Profile

I am thirty one years old and I am a stage manager for an Off-Broadway show called Ziegfeld’s Midnight Frolic (if you live in the tri-state area, buy a ticket and support us some Saturday – we extended into the fall!). I have no rent and no real bills. I now make $175 a week, which would be a total unsustainable lifestyle if I weren’t currently living with my parents. I am super excited to be three weeks away from full time work.

Saving & Spending

So to finish out my last month of part time employment, I totally didn’t make anything near the $500 budget, although this month I also took that best friend trip that had it’s own $500 budget too.

I also got to actually do some things I bought tickets for in previous months like see Book of Mormon, which was pretty good, and run in the Insane Inflatable 5K.

My biggest budget buster this month was going to be $360, a rather unexpected expense, to replace some contacts that got stolen back in February (because sometimes when you’re on tour, all your stuff gets stolen). I went to the eye doctor to order them and he said he would order 3 months worth, which I figured would be about $150. When I went to pick them up, he had ordered 6 months and I was like… what the heck, man? That’s the majority of the spending money I had left to get back to full time employment!

But you can see that I wrote “was going to be” because I feel it’s important to note when your parents give you a hand. My mom offered to bail me out there and called it a late birthday present and after swallowing my pride, I definitely accepted. And yes, I know how lucky I am.

I think that hit particularly hard because I got my contract to go back to work and found there’s a random layoff week in October as well as the long layoff I was expecting in December and January and was definitely feeling very, “well what else is next?” about trying to calculate how I would achieve all my savings goals for the year.

Despite traveling a lot this month – seriously, Vermont, Maryland, D.C., and Niagara Falls, I didn’t actually have any huge expense other than those contacts.

I did feel kind of stupid about $20 of that clothing expense, because I left my bathing suit hanging over the shower at the gym and by the time I remembered, it gone.

My spending breakdown this month:

- Food: $256.32

- Clothing: $52

- Fitness: $37.40

- Niagara Falls Trip: $274.91

- Entertainment: $66.88

- Pet Supplies: $10.68

- Commuting: $119.07

- Gas: $174.02

- Gifts: $98.53

- Miscellaneous: $25.76

Total Spending in August: $1115.57

Not actually terrible for a $1000 budgeted month.

Hustling

I brought in some income through 2 other methods besides stage managing this month too, but to be honest, I think this is my lamest month of hustling ever, although I am waiting for payouts on several things I did this month that just didn’t come yet.

- User Testing: $10

- digit: $5

(Seriously though, have you signed up for digit yet? I love, love, love how it ciphers out my money without me even noticing – every time it hits $100, I transfer it to one of my savings goals. It’s how I managed to add $100 to my computer fund every month this summer without even trying.)

Notice what’s missing? That’s right, I made $0 on brokeGIRLrich this month… which also added to my contacts-how-am-I-ever-going-to-achieve-all-my-savings-goals freak out.

Additional Income This Month: $15

Total Income This Month: $365. Ugh.

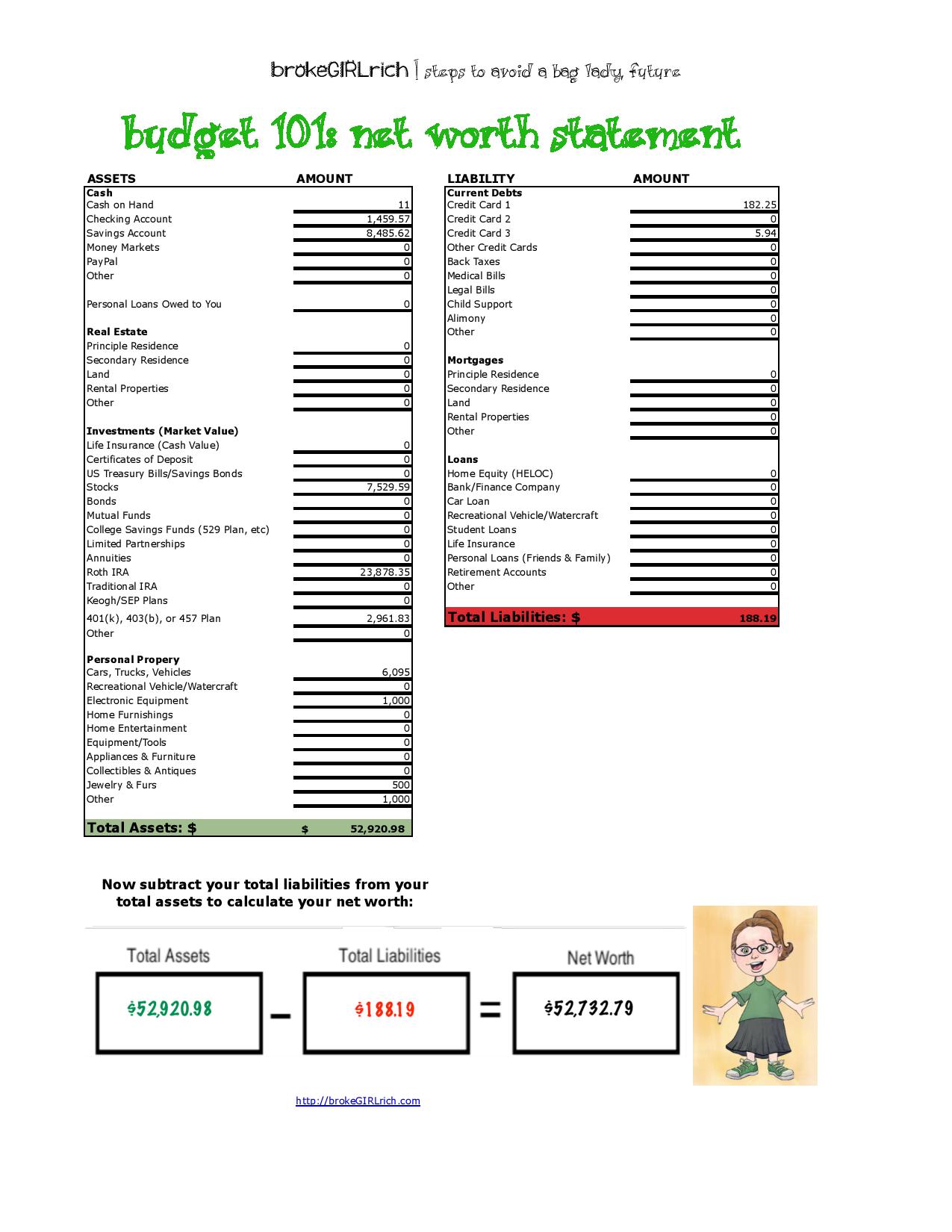

It also looks like the stock market is a little lame right now, which would be cool if I had money to invest, instead, it makes my net worth even sadder. Plummet, little net worth, plummet, some day I’ll be able to fix you.

C’est la vie.

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: How Running is Like Personal Finance – Part I

Elsewhere on the Web: Top 5 Hustles to Bring in Extra Money at U.S. News & World Report

5 Money Saving Travel Hacks for the Airport at U.S. News & World Report

Entirely Unrelated to Personal Finance

Perhaps my greatest achievement this summer has been binge watching Parks and Recreation. And I finally completed that task this past week.

Goals

1.) Max out my IRA… still at $800 to go. I’m feeling moderately confident about succeeding here though. Finishing that up is a priority with my first two paychecks when I get back to work full time.

2.) Contribute $1,000 to my emergency savings – Done.

3.) Buy $1,000 of stock – perhaps by November.

4.) Save $100 a month for a new computer. August – check.

5.) Save $100 a month for a new car (I’m hoping the current one will make it to roughly 2021). Not this month…

6.) Save $2,000 for a house down payment. Still at $1,500 to go. It might be doable, then again, it might not. This is the goal I’m the most on the fence about achieving.

7.) Keep an eye out for any work I can pick up to fix the crappy hustling I did this month before going back to work full time at the end of September.

Keep on hustling! You’re doing a great job of managing your money. There are a lot of people who probably make more money but don’t have near the Net Worth that you do. The money will start coming in soo, for sure. If it makes you feel any better, I get $0 side hustle income 🙂

Luke Fitzgerald @ FinanciallyFitz recently posted…What Do Casinoâs and Stockbrokers Have in Common?

Thanks! It definitely wasn’t an impressive hustling month for me, but that happens and actually, it usually happens right after really good months – so I should probably start getting used to that. 😛

Sounds like you have a great plan for your current situation. Congrats on surviving the run! Keep going with the side hustles. Love your blog!

Penny @ She Picks Up Pennies recently posted…Monday Motivation: Decluttering, Homesteading, and More

1. What kind of computer are you getting?

2. Contacts are expensive! Sometimes I want to just wear glasses.

3. I love that guy’s shirt on the right.

Will recently posted…I’m Going to FinCon15!

1. Another Macbook. My current one has lasted 7 years, so I don’t mind spending the extra money and I use the sound editing software for work all the time.

2. No kidding, right? I freak out trying to swim without contacts though and hate working out and having my glasses slide off my face. Also, I love $5 sunglasses.

3. Eric wasn’t messing around ;o)

Mel @ brokeGIRLrich recently posted…Accountability: August 2015

That’s awful about people stealing your stuff! I wear contacts too, I must admit I probably reuse them longer than I should. I am curious about the $2,000 down payment on a house, are homes very cheap in your area?

Mrs. Budgets @MrandMrsBudgets recently posted…FinCon 2015 Tips & How I’m Going for Free

Oh gosh, no. It’s just the first year of saving up. I’m not actually in a hurry to buy a house, but want to be ready when I am. It was also a realistic goal for what I was making this year.

I hate those months when it seems like one thing after another and you’re waiting for the next problem to crop up. But overall it seems you didn’t do too badly, especially considering the trips you got to take. And doing the 5k was an awesome thing to do…and reminds me I need to step up my fitness goals!

Gary @ Super Saving Tips recently posted…Common Retail Myths Exposed

Keep on hustling (I love a good side hustle). I hate it when stuff gets stolen or lost. We had our friend (who’s crashing in our lounge) lose the set of keys we lent him, so we had to go get a new set cut, but the new ones didn’t work. It ended up being such a palaver and quite expensive. Best of luck with getting back into full time work.

Rebecca recently posted…How meal planning can cut your grocery costs + FREE PRINTABLE

That stinks about the keys – I’m sure he felt bad about it!

Keep going you will get there! I understand how it feels to not reach your goals one month but just makes it more motivating for September! It would be very hard saving on the income your getting so good job! Keep hustling!

Jessica recently posted…It’s Finally Friday (Favourites) #1

Congrats Mel you made the 5k. Your net worth is pretty impressive. You are way on the top despite your erratic job you are able to still able on your goals.

By the way, I love that photo.

Esther@Moneynuggets recently posted…How to Kick-start a Freelance Career

Some months are like that. At least you don’t have to worry about contacts for 6 months! August is usually a slow month with everyone on vacation. Hopefully the side hustle will pick up in September.

Tre recently posted…Register Your New Business

How have we missed each other this summer? First Myrtle Beach, but now Niagara Falls, too. Uck, those $0 blog months suck. Things will start looking up again, though. I don’t have regular employment during the summer, so the end is always nail biting, but when those paychecks start coming in again the psyche will go back to normal!

Femme Frugality recently posted…Nightswapping: Free Accommodations for the Frugal Traveler

Yup, I’m already starting to get emails for my next gig even though I don’t actually start getting paid until the 13th, but it’s making me super relieved to have survived the summer.

I’m glad your parents could help you out with the contacts bill – they are expensive. I pay for mine by direct debit and get a three month supply in one go. They never seem to last though as some break or tear along the way, so I usually have to buy an extra box or two a few times a year.

I hope work goes well when you start back full time soon! You could maybe make some extra money during the breaks through article writing on Upwork?

Hayley @ Disease Called Debt recently posted…Financially Savvy Saturdays #106

I’ll have to look into Upwork! I’m lucky that I usually stretch my contacts so they last extra long by just wearing glasses on days when I’m hanging around the house.

That house downpayment–how about renaming that account “long term goals”? From what you say about your life in general, if I was in your shoes and someone gave me enough money for a downpayment on a house, I wouldn’t buy one. If you have a relatively stable fulltime job that you like and you plan to live in the area you are in long-term, buying a house is a good idea. The way you describe your life? Rent, and invest your money.

RAnn recently posted…So How Is Kickfurther Working for Me?

I think I’m content with leaving it as “down payment” because I can already feel the tug to be less nomadic. I’m actually kind of looking forward to settling into a more normal job and having a home – not quite yet…. but I’m know it’s coming.

Sorry to hear you had a rough hustling month! It happens. The end of August really slowed down in terms of me trying to monetize RSF; it was just too busy prepping for the semester and handling last-minute tutoring students who needed help with summer reading. Although that was a good surprise, it is definitely not passive income and was very short-lived.

Alexandra @ Real Simple Finances recently posted…Becoming Minimalist: One In, Two Out

I love that your Mom bailed you out. She’s sounds like a great Mom! I’m sorry though things get stolen.

Keep up the good work you do and things will start rolling like you want them soon!

Have a great Sunday.

Vickie@Vickie’s Kitchen and Garden recently posted…My Frugal Ways this Past Week 9/6/15

She is an awesome mom! If I ever have kids, I want to be just like her.