Profile

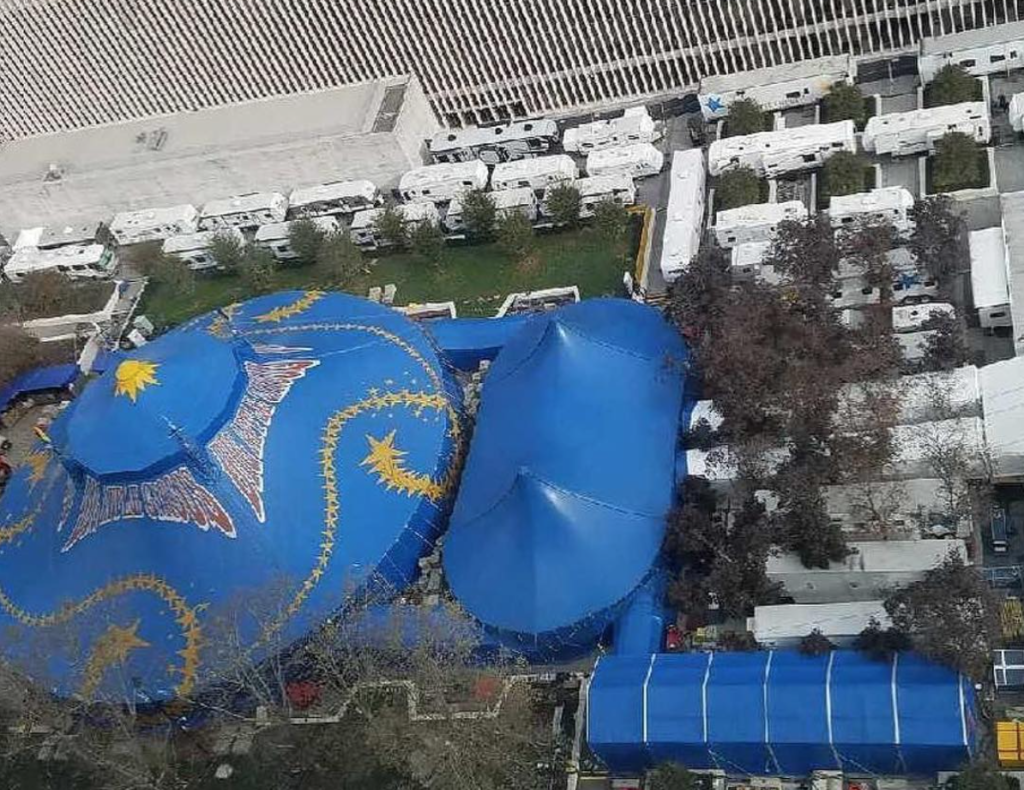

I am thirty three years old and the Performance Director at Big Apple Circus. I make $70,000 a year and live in a show provided RV. I also have health insurance through this job that’s deducted straight from my paycheck, so I don’t really count it in my bills since it’s never money I saw anyway (it’s roughly $180/month).

Saving & Spending

I can’t get over how quickly November flew by. I was staring at my calendar in my office and thinking about how it feels like I just wrote in all the November information and now it’s pretty much December.

Life is just terrifyingly fast sometimes.

I still love my job a lot, which is nice. It’s still stressful and the hours are incredibly long, but I think December will actually be a little easier – between having more organizational systems in place now and a little less PR since we’re coming to the end of our time at Lincoln Center, December looks promising.

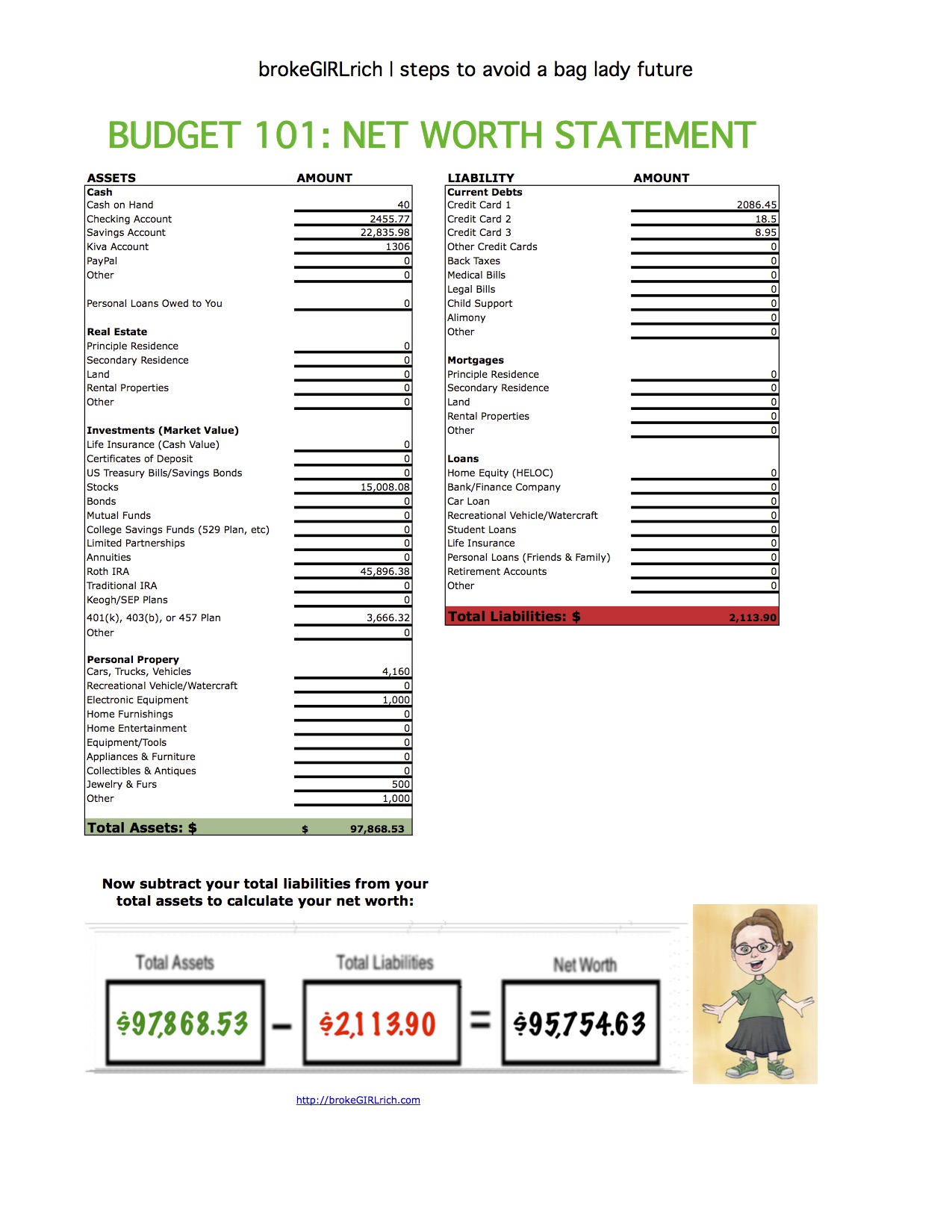

I managed to hit all my financial goals for the year this month. My “official” ones that I list at the bottom of these posts and my savings avalanche ones too.

So my IRA is maxed out. I bought $1,000 in stocks. I contributed $2,000 to my new car fund, which is now up to $6,110.01 – a little under halfway to the type of car I’d be likely to buy when my current one bites the dust (though hopefully she’s got approximately 6-8 more years in her). I contributed $5,000 to my down payments fund, which is now up to $5,511.14 plus whatever happens with my mad credit churning Kiva experiment. My cousin’s wedding account was fully funded and I was able to give her a decent wedding gift too.

My savings avalanche included two additional goals. I wanted to save at least $600 of the estimated $1200 for my 2018-19 Car Insurance payment next June. I managed to set aside the entire amount. I also wanted to get my emergency savings back up to its pre-unemployment amount of $10,000, which I managed to do with my last paycheck.

So I’ve added one more sort of crazy goal for 2017, which is a major stretch, but if the market stays favorable and brokeGIRLrich has a strong month in December, I might be able to crack a net worth of $100,000.

Which is a big, freaking deal, guys. At the beginning of the year, I thought I was at least another year away from that goal.

As for the spending, a lot of my expenses are related to our show. I get reimbursed, but I’ve often found I’ve got several hundred or even thousands of dollars of props and equipment purchases that I’m waiting for reimbursement on. My current astronomical credit card bill is mostly thermal underwear for my entire cast for the Macy’s Thanksgiving Day Parade.

A fun expense this month though was tickets to go see Sweeney Todd with one of the girls from work. They put on the show in a meat pie shop and you eat meat pie there before the show. The ambiance is awesome, but the performance is incredible. The actors are so talented. I was all in from the opening number, which is really something.

Other than that, my expenses were primarily food and NJ Transit related. If I actually have a full day off, I usually go home and visit my family. One of the best things about this job is that it’s actually so close to home for several months, I get to see them sometimes. I’m really going to miss that when we head out on the road again in January.

There were a couple of expensive food choices when out with friends in the city, but I’m not going to lie, it’s been kind of nice just to be able to go. And pay the bill without worrying about what I’m ordering.

There was also the last minute scramble to put together my part our of company pot luck, when I realized I don’t known things like a blender and a mixer. There were definitely cheaper ways to obtain those items than running across the street to Bed, Bath & Beyond at the last minute, but it was certainly the easiest way.

My stupidest spend this month was when I signed up for the 30 day free trial of Amazon Prime and then forgot to cancel it! Personal finance blogger fail. I even slapped a post-it note with a reminder on the wall by my desk in my office and I still forgot.

…at least I get access to mostly free shipping for a year? Maybe it will be worth it. We’ll see, I guess.

Anyway. This month’s spending:

- Food – $507.45

- Travel – $47.45

- Gifts – $23.95

- Lifelock – $9.99

- Amazon Prime – $105.81

- Home Décor/RV Supplies – $205.02

- brokeGIRLrich – $2.99

- Haircut – $40.00

- Clothes – $105.01

- Toiletries – $34.50

- Entertainment – $163.50

- Work Related – $1051.78

Total Spending in November: $2,297.45

Hustling

My income this month was from performance directing at Big Apple, my last Medi-Share payment reimbursement, and brokeGIRLrich.

- Stage Managing – $3,578.22

- brokeGIRLrich – $960.82

- Medi-Share Reimbursement – $211.00

Income This Month: $4,750.04

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: The Budget Guide to a Geeky Christmas

Totally Unrelated to Personal Finance

Does anyone know anything about creating apps? I’ve spent this month listening to some YouTube videos and trying to read up a little on how to create them, because I’d really like to create one for work. I think it would be great to have an app that lets us send out announcements, message each other, request comp tickets and work orders, etc.

It doesn’t seem like it should be that complicated, but I’m definitely struggling with exactly where to start.

Goals

- Max out my IRA. – Done

- Buy $1,000 in stock. – More mutual funds.

- Contribute $2,000 to my New Car Fund – Done

- Contribute $5,000 to my Down Payment Fund –

- Contribute $200 to my cousin’s wedding fund. Done

- Develop 2 new resume skills – One to go. Maybe app building?

- Do something really fun with my brother. –Done

- Write a journal or magazine article. …I think this goal is probably being moved off the list for 2018. It’s a remnant of those grad school goals I had at the start of the year.

- Hike something.

- Master making macaroons. …probably not till 2018.

Well one, Mel! That is terrific. I also wanted to say that I love how neat and organized your net worth sheet is.

Thanks! I’ve been using it for years. It’s pretty much the #1 motivator in my personal finance journey these days.

Have you tried SLACK? It is a free app the you can send out messages to everyone that they can see on their app or start different channels like work orders, parties, etc…

It is nice when things start going your way financially. Hope you enjoy life on the road!

RAnn recently posted…How Good is Good Enough?

Always so nice to see you crushing those goals! I’ll keep my fingers crossed that you hit that $100k net worth, but if it isn’t in December, I’m sure it will be soon. BTW, I don’t know the slightest thing about app building, but I think that it would be a great skill to learn.

Gary @ Super Saving Tips recently posted…17 Weird and Wacky Ways to Save Over $7,000 A Year

Right? I keep thinking I managed to build a website, surely I can figure out this app thing.

Pingback: Church of FI – November Expense Reports | The Jolly Ledger