Update: 4/18/17: In light of digit’s move to start charging $2.99/month for their services, you may want to check out my post What Are Some Other Ways to Save besides digit?

In early January, one of my credit cards had fraudulent activity or something on it and was cancelled. Since I’ve been traveling, I haven’t had a chance to get the card from my parent’s house yet. This is the card my Acorns account was attached to.

I realized that this puts me in a position to look at Acorns vs. Digit with about a month and a half of use on each, since my Acorns account has been just sitting after roughly a month and a half of using it.

Acorns is an account that attaches to one of your credit cards and rounds up every purchase you make to the nearest dollar. If a purchase comes out even, it adds a dollar to the total and once that amount hits $5.00, it withdraws it from your connected bank account and places it into an investment account.

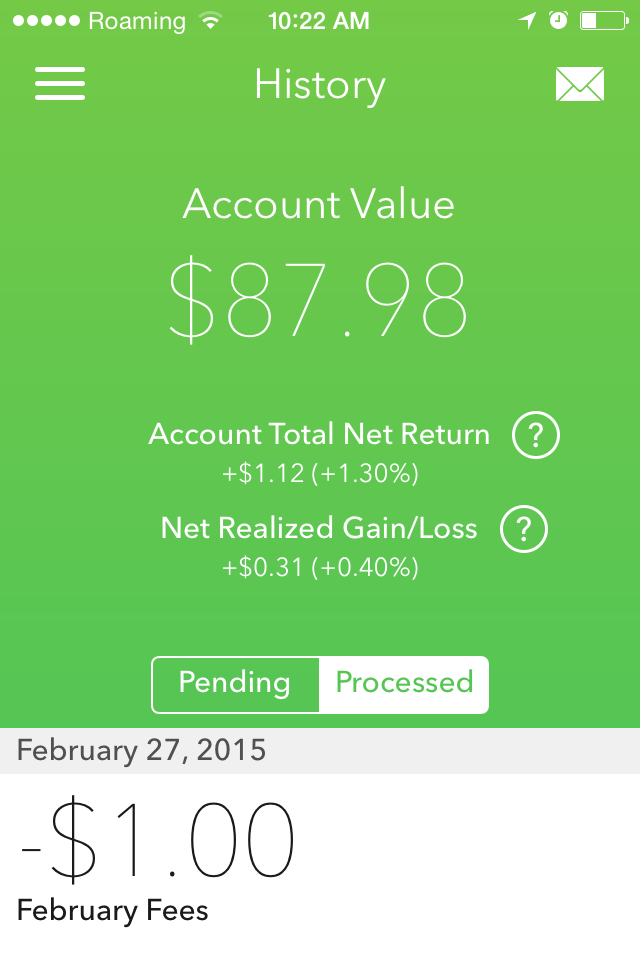

Acorns has a $1.00 a month fee to use the app. When you set it up, you select the investment settings that you’re most comfortable with.

So – since I set up the account in October, Acorns has cost me $5.00, automatically socked away about $90 (keep in mind, of my own money) for me, and grown…. wait for it… $1.12.

Granted, there are lots of mitigating factors here, like the fact that I haven’t contributed a cent in about two and a half months and have still been paying the $1.00 fee. None the less, it’s pretty obvious that it would take a substantial amount of time to amass enough “acorns” cent by cent to make the interest outweigh the $1.00 a month payment.

That being said, I’m opting to withdraw what I’ve got in there and close the account. We’ll see how smoothly that goes.

Digit, on the other hand, I’m a little more sold on. With Digit, you link in your checking account and Digit trolls through and uses it’s terrifying robot computer brain to figure out your spending patterns and makes a few small withdrawals a month that it swears you won’t miss. Digit also covers your account if it does anything that put your into overdraft.

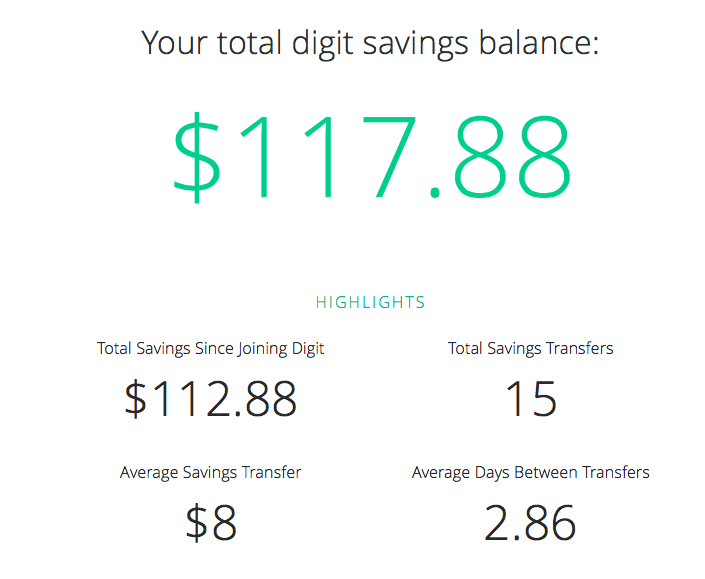

On average, digit takes $8 every 3 days. And I’m pretty confident this is a rather high number, since my spending patterns are pretty much – dump most of my money into savings and investment accounts anyway.

Digit also provides this service for you for free! This is because it acts as a savings account with 0% interest and Digit makes their money from the interest off of how they invest the money.

So – a month and a half into using Digit and I have a little savings fund of $117.88. While this isn’t a great way to grow your money, it is an awesome way for people who claim they can’t find money anywhere to start a savings account.

The only thing that irritates me about Digit is all the text messages – but for someone just learning how to manage their money, the daily reminders could be really useful.

My Digit plan is to just let it keep on sucking money out and whenever it gets to $100, transfer that money to somewhere else, where it can actually earn interest. It definitely does feel like magic money – Digit was right, I don’t miss it at all.

Have you guys had any success or fail stories using these apps?

I have not heard of either app before, but I am curious. Will have to do some exploring with these. I have to admit that giving a third party access to my checking account makes me a little nervous.

Tre recently posted…Net Worth Update – Q4 2014

I’ve been using Digit for 2 years – I paid for my trip to London last year, a trip to Colorado in January. I have little over $2k in my Digit right now, let the trip planning begin!

I’ve been very curious about using one (or both) of these programs! I’ve wanted to get around to it…but that hasn’t happened yet. Nice to see you’ve saved a little extra cash! 🙂

K @ One More BROKE-TWENTY SOMETHING recently posted…Handling a setback!

Pingback: Weekly Updates: March Madness + RPGs - leslie beslie

Apparently I didn’t read the fine print with Acorns. I didn’t realize they charge $1 per month. That makes me want to dump a few hundred in there to counteract the fee.

I love digit and I prefer the daily text messages, it’s nice knowing my daily checking balance.

Jason @ Debt Departure recently posted…Best Personal Finance Books

I’m finding Acorns to be less and less worth it and am likely to close my account soon – on the flip side, I really love digit.

I have had acorn for about 5 months and have invested $624 through roundups which i have not missed but have a balance of $587. I went 3 months agressive and 2 months moderate and they lost money all 5 months. So I would say unless acorn actually make you interest it’s not the one to choose. I would love to see what kind of interest Digit is making and keeping for themselves since if Acorn cannot than Digit people are comparitively geniuses.

Yeah. Although the market hasn’t been doing too hot the last few month either, so it’s not so surprising investments aren’t doing that well.

Pingback: Is digit Awesome? A Year Later, I’m Still Saying YES - brokeGIRLrich

Digit is nicer and now they are throwing some interest on top of our money which is good.

I accumulated 3000 in an yr without being missed. It is good to have it as emergency fund.

Definitely! I think it’s a terrific way to build up a pain free emergency fund.

I’ve found a lot of people complain about the $1 fee on Acorns, especially on the PF Reddit thread, however I have been using it consistently since January with round-ups and a weekly deposit of $7.50; it didn’t charge me the first month’s $1 fee, but since then has charged me the $1 four times. On average, I’m depositing $60-70 a month, and have currently put in just under $300. After the fees have come out, I’m still up about $12 on the market right now, and have earned another $1 in dividends to date. Yes, it fluctuates up and down over time, but overall it’s been a great way to add up money over time in an investment account, and I expect to continue to make small amounts on it. When it reaches a thousand or more, and I am in a better position financially to contribute $100+ to investments a month, I plan to move it to a different service.

That’s so strange that it’s inconsistent about charging you the monthly fee – but I’m glad it’s working out well for you!

I started using it in January, but didn’t use it the entire month, so I think it skipped charging me. I’ve otherwise been charged consistently. I think it gets a bad rap on the finance blogs/forums! Sure, it’s a little pricier in terms of percentage of fee/return, but it’s great for starter investing.

I love Digit! <3 But, you can disable the text messages! I did that so I am not reminded that it's taking money. I don't check my bank account every day. So, today I was looking at my account and went "oh crap" because I spent more than I should've and had a bill coming up… Digit to save the day! It had been squirreling away money for months without me remembering it! I forgot all about it. Love it.

I'm going to give Acorns a shot,

Me too! I’ve actually gotten really used to the text messages and kind of enjoy the quick reminder of my balance now. It also helps me catch the “wait, what??” moments when a check is cashed later or something and I realize my balance isn’t what I thought it should be.

I’m definitely a bigger fan of digit than Acorns, but they’re both worth looking into.

As a current digit user I wanted to chime in. I love the service but with the recent change to charge $3/month I’m going to have to think about continuing.

OMG. Me too actually. I have loved LOVED digit since it first came out, but that email today has me really bummed too. I don’t think I’ll be spending $3/month to help me save. Seems counterintuitive. I have my fingers crossed that others see it the same way and it drops back to being free soon.

I want to share a word of caution, in this article and some of the comments I see the term “interest” used to describe growth on funds invested through Acorns. “Returns” is more accurate, since Acorns isn’t a savings account, it’s an investment account comprised of stock & bonds. It’s not FDIC insured and you can incur losses. Digit is (reportedly) FDIC insured and yields true (“safe”) interest.

I also wanted to share that you can link Acorns to multiple credit/debit cards, not just one like the article implies. This might be a relatively new tweak given the age of the article to be fair. In my experience, they also monitor and round-up transactions that hit your checking account directly (e.g. transfers between my checking and savings accounts, transfers to pay credit cards, possibly even checks). This can be a pro or a con- I don’t mind it since it tips the scales toward savings. 🙂

And they waive the fee if you sign up with a .edu email address.