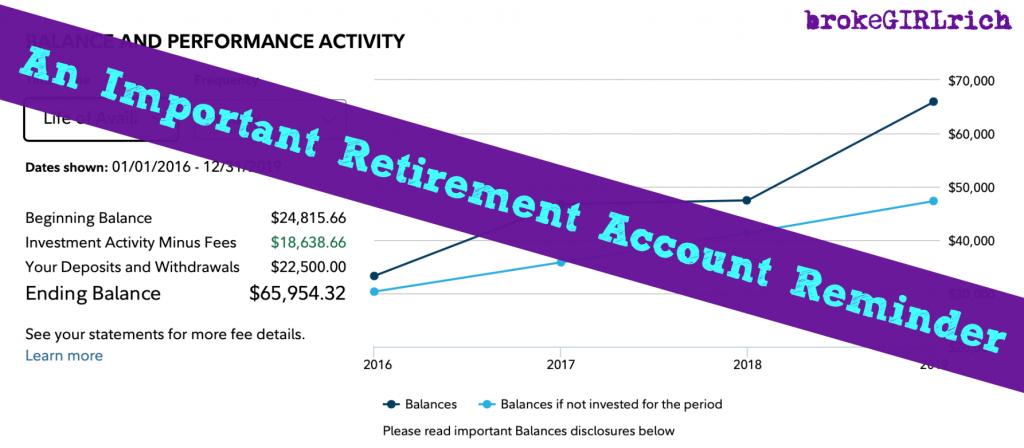

An Important Retirement Account Reminder | brokeGIRLrich

Today’s post will be a quick one but important.

When you open a retirement account like an IRA or 401(k), the money you contribute often goes into a money market account.

After you make a contribution, you still have to invest that money!

Some folks open retirement accounts and think that because the money is going into an IRA or 401(k), they’re set now.

I’ve seen several upsetting tweets this week from people who went years (and one horrific one where the woman contributed for 25 years and didn’t realize this until retirement) without actually looking at the account.

They would just faithful have money directly deposited from their employer or automatically drawn out of their checking account.

Now, some 401(k)s are set up to distribute right into your elected investments, and that’s great, but double check.

As for IRAs and several self-employed retirement plans, my deposits go right into that money market fund, which doesn’t collect any interest.

It is worse than a savings account.

I then have to go back a few days later and buy that contributed amount of my target date fund. Once I’ve done that, now the money is properly invested.

So, if you’ve been contributing to your retirement accounts for a while but never actually log in and check the account – give it a look.

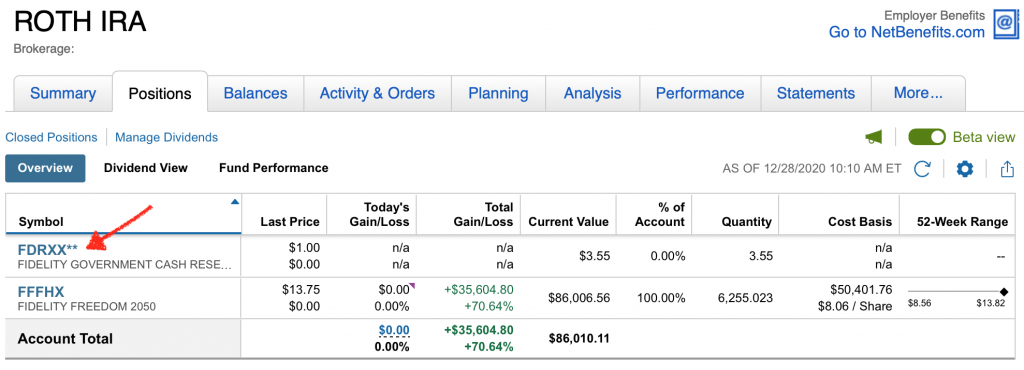

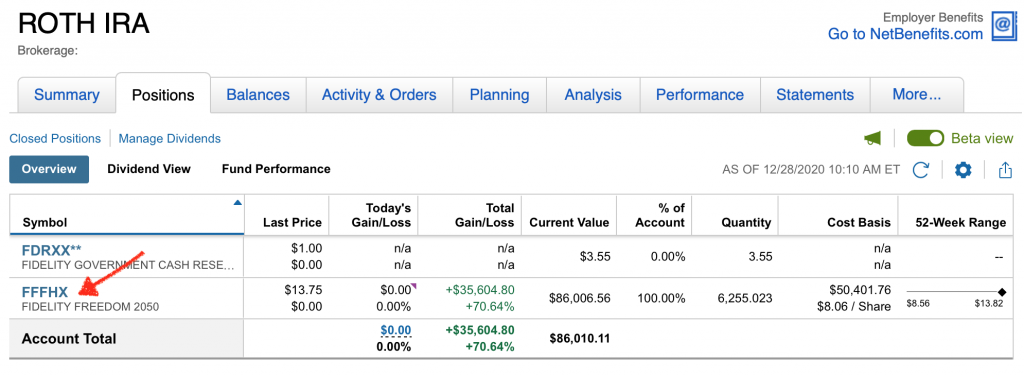

The slightly tricky thing is that the money market account can look a little like you are invested in something. Mine appears as FDRXX but if I look closer, I can see that it says Fidelity Government Cash Reserve.

As you can see it has a n/a under Today’s Gain/Loss and Total Gain/Loss because it has none. Any type of cash reserve is not collecting interest.

If I never checked on my IRA, the cash would accumulate there, and I would lose the 70.64% of gains I currently have in my IRA –> more than $35,000 (over 10 years).

So that’s a really important 30 seconds to spend each time you make a contribution, or monthly if your money is just auto drafting in these accounts.

Not sure about your account? Well since this post was way shorter than usual, in the amount of time it would take you to read most of my posts, you can go check your retirement accounts now.

P.S. Brokerage accounts are the same. Money goes into a cash account and from there you still have to make one more move to buy the specific funds and stock you want.

I was on our retirement plan committee at work. It amazed me how few people were mostly in stock funds, choosing stable (money market) funds instead. We brought in experts to teach employees but they refused to attend unless they were getting paid and even then we had to give nice door prizes and snacks to get even a small audience. I’d watch employees borrow from their 401k to buy a new pickup truck or to fund a fancy vacation. That required them to stop contributing and stop getting the company match until the loan was repaid. It cost them tens, maybe hundreds of thousands of retirement dollars. And these were smart people. It was depressing. Good for you for educating your readers.

Steveark recently posted…Totally Retired Paycheck

Holy moly, that is so crazy. I think a lot of people just don’t understand the numbers or the power of compound interest. But sadly, some people also just don’t care.