. – $2,127

- 3. Georgia – $2,201

- 2. West Virginia – $2,518

- 1. Michigan – $2,551

Top 5 Lowest Car Insurance Premiums:

- 4. Idaho – $1,053

- 3. New Hampshire – $983

- 2. Maine – $964

- 1. Ohio – $926

Check out the whole list here and see where your state ranks.

Keep in mind, those are just averages, and they’re of the whole state. Certain cities and urban areas have significantly higher average. I’m lucky enough to live right next to the 4th most expensive city for car insurance in America – Newark, NJ – where the average premium is $3,525.43. Aside from the fact that people from New Jersey all drive like psychopaths (although not nearly as crazy as people from New York and Pennsylvania. Has anyone else noticed it’s always the states next to you that drive the craziest and cause the most rage when you see their license plates? It’s never you), Newark is also a lovely hotbed of crime and our winters do suck. We don’t even get a ton of pretty snow, it’s all ice and then fishtail enabling slush.

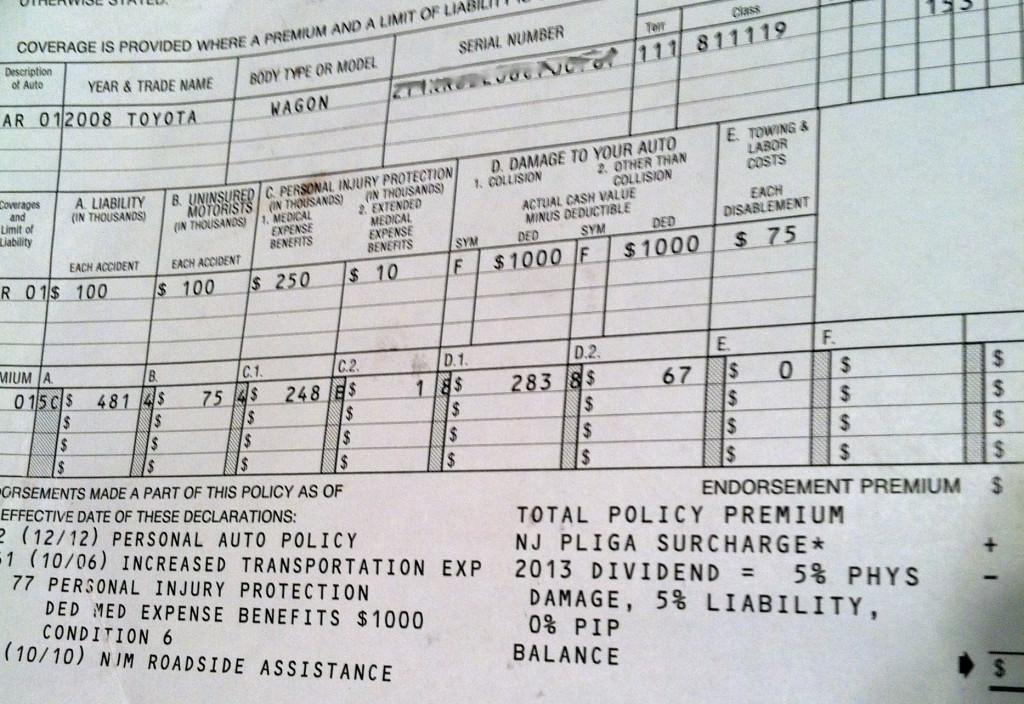

While I totally believe that is the average for Newark, my own premium is $1,119.65, which is a reminder that you should always shop around for your auto coverage. And one thing I definitely did learn from my days with an insurance agency, you will almost always save more by bundling all your insurance needs with one company. That’s when the discounts really start to kick in!

Anyone else ready to go back to the horse and buggy days after trying to make sense of their insurance premiums?

*Part of Financially Savvy Saturdays on Femme Frugality and The Million Dollar Diva*

“Anyone else ready to go back to the horse and buggy days after trying to make sense of their insurance premiums?” Haha…Interestingly enough, there are still places in the U.S. where this could happen. Check out parts of Pennsylvania and southern Indiana. I still think they need to carry some type of liability insurance to be on the road though.

Brian @ Luke1428 recently posted…Why I’m So Excited to Spend Money Again on Cable TV

Do they really carry liability insurance on their buggies?? I had no idea.

Ooooh killer post! I love my car as well. Izzy is a ’99 Mitsubishi Eclipse 10th Anniversary Edition. She’s “cheap” though so I just run liability and only pay $18 and some change each month. Pretty great deal considering I’m a 24-year-old male. But I also rarely drive the car too (I bike to work most days).

will.i.am lol recently posted…What The Oregon Trail Video Game Taught Me

$18?? That’s crazy. It’s about $67 a month for just liability in NJ.

Ouch! I know it helps me being from Nebraska. Not too many people around to crash into. 🙂

Will — FQF recently posted…25 Random Facts About Me!

I have to admit that I have no idea what we pay for as far as car insurance. I am sure if I got into an accident, I would be quick to find out, but I should really read it before. We shop our car insurance all the time, though, because there are lots of options and it is a quick and easy thing to switch if you need to save money.

Shannon @ Financially Blonde recently posted…Music Mondays – Compass

We have a car here in Chicago though we really do not need it. Ride share would be so much cheaper for us (like $50-80 a month vs. $500 a month for car + insurance + gas + parking). However, my family lives in the middle of nowhere and we go to see them quite often. We cannot bring the ride share car that far. Totally blows!

Michelle recently posted…Creating a Blog: 9 Ways Writing Can Help You Achieve Your Goals

That does suck. Rides shares are really interesting to me. When I lived in England, there was a system like that, but all the cars were stick and I didn’t know to drive one. I really wish I had learned because there was so much cool stuff to check out around me that I could never get to.

My rates were so flipping low in Idaho. A lot of it really does have to do with population per square mile. Had an ex who had state farm…their Dec page is coded! So not only do you have to know these terms, but you have to call them and ask them which code aligns with which coverage. I worked in the insurance game around the same time, but only for a minute. 🙂

femmefrugality recently posted…Financially Savvy Saturdays: Forty-First Edition

A minute is more than enough in the insurance game 😉

I think your site is helpful because it informs every state what their premiums are. I like that you have advised to get motor insurance that has limited liability coverage. I know it isn’t the best situation, having to look out for others, but I love that auto insurance can save you from litigation (my insurance has defended me in a lawsuit and the attorneys that were appointed were the best in the state) so feel reassured that your premiums can protect you.

Sounds like a great way to save on car insurance. I have also saved money on car insurance by taking an extra driver education course. I still remember many of the things I learned in that class. It is interesting that you say driving faster will wear your tires out quicker.

What a helpful post! Thanks for explaining all of these things. It’s true, the first reaction is that you have to fight with the insurance company to get anything covered.

Completely loved your writing! the way you made your car an important character in your story and gave her a name and then came down to explain all the various insurance covers. Very interesting read!

Remo Faria recently posted…Tips on Making a Personal Injury Claim After an Animal Attack

Pingback: Does New Hampshire Require Auto Insurance | Auto Insurance Quotes - Car Insurance | Allstate Online Quote

Pingback: Does New Hampshire Require Auto Insurance | Auto Insurance Quotes - Car Insurance | Allstate Online Quote

Great Blog! Thanks for highlighting the areas that we should consider before signing up for insurance. I recently came to know about an insurance company UltraCar Insurance llc, they are really known for their SR22 FR44 Insurance also their insurance packages are really reasonable prices. For more details you can visit their website.

My aunt has been thinking about getting better car insurance now that her kids are learning how to drive. I’ll be sure to tell her that she might want to get collision coverage which can protect them if they hit another car. She would really like to get some help from a professional to pick what would be best for her.

Great Blog! Thanks for guiding about car insurance policies. It will be really helpful for beginners. I recently came to know about an insurance company UltraCar Insurance llc, they are really known for their SR22 FR44 Insurance. Also their insurance packages are really reasonable prices. For more details you can visit their website.

I read many articles about Uninsured motorist coverage will also help cover medical bills, but none could give clear conceptions. Finally found your writing where you described the process in detail, which is beneficial for me to wrap my damages. Thanks for sharing!

Salman Jackson recently posted…How Does a Disability Insurance Policy Work?

Thank you for the amazing tips! I am planning to buy a car, and I will keep these tips in mind for sure. I have also kept in mind that the title should be transferred as well. For this, I will contact Auto Tags & Titles of South Florida Inc. as they provide title transfers and tag renewal services in Florida.

https://goo.gl/maps/pH8Xij3HdUM49X8K9

Rev up your knowledge and drive away with confidence! From navigating the twists and turns of coverage options to finding the perfect policy for your unique needs, this article is a must-read for anyone seeking a smooth ride through the world of car insurance. Click, learn, and gear up for smart choices on the road ahead!