Refinancing is a term that has always made me leery. I’m not sure why, but to me it has a snake oil peddler/smarmy car salesman sound to it. Maybe it’s the ridiculous booming voice on so many of the commercials I’ve heard.

But one thing I’ve learned as a personal finance blogger – a lot of things I’m leery about can be really helpful, especially after a little research.

This post goes out to all my homies drowning in debt.

Now if you’ve got some little debt number, less than $1,000 or so, refinancing is probably not your best option, but let’s get real here. A lot of folks have tens of thousands, if not hundreds of thousands of debt, especially if you start factoring in mortgages.

And we all know any money that isn’t your own comes at a price and that price is the interest rate.

Really long term loans like mortgages and student loans often come with pretty low interest rates, since you’ll be paying them for decades the banks know they need to remain affordable payments, or you wouldn’t use them.

Cars and some private student loans can come with modest interest rates.

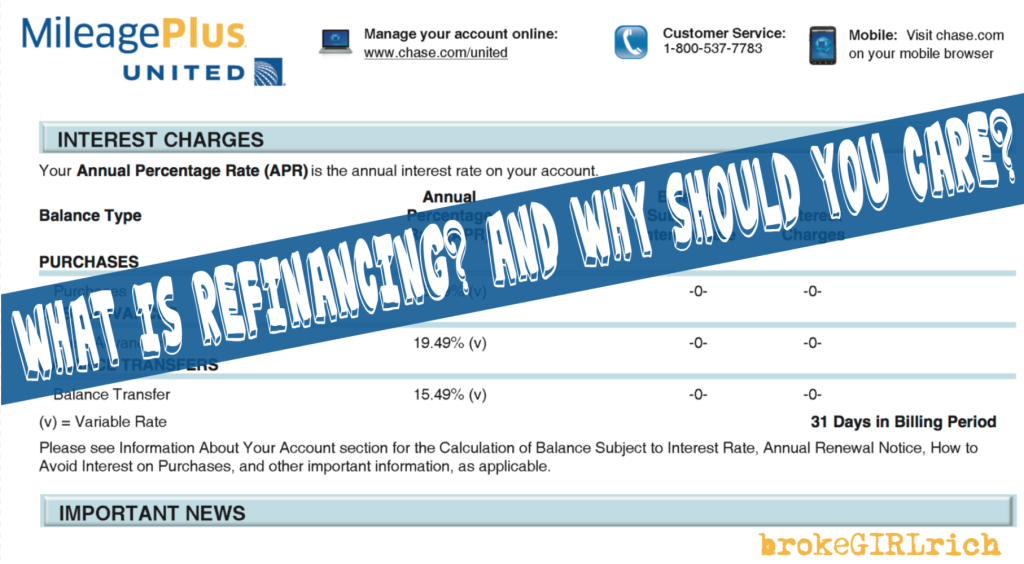

And then there are credit cards. For my two main credit cards that I use most of the time, my APR is 15.49% and 15.24%. That means that for every $100 I don’t pay off within the month I put it on there, I owe a little over $15. Not a big deal.

But for every $1,000 it’s a little over $150.

Say I had a $5,000 credit card balance (certainly not unheard of – there was a time in my life when it was that). My minimum payment was somewhere around $400 a month. But every month it was still racking up around $660 in interest when I paid that. How on earth could you ever escape that cycle?

Well, the answer is you can’t if you are only paying the minimum interest. Not only won’t you escape it, you’ll wind up progressively owing more, without ever spending another dime.

Sometimes when you’re in a debt cycle that bad, you need help. Bigger help than cutting back and living frugally, bigger help than side hustling your tuckus off.

And this is where refinancing can enter.

Refinancing companies take on all of your debt and pay it off. Now the only person you owe is the refinancing company and they will set a new, lower interest rate for the debt you owe.

Now if your debt is concentrated in government based school loans or a low interest mortgage, debt refinancing may not be for you. The number the refinancing company provides might not beat an already solid loan.

But credit cards, car loans and private loans can have some pretty high interest rates.

Over at EVEN Financial, I used their loan calculator to check out what refinancing that hypothetical $5,000 credit card debt would cost me. With my excellent credit rating score, my monthly payments dropped to just under $88 a month and the interest rate plummeted to 4.04%.

But let’s assume my credit score had taken a hit during all of this. Even if I dropped all the way down to Fair (640-699), my monthly payments still wind up lower at $119 a month and my interest rate is still much lower at 4.95%.

The numbers don’t lie. If you have a lot of high interest debt, you should absolutely be checking out how to refinance it and companies like EVEN Financial have the tools to make it quick and easy.

I used an Upstart loan when I put all my moving expenses on credit cards with 19%+ interest rates! I saved a ton of money and am using the debt snowball method to pay off my remaining credit cards first!

Emilie Burke (@burkedoes) recently posted…Spending Challenge: January Update

Awesome! 19% is killer – it would be tough to get out of the hole with an interest rate that high.

Just an FYI… the way you are calculating this is completely wrong. If you have a 15% APR on a credit card, and you had a $1000 balance, you are NOT paying $150 a month. You are paying $12.50 a month in interest, and $150 a YEAR if you didn’t pay it off. ($1000×0.15/12). Just wanted to clear that up!

Thanks!