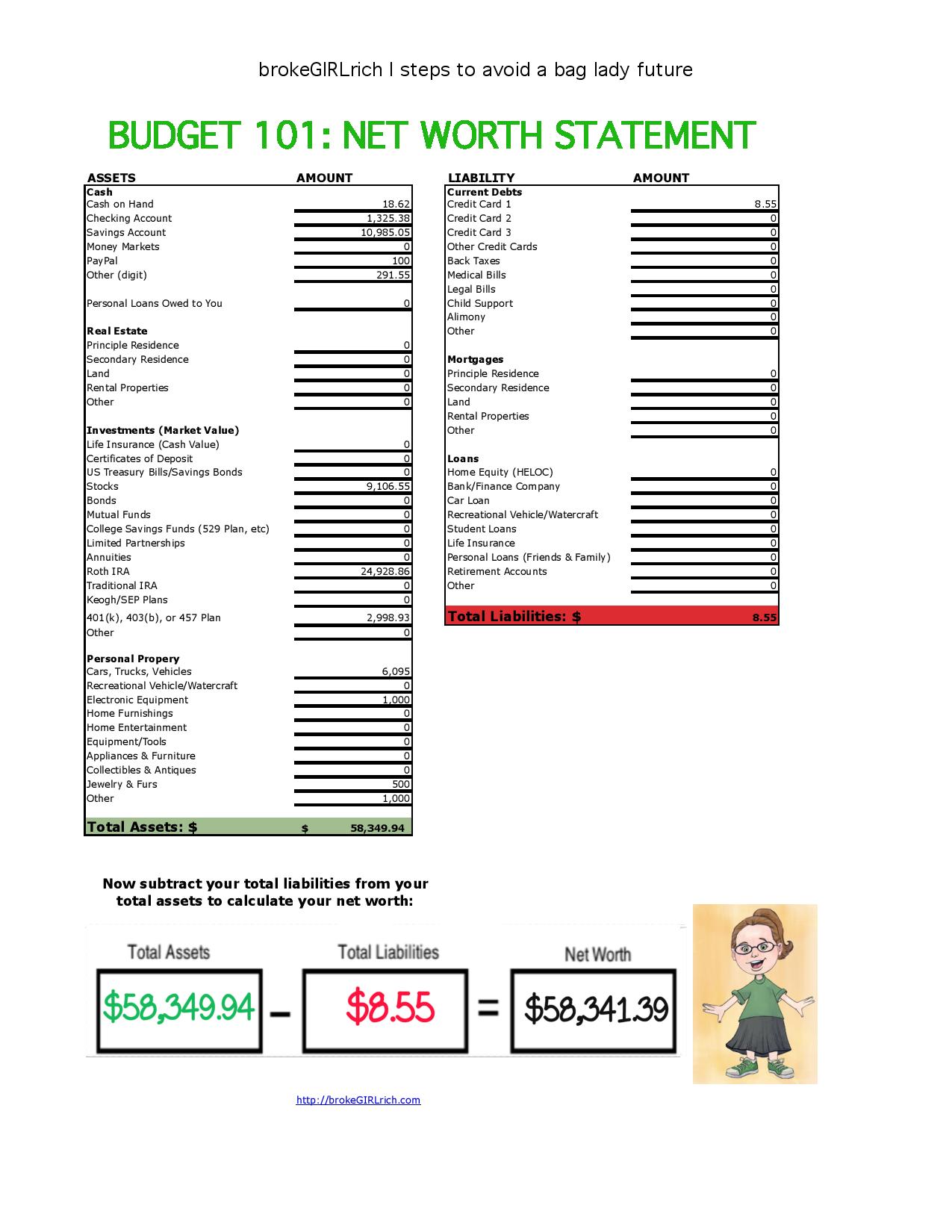

Profile

I am thirty one years old and technically, I am still the stage manager and lighting director for a touring children’s theater show called Clifford the Big Red Dog Live! Although this month has been month one of a two month unpaid layoff. I worked as a stagehand where I went to college for about a week (thanks, Dan!) and I substitute taught a few days. Fortunately, I pay no rent and have about $210 in monthly bills, so this wasn’t a huge problem

Saving & Spending

This month was one of those when planning ahead paid off. About a two weeks ago, I started getting this weird postcard shaped box of white lines across the bottom corner of my computer screen, but if I wiggled the screen it would go away. About a week ago, the postcard shape spread across the entire bottom and wouldn’t go away. Finally, I went to turn it on the other day and the entire screen stayed so dark you could barely see, even after going into preferences and trying to adjust the monitor. I could get the screen back to normal, but as soon as I touched a key, it would go back to too dark to see.

Instead of thinking “ahhhhhhh, my computer!” I sighed and thought, “there goes part of my awesome net worth, but at least I’ve got $1,200 saved up specifically for this already.”

So my biggest spend this month was on a new Macbook Pro. I did not manage to get the best deal since my computer died around 3 PM and by 8 PM, I had a new one, but I’m ok with the amount I spent. I’m really hoping Macbooks are as sturdy as ever, since this new version doesn’t feel as resilient as my old one and that’s the main reason I think Macbooks can be a frugal decision.

I topped off all my savings goals for this month last month, so I didn’t have to worry about them, although I did manage to pay for health care coverage from my checking account and didn’t have to touch the extra money I stockpiled into my emergency savings.

So not a lot has happened this month. I spent a week with friend’s from college while I worked down where I went to school.

I baked a bunch of Christmas cookies and wrapped a lot of gifts for my mom. Bought more gifts than I should’ve myself – I think I spent a week obsessively writing about overspending at Christmas because I was doing it. Sigh.

I got a shiny new computer.

I spent the holidays with family.

I also joined Planet Fitness with the hope of being able to run another 5k in May… and maybe even a 10k. It’s supposed to be very easy to cancel, which always seems to be a lie, but we’ll see in February.

My spending breakdown this month:

- Computer – $1282.93

- Gym – $31.03

- Shipping – $11.56

- Food – $200.85

- Charity – $500

- Entertainment – $27.38

- Transportation – $57.63

- Gifts – $237.78

- Miscellaneous – $5.33

- Healthcare – $185

Total Spending in December – $2,539.49

Hustling

My income this month was made up of a final week of pay from Clifford, finally depositing that initial substitute teaching check, brokeGIRLrich, eBay and a few dividend checks.

- Stage Managing – $756.17

- Substitute Teaching – $473.01

- brokeGIRLrich – $777.23

- eBay: $12.31

- Dividends – $22.40

Additional Income This Month: $2,041.12

So overall about $1,000 net worth drop, which is pretty exciting considering I didn’t know how employment was really going to work out this month and I wound up buying a computer.

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: Does Influenster Really Work?

Elsewhere on the Web: Tips for Conscious Holiday Spending U.S. News & World Report

How to Support Small Business Owners on a Budget U.S. News & World Report

Entirely Unrelated to Personal Finance

After getting hooked on The Newsroom last month, I binged watched everything I could find of Aaron Sorkin’s, including Sports Night, which was a pretty amusing look back at the turn of the millennia. The haircuts were a little rough circa 1999, but the writing was still awesome and hilarious.

I also had a lot of time to read while working as a stagehand, so I finished George Washington’s Secret Six: The Spy Ring That Saved the American Revolution by Brian Kilmeade and Don Yaeger. It was actually a really cool book – I had no idea spies were such a big thing so early in our military history.

I’ve also been working on ProBlogger: Secrets for Blogging Your Way to a Six-Figure Income by Darren Rowse and Chris Garret. It’s got lots of useful tips, especially about building sticky readers… many of those tips I’ve not been that good at doing. So I’m going to try to improve.

Goals

Ahhh, it’s the last goals update for 2015! Where did this year go??

1.) Max out my IRA… Done.

2.) Contribute $1,000 to my emergency savings. Done. Obliterated actually. This year I contributed $2,425. Some of that was extra top offs before going into seasons of un/underemployment, but I never wound up needing to touch it.

3.) Buy $1,000 of stock. Done. Bought $1,000 of DIA, the Dow Jones Industrial Average ETF.

4.) Save $100 a month for a new computer. Not only done, but done in the nick of time. I’m writing this now from my new Macbook Pro.

5.) Save $100 a month for a new car (I’m hoping the current one will make it to roughly 2021). Done.

6.) Save $2,000 for a house down payment. Done.

7.) Continue looking for work for December and January. Done. I was offered a position ASMing another show that goes right up until the day before Clifford restarts, except it requires me missing the Clifford drive down to Missouri. I’m waiting to see if the company approves my request. If not, I’ll just be subbing until we start up again.

Congrats Mel! It is great to be able to not worry when you find yourself in a sticky situation. Great year and I am looking forward to seeing what the next has to offer!

Jesse Gernigin recently posted…The Ambition Formula: Taking Passion From Page to Paycheck

Thanks, Jesse, me too!

You really did obliterate your goals this year! Well done, and I hope that job works out for the next month.

Thanks, Hannah! I definitely think I need to reach a little more for next years’ goals.

Nice job! That’s a pretty good way to end the year. I’m glad you had savings for a new computer. That’s the pits!

Cat@BudgetBlonde recently posted…3 Last Minute Gift Ideas that Don’t Seem Last Minute

I hope I can check off my goals as well as you have. I just created a list of 35 for the new year, including a 5k. It’s a little intimidating when you look at it all at once, but with a little diligence, I am feeling good about matching your success. Happy New Year!

Amanda @ The Fundamental Home recently posted…Goals for 2016- The Year of Diligence

I ran a 5k this year! And then I didn’t move at all for like 3 months. I’m just starting to train again to run another in May.

Great job on your goals and on having the savings ready for a new computer. Wish I could say I’d done as well at saving this past year, but I’m working on getting that resolved in 2016. I was thinking about picking up ProBlogger…I’ll have to move that up on my reading list.

Gary @ Super Saving Tips recently posted…Making A Success of Your 2016 Financial Resolutions

I’ve liked ProBlogger a lot, although I do have to say I’ve found How to Blog for Profit Without Selling Your Soul to be my favorite blogging book so far.

Did you watch Studio 60 on the Sunset Strip? That’s my favorite show of all time – and one of Sorkin’s shortest projects EVER. A lot of the same themes as The Newsroom (which I love) but more Bradley Whitford:)

MJ recently posted…Financially Savvy Saturdays #123

Oh my gosh, yes! It was over way too soon. I heard it came out at the same time as 30 Rock. I think it would’ve done better a few years after or before because they are very similar, but I did love it.

You’re amazing! Way to rock your goals, and be prepared for the computer update!!! Hope 2016 holds only good things for you, Mel.

Femme Frugality recently posted…New Year’s Resolutions: Clean Up Your Credit Report

And you too! And maybe some show will eventually swing me through Pittsburgh.

You’ve done so well with your goals for this year, congrats! Glad you managed to get your new macbook right in the nick of time. Hope it lasts a long time and you won’t have to worry about another one for a while. Love the family pic!

Hayley @ Disease Called Debt recently posted…Financially Savvy Saturdays #123

Me too! Fingers crossed that it’s 6 more years before I buy another laptop.

I have always being a little bit jealous when I see big family gatherings. That must be quite exciting 🙂 Out of 3 laptops I have had only one broke. the other two still with me.

I am actually thinking about buying another one sometime next year 🙂

Financial Independence recently posted…2015 Financial Independence Goals ($295,536 +$22,649 or +8%)

I think big family gatherings are the times when I know I’m just blessed beyond belief.

Pingback: Frugal Friday {Week #10} - Aspired Living

Pingback: Review of 2015 and Goals for 2016 - Disease called Debt

Pingback: How to Plan for a NO SPEND MONTH & Frugal Fridays #10 ~ Annie and Everything