What Is A Credit Score? | brokeGIRLrich

Let’s talk a little about credit scores today.

First, let’s start with what they are.

A credit score is a number between 300-850 that lenders use to determine how good you are with credit. Having a higher score is better. There are two main types of credit scores, FICO scores and VantageScore, which are very similar, but calculated a little differently, so your numbers on both are probably slightly different.

Credit scores are affected by a few things, so let’s start with length of credit history. It’s important to be careful with credit cards, because interest rates can be really high, making your purchases cost much more in the long run than they do if you can pay off the balance each month.

I put that warning in there because while you need to be careful with your credit cards, it’s still a good idea to open one when you turn 18. If you don’t think you can be responsible with it yet, put a small recurring charge like your Netflix account on it, set the account to autopay your card from your bank account each month, and never touch it again.

This is because length of credit history isn’t an easy thing to suddenly fix if you find yourself in your late 20s or 30s with no established credit.

Additionally, if you are college bound, a lot of college orientations have a booth that let’s you sign up for a credit card. Again, be careful, because the folks from the credit card company probably aren’t going to warn you repeatedly about the true cost of interest payments (though if you pay off your balance each month, you don’t pay interest). However, that’s usually a really easy time to get approved for your first credit card.

Speaking of paying off your credit card monthly, the next thing that effects your credit score is your payment history. Late payments will show up on your credit score and count against you. Late payments can stay on your credit report for up to seven years, so make sure you’re always making at least the minimum payment on your card.

Your payment history is the most influential part of both FICO and VantageScore.

The next things that effect your credit score are total debt and credit utilization rate. Total debt is pretty self-explanatory. If you have a lot of debt, your score goes down. If you have little to no debt, your score goes up.

Credit utilization is how much of your revolving credit you’re using (so while a mortgage or car payment does impact your credit score – we’ll talk about that in a sec – it doesn’t impact credit utilization). Let’s say you get that credit card at college orientation and it has a $1,000 limit on it. Every week you use it to go to the movies and put $25 on it on Saturday night. At the end of you month you’ve put $100 on your card, so you’re utilizing 10% of your available debt.

You’re golden.

The general advice is to keep your credit utilization below 30%.

I have also seen a few rumors warning people against keeping your utilization at 0% (as in, open a card and never use it). I can only speak from experience that there have been times where my credit utilization is at 0% and I have not noticed any sort of drop in my credit score as a result – but I also have a well established good payment history, which might be part of why that’s a negative thing at least in the beginning? All I can do here is speculate.

If I were trying to build my credit score from scratch though, I would make sure to use the card a bit, like in my Netflix example above.

Additionally, if you’ve had a credit card for a while and know you can be responsible with it, one of the main ways I built up my credit score was applying for a few new cards.

Credit inquiries (the thing that happens why you apply for any sort of credit) do effect your credit score in a negative way, but they don’t cause that much of a drop and, personally, I’ve found being approved for the new credit line, which lowers my utilization rate, at least initially, more than makes up for that initial ding from the inquiry.

The problem with inquiries really seems to come if you are denied the line of credit, which can happen if you apply for certain cards and don’t have a high enough credit score, or try to get a car or home loan and don’t get approved. Then the dings can add up.

The other thing to keep in mind is that credit scores are influenced by the average age of your accounts, so whatever that first card you opened is, you never want to close it, so choose carefully and choose one without an annual fee.

Opening a bunch of accounts will also lower the average age of your credit score, which isn’t something to stress out about too much because you will just have to take out more credit at times in your life, but don’t be surprised to see a small drop in your credit score when you do.

Again though, I’ve found opening new cards with a high limit adds to my credit utilization in such a positive way that I don’t see these drops.

Another thing that effects your credit score is types of debt. So while we’ve been talking a lot about credit card debt here, because most people will open a credit card at some point in their life, student loans, car loans, and mortgages, as well as personal loans, home equity loans, pretty much any kind of loan you can think of – all factor into your credit score.

It’s important to make those payments on time as well, and they do effect your total debt amount. Despite that, these other loans can have a positive impact on your credit score, especially once they’re paid off, because lenders like to see a mix of credit.

So… one sort of silver lining to those student loans.

Finally, if you have a public record like declaring bankruptcy, that will also show up negatively on your credit report (very negatively, actually).

Now that you know what effects your credit score, do you know what yours is? You can check annually for a free credit report here, which tells you more about why your score is the way it is and what areas you could improve on. It usually doesn’t have an actual score though.

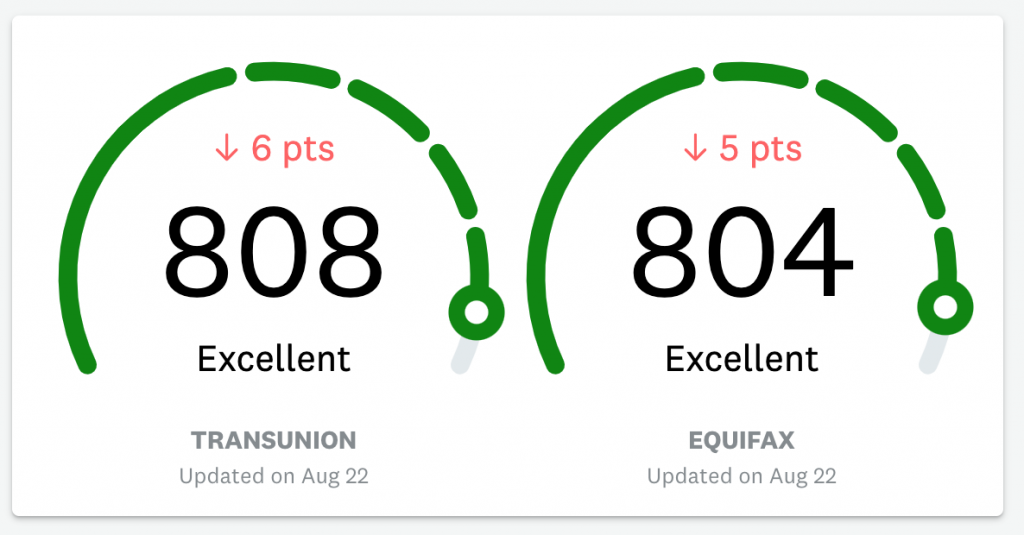

To quickly get my credit score, I check out Credit Karma. It’s super easy to use and free (though they have a lot of advertisements for services to balance out that free – I do like their credit card suggestions though when I’m looking to open a new card).

What do these scores mean?

Most Americans have scores between 600-750.

- 700 and above is good.

- Over 800 is excellent.

These scores effect your capacity to get loans, lower interest rates, and can even impact your ability to rent an apartment or get a cell phone plan.

Do you know your score?