Explain Brokerage Accounts to Me | brokeGIRLrich

Glad you asked, reader!

For me, brokerage accounts were one of the bigger signs I was starting to do ok financially.

There are a few goals I feel should be hit before you start to worry too much about brokerage accounts:

- Debts paid off (or totally managing low interest debt payments).

- Emergency fund fully stocked.

- Getting the match on any 401(k)-type retirement options.

- IRA maxed out.

And personally, I also max out my Health Savings Account for the year before worry about my brokerage account.

So what is this thing?

A brokerage account is an investment account without tax benefits. You use this investment account to invest in things like stocks, mutual funds, ETFs, etc.

This money doesn’t have any of the tax protections that retirement accounts like IRAs and 401(k)s have – so often maxing out both of them first is a better idea.

However, some companies have lousy 401(k) plans (or no retirement plans), and in that case it can make more sense to contribute just enough to get any matches and then start putting your money in a brokerage account.

What makes a lousy 401(k) plan? Usually having only a few investment options and/or options that have high fees.

Speaking of fees. When you invest, there are often fees involved. Here are some of the most common:

- Expense Ratio

- Investment Management Fees

- Transaction Fees

- Annual Account Fee/Custodial Fee

Expense Ratio

Let’s use my brokerage account as an example here.

Let’s use my brokerage account as an example here.

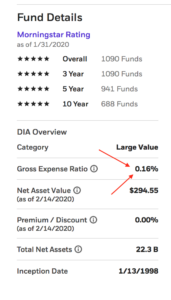

I use E*Trade and own DIA (Dow Jones Industrial Average ETF). It has an expense ratio of 0.16%. That means that for every $1,000 I own, there is a $16 expense deducted from it annually.

I also own shares in ITOT (iShares Core S&P Total U.S. Stock Market ETF). That has an expense ratio of 0.03%. So for every $1,000 I own of that, I pay $3 annually.

Assuming both were reacting exactly the same in the stock market, ITOT would be the better buy, because it has the lower expense ratio. If you buy and hold for a long time, the expense ratio costs can start to add up.

ETFs and index funds usually have lower fees than mutual funds, and both are cheaper than REITs. Individual stocks don’t have expense ratios.

Investment Management Fees

If someone actively manages your brokerage account, it can trigger a fee. However, you would know that’s what you’re signing up for.

For example, E*Trade has professionally managed core portfolios that have a flat 0.30% annual fee for accounts with a market value of more than $500. If you have a massive portfolio, they have other options with varied expense rates as well.

But let’s be real, if you’re a brokeGIRLrich reader, you’re probably going to manage your account on your own, and there are many options in many brokerage firms that allow that.

Transaction Fees

Paying transaction fees these days is pretty ridiculous. The little internet-based trading companies started doing away with them a while ago, and no-fee trading has become so common that most of the larger financial institutions have also had to get onboard to keep up.

E*Trade has no fees for up to 30 transactions a month.

And I realize I’m starting to sound like an E*Trade commercial here – and if I can ever find an affiliate link, I’m sure as heck linking it, but right now I’m just an E*Trade commercial because I’ve been using it for years and I’m really happy with it.

Annual Account Fee/Custodial Fee

Surprise, E*Trade doesn’t charge for this fee either. And actually most brokerage accounts don’t these days, so just make sure to double check when you pick one.

So now that you know what you’re looking to avoid in fees, how do you get started?

It’s pretty much the same as opening any online bank account. Do a little research (though you just got a great snapshot of E*Trade here), decide what you want to buy, and sign up online and make your first purchase.

But how to decide what to buy?

I can’t really make that decision for you, but I can tell you how I do it.

When I have money to invest in my brokerage account, I split it up two ways. In my head, I call them super safe investments and somewhat less safe investments. The ones I think of as super safe are ETFs and index funds that cover a large portion of the stock market (DIA and ITOT, like I mentioned above).

The ones I call somewhat less safe and the individual stocks that I buy. I’m not a huge gambler on those either. I’m a big fan of the blue chips stocks. They’re called blue chip stocks because in poker, blue chips have the highest value. These are companies that have turned a profit for a very long time, even when the stock market isn’t doing so hot in general (so, for example, I own individual stocks in Coca-Cola and Exxon).

Other than that, you have to decide what you feel comfortable in investing in. A few of the other stocks I own include Hillenbrand, one of the largest players in the death industry. It’s currently way down – down enough I’ve been wondering about this choice – but I actually feel like it keeps my portfolio kind of balanced because when everything else goes down, it usually comes up and stays steady. I guess when the economy is lousy, people still have to bury people.

I also invest in Dollar Tree under the same idea that when everything else goes down, that one also goes up.

Before I pick an individual stock, I look at it’s long term earnings, how it’s doing in comparison to it’s competitors, and I try to read some news articles about the company.

Yeah.. I am now focusing on 401k and IRA… but it good to hear about the other stuff out there… pinning it for the future.. thanks for sharing 🙂