Profile

I am thirty years old and I am a stage manager/lighting director for a show out on tour. I have no rent and no real bills… although there’s a good chance I should actually invest in some health insurance. I’m not 100% sold on that idea yet though. I make $700 a week with an additional $30/day per diem. I have no benefits whatsoever with this job – except workman’s comp, should I electrocute myself or something awesome like that.

Saving & Spending

Ugh. This month. I pretty much made the decision earlier this month to let go of the frugal reigns for the duration of this tour. I have several savings goals for each month and as long as I actually meet them, then I decided I was ok with whatever else I spent.

So that has worked out. I contributed more than my intended goal to my IRA, added to my emergency savings and contributed to my house,car,computer,phone savings accounts. And I still have a little money left over.

However, our van getting broken into and all of our luggage getting stolen definitely threw a kink in my spending plans. It was definitely one of those moments where I was thankful for previous financial savviness, since the majority of my cast about died when they realized we weren’t covered by insurance and the cops were pretty much useless. On the flip side, I sighed, was thankful I never really bring much that’s irreplaceable on the road, and headed out to Walmart to stock up on underwear… and a seriously styling pair of jeggings… and, most unexpectedly, an incredibly comfortable and flattering pair of real jeans for $20. That are a size smaller than when I started tour. Yay stress and crazy schedules.

I then had the sole of the only pair of shoes I had left split in half. Which I gaff taped together is a very classy fashion for a few days, but I was really intent on not dropping $20 to temporarily fix the problem with shoes that weren’t really comfortable at Walmart and instead kept my gaff tape awesome look for several days until we found an outlet mall and I was able to replace them and pick up a pair of sneakers.

Replacing my shoes cost more than replacing everything else!

I also work for an awesome company who mailed us out new suitcases and increased our stipend for the week by $500 so the people effected could buy new clothes. I am definitely on the best children’s tour in existence.

Sadly, 5 shot glasses from my collection were stolen, including the incredible Wall Drug jackalope, so I’m back to square one there. But I did pick up a new one at the World’s Largest Pistachio this week – so nothing’s going to keep me down!

Hustling

Oh my gosh, hustling on the road is hard. On more than one occasion, I’ve managed to work really ahead and feel like I rule the world and on more than one occasion, I’ve written a post the night before in a sleep deprived panic.

That being said, I still managed to make a few dollars again over here.

brokeGIRLrich: $180

*~**~*~**~*

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: Sing For Your Supper: Busking in NYC

Elsewhere on the Web: How to Maximize Your Savings on Clearance Items at U.S. News & World Report

Travel Investments That Are Worth the Splurge at U.S. News & World Report

Women into Investing Part II: PF Bloggers at Makin the Bacon

Entirely Unrelated to Personal Finance

So I started a new series this month called PODCAST (DAY)!! because one of the girls in our cast is super into podcasts. They let me torture them all with some personal finance ones but a major group favorite is Night Vale, which has nothing to do with personal finance (unless that’s what they’re doing in the dog park) and is very much like a podcast version of The Twilight Zone. It’s pretty entertaining and delightfully weird.

You can download it or even catch their episodes on YouTube.

Just remember, do not go into the dog park.

Goals

1.) Max out my IRA… chugging along. $2,300 to go.

2.) Contribute $1,000 to my emergency savings… only $800 to go.

3.) Buy $1,000 of stock.

4.) Save $100 a month for a new computer. February – check.

5.) Save $100 a month for a new car (I’m hoping the current one will make it to roughly 2021). February – check.

6.) Save $2,000 for a house down payment. Only $1,800 to go.

7.) Find a job for when the current one ends at the end of May. Maybe nailed it? I have had trouble finding a scanner and the app on my phone refuses to work right, so I haven’t been able to mail in some necessary paper for that next job. We’ll see how long they stay patient. In the last town, the lady literally laughed at me when I asked if there was a Kinko’s or something where I could scan documents.

8.) Side hustle and credit card reward my way to FinCon15 – if my work schedule allows… which is looking less and less likely ;o( But I won’t know for sure until much closer.

9.) Figure out what to do if I manage to surpass all my savings goals…

I’m so glad the company gave you a boost to help replace your things! Do they provide housing in addition to your $30/per diem? I hope!

Stefanie @ The Broke and Beautiful Life recently posted…What My Zero-Sum Budget Taught Me

They do! After your stories, I feel like I’m living large. When the case complain, I start several stories with “it could be worse, one of my friends…” and I’m usually telling your stories.

That’s great that the company is helping out with the replacement of your stuff — and that you got great jeans unexpectedly too 🙂 Good shoes really do cost an amazing amount, sigh. Anyway: great job in February, especially given all the curveballs, and good luck getting your paperwork in for that next job.

C@thesingledollar recently posted…Zero Food Waste 2015, Week 7: Ham-and-egg it (plus bread recipe)

Finally got the paperwork in in Memphis, so we’ll see how angry they are about the delay.

Not the jackalope! Anything but the jackalope! I’m so sorry for your loss.

I’m impressed by your ability to lead a normal financial life on the road. As for the next gig-Could you fax your stuff? I feel like a fax machine would be much easier to come by.

I kept trying to find a fax number unsuccessfully, but I actually managed to get it sorted. Hopefully the fact that it took me roughly 3 weeks longer than it should’ve won’t keep them from hiring me.

It’s good that they gave you some extra $$ to cover some of your losses. Sounds like you’re still on the right track with your finances too. Kudos for going down a pants size! 🙂

Kayla @ Everything Finance recently posted…Everything You Need to Know About Hiring a Financial Adviser

I hate that the van got broken into, but that is really awesome about the company sending suitcases and approving more money! It’s nice to have those things, but it does suck to lose the stuff that can’t be replaced like shot glasses.

Shannon @ Financially Blonde recently posted…Happy Hour Session Two

Haha, you definitely put it in perspective when you say “it does suck to lose the stuff that can’t be replaced like shot glasses.” ;o)

Oh, man, I’m sorry about the van! It’s not just the stuff being gone (though monetarily that does suck,) but there’s that gross feeling of violation of privacy that comes with it.

I think you’re doing good things. You’ve got so few bills…it’s okay to enjoy life a little sometimes. Or just spend a little more because you don’t have a homebase. (But all that money you’re saving on rent probably more than makes up for it!)

And, okay, I don’t even believe that’s a real pistachio.

femmefrugality recently posted…BYOB Wedding (for the hosts, not the guests!)

Definitely NOT a real one, just the world’s largest. I have no idea what’s it’s made of. Usually it’s something like concrete.

Hi Mel,

Thanks for visiting my blog. This is my first visit to yours. It looks like you are making good progress on your goals. Knock them out early in the year I say. Keep up the good work.

DD

Dividend Dreams recently posted…Dividend Dreams Fund Update – February 2015

Thanks for stopping by, DD!

Glad to here the company kick in the $500, I’m sure that was a stress reducer for all involved. Even with that set back looks like a good month.

Brian recently posted…Week End Round up #71

It’s true. It’s amazing what being on top of your finances starts to do after a while.

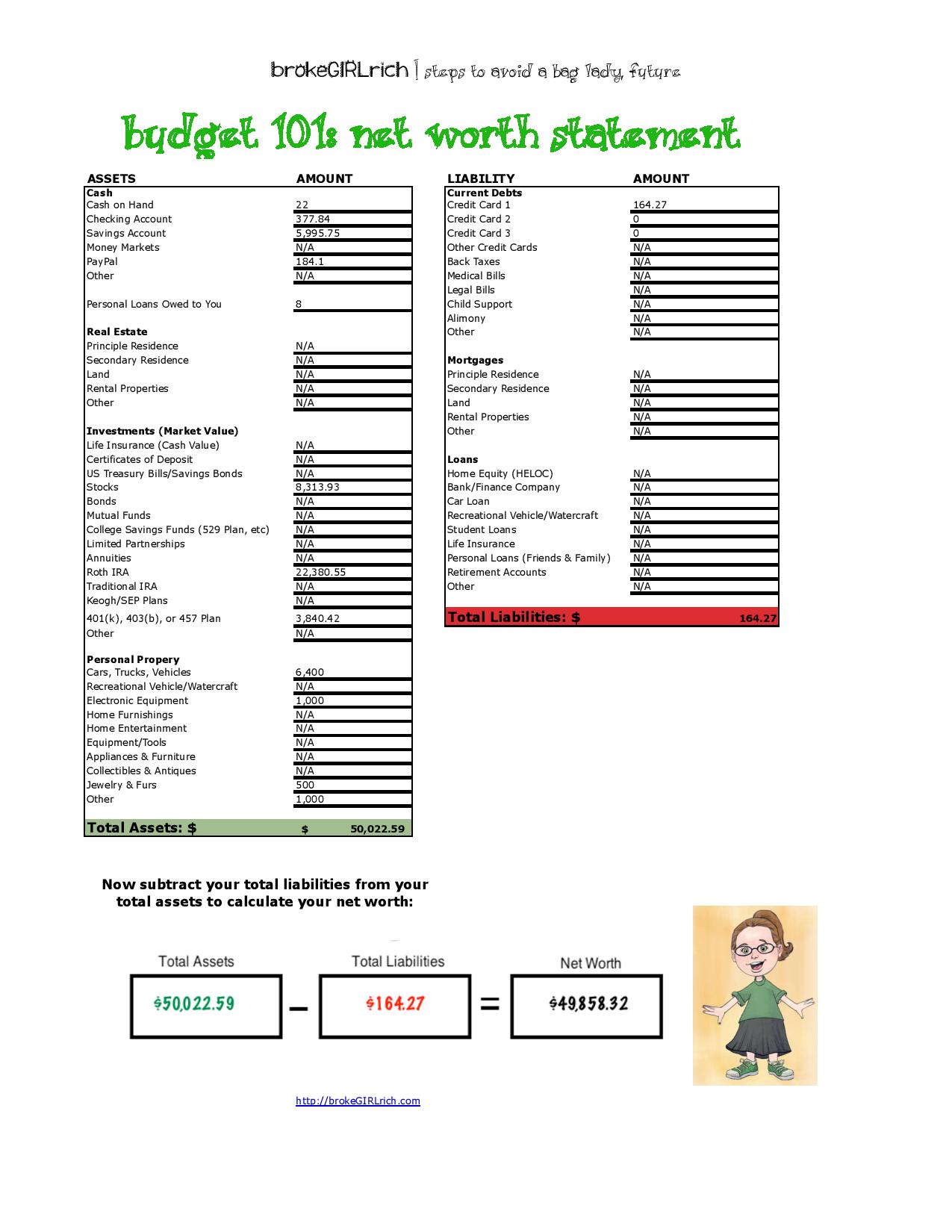

Pingback: The Net Worth of Personal Finance Bloggers

Pingback: The Ultimate List of Blogger Net Worth |

Hi,

I have been following net worth blogs for years, I finally started one of my own;

https://othalafehu.wordpress.com/

Please check it out, any advice/tips is appreciated

Pingback: The Ultimate List of Blogger Net Worths – Celeb Net Worth