Here’s something I don’t feel like we talk about much in the personal finance sphere – you don’t need to budget ALL the time.

Let’s compare budgeting to learning how to play an instrument.

When I was 8 years old, I dragged home a trumpet from school and started being forced to practice 20 minutes a day, 5 days a week. There was a little sheet stapled to the back of my little beginner trumpet practice book that my mom signed off on that I had practiced every day for twenty excruciating minutes (looking back, they were probably excruciating for the both of us).

Then I joined the school band and started practicing to 30 minutes a day and playing in the band for an hour twice a week.

By the end of high school I was still only practicing about an hour a day, but I was in marching band 3 days a week, wind ensemble once a week, jazz band once a week, and concert band five times a week, as well as playing in the school pit orchestra for any musicals we did. I was probably playing my trumpet about around twenty hours a week.

And while, overall there were challenges to be overcome, the ease with which I played the trumpet was way greater than those 20 excruciating minutes a day I started with.

Budgeting is the same. You start with a really basic idea of what a budget is. It starts to work, so you put more effort into perfectly fine tuning that sucker. After a while, an effective budget can take a good, little chunk of time weekly or monthly to stay on top of.

But then there’s this glorious moment in time where you can coast a little.

I initially had grand dreams of being a trumpet player for a living, but quickly learned in college that I would starve to death if I picked that path. Not only because I never really managed to have a tone that would make me any money, but, and this is a big one, I hated practicing.

The thing was though, by the time I stopped playing for hours and hours at a time weekly, I’d been doing it for twelve years. I had a good base going and I could coast. So I would pick up local gigs playing in pit orchestras around the area and make a little money and go about my day.

I do the same thing with budgets. I spent quite a while pouring hours of my life regularly into refining one and once it was running on it’s own, it just required the occasional check in when something came up and I’d otherwise forget about it.

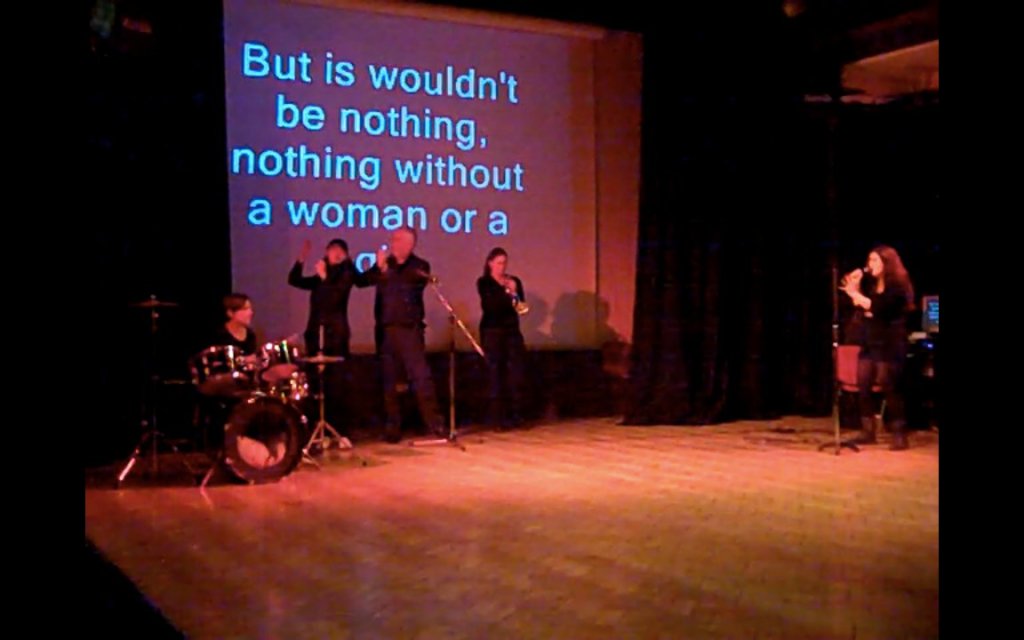

Then I stopped doing anything with a trumpet for about five years. I went to grad school for theater and during that year, we had to create a devised theater piece. We decided part of our theater piece was going to involve a musical number since a quick discussion with everyone led us to realize we had enough former musicians to make a little band.

We picked a segment of It’s a Man’s World. Guys, that song is so, so easy to play. I pulled out my trumpet thinking of my twelve years of experience, the fact that I started college as a music major, all of the pit orchestras I’d played in, all of those years of band.

It’s a man’s world… even though it was all women who had the skills to perform the song and the man in our program stood in the back and clapped.

And the first time I tried to muddle through that song, I sounded almost exactly like I did at eight years old with my mom signing off on that practice sheet in the back of my beginning trumpet book.

It was horrific.

Even more so because I’d always been bad at playing by ear, but this was like… horrific. Let’s just stick with and repeat horrific.

The same happens when you skip five years of budgeting. You think everything is bopping along like normal below the surface, but when you actually check in, it’s a mess.

Here’s the nice thing though, it doesn’t take twelve years to get back to where you were. All the knowledge to get back to your previous skill level is already crammed in your head, you just need to put in a little hard work to get back to where you were.

Instead of twenty minutes a day, it became an hour a day that I just sat in my apartment and played the melody of Man’s World over and over again (I’m sure my neighbors wanted to murder me) and by the time we put the production on, it was not a terrible embarrassment. It was nowhere near as good as if I hadn’t just stopped playing for five years, but it wasn’t the sad sounds of a cow dying that happened the first time I tried to play the song a few weeks earlier.

The fact is the problem could be fixed.

The easiest way to fix it though would’ve been to just play a little more frequently over the years. I firmly believe that busting out my trumpet once a week or even once every other week would’ve kept that decline from being so severe.

The same with budgeting, even once everything is under control, you should still check in regularly. You don’t need to put in all the hard work you did when you were learning how to control your money, but you still need to use the tools you have once in a while to keep them sharp.

That’s a great analogy, Mel. I think once you’ve been running with a budget for awhile, you develop an almost automatic sense of what you can spend. But every month that goes by without checking in, you probably lose a bit of that sense, so that if too much time goes by, you’re off by a lot. Every month, my wife and I have a quick budget meeting to check in, but it’s rare at this point that we need to consult the numbers mid-month because we pretty much know where we stand.

Gary @ Super Saving Tips recently posted…Social Security COLA for 2018: Is It All Good News?