Profile

I am thirty years old and I am a stage manager for an Off-Broadway show called Ziegfeld’s Midnight Frolic. I have no rent and no real bills. I make $300 a week (the job is part time) and am not sure whether or not I’m going to still have a job after this weekend, since my show may be closing. Yay, freelance summer. #nostress

Saving & Spending

So some of my regular readers might remember my grand $500 a month spending budget that I set out to adhere to for the summer.

Well. That didn’t happen.

I did learn that if your first purchase on the first day of the month is for $110 – this has a negative effect on your mentality. I totally already felt defeated by my budget on the first day of the month. #nailingit

On the plus side, that $500 budget was assuming total unemployment and living off of savings, so at least that isn’t happening. Yet.

- Shipping: $46.12

- Commuting: $202.25

- Stage Management Related: $125

- Food: $185.39

- Starbucks: $35

- Exercise: $85.70

- Car: $17

- Father’s Day: $13.99

- Compassion Child: $19

Total Spending in June: $729.45

If I actually were completely unemployed, I wouldn’t have spent $217.25 of that money (NJ Transit, MTA and a new pair of shoes for work).

I also think the food spending might have been a little lower, since a lot of those purchases are grabbing food on my way home from work.

Although, on the flip side, I’d probably just spend those savings actually doing things with all that extra free time. So. There ya go.

Additionally, I think shipping is a negligible line item, since it was all eBay items and the shipping cost was covered by the people purchasing them.

So my two biggest expenses this month (aside from commuting) were that first aid, AED & CPR recertification ($110) and the fee to run a 5K at the end of August ($63.25) – because I have clearly completely lost my mind.

Wait, that’s a lie, because there was one giant expense for this month – my car insurance for the entire upcoming year at $1,003.60. But I knew that payment was coming and had saved up for it, so while that’s never a fun amount to write on a check, I was prepared.

As far as saving goes – not my most impressive month. I managed $100 into the new computer fund, since it’s the savings goal with the soonest date I’m hoping to actually use it, and $225 into my emergency savings. Sorry car, house and retirement. You’ll have to wait another month.

But where’s the money coming from now that my full time gig has ended? Well, that job I asked you all to cross your fingers for last month – I got it! The first weekend of the month I was training, so I only received a travel stipend. After that I made $300 a weekend, so my income from stage managing this month was $975.

It’s a W-9 show though, so I’m consider that income to really be $650 and the rest of that money is going into my emergency savings, to be tapped as necessary come tax time.

Unfortunately, the show has reached its make or break point and if we don’t pick up an outside investor this week, then this past weekend was our last show. We should know soon though if we are extending until the end of August, which would be pretty perfect for me.

Not only a night at the Frolic, the show also focuses on the story of Olive Thomas – The Most Beautiful Girl in New York City.

So cross your fingers for me again. It’s really just an incredible, incredible show and if you live in the City and we do extend, you should check it out. I am continually in awe of the talent in the entire group.

Hustling

I brought in some income through 3 other methods this month too:

- Used Book Websites: $79.70

- eBay (including some books): $30.55

- brokeGIRLrich: $179.71

Additional Income: $289.96

That brings my total income for the month up to: $1264.96

Not terrible. Although it definitely makes me look forward to going back to work full time in September when that will be less than half of what I make in two weeks after being taxed.

To be honest, I’ve been pretty lazy and unmotivated in the search for extra work, which hasn’t helped the additional income side of things at all. That being said, when we got the word this week that the show was on the financial rocks, I applied for roughly 20 freelance writing gigs in about 2 days… so apparently I can be motivated when necessary.

Also, if anyone needs a stage manager in the NY/NJ area for July or August – keep me in mind ;o)

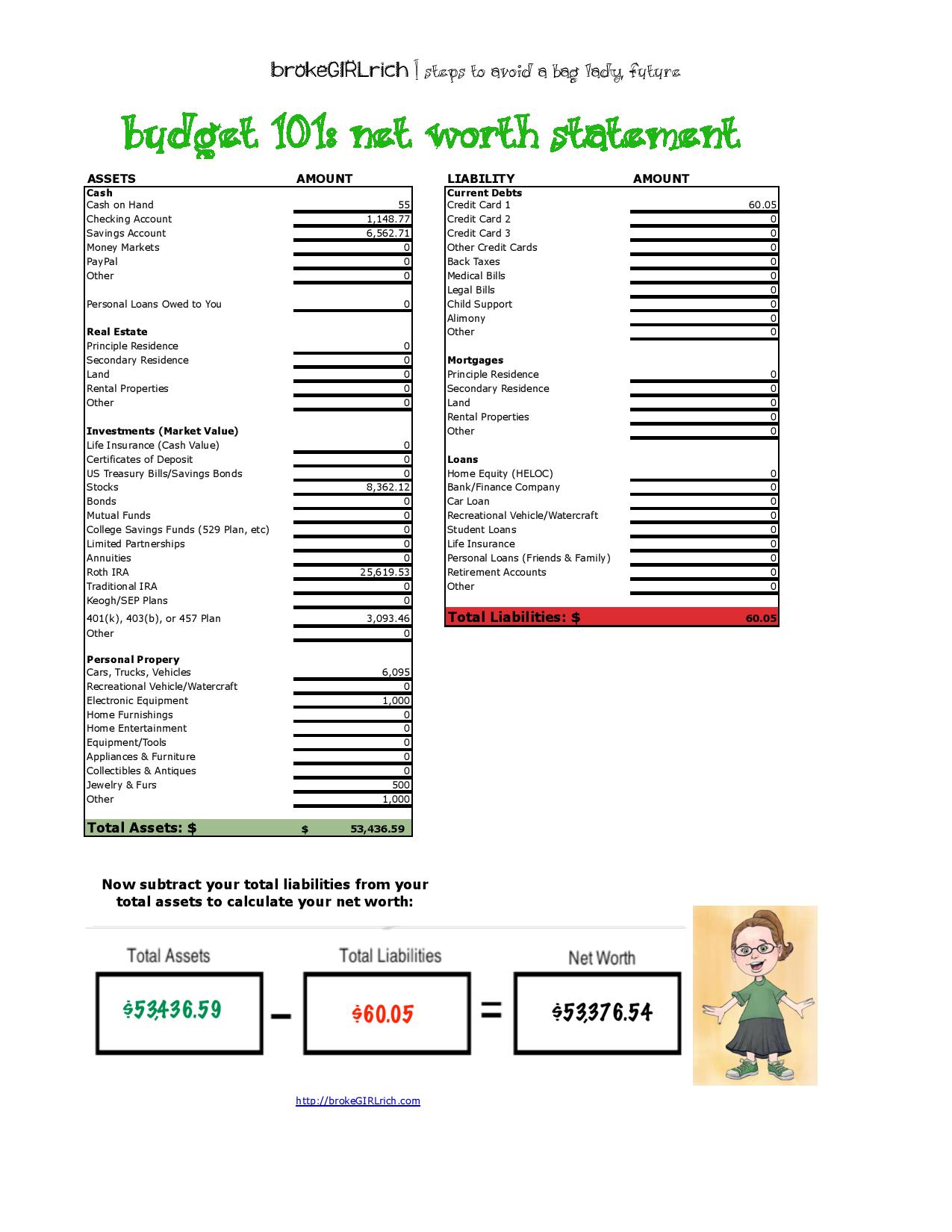

And now, for a recounting of my first net worth drop in a long time :o/, see below. C’est la vie.

*~**~*~**~*

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: Working for Free

Elsewhere on the Web: How to Get More Out of Your Credit Cards at U.S. News & World Report

How to Take Advantage of Loyalty Cards at U.S. News & World Report

Great Wall of China – Fun Facts and Fictions at Travel Blue Book

Goals

1.) Max out my IRA… still at $800 to go. I’m feeling moderately confident about succeeding here though.

2.) Contribute $1,000 to my emergency savings… the $225 actually caught me up and put me $25 ahead.

3.) Buy $1,000 of stock.

4.) Save $100 a month for a new computer. June – check.

5.) Save $100 a month for a new car (I’m hoping the current one will make it to roughly 2021). Nope – this is on hold.

6.) Save $2,000 for a house down payment. Still at $1,500 to go. If I had to guess, the goal I’m least likely to nail is this one.

7.) Figure out some employment plans for July and August in case my show closes.

8.) Side hustle and credit card reward my way to FinCon15 – this is really up in the air. I’m pretty sure I’m committing to this too late to successfully side hustle or credit card reward my way there and I’m waiting to see if anyone puts up an early bird ticket to swap. Also, if the show I’m working on actually does extend not only through the summer but beyond, I probably can’t go anyway… but in case you couldn’t tell from the whole post, that’s a pretty big if.

Congrats on the gig- commuting costs are a b**ch

Stefanie @ The Broke and Beautiful Life recently posted…Top Job Search Lessons From My 20s

No kidding. And when I’m waiting in Penn Station at 1:15 AM, I desperately miss my apartment in Inwood. I think about how I would be in bed already while I’m still waiting for a train all. the. time.

Sounds like a good month, other that waiting for the train. 🙂 The last few trips we’ve made into the city I’ve just drove in and parked it ended up cheaper and move convenient.

Brian recently posted…Independence Day

I think the bridge toll + parking making it slightly more expensive for me, although if the show winds up adding a second late night show (AND they pay us for it), I’d probably start driving in.

I’m excited about moving to NJ soon! If the show is still running, I’ll definitely come see it! 🙂

Chela @SmashOdyssey recently posted…Relocating Is Hard Work: Pt 4 – More Unexpected Curveballs

Awesome! And I totally forgot to reply to your email! I’m so sorry! I’m going to hunt it down and do that now.

It seems that you have a perfect month! That commuting costs is really a headache and that exercise cost is a gym membership?

Kate @ Money Propeller recently posted…Some Quick Notes on How Healthcare Works in Canada

No, it was a sign up fee for a 5k and a mouth guard so I could go to a roller derby team orientation.

That’s awesome that you got it! Crossing my fingers for an investor for you! I’ve totally had the same problem before; the more I work outside the home the more I eat out. It’s a rough one to beat.

Femme Frugality recently posted…Why The Founding Fathers Were Broke

Glad you got the stage manager job! Sorry to hear you had to fork out all that for car insurance – at least it’s out of the way though, paying it upfront for the year ahead.

Hayley @ Disease Called Debt recently posted…Financially Savvy Saturdays #97

Yeah, I’ve always tried to pay it in one huge chunk. And at least it’s slowly starting to creep down. I guess 30 is the magic number when they think you’re not a totally reckless driver anymore.

Woohoo for stage management gigs! Boo for late night train waiting. That’s the worst! That’s just one of many reasons that I’m so glad I have a car!

K @ One More BROKE TWENTY-SOMETHING recently posted…Financially Savvy Saturdays #97