Profile

I am thirty one years old and I am a stage manager and lighting director for a touring children’s theater show called Clifford the Big Red Dog Live! I make $700 a week and get a $30 per diem for each travel day. I pay no rent and have about $210 in monthly bills.

Saving & Spending

It’s been another stockpiling month, preparing for another budget lockdown as I go into a 2 month layoff with Clifford.

I’ve got some overhire stage hand work lined up to take me through the first two weeks of December and then I’m back to substitute teaching until the end of the first week of February. Although fingers crossed I can find something else in a theater to do instead. I have an interview with the theater in my hometown when I get home to work overhire for them too, but I don’t know how busy they’ll be in December and January.

I put in a little to extra toward my new computer and new car funds so that I don’t have to worry about them during the layoff and still meet my goals. I also started a new savings account for My Best Friend’s Wedding. The goal is to get it up to $1,000 and currently it’s at $300. I also added a little extra to my emergency savings that I can tap into if I need to use for my healthcare coverage payments in December. I’m going to take $200 out of my last check in December to cover that for January as well.

We also stopped at the Unclaimed Baggage Center in Scottsboro, AL, where unclaimed baggage from airlines, train stations and busses goes to die. It’s sold at a steep discount and I was able to pick up a few necessities really cheap (like a belt so I could finally retire the one that was held together by electrical and gaff tape).

My biggest splurge this month was on clothes. One of the ladies on our tour works part time at Old Navy and had this crazy 50% off the entire store sale coupon for a few days before Thanksgiving that we all used. Further proof that coupons absolutely can make you spend more. I didn’t need a single thing I bought, but I definitely like everything I got and managed a pretty good haul for $50.

I also got to catch up with two ship friends one night in Vermont when we learned there’s really not much open to eat in Rutland after 10 PM. It’s always awesome to see both of them and I was not a little jealous to learn one of them was going back to fill in on a ship for a week this month. I wonder when the urge to run back to the ship completely goes away? It’s faded a lot after 3 years, but there are absolutely still some days when it seems like the best idea ever.

I’m still doing pretty well with Christmas presents and coming in well under $100 and only have 3 left to get, although my brother usually gets the largest chunk of my Christmas budget and I currently have no idea what to get him.

Of course, in typical touring style, my largest budget item is still eating out. I realized in the middle of the month that I had been to several more expensive places than usual, so I put more effort into reigning that spending in and hoarding venue and hotel food for the last two weeks.

Entertainment came in good and low at $29.30 but we actually saw a ton of awesome things this month! This includes the Merry Go Round Museum in Ohio, the Iron Island Museum in Buffalo (which is seriously just the weirdest place – quite possibly the oddest roadside attraction I’ve ever taken a cast to), Opus 40 in upstate New York, the World’s Largest Fire Hydrant and Peanut… to name a few.

My spending breakdown this month:

- Food: $575.04

- Entertainment: $29.30

- Christmas Gifts: $35.90

- Healthcare: $205

- Clothes: $60.72

Total Spending in November: $905.96

Hustling

Still going strong and trying to build up brokeGIRLrich a little more. I also got my check from substitute teaching in October, but since it’s at my parents house and I haven’t been able to deposit it, it’ll make it onto the December side hustling tally.

- brokeGIRLrich: $508.50

- UserTesting: $13.00

- eBates: $11.66

Additional Income This Month: $533.16

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: Start a Blog. Have a Voice. Make Money.

Elsewhere on the Web: 4 Must See Roadside Attractions at U.S. News & World Report

How to Put Your Money to Good Use U.S. News & World Report

Entirely Unrelated to Personal Finance

I’ve gotten hooked on The Newsroom. I don’t know how I missed this show when it came out, but I generally love Aaron Sorkin shows. This one is no exception – if you like clever writing and feeling like you’re learning something while being entertained, give it a watch… unless you’re part of the Tea Party. You might not love it then.

Speaking of politics, at my brother’s request I request, I read Ben Carson’s book, which I don’t really have a problem with, since it’s important to have a clue what all the political candidates are about, even when you don’t agree with them. I felt like I was back at Liberty while reading his book… this is not necessarily a compliment and makes me uneasy about any political candidate. I also felt extraordinarily talked to down to. Suffice to say, it hasn’t swayed me from feeling the Bern.

On a much lighter note, I’m currently reading Stephen King’s Revival while trapped for endless hours in our tour vehicles. Sometimes I forget how much I love his writing. And then he writes another book and I remember.

Man, I used to have all of Stephen King’s books. I just loved them. But it’s been so long now (I pretty much stopped reading so much after I had my son) that I have no idea what he’s written in the past decade or so. Great update and you really seem to have a grip on your financial comings and goings. Best wishes on all of your gigs, Mel! 🙂

kay ~ the barefoot minimalist recently posted…What’s In a Name?

He wrote a lot of really weird and (to me) considerably less interesting stuff. I thought it started to pick up again with Under the Dome and Duma Key.

You are a great example for people who are in your field, and I love how you always have a plan. Good luck with everything, and thanks for sharing the pics…

Petrish @ Debt Free Martini recently posted…Melodrama Monday – Finish What You Started…

Thanks, Petrish! That’s really what I’m going for – proving you can work in the arts and still make successful plans with your money!

I’m glad you are planning ahead for your expenses and bills for when you are in-between work. I hope you find something good to cover that time period though. 🙂

Cat@BudgetBlonde recently posted…How to Practice Feeling Content This Holiday Season

Thanks, Cat!

That’s so cool that you went to the unclaimed baggage place! I’ve heard about that place!

Heather @ Simply Save recently posted…MinsgameBOSS: Week 5

🙂

Ohhh, this post makes me want to travel. I’ve never heard of a baggage sales centre, even though it makes tons of sense. So it’s basically a gigantic thrift store? Plus that fire hydrant is hilarious.

Here’s to a great job in the interim period.

Anne recently posted…Supercharge Your Career through a Healthy Lifestyle

It’s sort of a giant thrift store, but they’ve got all sorts of stuff, including computers, iPads, etc. Those are still pretty expensive, but considerably marked down from what they’d be to buy new and thoroughly checked out before they are sold.

I have to say, you really don’t spend money! I mean outside of food, your expenses are nothing. Best of luck nailing down some theater work for December/Jan.

Thanks! Insane work scheduling definitely helps me not spend a lot. :oP Those numbers will be really different when I compute them at the end of December after a month at home.

Great to see your progress like this. Also, it’s amazing you spent so little on your vacation! I’m always tempted to turn into a shopaholic when I’m vacationing.

Jordan recently posted…Get Connected with the Finance Globe Community

I wasn’t on vacation! I actually work out on a tour – so I’m constantly moving from place to place.

Sounds like you saw some pretty cool places this month! I’m not one for long road trips, but there are a lot of interesting sights to see nearby and I’ve really got to start taking better advantage of that…especially the free and low-cost ones!

Gary @ Super Saving Tips recently posted…10 Year End Tax Planning Moves to Save Money

It’s so easy to overlook the local stuff! I live 35 minutes outside of New York City and have wanted to go in the Empire State building for years, it just keeps on not happening.

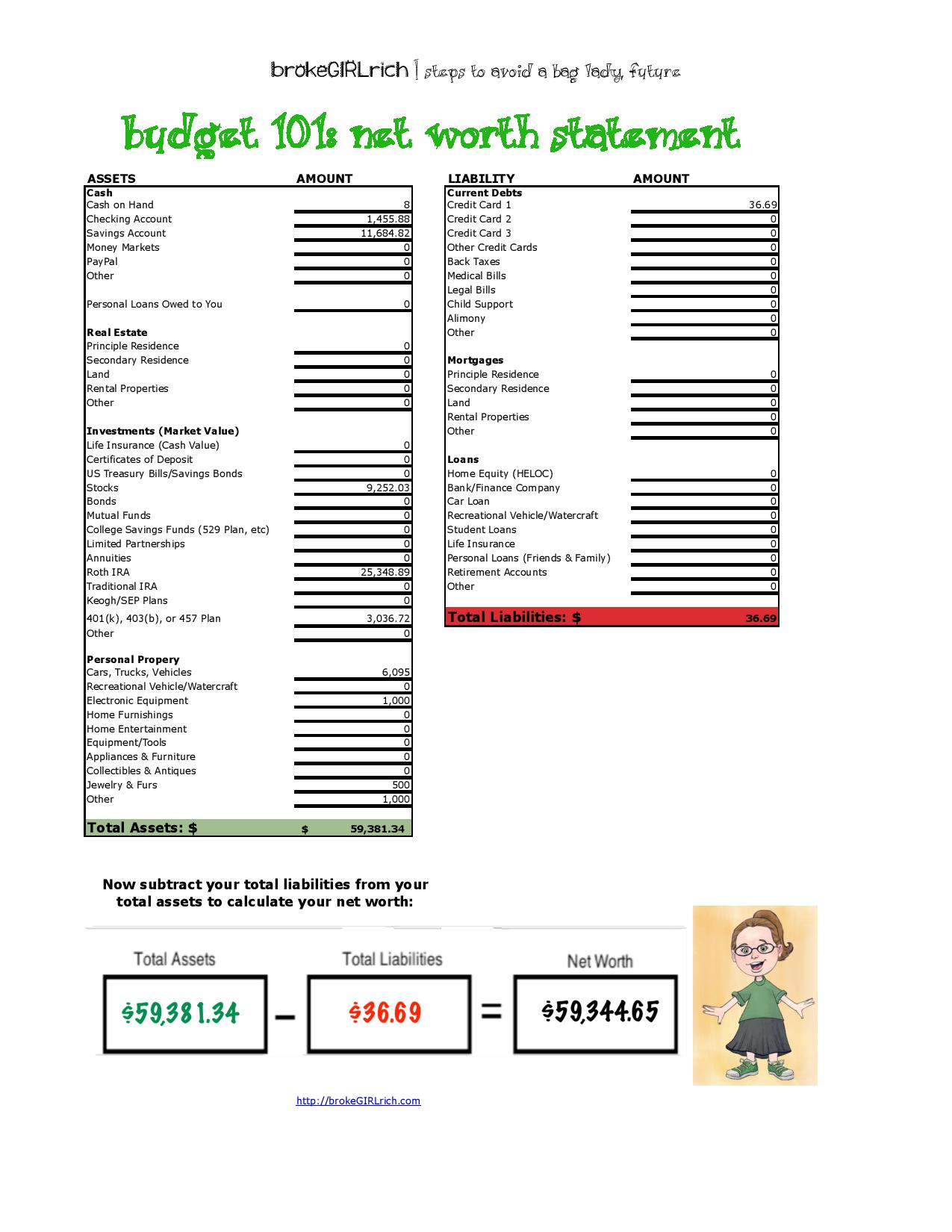

That red liability figure looks great! So low – what a nice feeling to know that most of your money is yours. Whenever I look at your accountability reports I remember just how variable your income is and what a great job you do in managing your money throughout the year to account for those periods of downtime in your job. Love the pics!

Hayley @ Disease Called Debt recently posted…Financially Savvy Saturdays #119

Thanks! Honestly, the entire goal of my website is to show other, younger stage managers and people who want to work in the arts that it can be done!

Unless, of douse, I totally fail… then it will be a pretty public warning to go be an accountant instead. ;o)

Cool stops on the road this month! You do a great job managing your finances considering how variable your income is. I’m not sure I would do as well.

Tre recently posted…Financially Savvy Saturdays #119

I’m really lucky that when I was financially ignorant, I didn’t have many bills and had a pretty good income. And then I dated several boys who force fed me financial skills. Nothing like a guy making you feel unsexy cause you don’t have an IRA – thank God I dated such weird boys.

This reminds me that I owe you an email. I’ll get on that. Where in Ohio is the meet go round museum? And is it interactive? I hope you find something in theater for the next couple months… Subbing can be a pain!

Femme Frugality recently posted…Getting Through Christmas Without Debt: This Is How You Can Do It

The Merry-Go-Round museum was in Sandusky and you get one free ride with your admission. It’s a cute little stop if you’re driving through.

Congrats on the positive month. You did a great job with your entertainment expense. I need to cut back on that.

Alexander @ cashflowdiaires recently posted…November 2015 Net Worth Update

It helps when you’re working too many hours to do much else ;o)