Profile

I am thirty four years old and I’m still living the freelance/sabbatical life. My only monthly bill is my health insurance. I’m starting to consider my return to the rat race, but likely not until the end of summer. Though if anyone needs a darn good PSM starting mid/late August, give me a holler.

Saving & Spending

I worked for five days this month. So there’s that. The majority of that was lighting a 1980s themed dance show.

…and now the music from the number that they used for the above picture is stuck in my head again. #theatreproblems

I did finally get paid for all the work I did in April and I did not buy any houses, so there’s also that. The magical swamp house was totally not magical and really just a swamp.

I was also wildly bored this month – which isn’t the worst thing, because it’s been the first month since December where I thought, “I’d like to go back to work.” I think I’ve made it past the career burnout hurdle.

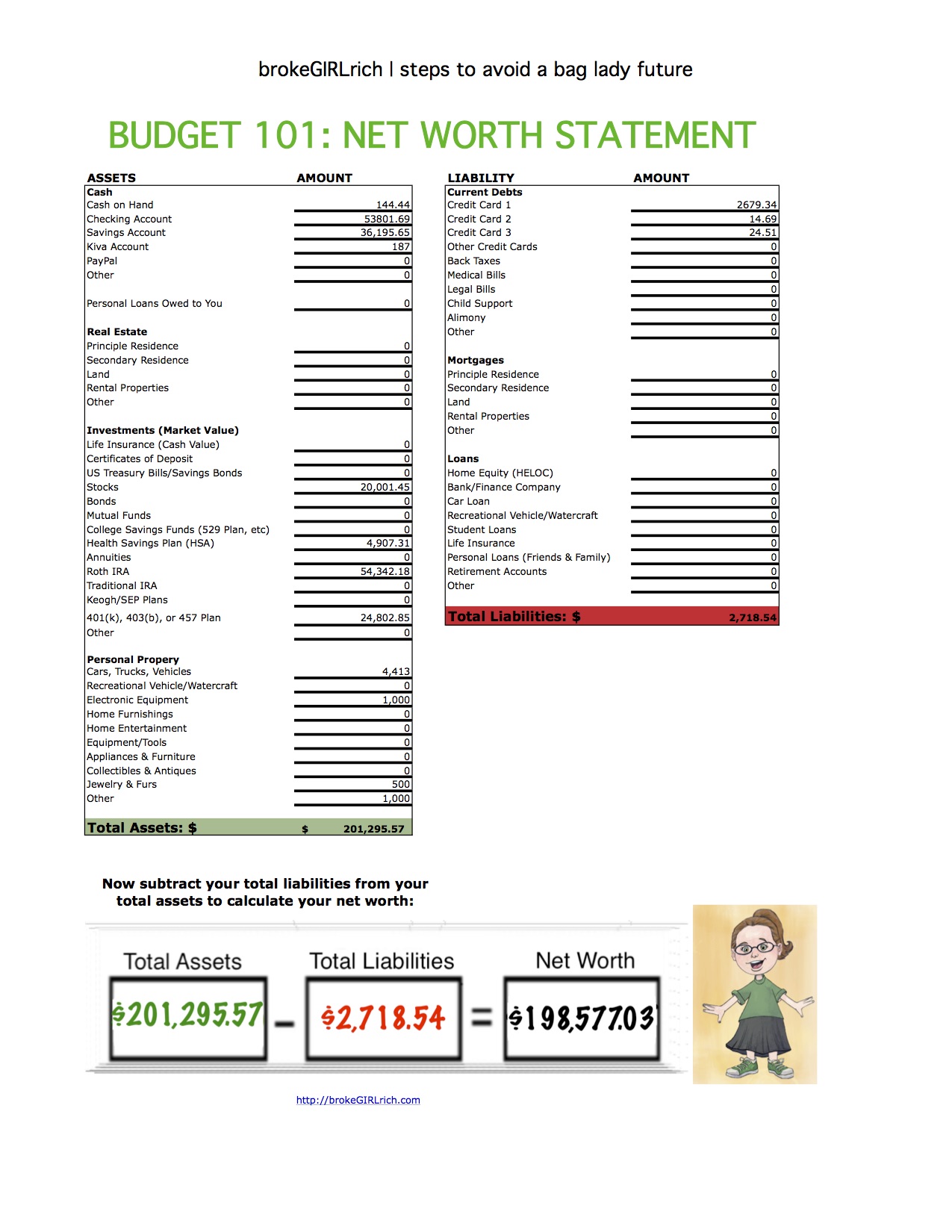

My brother and I also received the check for our mother’s life insurance – so there’s a pretty big net worth boost, but geez, what a crappy way to get it. I just look at that net worth number and think I’d trade the entire thing just to have her back.

But here we are.

It was kind of an expensive month.

Who am I kidding? It was a way expensive month.

- The annual car insurance hit got me again.

- I went to the dentist.

- The neighbor kid hit my car and in the process of him fixing that, several other issues were found.

- My website got hacked for the first time ever and my total lack of updating and not understanding the back end of this sucker caught up to me financially big time.

And I YOLO-ed it up a little, though honestly, I’m an ok YOLO-er, as we’ve previously established, so I’m not super worried.

My mother, who was like, not so hot with money, would totally approved of my clothing/candle/fun with friends splurge, and I thought of her every time I was doing it, so assuming I don’t fall into habit territory here, I’m calling it good.

One of those days was actually one of those random life days where you think, I’m just going into the City to grab lunch with some friends and maybe a drink with another friend, that spiraled wildly. I saw a ton of different friends, it involved a stop at the Color Factory (which is actually kind of lame though my company was great), copious alcohol at a variety of bars, and finished up with a massive milkshake from Black Tap. Short of paying my car insurance, it was the most expensive day of the month.

Worth every penny.

I also managed to shatter the family coffee pot this month. I call that budget line “stupid money.”

Here’s the damage:

- Food – $484.59

- Car – $375.83

- Car Insurance – $1183.05

- Healthcare – $140.63

- Dentist – $185.00

- Haircut – $50.00

- brokeGIRLrich – $549.20

- Music Lessons – $191.50

- Fun – $189.21

- Gifts – $45.92

- Candles – $54.75

- Clothes – $472.82

- Bed Bugs – $42.43

- Stage Management – $86.80

- Train – $18.50

- Stupid Money (Coffee Pot) – $22.99

- Miscellaneous – $14.99

Total Spending in May: $4,108.21

Hustling

I finally got paid for the BAC gig in April and that hot second as a photography PA. I also have a mystery check that I deposited at the beginning of the month and I can’t remember what it was from. I’m inclined to think it’s probably a final state tax return. I also cancelled a travel card the same day the annual payment was due – I paid it, thinking I had messed up, but the company refunded the payment and sent me a check.

And, of course, there was the Mom life insurance bump.

- Taxes,, Maybe? – $140.00

- American Express Refund – $95.00

- Photographer PA – $100.00

- brokeGIRLrich – $619.98

- Stage Hand Work – $654.79

- Stage Managing – $2150.52

- Inheritance – $50,483.12

Income This Month: $54,243.41

Oh, hey, and just a reminder that if you came out a little ahead this month, That Frugal Pharmacist could still use a few bucks as they figure out life with their sick kid. You can read the whole story and donate via this link. Or if you’re doing some Amazon shopping, you can do it via their link at the bottom of their website and at no cost to you, they’ll get some kickback from Amazon.

Most Popular Post of the Month: 10 Things I Wish I Could’ve Told 21 Year Old Me About Stage Managing

My Favorite Post to Write This Month: 10 Things I Wish I Could’ve Told 21 Year Old Me About Stage Managing (because, holy cow, USITT promoted it on their Facebook page and I felt like a rockstar).

Goals

- Start eating better. No.

- Work out more. I did go hiking twice?

- Better stress management. This is going ok.

- Keep taking accounting classes. Nailing it.

- Do two things to build up my stage management skills. I went to an APA sponsored pyrotechnics course, so one skill project done.

- Take music lessons while I’m home for a few months. I started them at the end of the month!

- Spend more time with family and friends. Success!

- Be more supportive of family and friends when I can’t be there in person. Yes, maybe?

- Go out on a date.

- Make an effort to not withhold kind words and encouragement.

- Max out my Roth IRA. On track.

- Max out my HSA. On track.

- Set aside $5,000 for my house downpayment account. Next month.

- Set aside $2,000 for my new car account. Next month.

- Invest $2,000. Next month.

- Read more. I read a book and a half.

- Learn to make macaroons. No further progress.

- Visit two roadside attractions. Wild Bill’s Prop Shop in Connecticut, the Mars Cheese Castle, the National Bobblehead Museum, the Lake Geneva Ice Castle.