Profile

I am thirty years old and I am a stage manager/lighting director for a show about to head out on tour. I just moved out of one of the most expensive cities in America in favor of storing my stuff at my parents house while I’m on the road until the end of May. I make $700 a week with a $30/day per diem once we hit the road on January 1st.

Saving & Spending

This month was sort of ridiculous. I was really excited to get paid two weeks of vacation pay from my previous job, only to learn my boss had messed up and given me too much vacation time back in August that we both thought I had banked, but in reality ate up those days. So… yay for 1 vacation day of extra pay.

Sigh. It really just felt par for the course over there when our HR person was going over that with me. I did however finally get the reimbursement from my flex account for my contacts, so my final check had that additional $525 in it.

On the plus side, I don’t work there anymore. And life has been much better since I left in the middle of the month. Also on the plus side, the week before starting my new job, I was told by their HR person that I was getting paid at 60% the week before for any prep work I had to do – which was pretty exciting since I did do several hours of prep work that week, including going to a meeting with one of the producers, but I didn’t expect to get paid for any of it. So while it wasn’t the two weeks of pay I was expecting, it was still a few hundred extra dollars.

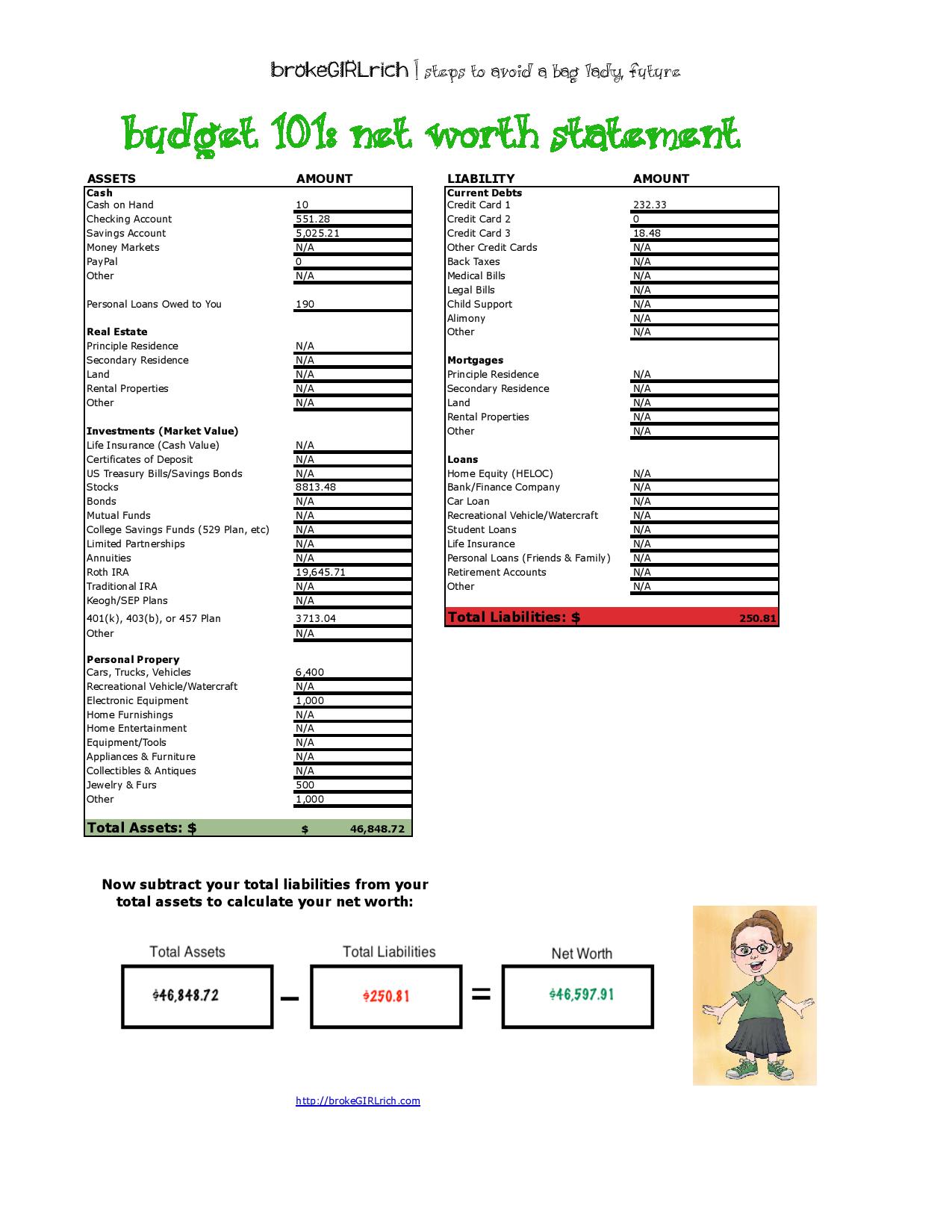

After the vacation pay snafu, I wasn’t sure if I would make my savings goal for 2014, but this week I did top off my savings account! It’s sitting pretty at $5,025. Nailed it. Also, since my rent is $0 with my parents, that is definitely more than 6 months of expenses covered. My end goal for my emergency savings is actually $10,000 but I think going forward my goal will be to add $100 a month until I hit it.

I’m also holding onto a few hundred dollars in my checking account to dump right into my IRA on January 1st. I’m going to start the year out right.

As far as spending, I thought it would be a much more expensive month than it was. I finished most of my Christmas shopping by the end of November. Speaking of, my favorite post I read this month was from Brian over at Debt Discipline who asked What Did You Get? You should all check it out if you haven’t already!

I ate lunch out pretty much every day of rehearsals, but I had a gift certificate from my aunt for Christmas that funded all of that… it sure didn’t hurt that I was rehearsing around the corner from a $1 pizza place and I love that stuff (this is probably why I failed at that whole losing weight goal). Other than that I was trying to clean out my cabinets, so all other food I ate for about a week and a half came from home.

Hanging out with the coolest Who in Whoville and Mario of DebtBLAG, Dave of The New York Budget and their ladies.

I also met up with a few other PF bloggers to go see Stefanie from The Broke and Beautiful Life in How the Grinch Stole Christmas! It was a terrific show – although I’m not gonna lie, it was the first time I’d heard some of those songs about all the crap the Whos buy and thought “these would make some excellent blog posts.” Anyway, she was terrific and the set design was a lot of fun.

My big spend this month was on tickets to a masquerade ball for New Year’s Eve… which I’ve been increasingly excited about since I bought my mask.

Hustling

This month’s hustles weren’t super impressive, possibly because I felt like I was running full tilt into a wall most of the month.

- brokeGIRLrich: 96.80

- eBates Check: $105.96

- Dividends: $18.56

*~**~*~**~*

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: Give Thanks the Smart Way: How to Check a Charity is Legit

Inside the Artist’s Wallet: Episode 3: Artistic Dreams and Financial Responsibilities

Elsewhere on the Web: Why Shopping in Your Home State Can Help You Save at U.S. News & World Report

How to Save Money by Staying in Hostels at U.S. News & World Report

Entirely Unrelated to Personal Finance

I was really excited to learn that my new cast loves board games. I’m kind of an addict myself and am planning to pack a few for the tour. Does anyone have any van friendly recommendations?

Also, the song I’m really into this month is Murder in the City by the Avett Brothers. It’s just so weird, I can’t stop laughing while I listen to it.

Goals

Oh my gosh! A whole new years of goals!

1.) Max out my IRA (didn’t I just do this? Sigh. Circle of life).

2.) Contribute $1,000 to my emergency savings.

3.) Buy $1,000 of stock.

4.) Save $100 a month for a new computer (hopefully the current one will make it another year).

5.) Save $100 a month for a new car (I’m hoping the current one will make it to roughly 2021).

6.) Save $2,000 for a house down payment.

7.) Find a job for when the current one ends at the end of May.

8.) Side hustle and credit card reward my way to FinCon15 – if my work schedule allows.

Congrats on meeting your savings goal for the year! 🙂 Have fun tonight at your New Year’s Eve Party! 🙂

Nichole @Budget Loving Military Wife recently posted…Most Popular Posts on Budget Loving Military Wife of 2014

Good luck with the new gig Mel! Happy New Year! Thanks for the mention!

Brian @ Debt Discipline recently posted…Time

Thanks! And great post – I really loved it!

Oh man, free rent and all that income/per diem! Way to start out 2015 right! Plus, it should be fun 🙂 You’re making me miss the theater world.

I love your goals, too. Good luck with all of them!

C@thesingledollar recently posted…December 2014 Net Worth Update

That’s the plan! Hopefully I’m still as fond of children and dinosaurs at the end of this gig as I am at the start of it.

I hate that I missed Stefanie’s performance, but so glad you guys got to see it and I totally think you should write a post about keeping up with the Who’s instead of the Joneses. I can’t wait to read about your road adventures with the new cast and crew! I love board games too, but don’t know many that translate well for moving vehicles. Although something like cards against humanity, scattegories or apples to apples probably works. Happy New Year my friend!!

Shannon @ Financially Blonde recently posted…Top Ten of 2014

I think you’re right about Scattegories – I hadn’t even thought of that one.

Happy New Year back at you!

That’s awesome you are living rent free, enjoy it. Is your theatre gig in NYC? So congrats on meeting your savings goal, good luck in 2015.

EL @ Moneywatch101 recently posted…Milestones Achieved in 2014

My theater gig is out on tour around the country. We just rehearsed in NYC for a week, but tomorrow we’re heading out to Colorado Springs for tech and then all over the country until the end of May.

I feel you on saving up for a car – I’m sincerely hoping mine makes it to 2020, but I kinda doubt it… it’s been grumpy lately! I guess I better get on the car-saving bandwagon too! Have a great new year 🙂

Melissa @ Sunburnt Saver recently posted…Year in Review

Can’t wait to hear about the masquerade ball! Hope it was a blast. Good luck with the car, haha. I’m hoping mine will hold out a few more years, too!

Chela @SmashOdyssey recently posted…I’m Trying To Evolve

One of my goals is also to max out my IRA. It will be the first time I do this so I am so excited. I wish you the best of luck with your 2015 goals.

Petrish @ Debt Free Martini recently posted…New Years Financial Resolutions

Sounds like you’ve done great in 2014. I’m glad you are happier now that you quit you job. Enjoy your time on the road, that sounds fun! Nice of your parents to store your stuff too. Not having rent for a few months will really help too I think. Can’t wait to see how 2015 goes for you!

Kayla @ Everything Finance recently posted…Reflect on 2014 for Better Financial Resolutions in 2015

Pingback: January Update: The Problem With Tracking Net Worth | SmashOdyssey

A great start to a near year. I was looking at your goals and I had to laugh we hope our old cars make it till 2021 too! Although you probably have a better chance ours are ancient. I hope you make it to FinCon too -sounds like a great convention.

vickie recently posted…Menu Plan for this Week 1/4/15