A few weeks ago, I wrote a post over on DINKS Finance that basically lamented what happens to your finances when you go from being in a relationship that splits most of the bills to on your own. Suffice to say… it’s not pretty. And who wants to deal with your bank account getting punched in the gut right while you’re having the same thing happen to your heart?

Funny thing though, there are plenty of monetary issues that benefit from living on your own too. Maybe I just think it’s funny because I had this brilliant realization while in the bathroom today, changing a roll of toilet paper and realizing that I have bought toilet paper once all year – it was one of those giant, mega value packs with like 30 rolls, but still – once. And I’m about to move out of my apartment with 4 rolls to spare.

TMI? Probably.

So it got me thinking, where else have I saved money by being on my own this year?

The biggest money saver has been only doing the things I want to do. I have spent $0 on baseball tickets this year (a big one in my previous relationship), which is delightful as I am 100% indifferent to baseball. Along the same lines, I have spent $0 at Panda Express, a fast food chain I pretty much find disgusting but might have been a certain someone’s favorite.

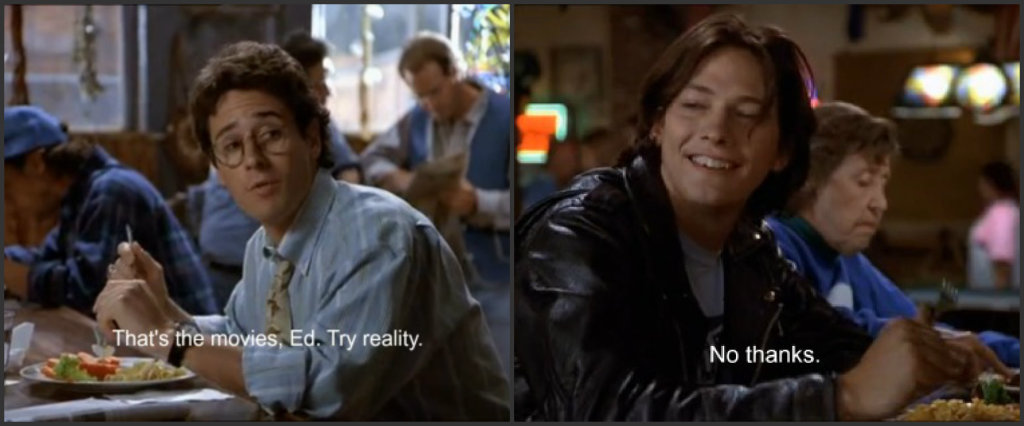

Also, in the depths of the breakup, I became a sort of weird hermit, which saved even more money. Of course, at some point you have to stop watching old reruns of Northern Exposure and leave your apartment.

Whether or not I eat out is 100% up to me and totally based on my own financial situation. Instead of feeling pressured to eat out more – and to make sure I pay about half of the time, I could literally eat in every day (not that I have). If I do just want to grab dinner on my way home, the $1 empanadas at the corner bodega are plenty for me.

Along the same lines, I can’t imagine how difficult a no-spend week becomes when trying to do it with someone else… maybe that’s actually a great test of a relationship? ;o)

I was completely in charge of when the A/C went on this summer and when the heat went on this winter. I could also save electricity and sit in the dark without anyone judging me or calling me cheap (other than all of you, now that I’ve let the cat out of the bag… and my mother, who thinks I’m endlessly weird).

The quantity of laundry I do is just for one person now… which is great because detergent is surprisingly expensive.

When another relationship ended I had a drastic savings in gas, since I wasn’t driving several hours a week to see him anymore.

So while they say two can live just as cheaply as one – this is pretty much crap… although perhaps the overall savings in rent and utilities evens out buying a little more toilet paper.

I definitely saved SO much money when I was single!!! I used to workout after work, come home and eat frozen dinners then go to bed. I rarely went out and I was okay with that because I enjoy my own company. I definitely spent more when I was dating, then of course I spent on the wedding and now I have the ultimate financial black hole, my son. Single life sounds good many days! 🙂

Shannon @ Financially Blonde recently posted…Music Mondays – Shake It Off

Hahaha, what a term of endearment for your son! Although I feel like my mom had referred to both my brother and me as that in the past.

This makes sense for you definitely, for me…I am “that guy”. My wife basically controls my spending; otherwise, we would have all kinds of new electronic toys that we don’t need. She probably feels like you in this post. lol. It’s interesting to see it from the other perspective. 🙂

Kalen Bruce @ MoneyMiniBlog recently posted…My Biggest Money Mistakes (That I’m Glad I made) Part 3: A Common Mistake

LOL. It didn’t even occur to me that maybe some people actually do better with a… er… “keeper”?

I hear ya. My biggest money drain was a long-distance relationship. Sure, it saved money day-to-day by not having to do the normal couple type stuff. But driving/flying a billion miles a year… wasn’t cheap.

Will recently posted…Comment on How to Use Investing to Pacify Your Desire to Spend by Michael

Amen to that! The worst spending of my life was the year I was in grad school and dating a guy who was working on the other side of the world. Between insane phone expenses and the cost of trying to get to each other once in a while, it was a doozy.

Married for 15 years, so can’t really offer and good advice here, but certainly can see how streamlined your spending, budget would be being single. I have a family member who recently divorced and once the dust settle their financial picture became so much clearer being single.

Brian @ Debt Discipline recently posted…Passion

Great post! I’m kind of newly wed, and have recently discovered that I love cooking! I look forward to making delicious dinners at home every night. But then I got to thinking, what did I used to eat for dinner? Oh yeah, that’s right, not much. Just a snack, maybe. Even though we mostly eat at home, I definitely spend much more on food than I used to.

Chela recently posted…My Favorite Gift to Give

I was in an LDR, but minus the plane tickets (which luckily weren’t that expensive – two big airport hubs + cheap Southwest flights), I saved a ton of money! I also lost a bunch of weight… haha. The only things I did were 1) go to class 2) go to the gym 3) go to work 4) go to my internship 5) OCCASIONALLY go out with the other grad schoolers, but I’d usually call it an early night because I had to rinse and repeat (school, gym, work, intern, homework).

The life, man. (but you know, bfs are cool and all that ;))

I definitely think being single can help the budget date wise! But being in a relationship has helped me split most of my necessities (of course not a reason to just be in a relationship that sucks!). When I was single before, I didn’t do much and it was so helpful for my finances in regards to going out.

Melanie @ Dear Debt recently posted…Are You Ready to #DumpDebt?

Being in a long term relationship, where you live together and split all your exposes definitely has a lot of financial benefits – probably outweighing what I’m managing to save now as the reclusive hermit I’ve become ;0)

To argue the other side here, I actually spent more money when I was single! I was always out at restaurants or bars with my girlfriends and lived on my own in a 1-bedroom apartment. I’ve been with my boyfriend now for almost 5 years and our dates usually involve sitting on the couch in our PJs or whipping up a nice meal at home. We also never buy each other crazy expensive gifts for Christmas or birthdays and split all of our shared expenses.

Christine @ The Wallet Diet recently posted…Living on a Millionaire Budget with a Middle-Class Salary

I can’t even imagine. I married my high school sweet-heart a year out of high school in 1977 so our life and eventual FI has been done together. I think if you have someone who is on the same page striving for the same goals it might be easier than being single. You can have positive impact of a dual income too. Being both on the same page is key.

LeisureFreak Tommy recently posted…Embrace Failure as Necessary for Success

I am too much of a pleaser. When I’m alone I work, workout and go home. Nothing exciting. But in a relationship I’m always trying to please the other person and that costs money.

Tre recently posted…Weekly Update #21

I am reaaaaaaalllly good at hermit mode and eating an apple and yogurt for dinner, so I know for a fact being in a relationship upped my expenses. It’s that whole “taking care of someone else” part that usually gets me. I mean, I love him and its definitely worth it, but why do boys eat SO much?!?!

Brittany @ Fun on a Budget Blog recently posted…Weekend Survival Guide for the Girl on a Budget

It’s hard to say because I’ve been single for SO long now. Which reminds me, I really should make an effort to date. 🙂 I think it can work both ways. I do know when I dated my last boyfriend we took more road trips together, which if it was my current situation now, I couldn’t do unless he was willing to pay for most of it. So that right there is a savings. I’m pretty much a homebody too…although truthfully it would be nice to be a homebody with someone else eventually. 🙂

Tonya@Budget and the Beach recently posted…Do You Want to be Rescued?

I’m definitely tempted to go out to eat more when the boyfriend is in town. My best spending months this year were when he was in Europe.

Stefanie @ The Broke and Beautiful Life recently posted…Rejection Isn’t Failure

I’m surprised there are few comments to the contrary, I definitely agree with you. Whenever this comes up in my conversations someone always argues that they tend to stay at home more when in a relationship (lazy nights watching netflix) and will go out a lot more when single. So I guess it depends on the person. But I am definitely a hermit by nature and tend to date extroverts, so I save a lot of money when I’m single!

Leslie Beslie recently posted…2014 Big List of Books I’ve Read

My food budget was a lot less. I never fix big meals, I would always do something simple, but my wife is an amazing cook. She doesn’t go overboard on the food budget but she has standards that I definitely didn’t have. I actually do better now with my wife. She was as much of a saver as me and just having an extra person to check with keeps me in check. Finances were a big test in all my relationships.

Lance @ Healthy Wealthy Income recently posted…Living a Money Lie Part 2

Great post! I have saved some money being single, but in other areas my bills went up. I guess there are pros and cons to both being single and being in a relationship.

Kayla @ Everything Finance recently posted…3 Ways to Beat the Winter Blues On a Budget

This is incredibly funny! Yep, I think the split on household expenses evens out the increase in toilet paper…wait until kids come along. I think we secretly eat this stuff (that and paper towels). I definitely saved on food as a single person…which is why I was also much smaller back then. That’s another story. LOL!

Toni @ Debt Free Divas recently posted…Americans Blowing Budgets on Food