If you’re an early career stage manager thinking of making the move to NYC, there are a few important financial decisions to make before taking the leap.

Some questions to consider:

- Are your student loans paid off?

- What is your max rent budget?

- Have you budgeted for additional expenses?

- Do you have enough savings to get you through a few months?

- Do you have a job lined up?

- What are your plans for survival jobs?

- How long do you think is a reasonable time to try to “make it”?

Are Your Student Loans Paid Off?

This can be a pretty brutal reality. For a lot of recent grads, your student loan payments can be nearly the same or even more than the cost of rent.

The odds of you staying afloat in NYC if you’re also trying to make a student loan payment that’s the same size as your rent are pretty slim.

If you’re still paying off your loans, it might be in your best interest to wait until they’re paid off.

The Class of 2017 had an average student loan debt of $28,650 according The Institute for College Access and Success and I’ve got say, that number doesn’t surprise me at all – it’s right around what I owed when I finished grad school in 2011.

The good news is that I was able to repay them in two and a half years. The other good news is that I was able to do that because of jobs that provided housing. The best news is that those jobs are not so difficult for people in the arts to find.

My salaries during that time were pretty terrible – before taxes during those years I made between $32-$36 thousand dollars. I also wouldn’t say that I was living it up at all, although there are worse places to live on a tight budget than a cruise ship. I will up sum it with I definitely felt the pinch often, but I still was able to splurge once in a while (like a week long trip to Peru with my cousin).

Two or more years spent in full debt repayment mode isn’t a blast, but the freedom it’s given me was worth every bit of aggravation and frustration. Also, by selecting these cruising and touring jobs, I was able to build my resume and stage management skill set at the same time.

If your student loans aren’t paid off yet, here are a few companies you can check out that often hire younger stage managers and provide housing:

If you know my career path, you’ll notice I didn’t put the cruise line that hired me. That’s because they don’t usually hire young stage managers, but there were in a bind and did hire me, so don’t consider the list above your only options. Apply everywhere.

I’d love to tell you there’s some trick to budgeting for paying off loans and living in NYC, but on an early career stage management salary, there really isn’t. Your best hope would be deferring your loans due to low income, but this will still get you in the long run, because you will eventually have to figure out how to pay them off and the interest will just keep building and building.

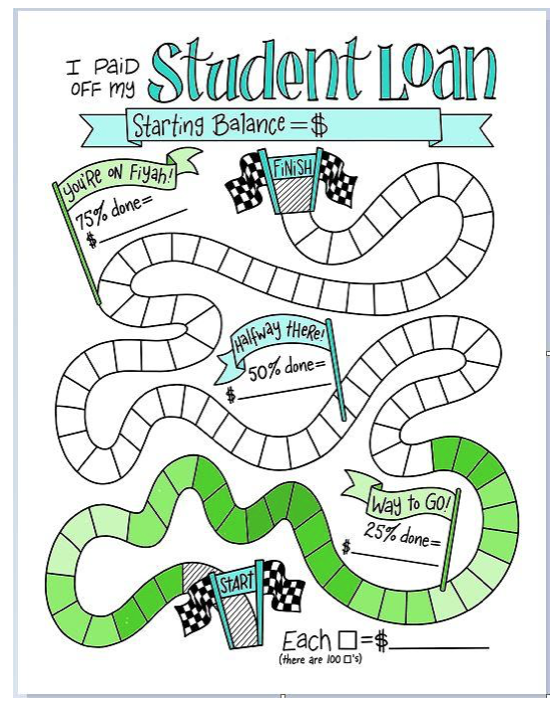

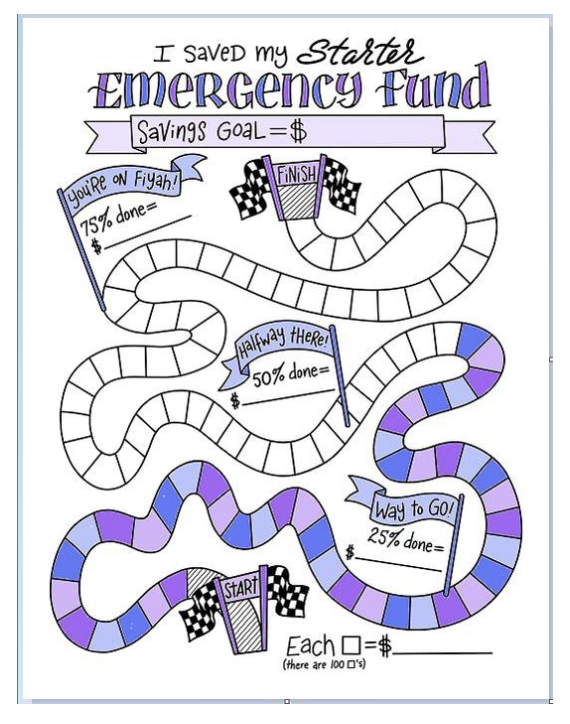

And while there’s not much fun about paying off student loans, there are these great totally free charts you can download at Debt Free Charts that help you visualize your journey and see your progress (and at least coloring is fun).

You can download these coloring sheets for free on the Debt Free Charts website. They actually have them for all sorts of debts.

What Is Your Max Rent Budget?

Now is the time to start looking at some hard numbers.

New York City is very diverse and has a lot of different boroughs and these boroughs have different ranges of rent.

If you’re Broadway or bust, the Theater District rent comes in at an average of $3,897. If you want to head uptown to Inwood or Washington Heights, you’re now looking at around $2,250 a month.

Of course, you don’t need to plan on getting a one bedroom apartment on your own. You can find slightly better deals on a studio, or you can do what most New Yorkers do – find roommates.

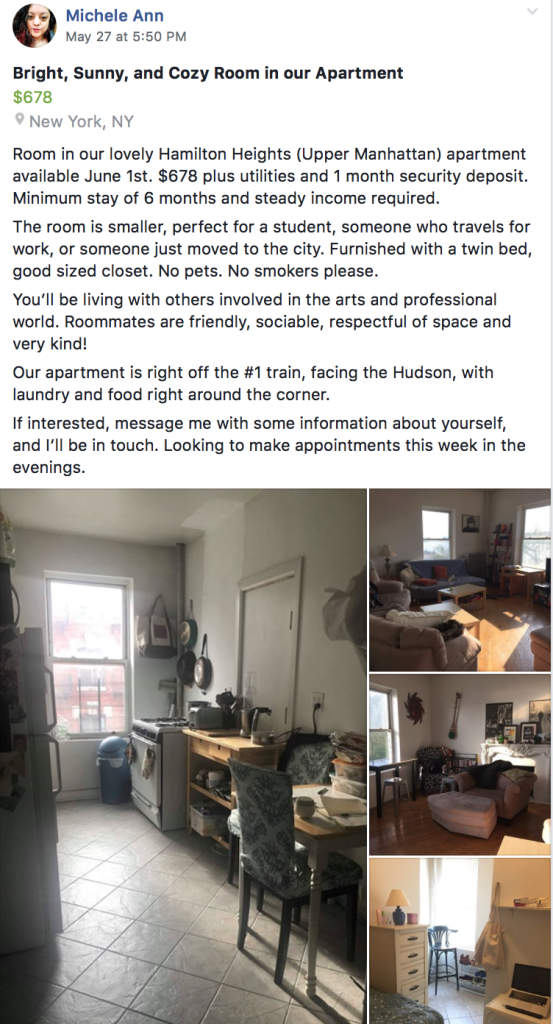

Sites like Craigslist and Facebook groups like Gypsy Housing can help you find roommates.

Finding a roommate also means you can skip the hassle of apartment hunting, which 95% of the time involves a broker fee (usually 15% of the annual rent), even when a lot of ads say it doesn’t.

If you’ve never lived in NYC before, you might be unfamiliar with broker fees. In most of the United States, you can just work directly with the owner or property management company and move into an apartment.

In NYC, you rarely rent directly from the owner, so the broker gets involved and it has become common to expect the renter to pay all the fees associated with the broker. It doesn’t matter if you went through the broker to find the apartment or you find it online yourself after hours of searching, you still have to pay the broker fee.

This site has a more detailed explanation of broker fees and a few hints on how to avoid them. I can also vouch for the fact that one of those points has actually happened to me and I was so frustrated and done with apartment hunting, I just signed the lease:

Often, no fee listings are used as a bait-and-switch tactic. An apartment may be advertised online as no fee, but once you have viewed it, fallen in love and are ready to move forward, you may be presented with an “apology for the confusion” and take-it-or-leave-it offer that requires you to pay a fee.

Are broker fees a total pain in the behind? Yes.Can you get around them? Maybe. Do you want to spend hours and hours of your life trying (trust me, I’ve been there)? Probably not.

Of course, the lower rent you can find, the better off you’ll be, but don’t forget in NYC, you want to make sure you’re in a place that’s safe enough to come home to at all hours of the night, and you also probably don’t want to live in a crack den.

Make sure you either check out the place yourself first, or if moving from a far distance totally prohibits that, you get a Skype tour of the apartment. It’s also good to chat with your potential roommates, because you can catch a lot of red flags in a 15 minute video chat that you might not catch otherwise.

For your initial rent and utilities, without a steady paycheck lined up, you want to try to stay in the less than $1,000 a month range.

At this budget level, you’re probably looking at some of the further out Brooklyn and Bronx neighborhoods, or you could get lucky in the Washington Heights/Inwood area with enough roommates.

Have You Budgeted for Additional Expenses?

Unless you’re moving from California, D.C., or Chicago, you’re likely to be spending more on everything than you used to spend.

Do you do most of your spending with credit cards? If so, it’s really easy for you to go back and figure out what you spent on food, clothes, entertainment, etc. for the last three months.

Break it down month by month and then figure out the average.

If not, track everything you spend for the next month. You can track it as you go or just keep all the receipts and sort it out at the end of the month.

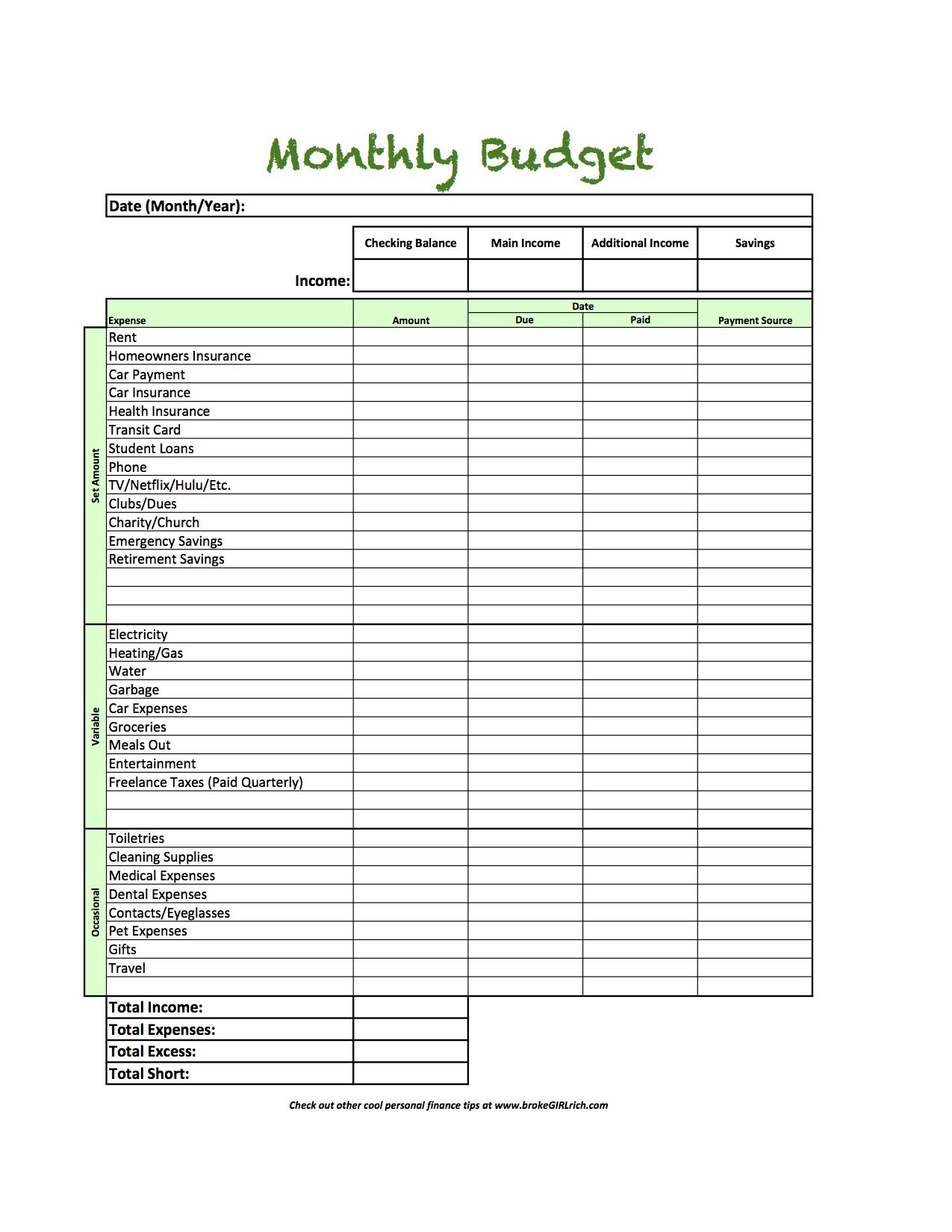

This is a starting point. You can use a budget sheet like the one I made here to figure out how much you usually spend on each item.

Go down the line, adding in your awesome new rent estimate from above, and you’ll have an idea of what you need to make to get by in NYC.

I’d suggest you actually make two budgets while trying to figure out the cost of your move – your happy life budget – where you book the gig, have an awesome survival job, and find a decent, lower rent apartment – and then a bare bones survival budget.

Your bare bones budget includes things like rent, utilities, phone, food, transit, etc. Things you really can’t live without. Don’t forget, if you plan to go the roommate route, there will probably be things like cable bills or anything else pre-agreed upon, that will need to be a part of the bare bones budget, even if you personally would’ve been fine cutting them.

Hopefully, you can live your best New York City life in the happy budget, but there will probably be times in the arts when you’ll have to scale back closer to the bare bones budget.

Also, occasionally switching to bare bones for a month here and there can let you super charge saving and retirement accounts. Compound interest is real and amazing, so get it while you can.

Some uniquely New York costs to consider:

- Unlimited Monthly MTA Cards – $127 (as of May 2019)

- City Taxes – hovers around an additional 3-3.5% removed from your paychecks.

- Happy Hour – for real, it’s harder to turn down there.

Do You Have Enough Savings to Get You Through a Few Months?

Now that you know your happy life budget for New York City, it’s a good idea to make sure you have some savings you can live off of while you adjust to the new place.

I’d recommend having at least three months of your happy life budget in a savings account before heading to the City. This gives you time ample time to find a job and get used to your new surroundings without being in a state of financial panic.

If you’re really set on your own apartment, make sure your savings include enough for a broker fee.

In addition to those savings, you should have at least the start of an emergency savings account that is not a part of this plan.

A great beginning goal for an emergency savings account is $1,000. A mid-term goal is about three months of expenses. A long term/full stocked goal depends on you and what makes you feel comfortable.

A lot of people with steady jobs aim for about 6 months of expenses. For freelancers, aiming for a year of expenses is more common.

I recommend putting your emergency savings into a different bank account than your main checking account, so it’s more difficult to use. You want it available but not too available.

And the Debt Free Charts website has a coloring page for funding your emergency fund too (sorry guys, I really like them)!

Do You Have a Job Lined Up?

Well, this one is a pretty simple yes or no.

If yes, hooray! And also, all that budgeting info above will be much easier to do.

And also, if you’ve got a steady job lined up, you can forgo the three months of happy life budget expenses buffer (though you should totally still be building an emergency savings account, so just put that money in there instead).

If you don’t have a job lined up yet, here is a pretty good list of Where to Find Jobs as a Stage Manager.

Additionally, I highly, highly, highly, recommend you join the Stage Managers’ Association. If you live in NYC, it’s one of the best investments you can make. They have all sorts of meet ups and shadowing opportunities.

I’d also really recommend you volunteer to give them a hand. They set up tables at several big theater conferences around the City. It’s a great way to get to know other local stage managers and the group has a really diverse collection of stage managers at all levels and types of theater/performance.

What Are Your Plans for Survival Jobs?

Maybe the perfect stage managing job doesn’t come through.

Or maybe you get a stage managing job but it doesn’t pay nearly enough.

What’s your plan then?

You can sometimes find arts friendly survival jobs on sites like Playbill.com, but other times you may need to get more creative.

Four great side hustles for stage managers include blogging, freelance writing, virtual assistant work, and transcribing. The reasons these are particularly good is that they are location independent and super flexible on exactly when you do them. Some of those require patience and effort in the start up phase before you start making any money though.

The ways to make money on the side are almost endless. For a bigger list, you can check out the collection of 114 side hustles I put together a few years ago. Some of them are a little more out there, but there’s likely something for everyone somewhere on that list.

And, of course, there’s always babysitting, temp agencies, and bartending/waitressing. They are all generally jobs that have a long history of keeping folks in the arts alive.

How Long Do You Think Is A Reasonable Time to Try to “Make It”?

This question isn’t the most fun to think about, but it’s better to conquer it before you begin the journey than to try to sort out your feelings about it along the way.

If you’re moving to the City specifically to make it in the arts, how long do you think is a good amount of time to try?

- One year?

- Three years?

- Five years?

And what do you even consider “making it”? For me, it has always been as long as I could pay my bills.

Additionally, you’re picking one of the toughest cities to make it in, between the fierce competition and high cost of living, so there’s a good chance if you picked another location, you might still be very successful in the arts.

It’s not that you can’t change your mind along the way, but making the move with a clear initial idea of how long you think is reasonable to chase the dream is really a good idea.

*~**~**~**~*

Still set on moving to New York City? If you Google “how much does it cost to live in New York City” you’re going to find a wide variety of answers and a lot of them are downright terrifying. A massive number of articles claim that trying to live there while making less than $100K a year is crazy.

The reality is that living in NYC for less than that is very doable and the best article I’ve ever read that breaks down a decent New York City budget for someone in the arts (written by someone is the arts), is by Stefanie O’Connell and you can check it out here.

Spoiler: the goal for living the decent life in NYC is around $40K a year.

Real life story: I lived there for a year on a steady salary of $53K in 2014 and definitely managed to live the decent life.

I also lived there in 2017 on a flexible salary and managed to live the decent life working 7-8 shows a week at $115/show.

So, it can be done!

Thank you so much! The article is so informative.