Profile

I am thirty one years old and I am a stage manager and lighting director for a touring children’s theater show called Clifford the Big Red Dog Live! I also just left my job as stage manager for Ziegfeld’s Midnight Frolic (if you live in the tri-state area and like weird immersive theater, there are still 2 weekends left where you can check out the Frolic before they close for good. You can try the code FRIENDS for a discount).

I pay no rent and have about $210 in monthly bills. I am ecstatic to be back to working full time.

Saving & Spending

I feel like I skid into home base by the hair of my teeth, as far as making it through the summer without touching any of my savings.

I also did a particularly horrid job of sticking to the $500 budget this month. Part of that was playing catch up from my whopping total income of $365 in August, and part of that was just my own questionable spending choices.

And by questionable I mean, I think I’d be happier with a little more of a buffer in my bank account right now, I get sort of antsy when the balance in below $500 and it’s currently around $200, but some of that is because I actually contributed to my Roth IRA for the first time since May.

This month just shot by. Going into Labor Day weekend, I had the week off from the Frolic and thought I was going to have 7 days of just nothing to do. Within about 6 hours of realizing that, the entire week booked up and I just feel like I’ve barely slowed down since.

I was training my replacement at the Frolic, which I always find to be one of the most stressful times as a stage manager. It’s far easier to just do the work than to double check someone else doing it, at least that’s how I feel. Especially while you’re still in charge of everything.

I also started prep work and went in for some training days on my new show, Clifford. So there were about two weeks there when the jobs were overlapping.

Now we’re heading into tech rehearsals for Clifford, so any of you who work in theater know what an easy, calm week I’m about to have ;o)

So, as usual, when life speeds up, so does my spending, in little ways I don’t notice. More trips on the subway instead of just walking, which at $2.50 a pop aren’t a big deal, but they do certainly add up.

Of course, the biggest offender again is eating out. The funny thing is that it was worse before rehearsals started, since as a stage manager, I learned long ago it’s best to bring your lunch or you might not get to eat, since people often stop you to ask questions or go over things during breaks.

But my largest purchase this month actually fixes one of my biggest personal finance fails – I finally sorted out some health care coverage. So yay, as of October 1st, if my appendix bursts or I get hit by a bus walking down the street, I will probably not go bankrupt getting fixed.

I opted for a medical sharing ministry instead of insurance because of the savings, which I plan to write about more next month, but in the meantime, if you don’t know what a medical sharing ministry is, I wrote about it in a post over on Femme Frugality’s site a few months ago.

My two large splurge purchases were tickets to Hand to God and Then She Fell. Hand to God wasn’t actually terrible for a Broadway play at $50 and was actually an awesome play. I liked it a lot better than Book of Mormon. Then She Fell was really the splurge at $130. You can get tickets as cheap at $95, but the friend I was going with wasn’t available any of those times and I’ve wanted to see it for so long. So, fingers crossed that it’s awesome.

My spending breakdown this month:

- Food: $329.21

- Clothing: $21.52

- Entertainment: $330.76

- Commuting: $236

- Gas: $123.85

- Toiletries/Hair Cut: $120.04

- Stage Management: $11.95

- Healthcare: $360

- Blog: $19.99

Total Spending in August: $1553.32

So… not quite $500.

Hustling

So after my lamest month as a side hustler in August, September actually kicked butt. Some of it was receiving delayed payments from August, but September itself was actually a pretty busy month.

- brokeGIRLrich: $779.85

- User Testing: $20

Additional Income This Month: $799.85

Added to my stage management pay this month, it brought my total income up to $1786.94.

Do you see that number?? It’s FINALLY higher than my spending. For the first time since May. Good gracious.

So in response to that and in celebration of returning to full time work, I put $700 towards my Roth IRA this month.

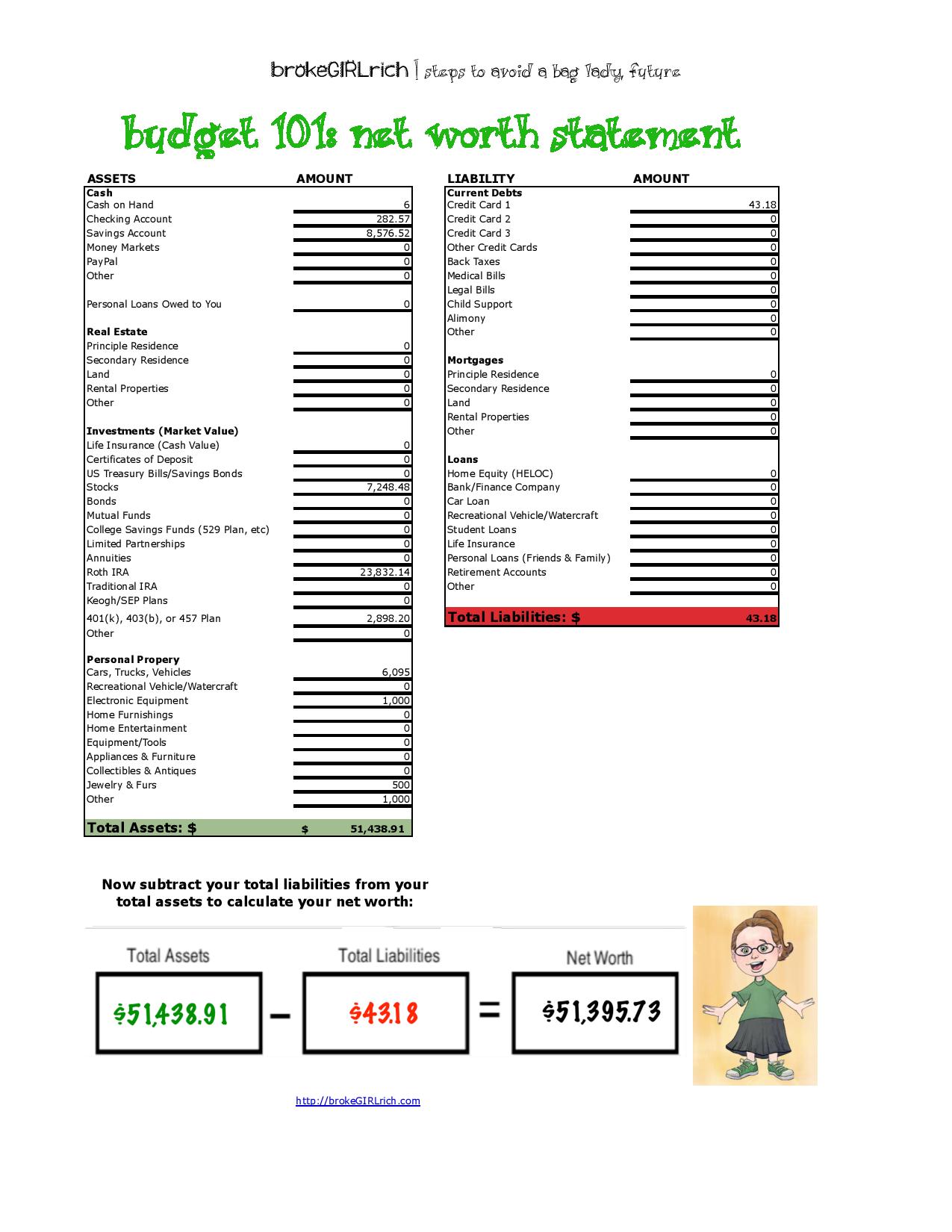

I also feel pretty pleased I made it through the summer without touching any savings, but checking out my May net worth versus my September net worth, which is $2,000 lower, reminds me that it’s still a lot nicer to watch my net worth grow than to just see it slink along or even drop a little – especially when the reason it drops isn’t market fluctuation.

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: How Running is Like Personal Finance – Part III

Elsewhere on the Web: 6 Free Things to Do In New York City at U.S. News & World Report

Cheaper Alternative to Traditional Wedding Gifts at U.S. News & World Report

Entirely Unrelated to Personal Finance

I’m currently hooked on Outlander. That show is terrific and desperately makes me want to go back to Scotland.

I also saw the Maze Runner sequel with my best friend last weekend and had literally no clue we were going to watch a zombie movie. The entire thing was strange and unexpected… I’ve also got to admit to a seriously unhealthy crush on Aiden Gillen. It’s mostly unhealthy because the characters he plays are seriously horrific people and yet…

Goals

1.) Max out my IRA… still at $100 to go. This will be done before the end of the first week in October.

2.) Contribute $1,000 to my emergency savings – Done.

3.) Buy $1,000 of stock – perhaps by November.

4.) Save $100 a month for a new computer. September – check.

5.) Save $100 a month for a new car (I’m hoping the current one will make it to roughly 2021). Not this month… but hopefully I can catch back up by the end of October.

6.) Save $2,000 for a house down payment. Still at $1,500 to go. It might be doable, then again, it might not. This is still the goal I’m the most on the fence about achieving.

7.) Start looking for work for December and January. Yay for freelance stage managing with giant ridiculous gaps in my schedule. At least my taxes should be nice and low for 2015 :o/

Nice work on your side hustling income, Mel. And, hey, we all have expensive months! I’m actually dreading my September budget review because I know it’s going to be my largest one so far this year! Enjoy being back on the road 🙂

Kate @ Cashville Skyline recently posted…10 North American Bucket List Train Trips

I will! Especially the per diem. 😉

Way to be moving in the right direction again; it is always a good feeling. BTW- even though you had a weird financial summer, I admire your willingness to take career risks and career breaks. It’s really important to be able to do that, I think.

I think I’ve been really lucky to be able to take career risks and career breaks – it’s the entire reason I try to stay on top of my finances, to allow for that flexibility!

Big bump is side income, nicely done! So did the Dino show you were on the road for get canceled or you’re just not going back? Considering the bump ride this summer, things are still looking good.

Brian recently posted…5 Tips to Create a Debt Killing Budget

The Dino show was slated to just be 5 months long. So now that it’s over, I’ve hopped onto a different show with the same producing company.

Congratulations! Some weeks end up being bigger than others in terms of costs. As an entertainer and freelancer you’ll end up with days where both insurance payments, your quarterly taxes and other random payments come do.

It does seem like bad things come in (at least) threes!

Nice job with your site income this month! That’s awesome. I had a great month in terms of income too, but stupidly I spent too much of it instead of putting some on debt or toward savings. Grr!

Kayla @ Kat Script recently posted…Getting Rid Of Television To Prepare For Nursing School!

Daily practices are the best prep work for improvment, And congratulations ! you are doing great job dear.Also you are earning very good.

ritesh45 recently posted…Get Women’s Belts on limeroad

Great income for the blog. Maybe one day…it is amazing though, I have a (mostly) book blog that is over ten years old (http://rannthisthat.blogspot.com) and I’d say the average post gets 20 hits, and I’m estatic at anything over 50, but because of the number of posts, I’m getting twice the daily hits that I get on Racing Toward Retirment, even though my individual posts there do far better.

RAnn recently posted…Preparing for the Unexpected: Automobile Insurance

I definitely spent a LONG time in the 20 hits a post range. I think it took about a year to even get past 50 views a day on my site. Now it averages about 7-800.

Yay for numbers bring in the green! Sorry excited to hear what you did with the health care ministry!

Femme Frugality recently posted…Decorating on a Budget: Finding Your Style Frugally

*being

Femme Frugality recently posted…Decorating on a Budget: Finding Your Style Frugally

This month was an expensive month for me as well with loads of unexpected expenses. Trust me you are doing good as your net income is growing. Your blog income is pretty high, that acts as a buffer in expensive months like this one.

Esther@Moneynuggets recently posted…Student Loans: A Guide to University Debt

It’s not the norm yet, but it was definitely a good month to be a blogger.

Well done on your earnings this month Mel! I’m really glad you sorted out health care provision through a medical sharing ministry. I can’t think of anything more frightening than having something awful happen to your health and not being able to pay for it. I thank my lucky stars once again for the NHS here in the UK which is healthcare payed by everyone’s taxes.

Hayley @ Disease Called Debt recently posted…Online Income Report – £1,201 ($1,549) in September

I loved NHS. I was so skeptical of your system until I actually had to use it when I jacked up my knee falling down a flight of stairs at uni. It was fast and efficient and didn’t cost a penny, since I was a student.