Profile

I am twenty-nine years old. I work as an assistant production manager and my yearly salary is $52,000. I guess my budget skills are doing ok, since I managed to not bankrupt myself so far.

Saving & Spending

So this month I learned that monthly bills are stressful and I am super impressed and slightly understand the crazy people that just try to go totally off the grid. It’s increasingly appealing to me. Someday…

None the less, I did ok for my first month with a pretty strict budget – not gonna lie, 4 days with the flu at my parents house, unable to move much, with my mom depositing soup in my childhood bedroom at regular intervals turned out to be a heck of a money saver. So at least that flu had good timing.

I also managed to get my internet bill knocked down from $50 to $15 for this month when I called trying to cancel my service. It’ll be $25 for the next two months and after that I’ll probably be finding a new provider, but for now I’m pretty pleased.

The job is going ok. Still not the perfect career choice, but at least I’m near home, which was a priority for a while, and it manages to get the bills paid. There’s also a lot of flexibility that I’m trying to work on exploiting. I’m trying to figure out how to become a certified pyrotechnician in my free time. I’ve also applied for roughly 120,446,209,523 side gigs as either stage manager or props master. Initially I wasn’t getting any bites and now a bunch of things are starting to crop up at once. So any New Yorkers who read this blog – you should check out Mercury Glass Theater Company’s production of Romeo & Juliet over Valentine’s Day weekend and marvel at the fantastic props (not an affiliate link, but buying a ticket totally helps ensure I get paid). Otherwise side hustles have been a bust this month. I made about .33 from this website and I did a few mystery shops, but they are paid a month off, so I’ll benefit next month for this month’s work. I should’ve had my act together in December!

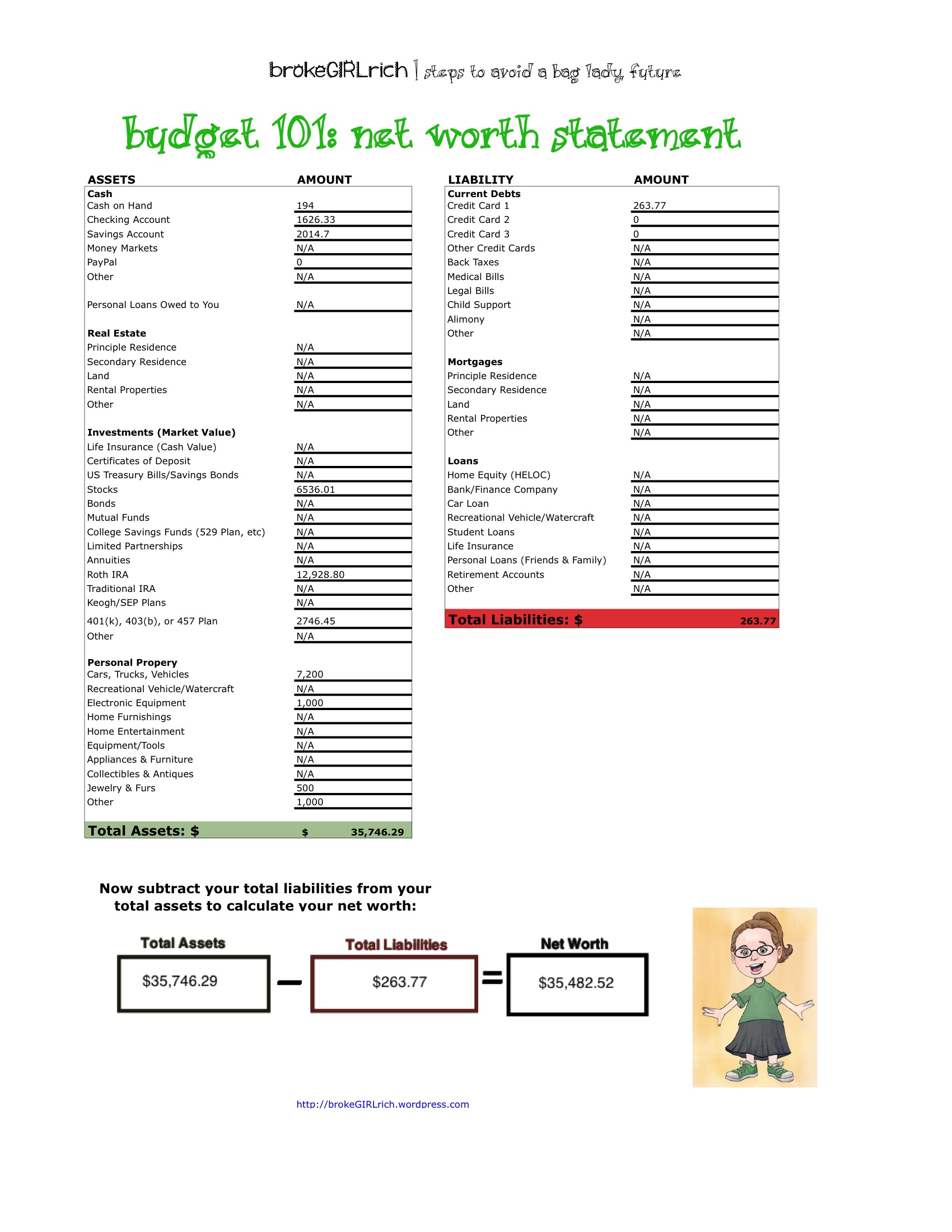

I was a little alarmed that my investments were all a little down for the first time that I can remember, but it wasn’t really a big hit at all. I’m pleased my net worth actually managed to weather all the extra payments and security deposits and everything of setting up house here – including buying my very first grown-up mattress (which is a soft, squishy plane of happiness).

My **doh** moment of the month was losing my Metrocard two days ago and having to buy a new one to make it to the end of the month. Fortunately, my job has the perk of letting you buy your Metrocard with pretax dollars, so starting in February I get to use that card and if I lose it (like I probably will), I can just go to the office somewhere in NYC and get it reissued. I’m excited about that.

I also joined the gym this month. If I go 50 times in 6 months, my company reimburses up to $200 in fees – and that’s every 6 months. I rejoined with Bally’s for the super high price of $99.99 plus tax for the year, so even if I mess up the first 6 months (which I don’t intended to), I can still manage to get the amount refunded if I’m successful in the next 6 months. Even after this year, Bally’s yearly membership fees come in under $400, so I’m probably going to stick with them. And hopefully lose some of this circus chubbiness.

- As for this year’s goals, I’m still contributing to my IRA, so I think I’ll be able to get that maxed out and I want to get my emergency savings up to at least $5,000. I’d also like to invest in another stock. I’m really interested in increasing my side hustle skills too and making those goals a little easier to achieve.

*Part of Financially Savvy Saturdays on Femme Frugality and The Frugal Exerciser*

The feeling of losing your monthly metro card is THE WORST. I’ve literally cried over it before. I can’t wait till it warms up a bit and I can start biking again.

Stefanie @ The Broke and Beautiful Life recently posted…I Went to the Gym… And It Was Awful

Ugh, I know! I thought I lost it at the beginning of the month and felt like the stupidest person ever – it’s just as bad as loosing a $50 bill. At least the new one kicked in today. It was still a stupid $15 to have to spend.

Mel @ brokeGIRLrich recently posted…Accountability: January 2014

Nice job on getting your internet bill down, even if it’s only temporary. That’s nice of your job to offer an incentive to go to the gym. I would definitely take advantage of that as well.

E.M. recently posted…4 Financial Tips for Young Professionals

Be careful with Bally’s contracts (or any gym contract that wont let you leave without penalty). I have a good horror story involving them that pretty much destroyed my credit score for 2 years. It’s fixed now.

Good luck with the side hustle! Have you heard of taskrabbit?

Michelle @fitisthenewpoor recently posted…Weekly Roundup #15: Guilty Pleasures

I’ve actually signed up with Bally’s before and I’m not surprised about the horror stories. I’ve heard Bally’s has an unusually large number of them. They were a pain to quit the first time, but I’m well aware that I’ll need to start the process like two months ahead of time and write like 20 letters and make about 8,000 phone calls… I just decided that for $99, it’ll be worth it.

I did LA Fitness but in my mind I am so cheap I was like I have the wii fit and I can walk at the park for free so I gave that up to save money. Great breakdown we have our internet and phone bundled and sometimes I am thinking is that such a good idea. Stopping over from SITS

Kita recently posted…Safety In Our Schools ~ Testing The Security of Schools

It usually seems like bundles are the best deals if you actually need everything, although it never hurts to look around. So even call and ask for a lower price. Even if it only lasts for a few months, it’s a nice reprieve. I don’t think I’ll ever have a landline – my parents do, but I’m pretty sure they only keep it because my dad runs his business out of their house.

Nice start to the year; the net worth statement looks neat; I may look into creating my own sometime soon!

Really like the the gym incentive!

Joe @ Budget Breakaway recently posted…January Financial Review & February Goals

Yeah, me too. The HR lady at my job laughed at me when I told her how excited I was as she explained it.

Aw! The Metrocard sucks – but you’re right: you can call a number (and if I’m not mistaken you can do this 3 times a year) to report your lost card, and you’ll get a new one!

One of my colleagues lost her card two weeks ago, and that’s how I found out!

Debby recently posted…Day 109 – I Get a Little Competitive.

Wow, for any old Metrocard or the kind that you get issued pre-tax from work? It would be awesome if it were any Metrocard!

Nice job on the internet bill! I need to do that too, I have been a bit lazy and just let them increase it! Sounds like you’re on a good path and have a good plan in place! And don’t worry about the investments… everyone’s were down with the way January ended, haha!

Jon recently posted…January 2014 Financial Update

That is a great incentive to get to the gym! I promised myself that I would quit my gym membership ($30/month!) 6 months ago, and never did it. I think I’ve gone 3 times in the past 6 months. So, they were $60 workouts. Doh! I really need to follow through with either quitting the gym or using it. Now, if it were free after 50 workouts, I’d *like* to think that I’d be there, but who knows.

Rebecca @ Stapler Confessions recently posted…Is a Professional Organizer Worth The Expense?

Honestly, I think actually paying for the gym helps me go, because the thought of the workouts being $60 each would kill me, but getting them down to like $1.10 would seem awesome to me.

Can you join a community fitness center? Do you have Planet Fitness in your area? You can probably find a cheaper fitness center. However, if the other places are not close , stick with Bally’s.

The Frugal Exerciser recently posted…Financially Savvy Saturdays: Twenty Third Edition

Honestly, there’s nowhere else cheaper than $99 for the year – and there doesn’t seem to be any way to swim for free in NYC. Although if I were into yoga, apparently the library does offer free classes of that – sadly, I am not.

I was sick for a few days in January, too! It was definitely a blessing in disguise because of all the no-spend days haha

Lisa E. @ Lisa Vs. The Loans recently posted…Wedding Tip Wednesdays: Introducing Zherr-Anne

I know, who’d’ve thought, right?

$263.77 ?? That’s it??!!

That is awesome! You are a rockstar.

Thanks for posting. Keep it up.

-Derek

Derek Olsen recently posted…Net Worth First Quarter 2013

Trust me, it took years to hit that rockstar status. And it’s holding in tentatively.

Wow, great work on the internet bill! That reminds me, I need to call and threaten to cancel as well – my cable company was sneaky in raising my cable/internet bill. Also, thanks for sharing these details!

Roger@lifelaidout recently posted…4 Financial Lessons I Learned in My 20s

Yeah, I’d read a lot about people who managed to negotiate lower rates but I was always too chicken. This time I was actually all about canceling, but she got me to put it off for 3 months.