Profile

I am thirty nine years old and I’m a digital event producer and very occasional freelance stage manager. I make $55/hour at the digital production company I work with, though work has been very slow this year. I work a variety of small side hustles and am a full time student working on a PhD in Drama.

Spending & Saving

It’s funny reflective tracking my charges at the end of the month makes me. For instance, I remember stopping into the Chinese restaurant completely knackered after work once this month and being a bit unhappy with how much it cost in pounds. When I do my month tracking, everything is in dollars and as I saw nearly $30 of spontaneous Chinese food scroll past again, I definitely remember how it wasn’t even that good.

On the flip side, I hemmed and hawed over buying three books at this really unique little bookshop on the boat while my BFF was visiting. I didn’t even enjoy the first book I read, it was pretty tedious, but I saw that charge and smiled because I really liked that little boat bookshop and it’s weird owner who chatted away with everyone and that day out with my BFF. $40 well spent actually. (Hopefully the other two books will be better too.)

I was legitimately dreading adding up the Switzerland costs, even though I’ve already paid them off with a transfer from my savings. 100% worth is but good golly, Switzerland is expensive. I was telling both the BFFs next time we do this, we’re going somewhere like Albania to balance out the costs.

But anyway. It was an expensive month. A lovely, wonderful month. But also really expensive.

The month began with BFF #1 still visiting from the States. We had a calmer few days after our Peak District adventure at the end of last month. Just some basic wandering in London and checking out a lot of the free or very cheap things to do.

If you are trying to save some money and see some cool things in London: the London Mithraeum is kind of interesting, the Monument is excellent, Donut Time is over-hyped (I’d rather Crosstown donuts anyday). St. Dunstan’s in the East is quiet and pretty, Words on the Water is really lovely

Fun Sidenote: I’ve always wanted to climb the Monument, which is only £5 and I thought it might be a bit whatever but it was actually really kind of cool. You learn a bit about the history of the fire of London while doing it and, this is very silly, but you get a little certificate once you’re back on the ground that says you climbed the whole thing that is actually kind of nice and the BFF and I both sort of joked about framing them but I think I might.

10/10 recommend (if you don’t mind climbing a lot of steps)

Then we went to Switzerland and met up with BFF #2 over there. Ya’ll, Switzerland is gorgeous. Alpine slides are the most fun things ever. Swiss chocolate and cheese are delicious. It was potentially one of my favourite vacations ever. I also sort of just gave up while I was there and YOLO-ed as soon as I realized I was going to have to pull from savings to cover things anyway.

Switzerland Adventures

I regret nothing. Also there were many times when I picked up the tab for all three of us in Switzerland to help fund my new credit card minimum spend. They then paid me back after the trip (you can see that reflected in income).

Adding to my expenses, I also attended Edinburgh Fringe for a week. My school pays for the train and housing at the festival and in exchange I have to attend the undergrads performance of MacBeth every day and carry an emergency phone in case they have any issues.

My boyfriend came with me for the week, which was lovely and I bought all of our theatre tickets and he fed us. We also went to three escape rooms because that’s like his favorite activity ever and they were pretty fun. There was one that was connected to the history of Edinburgh as a centre for medical knowledge in the 1800s but that also connected to a strong trade in dead bodies that wasn’t always done legally. It was fun but also really interesting. All of those expenses are rolled into the entertainment expenses for the month.

Some of the shows we saw at Fringe. Without Sin was my favorite, but we really didn’t see any bad ones. The Gotta Go Escape Room Thingy was the weirdest by miles.

Then at the end of the month, my dad sent a surprise message that he booked next summer’s vacation and my boyfriend and I owe him 50% of the cost for the cabin, so that is the line item called Maine since we are all going on a big family vacation there next summer. Not a terrible amount for two people for a week in Maine but this month and next month are going to be super expensive.

And to be 100% transparent, I am wildly spoiled and I have never paid for my part of these kind of family vacations before, so thanks boyfriend for pushing me into a new payment level, lol. Apparently bringing a significant other means you are an adult who can pay your own bills in my dad’s eyes. Sigh. I guess he’s worth it.

My friends and family are doing lots of exciting life things like getting married, having babies, and turning 2, so gifts are kind of high this month as well.

Other big expenses this month included a plane ticket to the US for September to work for a week. I’m very excited because my September income is going to be garbage but hopefully the payment for this gig in October will help a bit.

The online event production was also absolutely dreadful in August but does seem to be picking up a tiny bit in September. I’m really just not sure what to do on that front – look for a new job or wait a while longer to see if the bookings pick back up.

Next month will largely be pulled from savings accounts, both for planned expenses – taxes and tuition (though this should be the last full tuition payment of this mad Ph.D. project – next year should be prorated for half a year and then I can just pay the writing up fee for the last year which should only be £500 – though I’m still expecting some sort of caveat where that won’t apply to me or something), though I think I will be pulling from savings to pay my rent too.

The weekend job I’ve been working ushering at The Burnt City for the last year and a half also ends at the end of this month, conveniently the weekend before I go to the U.S. to work for the week, and I might enjoy having weekend for the month of October but then I need to start looking for some other part time job. I doubt I’ll find one that’s as flexible as this one has been. Ushering there isn’t exactly exciting and it doesn’t pay a ton but it has been super convenient and the team of people I’ve worked with have been really lovely. It also has conveniently covered things like my utilities so that is kind of lousy.

The month finished up with two days in Leeds, again paid for by school, to present a paper on my research. It was actually kind of awesome. I haven’t done something related to school lately that I’ve enjoyed much, but between seeing tons of interesting shows at the Fringe and then finally finding the right working group where everyone is researching on interesting topics that actually all relate a bit, I feel better about school and my research than I have in months.

So, that’s what August has been. Lots of excellent travel. Some cool school stuff. Very little work.

Here is the expense breakdown for the month:

- Rent – $1298.91

- Switzerland – $1144.20

- Stage Managing – $647.15

- Maine – $564.00

- Food – $480.20

- Entertainment – $402.25

- Gifts – $237.45

- Travel – $153.95

- School – $144.00

- Utilities – $88.78

- Blog – $57.58

- Charity – $40.55

- Flat – $35.35

- Health – $22.58

- Toiletries – $17.93

Total Spending in August: $5,334.88

Hustling

This month’s income:

- Research Assistant – $1223.08

- BFF Reimbursements – $676.92

- Digital Event Producing – $605.00

- Ushering – $564.11

- brokeGIRLrich – $335.68

- Murder Mysteries – $31.68

- Lawsuit Settlement – $21.00

Income This Month: $3,457.47

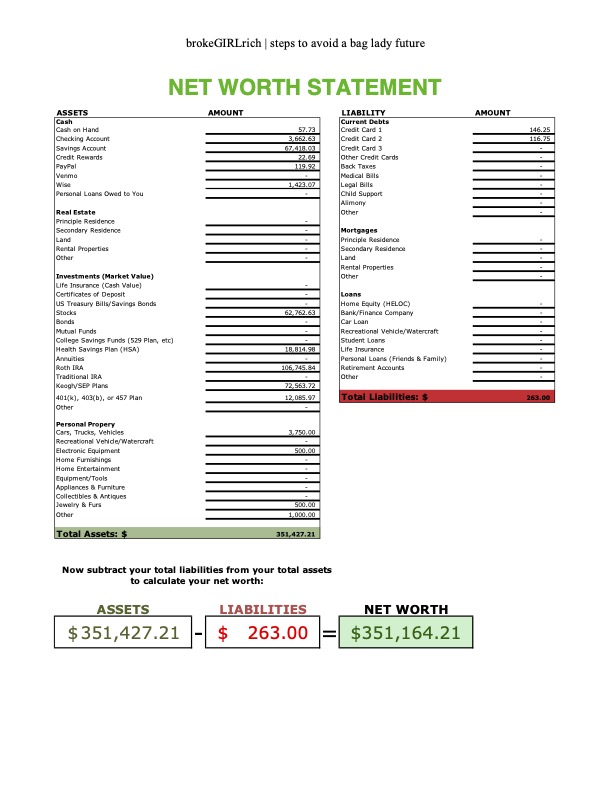

Net Worth: August 2023

So I am enjoying my last net worth update in the $350k range before paying my tuition and spending the next year struggling to get it back up to that level. And trying not to think about the fact that if I hadn’t chosen grad school I would probably be closing in on $500k around now if work was fairly normal. Sigh. But… achieving lifelong personal goals matters. I feel very certain death bed me won’t be thinking about my net worth. Also probably not that I finished grad school. But I also won’t be regretting that I didn’t try to do the hard thing I always wondered about.

Goals

- Save up $10,000 for school.

- Save up £5100 for school. This has been a resounding failure, so all of this year’s tuition payment is coming out of savings. I will try again for next year.

- Max out Roth IRA ($6500). $1000 contributed so far.

- Max out HSA ($3850).

- Buy the pretty lamp. I really don’t think this is happening this year.

- Save $2000 for vacation with BFF over the summer.This just completely and totally failed. It all came out of savings and, I’m guessing by the time we get back from Switzerland next month will be close to $1,000 more than I planned to spend too. Not my best money moments but some really great life moments? Sigh. I hate grad school for every financial reason imaginable,

- Stage manage a show.

I am so impressed–you went back to grad school, and are living in Europe and seeing some beautiful places (which aren’t so cheaply accessible from the east coast of the USA). It sounds like you have some geysers of spending which may run down in the next month or two; but you have some savings. You are fulfilling some dreams, and the cost is…. not insignificant, but not crazy. Grad school comes to an end. You should get a better paying job with a degree (hopefully a better paying job this fall, too!).

IM-PCP recently posted…Fitness Log #251 And Friday Firsts