Profile

I am thirty one years old and I am the Stage Manager/Lighting Director for Clifford the Big, Red Dog! I make $700 a week and receive a $30/day per diem. I also finished up Potted Sherlock the first week of this month and am now on the hunt for something to do this summer!

Saving & Spending

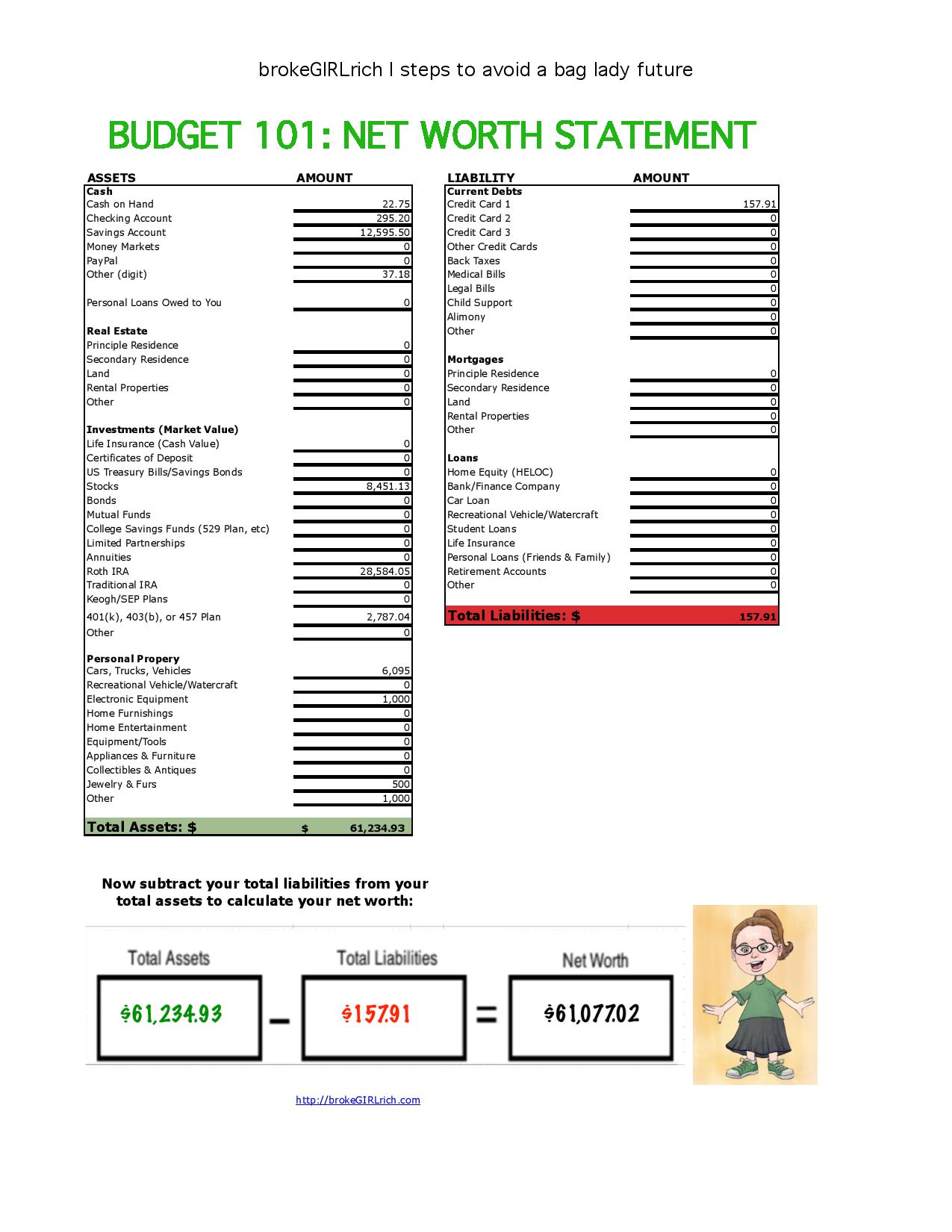

Let’s start with the big win of the month – I maxed out my 2016 Roth IRA in the middle of February!

I can’t even lie- I feel like a financial rockstar. I keep compulsively logging into my Fidelity account and checking my “year to date” contributions because I think it’s a lie.

So however else I may have felt about Potted Sherlock, I’m incredibly thankful for that gig since that’s pretty much how I managed this feat.

I also managed to squeeze in some pictures with the tigers in Detroit – another Potted Sherlock bonus!

Continuing on with the winning – I hit my goal on the My Best Friend’s Wedding fund. I was aiming for $1,000. I bought my bridesmaid dress at $100 (with a $20 coupon!) and there is now $900 sitting in that account waiting for all the other expenses that need to be covered related to her wedding this year.

I also put $200 into the new car fund, $100 into the house down payment fund, $200 into my emergency fund and $100 into savings for my car insurance payment this year.

I am pretty much winning at life this month.

Which is terrifying, because I know life can be a real b*tch too and my car is probably about to explode… or my appendix… or just some bad juju is certainly on my heels.

But for today – we celebrate!

Now that all the saving is out of the way, there’s also some spending to account for. Potted Sherlock paid out it’s per diems and reimbursements in cash, so I had about $250 in cash by the end of that tour. Clifford wound up with 3 unexpected days off in San Antonio, right on the Riverwalk. It was awesome, but expensive. Since that $250 in cash didn’t really factor into any of my plans, it became the San Antonio spending money. I can’t even tell you where most of it went (lies – it went into the bars of the Riverwalk), but I can tell you I finished up those 3 days with like $11 to spare.

Not my smoothest frugal moment except I didn’t break any budgets and I was a rockstar saver this month, so there honestly couldn’t be any less skin off my nose about how all that went down. I had several phenomenal meals and went on a fun Ghost Tour. Really, it was worth every penny.

We’ve been roadtripping like it’s our job here at Clifford and saw lots of awesome, free (or really cheap) things throughout the Midwest and Texas this month.

My biggest spend outside of the San Antonio madness was for my healthcare coverage coming in at $190 this month, followed by $104 to file my taxes.

My spending breakdown this month:

- Bridesmaid Dress – $99.95

- Gym – $10.70

- Travel – $25 (Stupid Overweight Baggage. Stupid Spirit Airlines)

- Food – $305.85

- Taxes – $103.77

- Entertainment – $7.47

- Shipping – $17.10

- Car – $48.44

- Healthcare – $190

- Miscellaneous – $16.05

- San Antonio – $229.99

Total Spending in December – $1,054.32

Hustling

My income this month was made up of Potted Sherlock and Clifford paychecks, brokeGIRLrich, UserTesting and my tax refunds.

- Stage Managing – $2,988.04

- brokeGIRLrich – $637.40

- Tax Refund – $704

- UserTesting – $20

Income This Month: $4,349.44

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: How to Request an Absentee Ballot for 2016 Primary Elections

Elsewhere on the Web: Why Frugality is So Important U.S. News & World Report

7 Things You Can Do to Save Money This Week U.S. News & World Report

Entirely Unrelated to Personal Finance (or is it?)

So I splurged last month on a pair of Tieks, which I had been obsessing over for a few months.

This is a picture of my feet after about an hour in Tieks.

I am not pleased.

I read several reviews that did say they need to be broken in, so I’ve worn them once more, with similar results. I’ve not completely given up on them (since they are far too expensive to give up on that easily), but they are not the end all be all of ballet flats that I was so excited about.

Sigh.

Goals

- Contribute $1,000 to my Emergency Savings Account– $600 so far. $400 more to go.

- Max out my Roth IRA– Done. DONE. Does a little dance, done, done, done.

- Contribute $3,000 to my Down Payment Fund– Added $100. $2,900 to go.

- Contribute $2,000 to my New Car Fund– Added $200. $1,800 to go.

- Have a $1,000 Best Friend’s Wedding Fund– Done. $100 of it is already spent on the dress, but there’s $900 sitting there, ready to be used when necessary.

- Buy $1,000 of stock– Nothing on this front yet.

- Develop 2 new resume skills– Nothing here yet.

- Track all the time I spent on my computer outside of work for 1 week and then go without a computer for a week and see how I use that time– I will not be attempting this goal until I find myself in one of those weird periods of unemployment/massive underemployment again. I’m sure there’ll be one at some point this year.

- Go on a vacation with a friend– nothing on this front either, although one friend has planted the idea of going to Alaska this summer into my mind… mmm. Crab. Tracy’s Crab Shack. Sigh.

- Look for a big show to stage manage– still have my fingers crossed for this over the summer, although I’ll honestly be happy to do anything that’ll make me some money stage managing from May to mid-August.

- Run a 5k– hopefully in May. Although this means I really need to start running a little again and I’m particularly terrible at making myself do it while on tour.

Hey that’s awesome you maxed out the Roth this month. It looks like you had a lot of fun in the pictures and with the side gig. Good luck in 2016.

EL @ Moneywatch101 recently posted…Why I’m not Buying Sneakers In 2016

Looks like a great month. Maxed out the IRA! Bam! Great photos, other than the Tieks one. 🙁

Brian @DebtDiscipline recently posted…Net Worth Update: February 2016

Wow, those are some *huge* leaps in progress! I’m hoping we can keep making some progress this year, but we’ll have to see how things shake down expense-wise. I’m going to try to monetize the blog a little, but I don’t want to go too crazy. So I can’t really hope for your numbers there.

Still, every little bit helps, right?

Abigail @ipickuppennies recently posted…Thank you

Every little bit totally helps! And it’s taken me like two and a half years to get to these numbers.

Nice job! It’s awesome that you’ve already maxed out your IRA. I’m sad about the flats, though I’m glad to hear your review of them.

Catherine Alford recently posted…Why Money is the Most Important Topic Imaginable

I know, right? :0/ I definitely wouldn’t splurge on them again.

Congrats on an awesome month, especially maxing out the Roth!!

I only heard of Tieks yesterday – in case you had the misconception that I’m hip in any way! – and now I know to avoid them. 🙂

Amy @ DebtGal recently posted…March 1 Debt Summary & February Side Hustle Income

Yeah, sad to report that’s probably the best case. But if you DO find an awesome pair of flats, I’d love to hear about them!!

Great work!

RAnn recently posted…5 Ways to Invest Your Tax Refund

What a shame about the Tieks, I’d heard good things about them in the past. I think the longest lasting flats I’ve had were the Maria Sharapova by Cole Haan pair I found at Nordstrom. I don’t know if they still have them but wore those suckers daily, walked at least a couple miles in them for my commute AND ran around all day at work, wore right through their soles. They were comfortable to the end.

Pretty stellar month, it looks like, between saving like awesome and having a good time too 🙂 Seriously strong start to 2016, I’d say!

Revanche recently posted…Just a little (link) love: babies and twins edition

I’ll have to keep an eye out for those shoes!

I’m really impressed with your saving achievements this month! You never know what life will throw at you, but in the meantime, you should definitely celebrate. And I love the travel photos…very cool.

Gary @ Super Saving Tips recently posted…Is Your Spending Out of Control? Compulsive Buying Disorder

Well done! It must feel good to look at that statement, good for you.

Funny how you think you might be jinxing it when you say you’re winning in life. At the very least you are well-prepared to manage some possible adversity (but hopefully not, of course).

Mrs. CTC recently posted…It’s not me, it’s you. An evolution of working for the man

Great job on the earnings and savings this month Mel! It’s brilliant that you maxed out your Roth IRA already! Love your photos, looks like you had a lot of fun when you got some time off.

Hayley @ Disease Called Debt recently posted…Financially Savvy Saturdays #132

Really?! A one way mirrored public bathroom?!! Who thought that was a good idea! It’s exciting that you get to travel so much for work. Looks like you visited some cool places. I’m impressed that you can save money while traveling.

Congrat on your progress this month!

Michelle recently posted…Share Your Skills – Thinking Out Loud Thursday

The one way mirrored public bathroom is one of the coolest and weirdest things I’ve experienced. Sulphur Springs, Texas is shockingly adorable. And it was free!

You did do well this past month! So sorry about those shoe. I hope you get to Alaska.. those Alaska type shows on T.V. are my favorite! Although I would never want to live there-Michigan has more enough Alaska type weather!

Vickie@Vickie’s Kitchen and Garden recently posted…Free Kindle Books for Today 3/5/16 and Last Week in Review

Alaska is definitely pretty cool. I didn’t appreciate it at all when I worked for the cruise line and kept getting sent there every summer, but I actually miss it a bit now.

That is so disappointing about the Tieks! I bought a pair of Dr. Scholls flats off Amazon for $29 and they were cute and comfortable. Hopefully the Tieks do break in though!

Kara @ Money Saving Maven recently posted…Frugal Facts Friday (3.4.16)

Congrats on the win!

I wonder if you have quite a sum in saving accounts why do you still need an emergency saving account? If it’s emergency it really doesn’t matter which account it come from right?

Well, it does matter to me actually. My savings are largely in investments that are intended for retirement, but as for my easily accessible savings – the majority of that IS my emergency fund. The other little funds are for specific expenses I know will come up in the future – I’ll probably need a new car in about 7 years and I’d like to be able to put a down payment on a house in about 5.

Neither of those events are emergencies and once I spend that money, it’ll be gone, so I’ll still need that separate emergency account. And this way, if an emergency does happen, I should still be on track to reach both those goals financially.