A few weeks ago we discussed some different methods for freelancers to save for retirement and hopefully you’ve gotten on that and opened up a savings account.

And that’s definitely step one to not starving to death in retirement. But the entire notion of how much money you need can seem really daunting and confusing. Today I want to introduce you to some great calculators that will help you figure out exactly how much money you need to live the life you want in retirement.

One that is really easy to use is the AARP calculator. What I don’t like is that it’s called AARP Retirement Calculator: Are You Saving Enough? Because probably… no. And the number you’re about to calculate is going to seem astronomical to many of you. I know I actually started to laugh the first time I saw my number.

So for today, let’s not worry if you’re saving enough. Let’s focus on how knowledge is power and just like setting up a budget, knowing the actual numbers you’re working with is the first step to empowerment (and if you don’t have a budget yet, take this one week Mint challenge and get one started!).

Let’s start with me as an example. I’ve lived most of my life until this year on a salary between $33-38,000 a year and I think it’s likely I’m headed back into that territory soon. I mostly suspect that I can do the same in retirement IF I have a home that is paid off by then AND I budget in some additional fun money – because in case you didn’t know, I’ve got the travel bug pretty bad and plan to feed the heck out of it in retirement.

So I’d say my goal for retirement is about $43,000 a year…. and then adjust that to whatever miserable inflation number it turns into circa 2051.

Because you ALWAYS have to remember inflation. It’s not your friend when budgeting for retirement, but if you don’t account for it, you will likely be totally screwed.

The AARP retirement calculator is super user friendly. If you did already set up your Mint accounts, it’s even easier to use that to pull your current retirement savings number and insert it in the AARP calculations.

After getting through the calculations, you can play around with some sliders that let you adjust your age when you retire or the lifestyle you want to have. If you’re not making your goals at 100% of your current lifestyle, see what adjusting it you 75% does for you – there’s a chance that if you’ve got a lot of debt or are paying a mortgage that you won’t be paying for in retirement, that’s the 25% difference right there.

That’s one of the reasons it’s so crucial to do what you can to get rid of all debts before retiring.

AARP tells me my retirement number is, at a bare buyantibioticshere.com minimum, $435,389.04.

Personally, I feel the AARP number may be coming in kind of low. We are talking bare minimum, but I really don’t want to be eating cat food. However, now that you’ve dipped your toes in the retirement calculations pool, let’s check out my favorite retirement calculator – Fidelity.

I admit it, I’m a Fidelity girl, but this post is in no way sponsored by them, I’ve just been using them for my IRA for the last 5 years and have found them to be an all around great company – easy to invest with and they have great tools – like this retirement calculator.

If you’re not a Fidelity customer, you can sign up for free to use their tools anyway, and I recommend spending the 5 minutes to do that.

The Retirement Quick Check is a lot more thorough than the AARP calculator… to be quite honest, I told you to use that one to dip your toes in the retirement waters. Or, if you opt to live like Mr. Money Mustache, those numbers could be accurate; however, my Fidelity number is the one I’m aiming for.

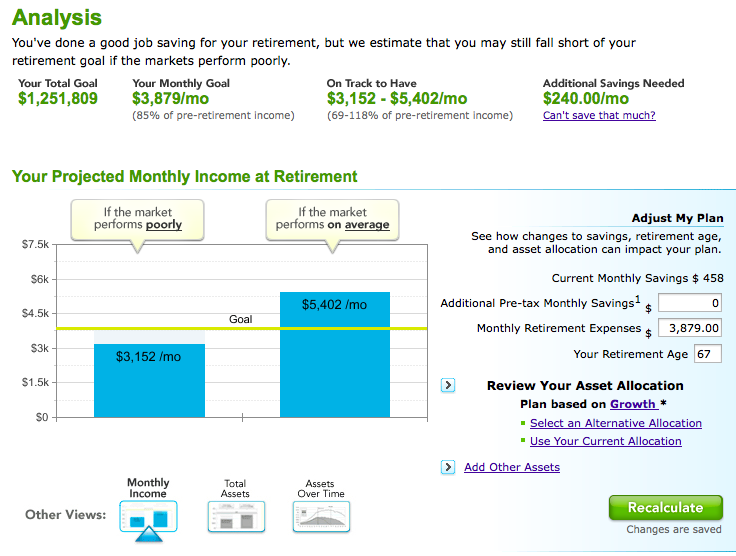

$1,251,809

Holy crap. Trust me. That number looks as ridiculous to me as it does to you. I mean, remember how I mentioned I generally make a little under $40,000 (this year being not the norm at all).

The first time I saw a number like that I just started to laugh. So I bumped up my retirement age to 70 and tried to figure out exactly how little I could live on, I knocked it down to $2,500 a month. That took my retirement number down to $994,506.

Still a pretty big number.

Finally, if you’re not interested in signing into Fidelity to use their calculator (still my favorite), Bankrate has a pretty simple Retirement Plan Calculator that gives me a number I also trust. It puts my retirement goal at $1,195,607 and, a cool feature unique to Bankrate, points out that I’ll likely have $153,032 remaining to leave to my heirs. Or my pet rabbits. You know… whatever my life is like at 97.

Still frightening, EXCEPT the magic of the calculator showed me that with my current savings rate, I’m still on track to retire with enough money even if the market performs poorly.

Am I superstar saver?

Um. No. I am an adequate saver. I max out my IRA every year (and I know $5,500 isn’t something to sneeze at – setting aside a little over $400 can seem almost impossible, I get it… although if you work on your side hustles, you could possibly max it out using just those skillz) and I contribute 3% of my income to my 401(k), with NO employer match. It’s about $30 a paycheck.

Like I said earlier, knowledge is power! So start playing with you numbers to see how much you need to be saving – the sooner you start, the better, because compound interest is your friend at any age. You know what they said about the tree – carpe diem!

I used to run retirement planning calculators all the time at my previous firm and honestly, they just don’t mean a whole lot unless you have your full money house in order. Numbers are just one component of your retirement, your money mindset is a much larger part of it and you can have millions saved; however, if you don’t tell yourself no enough and spend like it’s your job, it won’t last you very long. Rather than focus on numbers with my clients, I focus on their behaviors. When you do that, the numbers work out.

Shannon @ Financially Blonde recently posted…Investing Mistakes – EP 08

I bet! I don’t run them very often, but I remember looking into once at the start of getting my finances in order and it just looked hopeless. Without even thinking too much about it now, my money behaviors have changed so much that all my numbers turned out fine.

That being said, I think it still helps to have an idea what retirement costs. Seems like lots of people don’t realize that Social Security alone isn’t likely to cut it…. assuming it even exists then.

Excellent! I recommend always save even if it is just a few dollars. Become debt free as soon as possible and STAY that way. Look at your spending habits. Having been there and done that I can say don’t give up!

I have never ran one before…..I think I’m gonna try. Thanks.

Petrish @ Debt Free Martini recently posted…My Favorite Reads & Moments of The Week

I like this post because it gives me some insight on how others work out what their final number for retirement is. I personally have absolutely no idea what it will be for me and my family. I stopped after using the AARP calculator and it gave me a number of $6 014 302. It is nice enough to tell me that I will need to spend $2 629 266 less in retirement or I will run out of money. Retirement calculators run on rash assumptions, the major one being that you will get an increase in wages every year and you’re ROI is always good, even though your asset allocation will change bringing lower returns closer to retirement. Unfortunately for me, at 30 years old I am making absolute top dollar for my skill set and education. Once i leave my current job I will take almost a 50% hit on my income, there is no way around this. Personally for me, it seems like the only way to use the calculator is like you have done, manipulate the numbers so that it tells you something that you want to see. Do you think it would be worth signing up to the Fidelity site and trying that calculator as well?

Jeff recently posted…Our 2015 Budget(s)

I do like the Fidelity one best, but it’s still going to assume a wage increase and steady ROI. I do my best to even it out by setting my current wages lower and leaving the ROI about 2% lower than I think it may actually average.

Although you’re also right, in the long run there’s nothing guaranteed with investing, so who knows if things will turn out like the calculators predict.

I am going to create a fidelity account tomorrow and give it a try. I am actually going to take some time and figure out the real % of my income I think i will need when i retire. I guess the spot i usually get hooked on is they say for example you need 80% of your earnings now… Well seems how i put more than 20% on my mortgage a year i don’t think that’s right. Plus at retirement i will stop saving. Regardless, going to run some numbers on Fidelity and report back.

Jeff recently posted…Financial Goals Set

Two other comments mentioned FireCalc, which looks like it’s worth looking into.

Fidelity does let you estimate how much of your current income you intend to replace. I run my numbers at 75% since my goal is to have a paid off home by retirement… I still feel that number is actually high, but I’d like to aim for more than I need when planning my goals.

I ran the Fidelity calculator with no success. I noticed on your graph that it shows a monthly savings of $458. No matter what income or what monthly expenses I enter that number does not change. I have spent a good 45 minutes on it and give up.

The firecalc one is neat. Basically what you enter on that is your portfolio value, years of retirement, and estimated cost per year of retirement and it runs simulations on if your money will last. What I did, i entered my current savings amount at 5% interest and my current monthly savings into a compound interest calculator, ran it for 25 years until i was 55. I used that number to plug into the Firecalc page for portfolio balance. The number i used for yearly expenses came from the firecalc real cost of living with our current income level. When running the simulations it had a success rate of 46%. I then ran it again with only my income and the success rate was 74%. Now this makes me extremely happy as the total yearly expenses that the real cost of living calculator spit out was more in line as to what i think we will spend. The reason I am happy with it, is i know that once the house is paid off we have a solid 15 years of no mortgage to stash away money into savings!

Thanks for making this post, i would have never spent the time i did fiddling around with the calculators had you not wrote it.

My favorite free retirement calculator is FireCalc. I like that I can change variables like when I might start Social Security or sell my house to downsize (lump sum estimate) etc. to see if the retirement money will will last for however long you enter. You do have to have an idea how much you need to live on so knowing your lifestyle cost is important. Not sure how anyone can do that if your retirement is many years away but using today’s lifestyle cost is a good way. I used it before my early retirement and I still play with it occasionally.

LeisureFreak Tommy recently posted…Being Rationally Unreasonable

Always good to run the numbers! For us, it was all about figuring out exactly how little we can live on annually and then projecting out when we’ll be able to draw that amount as a 4% spin off of our investments. We’re pretty dang frugal, so it’s a pretty low number, and, we’ve settled on a level of spending that is, for us, the perfect intersection of comfortable, happy, and frugal.

Another factor to consider is whether or not you’ll be making any money in retirement. Most models assume $0 income, which won’t be the case for Mr. FW and me. Our income will be dramatically reduced, but it won’t be zero.

We like the cFIREsim calculator: http://www.cfiresim.com/input.php

Mrs. Frugalwoods recently posted…Weekly Woot & Grumble: Many Woots of Gratitude

Thanks for all the calculators! That’s great! I think too many people invest for retirement without a set plan or a goal. It’s great to actually calculate it; otherwise, so would you know when you’ve made it? lol

Kalen Bruce @ MoneyMiniBlog recently posted…How Does Debt Settlement Affect My Credit Score?

Its great that we have some calculators around. I have tried running the numbers severally but I think they were not very promising at the start but I think they make a good reference for your planning.

Amos @ Modest Money recently posted…A Review of The Intelligent Investor by Benjamin Graham

Exactly, they’re not a concrete number, but they do give you a goal to work towards – especially if you’ve never tried to figure out how expensive retirement can be.