Profile

I am thirty one years old and I am an Assistant Stage Manager on tour with Potted Sherlock, a hilarious romp through all 60 Sherlock Holmes stories in 80 minutes! The show is a month long and has a $4,000 stipend along with a $35/day per diem. However, since a bunch of our shows were cancelled, I was actually sent home for most of the last week – still receiving my stipend pay, but losing out on per diem. Next month, I’ll go back to Clifford.

Saving & Spending

Reason 8,000,000 to have a solid emergency savings account. Sometimes your new employer inputs your direct deposit information wrong and you don’t get paid for two and a half weeks.

That could’ve been a pretty big problem, but wound up being easily weathered.

We also spent the first week and a half of the show in Canada. So we were super busy getting the show on it’s feet, which meant less time to spend money (although I did finally get to see the new Star Wars movie on our day off) and Canada is pretty cheap. So… I had a ton of Canadian per diem money left over that I needed to convert back to US dollars when we returned (so I can spend it on shoessssss – see below).

I was pretty excited that my first action of the new year was to dump $1,000 into my Roth IRA, since I’d had it sitting in my checking account waiting for the clock to roll over into 2016.

When I was finally paid again at work, I put in $1,500 more, so only $3,000 more to go to max it out for 2016. Not a terrible start to the new year.

I also put $400 into my emergency savings for taxes from this Sherlock gig. I’m hoping taking out $200 a paycheck will suffice.

Finally, I added $200 more to the Best Friend’s Wedding fund.

You are so pretty with your little blue soles! Totally worth scrimping on per diem and reviewing extra websites.

I’ve also become completely obsessed with Tieks shoes (thanks so much for that, Pinterest). I decided to hustle my way to them. I initially planned to use UserTesting earned money to get there (I’m at around $30 so far), but since I’ve picked up this unexpected month long tour, I added any spare converted Canadian per diem money to the total, which got me to the final amount I needed to order a pair. To be honest, I’m not sure I’ve ever spent $180 on shoes… so we’ll see if they’re worth it… especially since I caved in and ordered them yesterday.

They better be worth it. I’ll let ya’ll know in my February accountability update. ;o)

I subbed a few days at the beginning of the month before leaving for this tour again and made a little with brokeGIRLrich. And can we just take a quick break here to talk about cold season and how it might kill us all (you think I’m being over dramatic?!? I’ve been sick for 3 weeks already). I had no trouble getting sub work at the beginning of January because half the teachers in the school district were legitimately sick.

I’m pretty sure the local school system does not do a single one of these awesome ideas in this infographic, but we sure implemented a lot of them out on tour to try to keep everyone from getting sick!

But while I continue to fight off this unending hacking cough, let’s get back to the numbers:

My spending breakdown this month:

• Dropbox Renewal – $99

• Gym – $10.70

• Stage Management Supplies – $76.22

• Food – $248.02

• Medicine – $8.88

• Massage – $74.19

• Clothes – $261.80

• Transportation – $18.50

• Healthcare – $205

• Miscellaneous Canadian Spending -$140 Canadian/$98.48

Total Spending in December – $1,100.79

Hustling

My income this month was made up half the Potted Sherlock stipend, a substitute teaching check, brokeGIRLrich, and a tiny bit of UserTesting.

• Stage Managing – $2, 535

• Substitute Teaching – $145.96

• brokeGIRLrich – $475

• UserTesting – $30

Income This Month: $3,185.96

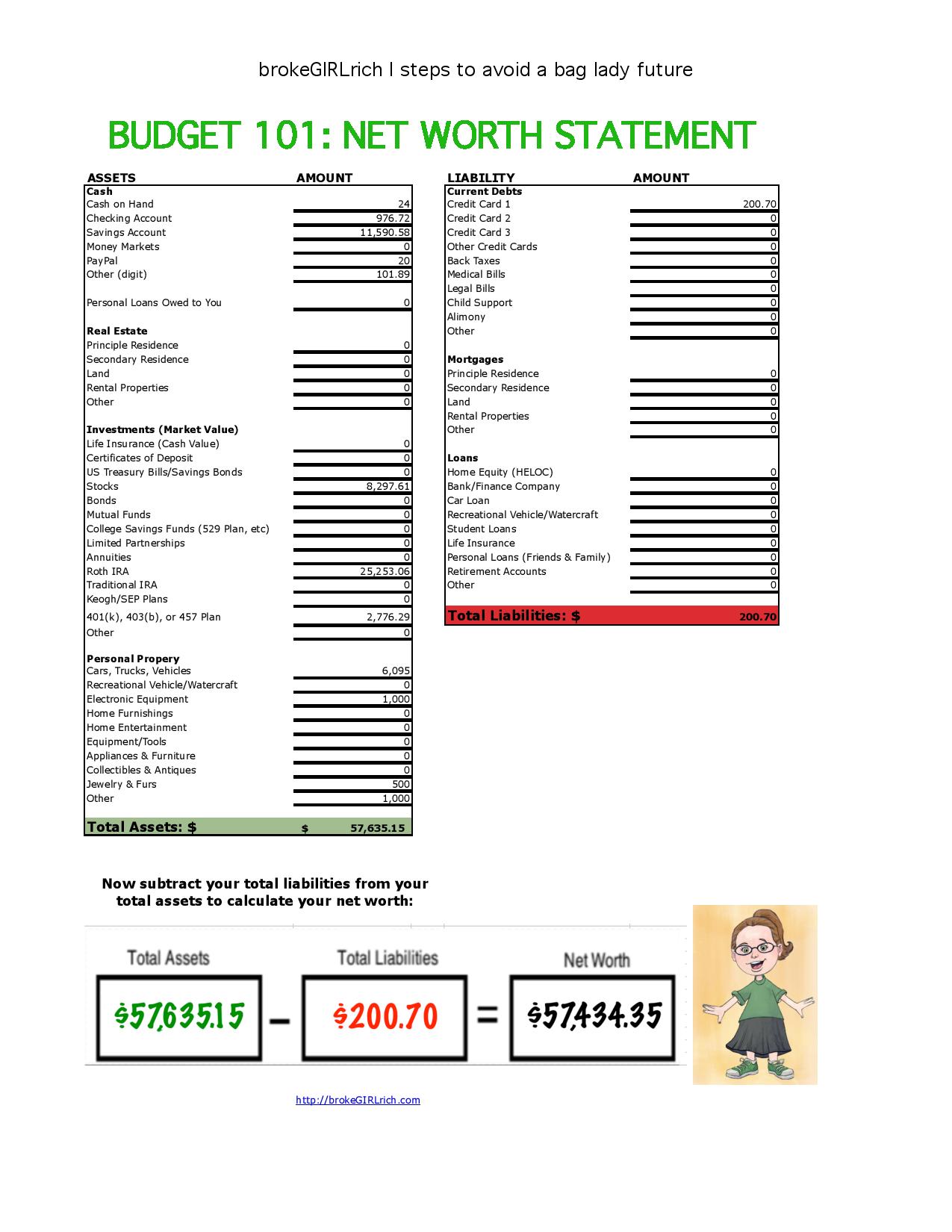

Nothing like being able to put over $3,000 into savings and investments only to have your net worth drop nearly $1,000. Thanks, stock market. On the plus side, since $2,500 of that went into my IRA, I can pick up cheaper stocks. Someday it will rebound.

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: Does Living With Your Parents Make You Financially Irresponsible?

Elsewhere on the Web: How to Save Money When You Go On a Cruise U.S. News & World Report (which was picked up by Yahoo! Finance)

How to Avoid Movie Theater Money Traps U.S. News & World Report

5 “Weird” Things to Do in Portland Travel Blue Book

Entirely Unrelated to Personal Finance

Have you ever noticed that binge watching TV can really effect your mood? I don’t know how it took me so long to notice or if was just having a moody few weeks as it was, but I binge watched a few really depressing TV shows and noticed that it definitely created a cycle of feeling pretty depressed. So I’ve been rewatching The Office now on the long drives with this tour and I started to read Stephen King’s Bazaar of Bad Dreams. So far it’s pretty good.

Goals

- Contribute $1,000 to my Emergency Savings Account – $400 went in this month, but it’s to offset the tax hit I’ll get for this job I’m currently doing. Then again, there have been several times when I’ve put money into my emergency savings to offset something and then was able to pay for it out of my checking account. So we’ll see what happens in April 2017.

- Max out my Roth IRA – I decided that since I magically picked up a $4,000 gig, most of it should go to this. So I’ve got $2,500 in it already for 2016 and the goal is to have it up to $4,000 by the end of February. Hopefully it will be maxed out by March, which would be the quickest I’ve ever managed that.

- Contribute $3,000 to my Down Payment Fund – I have done nothing towards this goal and, honestly, in order of financial priority, it’s the bottom of the barrel.

- Contribute $2,000 to my New Car Fund – Nothing done here yet either.

- Have a $1,000 Best Friend’s Wedding Fund – I put $200 into this account, so it’s up to $500 now. Halfway there! And since she’s started emailing us a few bridesmaid dress ideas, I’m glad I prioritized working on this savings account over the car and down payment fund.

- Buy $1,000 of stock – Nothing on this front yet.

- Develop 2 new resume skills – Nothing here yet.

- Track all the time I spent on my computer outside of work for 1 week and then go without a computer for a week and see how I use that time – I will not be attempting this goal until I find myself in one of those weird periods of unemployment/massive underemployment again. I’m sure there’ll be one at some point this year.

- Go on a vacation with a friend – nothing on this front either, although I did find a 20 One Week European Vacations website that has started to lodge in my brain. It’s been far too long since I’ve gotten a passport stamp – even Canada hasn’t stamped the dang thing the 3 times I’ve crossed with it this year.

- Look for a big show to stage manage – ya’ll keep your eyes open for me, will you? I applied to a big one over the summer that I’m in the running for, but I’d have to get myself to South Africa and find local housing for 6 weeks. Depending on the pay… I might do it anyway, even if I just break even for those 6 weeks, I’ve always wanted to go to South Africa. There’s a 2 month international tour after that.

- Run a 5k – hopefully in May.

I would absolutely love to chat with you sometime. First of all, I love the fact that you’re so honest about your finances, but even more so I love that you’re a stage manager. That’s the field I’m looking to go into, and I am finding there is just not enough information I trust to base a decision on!

I’d love to chat any time! You can shoot me an email through brokegirlrich (at) gmail.com or find me on Facebook or Twitter.

The stock market hasn’t been anyone’s friend lately. 🙁 Just keep thinking long term, long term.

Brian @DebtDiscipline recently posted…Interview Series: COL Carlos Perez, Jr., USA, Ret.

You are making great progress on your goals and will definitely max out your Roth IRA by March. Also, I am going to steal goal number 7 and add develop a new resume skills to my non-financial goals.

Sylvia @Professional Girl on the Go recently posted…First Investment of the Year – My Health

Sounds like you’re making good progress on your priority goals. Getting those funds into your IRA’s is an awesome way to start off the year!

Gary @ Super Saving Tips recently posted…Take Advantage of These Amazing Shopping Bargains for February

Those shoes look good (and comfy), I hope they are worth the expenditure! Look forward to reading how you get on with them. This gig sounds like it pays really well and brilliant that you can put so much into your IRA so early in the year.

Hayley @ Disease Called Debt recently posted…Financially Savvy Saturdays #127

Since I’ve spent 30 years – yikes working in some capacity in an accounting department I can give you a little insight into payroll errors. We are notified within 24 hours from our payroll company if someone’s direct deposit was bounced back. Usually someone closed or changed their account and didn’t tell us, but mistakes do happen.

If you were expecting a raise or a bonus and it was not reflected during the correct pay period, don’t assume it will magically appear on your next check. Your pay increase/bonus was not communicated properly to payroll. Contact your manager or HR department immediately. And make sure you get everything in writing.

I love the computer sanitation days. Thankfully I have a germ phobic co-worker who goes around sanitizing everything when someone comes in while sick.

Savvy recently posted…Appliances Don’t Qualify for the Energy Credit & Other Tax Tips

Those shoes are awesome!!! Well worth the money!And awesome job coming up with the extra money rather than taking it from savings or putting it on credit!

Elise @ Simply Scaled Down recently posted…Game Day Foods (With A Little More Class)