So, it’s not just another month, but a whole new year! I’m trying to be excited about all the possibilities and opportunities this year has to offer and I’m actually do a lot better than usual (shhhh… I’m not always the most positive person around, especially about my own future).

I actually just penned an entire New Year’s Resolutions post for Michelle at Fit is the New Poor, so I’ll spare you all the repeat and just link over to that, but suffice to say, sitting here and thinking about all the things I’d concretely like to accomplish has actually put me in a more positive and goal orientate place that I usually am at the start of the year.

Speaking of goals, I finally joined the Yakezie Challenge, so bring it on Alexa. I’ll get you down to 200,000 by June 29th. Currently I’m at just over 400,000, so I think it can be done.

And this month I decided to focus on bettering other people’s futures with a look at ways to save for college and tips to get through relatively inexpensively (you know, so that you or your kids don’t have 29,192.46 reasons to be stressed after graduating). That being said, I’m actually looking for two guests posts if anyone has a great story about a student worker job they had during college – either something that paid great and let you graduate without any or much debt or something that gave you a leg up resume and career-wise once you left school. So if you’re interested, drop me a line.

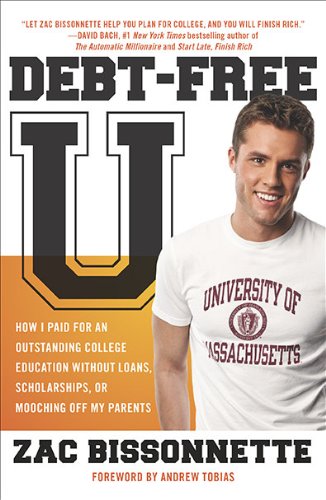

Also, be sure to enter this month’s giveaway to win a copy of Debt-Free U: How I Paid For An Outstanding College Education Without Loans, Scholarships, or Mooching Off My Parents by Zac Bissonnette. Contest ends on January 31st.

Welcome to the challenge! Happy New Year!

Brian recently posted…New Year Resolution

Happy New Year to you too, Brian!!

Mel @ brokeGIRLrich recently posted…Yakezie Challenge Here I Come (and Happy New Year)!

Welcome to the challenge! Best of luck for the new year!

Sam recently posted…2013 Personal Year In Review On Financial Samurai

Thanks, Sam! I’m pretty excited.

Mel @ brokeGIRLrich recently posted…Yakezie Challenge Here I Come (and Happy New Year)!

You can totally get your yakezie challenge done by June. You’re already well on your way!

Stefanie @ The Broke and Beautiful Life recently posted…5 New Years Resolutions Worth Making

Welcome to the Yakezie Challenge! I can honestly say that this challenge and it’s amazing network of bloggers has helped my blog more than anything else this year! Happy New Year!

MonicaOnMoney recently posted…How I Saved $6718 On Home Renovations

Best of luck with the challenge! I just got Tie the Money Knot under 200k recently.

Tie the Money Knot recently posted…4 Health Moves to Help You Get Wealthy

Best of luck on the Yakezie Challenge. I wanted to do this but cannot blog twice a week. This will be quite an accomplishment if you can pull this off. So all the best to you.

Welcome to the challenge! You are already doing great and will probably have to try to break the 100,000 mark by the time your challenge is up!

Kay @ Green Money Stream recently posted…How I Paid Off $20,000 in Student Loan Debt in One Year

Thanks, Kay! We’ll see. I put off actually joining for a bit to make sure I had the hang of how all the ranking things worked – I’ve actually dropped about 200,000 since I “officially” joined, so I may have to aim for 100,000 in 6 months! There are worse things to have to worry about ;o)

i’m in college now with $28,000 debt. i need this book!!!

Yes student loans because I really want to graduate from college.

yes, for school.

yes, our house, and twice to help family members dealing with crises – those took about 3 months each for us to pay off, and the relatives have since paid us back also.

We have a large mortgage and a home equity loan which we will be paying on forever!

Yes, I paid for our very expensive wedding using my credit card and I knew only about 20 percent of the people who attended

That stinks! I hope your wedding was lovely for the two of you, at least.

I have a large amount of college loans already- and I haven’t finished my degree! I just didn’t know any better back then.

gratefully, no

Student loans and our mortgage!

I did because I didn’t have enough money for car repairs. I now am working on an emergency fund and paying down debt.

Robyn R recently posted…Debbie and Friends “Variety Show” Review and #Giveaway

Way to go with setting up an emergency fund! The peace of mind is definitely worth the irritation of trying to figure out how to fund it.

When my sons were born premature in 2008, the medical bills piled up so incredibly high so fast, it became out of control!