Let’s Talk About Net Worth Worksheets | brokeGIRLrich

So over the last few weeks, we looked at budgets and the some tips behind spending less and earning more.

I think of budgets as sort of a living thing that you have to experiment with a bit to find a system that really works for you.

I’ll level with you. I don’t love budgets. But they are like the hammer of the personal finance toolbox. They are incredibly useful.

Net worth statements are like a screwdriver – also a key skill to have in your toolbox.

They tell you where you are right now.

They are also my biggest motivator to keep going.

Net worths are just snapshots of a moment, but just like a family photograph album, they tell a story over time.

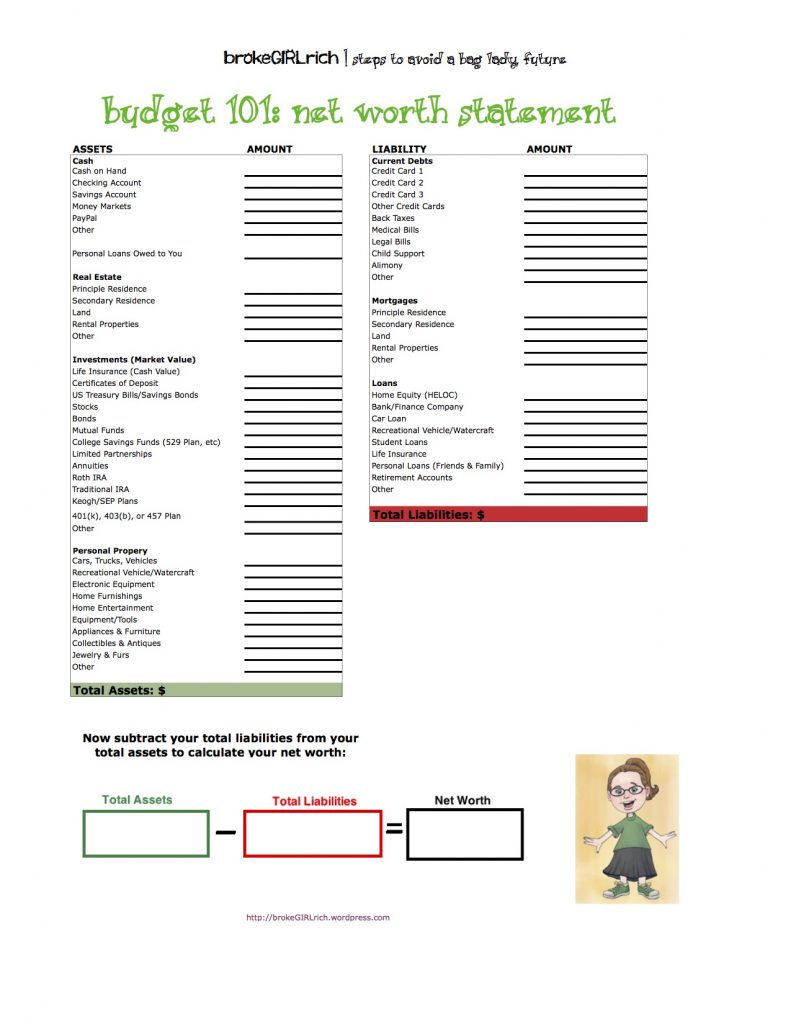

Your net worth is essentially just your assets minus your liabilities.

If you have more liabilities than assets, you probably have debts you need to work on.

If you have more assets than liabilities, you’re in a good place and just need to look into ways to strengthen that position.

When I was paying off debt, it felt like I was getting nowhere financially, but I could see the difference when I did a net worth statement update each month.

As I start to invest more and more, I see the effects of sticking with my plan long term, even if the market has a rough month here and there (December 2018, March 2020, etc.).

Another nice thing is there’s a whole pile of folks doing the public online net worth tracking (which you totally don’t have to do) and when your net worth randomly plummets one month, it’s like a built in support group of others who are going “WTF?” and sager folks who have been doing this a long time reminding us to calm down, stay the course, and don’t look at any of your investment accounts again until next month.

When I was just starting though, that was not remotely a problem. When I was just starting out, my net worth was only creeping up bit by bit but it was still nice to see something was happening.

Also, if you’re automatically funneling some money into a retirement account directly from your paycheck (like a 401k), it’s nice to see how that is affecting your net worth each month too. It’s easy to forget you have that money out there working for you. It’s also a motivator to creep up your contributions when you can, even if it’s just a 1% a year.

A net worth sheet, over time, shows you the impact of the little things.

Over enough time, it also shows you some more about your spending and savings habits.

For instance, for a long time, May of each year was usually my highest net worth update because I have a pile of annual bills each year due in June and I usually hit the eye doctor and the dentist over the summer. I got smart to the fact that all those bills were coming and I would save up for them over the year, but by the end of the summer, there was always a dive in my savings.

This frustrated me for a while until I figured out why it was happening and now I just know that June-August is usually a drop and it is what it is.

After a few more years of investing, now it isn’t even always a drop – though drops definitely occur out of nowhere pretty regularly with so much invested these days. I can go back to previous months though and double check my net worth dips to make sure they’re all in investment accounts and not me making poor choices with my savings.

Ok. Enough about why you should consider tracking your net worth, and let’s get a little more into how.

I favor this excel sheet (who doesn’t love a good excel sheet?). The reason I like doing it this way is because the action of updating it myself makes me think through each account.

There are some digital ways that will track your net worth for you if you connect your bank account and credit card statements (they’ll help you set up budgets too).

The only thing I don’t like about this is that you can just pop in once a month and glance at your net worth, which I don’t think carries the same mental weight as calculating it yourself.

It also makes it harder to go back over time and look at your progress.

Since I do a net worth update every month, once in a while, I’ll go back and see where I was a year earlier, or even five years earlier, or even check my first net worth update to see how far I’ve come overall. The ability to refer back has been almost as useful as just doing the net worth updates.

Personal Capital keeps a record of your net worth for as long as you’ve used it. I can go back as far as I want to track my net worth history. You just adjust the date range in the app.

Steveark recently posted…The Thing about Corona Virus Masks

Personal Capital is really amazing for mining spending habit data with minimal effort, after you’ve got your accounts linked up. I only never really transferred over to it because Mint came out first and I’ve been content with what it does for me. I always try to send folks who are setting up their online tracking to Personal Capital though – I definitely think it’s the better product overall.