Profile

I am thirty one years old and I am the Production Stage Manager/Production Manager for The Marriage of Figaro! I received a $3,000 stipend at the end of my contract (and am a dork who read her contract wrong and thought it was $500 more but it wasn’t) and a $300 travel stipend.

Saving & Spending

Woah, Nelly, where did June go? This was a busy month. The Marriage of Figaro had a successful run (complete with a good review in The New York Times!), but it was certainly a whirlwind towards the end there.

I also realized about midway through the month that I’d pretty much be in go-go-go mode until the middle of August, when I get a two week break. I finished up The Marriage of Figaro and went right into preproduction work for Into the Woods JR, a show I’ll be working on in Virginia through July and the beginning of August. I knew for the actual preproduction week for that show, I’d be in Hawaii, so I wound up doing all the paperwork and getting everything sorted while doing the postproduction work on Figaro. I usually really enjoy those weeks because they feel like the calm before and after the storm, but when the storms collide… let’s just say the last full week of June was a busy one.

It’s also had to complain about go-go-go mode when it’s really happening so I can take a full week off and GO TO HAWAII!! Which is where I am right now. Soaking up the sun. Going on a submarine and helicoptering over a volcano. Seriously, we have an incredible week planned.

I’m also super excited to be able to let go of my $500/month budget lockdown for the summer. I landed a tour of Fame that starts rehearsals on August 22nd. It’s the year of the stage management bucket list – an opera and a big musical! Also, it means only 3 weeks off this summer, this week in Hawaii and then two weeks in August and most of one of those weeks will be spent on vacation with my family, where I never wind up spending much anyway.

My biggest expense this month was my annual car insurance fee. Fortunately, that was already saved up and ready to go in a separate savings account. My stage management expenses were pretty high because I bought a new printer and finally sprung for actual head shots, since so many companies ask for them now. The rest of that will be reimbursed in July.

As far as entertainment, I went to Dorney Park with my cousin and had an amazing day – the water park was packed but there was pretty much no one in the rest of the park. I also saw the Curious Incident of the Dog in the Night-Time with a friend and it really was a pretty incredible show! I love the lighting and the set. And the rat.

My spending breakdown this month:

- Gym – $10.70

- Food – $281.32

- Stage Management Expenses – $601.11 (some to be reimbursed in July)

- Healthcare – $190.00

- Clothes – $60.62

- Car – $1050.54

- Commuting – $122.50

- Entertainment – $117.69

- Credit Card – $95.00

- Blog – $7

Total Spending in June – $2,536.48

Hustling

My income this month was made up of my Figaro stipend, brokeGIRLrich, dividends, and freelance writing.

- Stage Managing – $3300.00

- brokeGIRLrich – $685.75

- Freelance Writing – $400

- Dividends – $22.40

Income This Month: $4,408.15

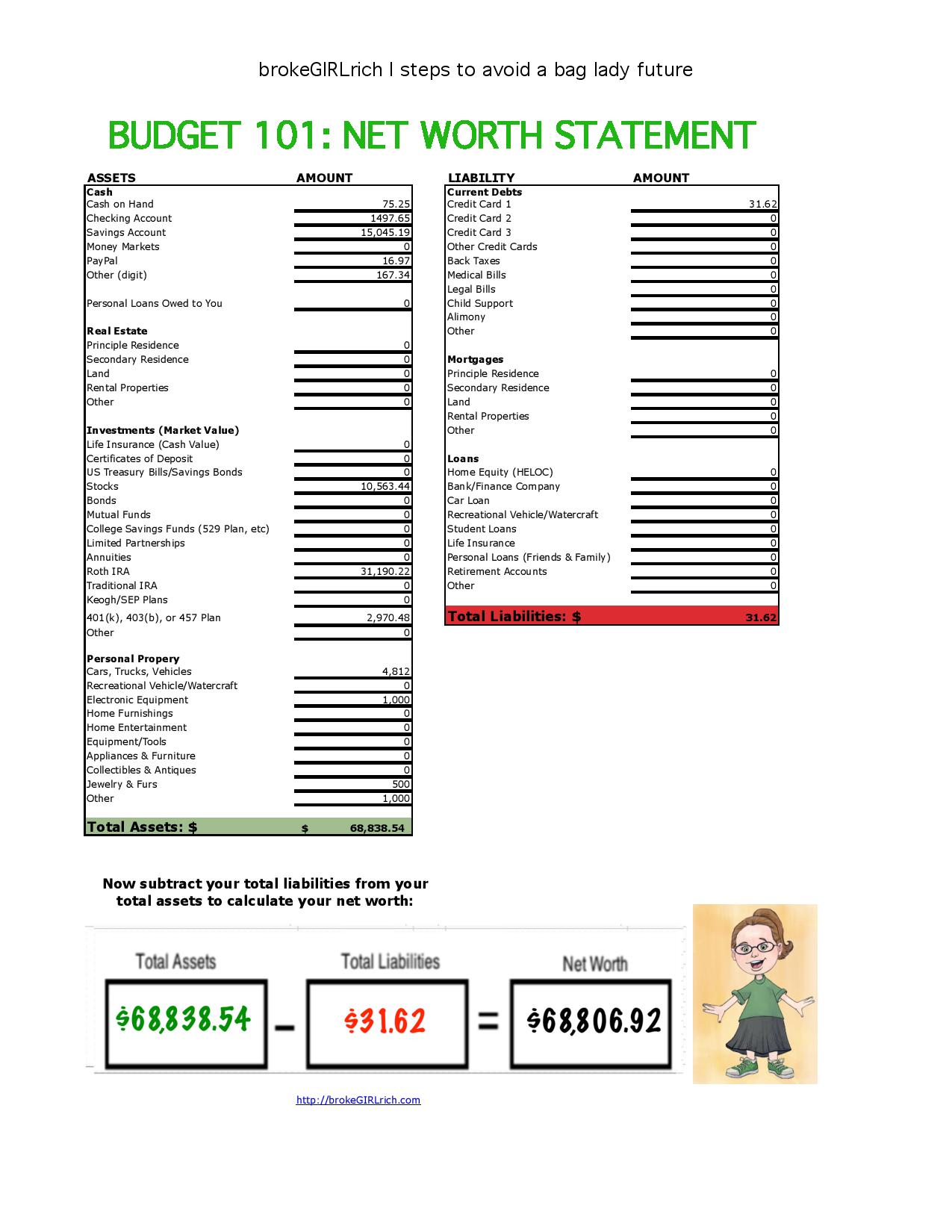

Well… at least I didn’t lose money this month, but I did think it was going to turn out slightly better than a $600-ish gain on my net worth. I put over $1,000 into my emergency savings for taxes and bought $1,000 of stock, but I noticed all my investments are down a little from last month. On the plus side, I guess that means it was a smart month to buy some stock.

I’m not going to feel dejected though. $68,806.92 is better than $53,376.54 (net worth as of June 2015) and $39,696.43 (net worth as of June 2014). $15,000ish a year increases isn’t bad on a salary that’s pretty much just under double that.

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: 5 Personal Finance Lessons from the Whole 30

Elsewhere on the Web: The Safety Costs of Being a Girl at Blonde & Balanced

How to Get Cheap Broadway Tickets at Money Under 30

Is Your Income Unpredictable? How You Can Still Hit Your Savings Goals at Money Under 30

10 Free (And Awesome) Roadside Attractions at U.S. News & World Report

How to Save Big on Eye Care at U.S. News & World Report

Small Purchases to Ease Travel Headaches at U.S. News & World Report

Financial Benefits of All Inclusive Resorts at U.S. News & World Report

Entirely Unrelated to Personal Finance

The Fame tour I’m heading out on is a bus and truck tour, which means I can add living on a bus to the list of weird places I’ve lived come September. However, I’m seriously considering getting a Kindle now (which costs money… so maybe this is not entirely unrelated to personal finance). The reason I hate Kindles though is that I think they are evil robot books with no soul and they smell wrong. You also can’t just borrow someone’s Kindle when they’re “done” with the book the way you can with an actual book. Someone out there sell me on this being a good idea. As far as amount of space it takes up, I know it is, but I just can’t seem to make the leap to robot book.

Goals

- Contribute $1,000 to my Emergency Savings Account– Done.

- Max out my Roth IRA– Done.

- Contribute $3,000 to my Down Payment Fund– Still at $2,650 to go.

- Contribute $2,000 to my New Car Fund– Still at $813.15 to go (I had a little extra in my car insurance fund for the year and it seemed logical to roll it over into the new car fund).

- Have a $1,000 Best Friend’s Wedding Fund– Done. Now I’m starting to deplete it. Dress is bought, bridal shower is paid for and hotel room is booked. All that’s left is bachelorette party, hair do on day of wedding and their gift.

- Buy $1,000 of stock– Bought another $1,000 of Hillenbrand, Inc. It’s been the strongest stock in my portfolio and I’m pretty sure people aren’t going to stop dying.

- Develop 2 new resume skills– Nothing here yet either. The goal was to achieve this in August, but I may have to figure out a different time to squeeze this in.

- Track all the time I spent on my computer outside of work for 1 week and then go without a computer for a week and see how I use that time– still working on a game plan for this.

- Go on a vacation with a friend– I AM IN HAWAII!!

- Look for a big show to stage manage– Done.

- Run a 5k– still training. It looks like I’ll be running the Vineyard 5k on August 13th with two of my cousins, we just haven’t actually registered yet.

I’m amazed you are able to send so little on food! What’s your secret?

Living at home with my parents! Although I also live out on the road and there have been some months where I managed to keep my food spending to around the same. And it’s only me, so when I really want to buckle down, $75-ish a week isn’t too hard to manage.

I feel the same way about ebooks but you can carry SO many more books that way which is why I finally took the plunge.

Check with a local library, you may be able to get a kindle app and borrow the ebooks just like you borrow a regular one. I use my iPad for this and it’s been such a money saver on books.

Awesome. My mom actually mentioned that she has a kindle she doesn’t use, so I think I’m going to borrow it for a while and see if I like it any better.

I was going to suggest checking your local library to see if they have a Kindle you can borrow (mine does) to see if you like it. Anyway, it’s all good because your net worth went up, and more importantly, you’re in HAWAII! Hope you’re having a great time and taking some nice pics to share when you return.

Gary @ Super Saving Tips recently posted…“Don’t Worry, Be Happy”: 4 Big Money Worries I Stopped Worrying About

Thanks, Gary! And I had no idea about Kindles at the library. That’s an awesome perk.

I hope you love every minute of being in Hawaii!! Come share notes with me when you’re done, I want to see what I have to add to our list for next time 😉

For the Kindle, I was absolutely against it philosophically as well but I find that it has been awfully useful. My physical limitations mean there are times holding a real book is torment but not reading at all is even worse torture! So the Kindle can help with that. And reading on the Kindle app when the baby was still in our bedroom in the early months was a brain saver. That said, I would second the suggestion of trying the Kindle app if you didn’t have your Mom’s as an option. It’s a relatively painless way to try it out.

I think that you can lend your books to other Kindle users, for a limited time, though. I don’t recall how but we could always do a test run to see if I’m right, if you wanted 🙂

Revanche@AGaiShanLife recently posted…Just a little (link) love: Riker and weird moves edition

I’m up for that test run once I figure out how to get my Mom’s Kindle to work!

My kindle has all of Shakespeare downloaded for free since it is public domain. Check out the Gutenberg Project. I also have notes on everything I’ve read in it. You can borrow books from the library on the kindle. It’s incredible. And usable in a dark space. I still have proper books and prefer reading that way at home, but the Kindle is great for travel and commuting.

ZJ Thorne recently posted…Net Worth Week 12 – A Glimmer of Progress

You’re making great progress on your goals for the year! Also, your blog income is awesome. Is that just from the ads in the sidebar, or also sponsored posts?

Pia @ Mama Hustle recently posted…What Financial Health Means to Me

It’s from ads and sponsored posts and affiliate links in a few posts.

I like paper books, too. But couldn’t you just use the Kindle app on your phone? Maybe there’s an advantage to getting a separate device…I just don’t know what it is.

FF recently posted…It’s back! Massive #SummerReading #Giveaway

When I read on my phone, I get car sick. That’s the biggest reason I’m hesitant to move onto a Kindle. Regular books don’t make me car sick, but the Kindle does have a different design than iPads/phones, so I’m wondering if that will make a difference.

You’re moving in the right direction 🙂 At least that’s what I continue to tell myself about less than fantastic financial gains.

Ah, to be able to read a book again – electronic or paper. The only way I have time to “read” is by listening to audio books during my commute. I guess that will be for our semi-retirement years.

Harmony@CreatingMyKaleidoscope recently posted…The Zombie Apocalypse Guide To Saving Money

You’re doing great! I always love to read your reports, they always seem realistic yet very well-played.

Have an awesome time in Hawaii!

Mrs. CTC recently posted…Free Investing Advice – Lifelong Returns Guaranteed!

Your gym membership seems very cheap, is that a monthly cost or pay as you go? Good job on the income this month, hopefully that will make the car insurance bill not seem quite so bad.

Hayley @ Disease Called Debt recently posted…Single Parents: Are You Missing Out on Child Maintenance?

It’s a monthly cost, but you can cancel at any time. The gym is pretty no-frills, it’s just for the treadmill. I may actually upgrade to their next level so I can use any gym anywhere, since there’s one near where I’m working in Virginia for the next month.