Profile

I am thirty years old and I am a stage manager/lighting director for a show out on tour. I have no rent and no real bills. I make $700 a week with an additional $30/day per diem. I have no benefits whatsoever with this job – except workman’s comp, should I electrocute myself or something awesome like that.

Saving & Spending

This month was the first time in a while I felt a pinch trying to get everything saved for and paid for.

My phone pretty much gave up the ghost this month, so while I was home, I got a brand new iPhone 5S. Not gonna lie, my mom actually got it for me. I went to the mall prepared to buy it myself, but when we got to the register, she slapped down her card and said I’m never home and she never gets to spoil me. Who am I to argue? No really though, I am very, very, very aware of how fortunate I am to have parents like mine.

That being said, my cell phone savings fund has been repurposed into my brother’s graduation gift fund. He graduates from college next month about 3 days before I get home from tour. After a fierce guilt trip from my mom that made me feel like the worst sister ever, I told my brother we’d celebrate in style and go sky diving as his graduation gift. Turned out he didn’t care all that much that I wouldn’t be at his graduation but is now pretty darn happy I’m footing the bill for us to do this thing together. Either way, the goal is now to have about $500 in that account by the end of next month.

I’m hoping to get that account up to that with hustling money, so anyone knows someone looking for a freelance writer, let me know!

I started the month out with a 10 day layoff. For those of you not familiar with touring lingo, that meant we had 10 unpaid days off at the top of the month. Clearly, not the end of the world, but it did reduce my income this month by 1/3, so there’s that.

I used half of that time to go to my cousins wedding in Alaska. Since my parents and brother were going too, my parents were incredible and let me stay in their hotel room with them and fed me pretty much the whole time. The only times I had to shell out my own money over there were when I went off with my brother or cousins to hang out. And for a wedding gift.

So it was exciting to go back to Alaska and to check out a city there I’d never been to (Anchorage) and I gotta say, skiing on top of a mountain in Alaska does not suck. The view was incredible and the runs were long and I fully realized how completely out of practice I am at skiing, since not only is my family full of incredible and skilled snowboarders, my newest cousin-in-law is a former X Games snowboarding champion. But it was still fun.

The worst spending pinch this month has actually come from our super bizarre touring schedule. We’ve only been averaging 3 days of work a week – which are an insane 3 days usually starting around 4 AM and finishing up around 10 PM – and then the other days are off. So we sit in hotels in the middle of nowhere and try to find things to do. There has been a lot of mini-golf and we’ve turned into official tri-state area ice cream taste testers. The two biggest money sucks were a night out at a go-kart track (which, for the record, I destroyed everyone at… first place every race. I think I was releasing my van driving frustration on the track) and Moonshine Champion night.

What is Moonshine Champion night, you ask? Well, while sitting in a hotel for the 3rd of 4 days in a row last week, we decided to journey into town. There I found a liquor store and bought a jug of apple pie moonshine. To drink my moonshine with me, cast and crew had to supply their own mixer, which then turned into a competition where the cast tried to come up with the best cocktail you can make out of apple pie moonshine and the crew judged their concoctions. We played it out like it was America’s Top Chef or something complete with eliminations and discussion about their “process.” It quickly grew beyond my original idea into something ridiculous and wonderful. The winner got a button and a homemade crown that said Moon Shine Champ… the home made crown was a little rough. Between Dixie cups for taste testing, glitter glue pens for the crown and the moonshine, Moonshine Champion night cost me about $40.

Holy cow, it was so worth it though. Like I pointed out in my roadside attraction post earlier this month, we’re pretty good at making our own fun.

But I’m sure you guys care more about the money than my ridiculous adventures. So I’m also going to admit this was almost the first month that I overdrafted my bank account since college, but I actually wound up with $3.10 left in that account – mostly because I forgot about that wedding gift check and immediately threw most of my money into my IRA to meet my savings goals upon being paid last Friday. Whoops. But literally thanks to one of the cast members paying me the $6 they owed me through Venmo this weekend, it all worked out.

Additionally, while going through my mail at my parents house, I learned that my 401(k) from my previous job apparently needed to be dealt with within 60 days of leaving since the balance was under $1,000. It either had to be rolled over into something else or it would be cashed out. Definite whoops. The check, minus all the lovely taxes, arrived at my parents house shortly after I headed back out on tour. I will probably just dump it into my IRA once I get home to deposit it, but that was a definite dumb money moment that cost me about $100.

Hustling

Not a bad month over here at brokeGIRLrich for hustles, although I am still trying to track down payment for one of them, which is a first… and already not my favorite part of hustling.

brokeGIRLrich: $225

*~**~*~**~*

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: The Cost of Being a Stage Manager

Elsewhere on the Web: Healthcare Sharing Ministries: An Affordable Alternative to Health Insurance at Femme Frugality

How Gift Card Swapping Sites Can Help You Splurge at U.S. News & World Report

When to Avoid the Mall at U.S. News & World Report

How to Save Money with DIY Party Ideas at U.S. News & World Report

Entirely Unrelated to Personal Finance

My cast is big on nicknames and my favorite one from this tour is the hobo princess. It occurred while listening to a podcast The Thrilling Adventure Hour, which we’ve been catching up on in the van. There are lots of different story lines, but the plot line of Down in Moonshine Holler is my favorite – it’s a hobo fairytale. And the episode we listened to this past week that played off of Shirley Jackson’s The Lottery was brilliant and hilarious.

Goals

1.) Max out my IRA… chugging along. $1,400 to go.

2.) Contribute $1,000 to my emergency savings… only $100 to go.

3.) Buy $1,000 of stock.

4.) Save $100 a month for a new computer. April – check.

5.) Save $100 a month for a new car (I’m hoping the current one will make it to roughly 2021). April – check.

6.) Save $2,000 for a house down payment. Only $1,800 to go.

7.) Find a job for when the current one ends at the end of May… this is becoming considerably more pressing.

8.) Side hustle and credit card reward my way to FinCon15 – if my work schedule allows… which is looking less and less likely ;o( But I won’t know for sure until much closer.

9.) Figure out what to do if I manage to surpass all my savings goals… accept I’m probably just going to meet each of those goals, especially if I can’t find a job for 3 months this summer.

Wow, what a month! OK, checking account near-mishap aside, it sounds like you’re both having a ton of fun, and still managing to save some money. Maybe it’s better for your health to be funding the moonshine party than to be crowned champion, though, all things considered 🙂

C@thesingledollar recently posted…Zero Food Waste 2015, Week 15: Clear Perishables Before Travel (plus awesome brownies)

Haha, so true.

Sounds like a tough, but fun month. I hope you are able to find a job for the summer though, that would really help your financial progress. Maybe if you can’t you can ramp up your writing side hustle?

Kayla @ Hello Pre Nurse recently posted…Narrowing down & Visiting Nursing Schools in the U.S.

The back up plan is definitely to put more effort into blogging and freelance writing, but I’d much rather be stage managing if I can swing it.

I was thinking the same thing, sounds like you are having a great time with your tour mates. Congrats to your bro!

Brian recently posted…Book Review: The Four Principles Of A Debt Free Life

Yeah, he’s a smart cookie! I’m proud of him.

I love the moonshine champ competition. How did everyone feel the next day after the competition? I am a seasoned drinker and even I can only drink a small amount of that.

Shannon @ Financially Blonde recently posted…Do You Get Saver’s Fatigue?

Well it was split among so many of us, the results were not nearly as disastrous as we’d all prepared for ;o)

The moonshine champion competition sounds like so much fun! Sometimes it’s worth it to splurge for entertainment purposes – it seems like yours was worth every cent! Too bad I can’t drink moonshine. The first time I had it, I thought I accidentally drank rubbing alcohol haha.

Anum @Current on Currency recently posted…10 Simple Rules of Personal Finance

Haha, it definitely does have a lot in common with rubbing alcohol.

Wow, what a month. Even with the cost of the moonshine competition and the misstep with your checking account, you still made progress towards your goals. It’s all about the baby steps to get there. Congrats on a good month!

Liz recently posted…Friday Night Shenanigans – Week 8

Even though you had a couple little setbacks, it looks like things still went well overall! Look at the pros vs. the cons – you had fun, but you still worked a little towards your goals! Sort of a win-win! 🙂

K @ One More BROKE TWENTY-SOMETHING recently posted…Financially Savvy Saturdays #88

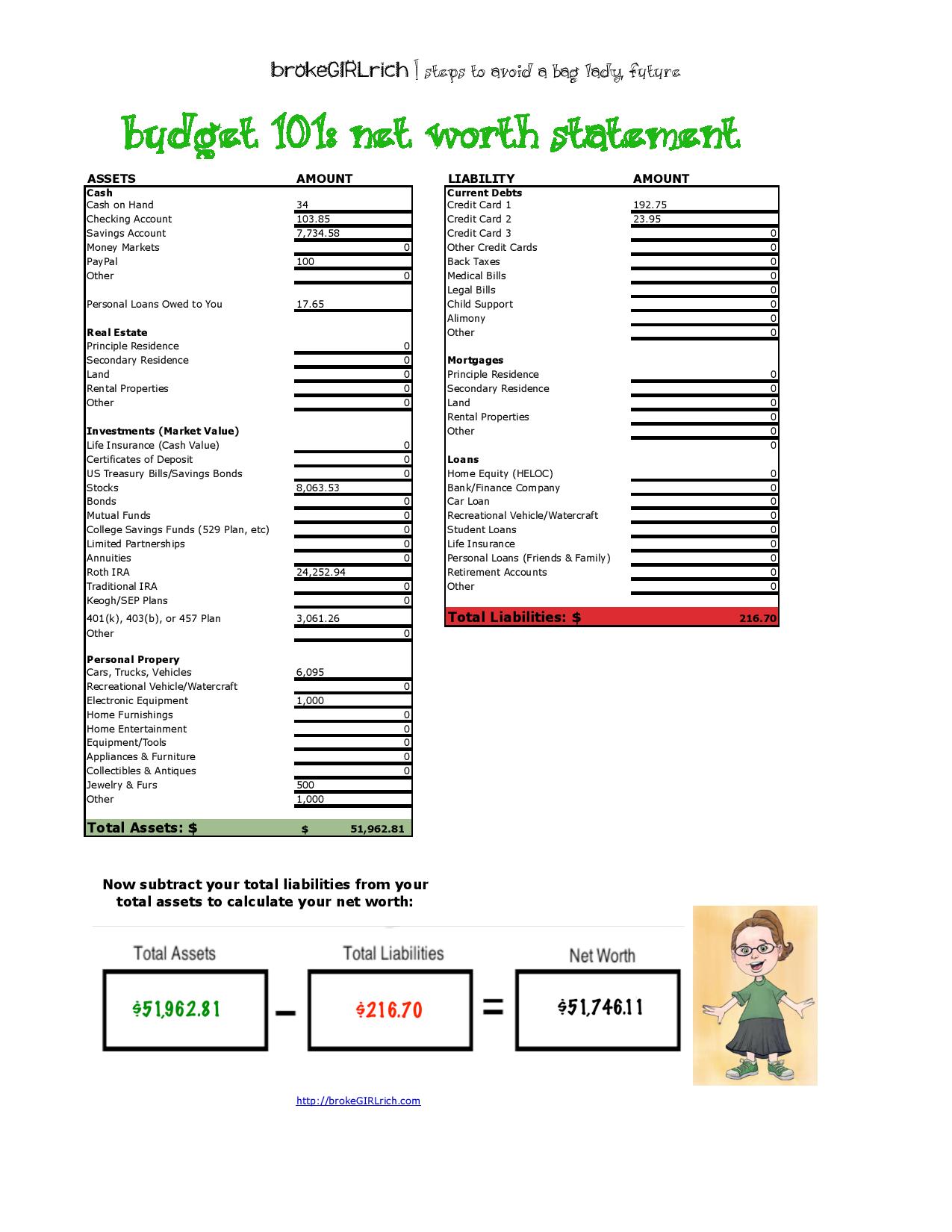

Mel, your life sounds so exciting! How cool that you don’t need to pay rent because of your job. I’m sure it’s tiring though, working long days like that. Well done on your accountability goals, you should be well up past the $60K mark next month on your net worth statement!

Hayley @ Disease Called Debt recently posted…Financially Savvy Saturdays #88

Hopefully, although I’m less concerned with my general savings goals this month and just trying to stockpile enough in my immediate savings & checking to make it through the summer.

Wow! What wonderful adventures you´ve had! I´ve never been to Alaska, but it´s on my list! Thanks for letting us live your adventures vicariously 🙂

Chela @SmashOdyssey recently posted…New Tools and April Update

Adventures are pretty much my favorite thing – I am glad you guys enjoy reading about them!

Wow! What wonderful adventures you´ve had! I´ve never been to Alaska, but it´s on my list! Thanks for letting us live your adventures vicariously 🙂 quote on disappointment