How to Open a Health Savings Account | brokeGIRLrich

I’ll admit, Health Savings Accounts (HSA), seemed kind of overwhelming to me for a long time. I sort of got the gist but avoided opening one.

If I could turn back time, I would prioritize an HSA over a retirement account if I was super cash strapped, because it’s really a magical account.

For health expenses (including health emergencies), your HSA can act as a savings account. Essentially, you pay for your health expenses and reimburse yourself out of this account.

Your contribution to your HSA, up to the annual limit, is tax deductible, like a retirement savings plan such as a traditional 401(k) or an IRA. This means that when you use the money to pay health expenses, you’re not paying tax on those expenses.

The reason the account is really magical is that is also has an investment component, which means if you don’t get sick and you don’t have medical fees more than the annual contribution ($3,500 for an individual in 2019), you can let that money grow.

You can also try to cash flow your health expenses and use the HSA entirely as a long term investment account.

How will you get that money out later? Easy. As soon as you open your HSA, you buy a binder. In that binder you keep every medical receipt you’re able to cash flow. You can use them anytime to withdraw the money in your account. If you pay a $120 co-pay next month and save the receipt, you can withdraw that $120 tax free in 20 years if you want. You can also withdraw it tax free a year from now.

Or you can go high tech, scan them, and store them in the cloud. Or you can double down for the long run and do both.

When you turn 65, the HSA becomes like a regular retirement account and you can withdraw what’s in it whenever you’d like a regular tax rate, or you can withdraw what’s in it for medical purposes tax free.

So how do you open one of these magical accounts?

Here is the major tricky thing to look for:

- Some Health Savings Accounts are only savings accounts and some are only investment accounts. You want one that is both.

If you’re not sure about how your spending is going to go, leave the money in the saving account portion for a year or so while you see what your health spending is like and whether or not you wind up using all the money.

It is easy enough to transfer money out of the investment side of the account, but your money in investments is subject to the whims of the market. It’s always more ideal if you can leave that money along – of course, ideal and reality don’t always go together, so do what makes most sense for you.

Who can open a Health Savings Account?

- Anyone over 18 years of age and under 65 years of age.

- Anyone with a high deductible health plan.

- For single coverage: a deductible higher than $1,350.

- For family coverage: a deductible higher than $2,700.

- Must meet the following annual limits**:

- For single coverage: limit of $6,750 for out of pocket expenses.

- For family coverage: limit of $13,500 for out of pocket expenses.

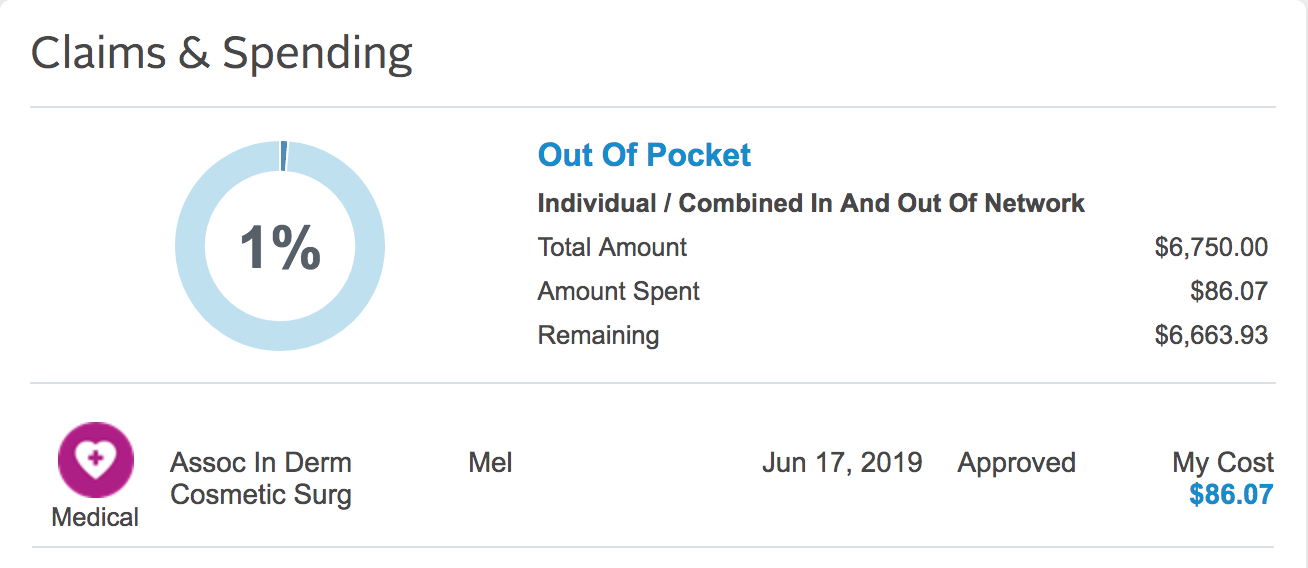

**This is an important one to double check because the out of pocket spending limits under the Affordable Care Act are sometimes higher than this amount. If you’re not sure what your out of pocket limit is, call your health insurer and ask. I know that my account with AmeriHealth actually has it listed on the log in page when I sign in to pay my premium each month.

My AmeriHealth log in page view. (My fancy cosmetic surgery was a mole check, real cosmetic surgery is still too rich for my blood. Also my fear of needles is very, very real.)

Where to look for a Health Savings Account?

If you work for a company that offers you other benefits, a good first stop would be your HR department to ask if the company or your health care insurer already has an HSA options.

You may even be really lucky and work for a company that contributes to your HSA. If you do, keep in mind that their contribution counts toward the annual limit, so you can only contribute the remaining balance.

Another thing to be aware of is that lots of companies have Flexible Spending Accounts (FSA). The nice thing about an FSA is that it doesn’t have the deductible and out of pocket spending limits that an HSA has. The bad thing about an FSA is that you have to use everything in the account within the year.

Years ago, I worked for a company that provided an FSA and I was able to use it to pay for some medical expenses tax free, but estimating what I would need for the year was difficult. If I knew then what I know now, I would’ve skipped the company provided FSA and opened my own HSA.

This is largely because I was your average, healthy twenty something back then. And I am your average, health thirty something now. If high medical bills are one of your financial struggles, a lower deductible health plan and an FSA might be the better choice for you right now.

In general, you can’t contribute to an HSA and an FSA at the same time. You have to pick one (there are a few special HSA accounts that let you do both, but they have special limits on them so that you can use both accounts).

If your employer doesn’t offer a Health Savings Account…

No problem, you can open one on your own.

Some places to look into:

- Old National Bank partners with HSA Authority (incidentally, that’s where my HSA is)

- LivelyHSA

- Fidelity

This article on The Balance heavily influenced my choice to go with the HSA Authority, because even though it didn’t rank as the highest choice, it was in the top few choices on every one of his breakdowns (best saving vehicle, best investing vehicle, lowest fees, etc.), and it’s the oldest HSA company around.

Investor’s Business Daily also had a really good breakdown of several different HSA accounts you can look into.

These last few steps here, I’m going to share my experience with Old National Bank, yours could be different with a different company.

How to open your account with Old National Bank:

The First Step to an HSA

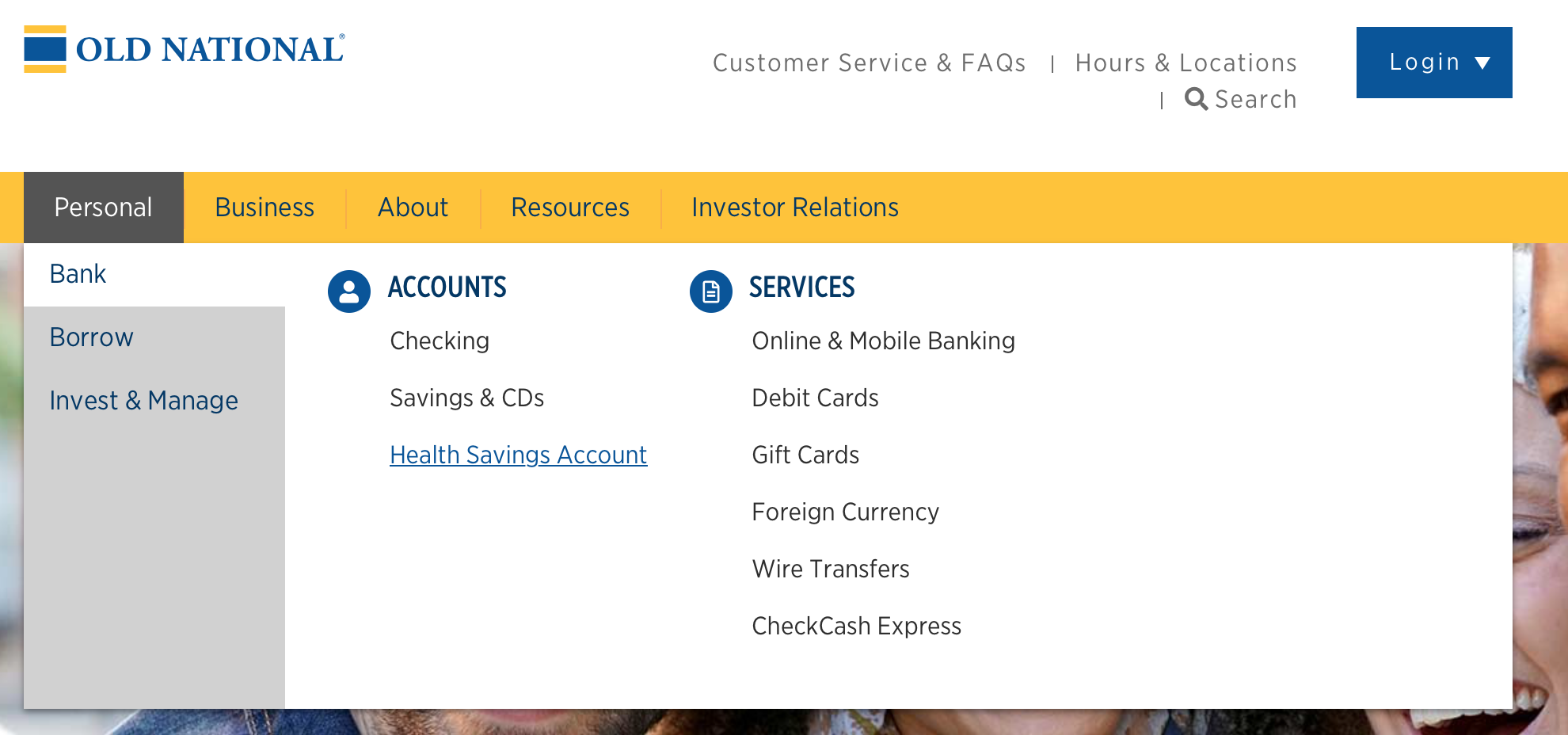

Go to their website and from the menu select Personal and Health Savings Account. It will take you to a page with more info about their product. You can read more about HSAs there. If you select enrollment instructions, you’ll go to a PDF with more info about their HSAs, including everything you can claim as a medical expense.

If you click on Open an HSA, it will take you to the HSA Authority site (their partner) and you can click on “All others click here.” It will then take you through the steps to sign up for both an Old National bank account and an HSA Authority account.

The first goal is to save up $1,000 in your Old National savings account. You can’t set up your investment account until you’ve done that.

Once you have the $1,000 or more in your investment account, you can contact the HSA Authority to link your Old National savings account to your investment account. I have to say it was the only frustrating part of the whole setup for me. I just recommend you call. I tried to do it all online and had a lot of issues.

I caved in a few days later and picked up the phone. I spent about 15 minutes on hold, and then talked with the nicest lady on the phone, and I was setup in no time.

This brilliant BuzzFeed article really does sum up my feelings about the phone in a delightful series of charts.

My current system is to leave about $1,000 in my Old National savings account, in case I need to use it for a medical expense and everything else gets transferred into the HSA Authority investment account.

Once I funded the HSA Authority account, I get charged $3 a month($36 for the year) and those are the only fees connected with my account so far. Old National sent me a debit card I can use if I want for medical expenses. I opted out of the checks, which do have an additional fee.

When the money transferred into the HSA Authority the first time, everything went automatically into a Pimco Money Market fund. After giving the money a few days to make sure it had all transferred. I went into my HSA Authority account and clicked on Manage Investments àRealign HSA Investments and rebalanced things into the accounts I wanted them to go into.

I spread mine out across six funds. If picking your funds feels overwhelming, there are some target date funds (funds with a year at the end of them) or total market index funds you can pick from that are generally safe bets and always better than doing nothing.

When picking a target date fund, you pick a year in the future around when you expect to retire (like 2040 or 2050) and the target date funds rebalance on their own over the years to try to get you the best returns with the least risk possible, decreasing that risk as you get closer to the target date.

And voila, you now have a very tax sheltered way to pay for medical expenses and/or save for retirement.

Pingback: Financial Stages in an Artists Career - brokeGIRLrich

Pingback: Keeping Yourself Afloat Financially When You Are Injured - brokeGIRLrich

Pingback: what can i do with old hsa account – Ascharters