One of the big reasons I got into blogging and also into charting my net worth was because I felt like a lot of personal finance bloggers were either painfully in debt or super rich (or what seems like super rich to me).

Not only am I super average, salary wise, I actually think I’m a little below. Someone who has been working at his or her job for a decade is usually bringing in more than that 37-39k I’ve averaged (granted, that’s also always in jobs that provide housing, which certainly has real value).

That’s a pretty low salary. There’s a lot you could say you can’t do on that kind of salary – especially considering that was the same salary I was making when I finished up grad school in June 2011 with $30,000 of debt.

Tracking my net worth has taught me that conscious spending and saving goals make a world of difference.

I’m not rolling in it – I actually have a pretty small nest egg and occasionally kick myself when I think of how much larger that nest egg would’ve been if I hadn’t gone back to school. I spent about $10,000 in savings, took on $30,000 of loans and lost out on another $36,000ish in income for the year. Considering my financially illiterate but still useful habit of hoarding money in the pre-grad school years, I think it’s safe to assume my net worth would be up around or just over $100,000 without that single year of financial derailment.

Maybe. Because that whole grad school thing is really what opened my eyes to the importance of being financially literate.

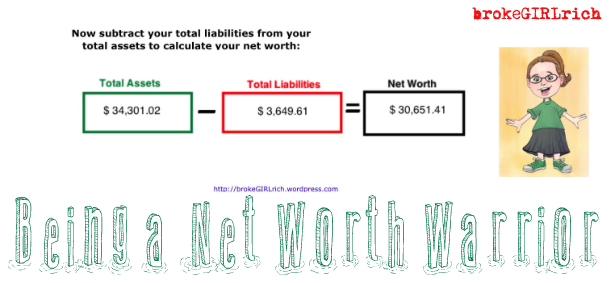

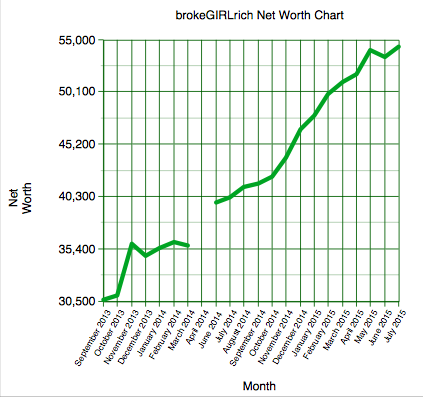

A few weeks ago, I wrote a post on the power of the list, but once a list is written down, you still have to review it. In doing my net worth updates, I usually glance over the previous month’s number while I’m updating them to see whether I’m doing ok or not, but I’ve never gone back to the first net worth update and seen how far I’ve come.

Today is the day, folks!

In just under two years of net worth updates, I’ve increased it $25,000. That’s nearly 1/3 of my average pre-tax salary a year. Even the year that I was living in New York City, once you factored in my rent, I was still making the same amount of money I’d previously been making.

Although who knows what was happening in April 2014 – totally didn’t do one that month.

Rereading some of the updates too has taught me a little about where I started to go right and a big area was when I set goals and prioritized hitting them. I’d say I was really feeling the pinch one month, but notice that there was a big jump in my net worth only to realize I was feeling the pinch because I’d set some insane savings goals – and nailed them. They made that particular month a little socially unpleasant, but had a big impact on my overall savings each time.

So if you’re making some pittance of a salary, keep in mind that there are ways to actually save money – the primary one being to minimize or completely get rid of rent.

Also, even small changes can add up over time.

What’s stopping you from tracking your finances?

And if it’s you don’t know how – here are a few posts to get you started.

Wow, that is a steep climb — it looks amazing laid out like that! Congratulations!

I love doing my net worth because it really keeps me focused on not being lame about spending — even when I start slipping, I remember really quickly to, you know, quit doing that. I think it’s helped me a lot with keeping on track financially after my loans were paid off.

C@thesingledollar recently posted…Zero Food Waste, Week 29: Keep Others From Wasting Food

Me too! Slipping happens (a lot, actually) but by staying on top of things, I can either stop spending or hustle harder the following month.

Way to go! That’s a lot of progress!

We actually dont check our net worth but once a year. We know we are making consistent progress by following our budget. For me, it would tempt me to do somethnig ill-advised, like messing with investments and such (only thing we could really change at this point as our monthly budget does most of the heavy lifting)

Luke Fitzgerald @ FinanciallyFitz recently posted…How Many Marshmallows Do You Have? And How Did You Get Them?

Ah – I have a lot of my investments in a target date fund, so I don’t mess with them, but I could see the temptation.

Sounds like you are making great progress! I think that your job sounds great – if housing is provided that makes SUCH a big difference. Also, on the grad school front, I can understand your point about where you could be without it, but I think that in the long run you’ll appreciate the extra education.

Ali @ Anything You Want recently posted…The Sunshine Blogger Award

I guess we’ll find out in the long run ;o)

I like they way that chart is heading! I find the same with tracking my net worth it really help me keep an eye on my over big picture. It’s such a helpful tool.

Way to go Mel! I’m not super rich either, nor am I in a TON of debt (unless you count my mortgage I guess) so it’s great to see you rocking it like this!

Kayla @ Kat Script recently posted…Resolutions and Goals for 2015 – UPDATE

Thanks! Sometimes it feels like I’m not actually getting anywhere, but tracking the numbers helps remind me there is a reason for all this!

Impressive growth!

We’re tracking our financial progress loosely. It’s no good us getting too wed to the numbers in our account right now. We’re saving up for my husband’s dental implants at a cool $25,000. So if I track my net worth all the time, I’ll be in mourning next spring.

Our house isn’t worth a lot, but that also means a relatively low mortgage. So overall, I was pleasantly surprised when I did bother to calculate it. I just don’t want to track the big number studiously. I’ll just worry about goosing up savings toward the goal.

Abigail @ipickuppennies recently posted…In which I electioneer

It is unpleasant when you’re saving up for something and then see the dip when you use those savings. :O/

You know, I haven’t been tracking my net worth because I’ve been so focused on paying off my student loan debt. Just recently, I got the balance down below what I have in savings. I finally have a small, positive net worth! Maybe now is the time to start tracking it. It would certainly be a worth goal – and one that I can set as a longer term one. Like, a year from now I want to have a net worth of X. This post is inspiring! I’ll definitely look at the posts on how to track it.

MJ recently posted…The Next Big Thing After Paying Off Debt

I’m glad you liked it! Net worth tracking has definitely helped me achieve a lot of my financial goals!