Using Kiva to Manufacture a Rewards Card Spend | brokeGIRLrich

One word: Don’t.

In 2016, my BFF and I went on a flipping awesome trip to Hawaii. I was a little cash strapped at the time, so I did everything I could to travel hack the heck out of that trip.

I read up on reward churning and tried some of the “crazier” ideas.

I opened bank accounts trying to get to my reward amounts by shifting my own money from one spot to another.

This worked out awesomely with PNC Bank and Santander.

This was a royal pain in the behind with First Niagara Bank.

Overall, it was a great strategy.

A year later though, I tried to do something similar to hack some rewards and it didn’t work.

This was a problem since it was a pretty big way to manufacture some spending.

I decided to get creative and help some folks and figured I’d fund some microloans over at Kiva to hit the minimum spend.

I dipped into my savings to do so, since I figured I would eventually get them back.

I also knew I was making a long play, since the repayment would take a while.

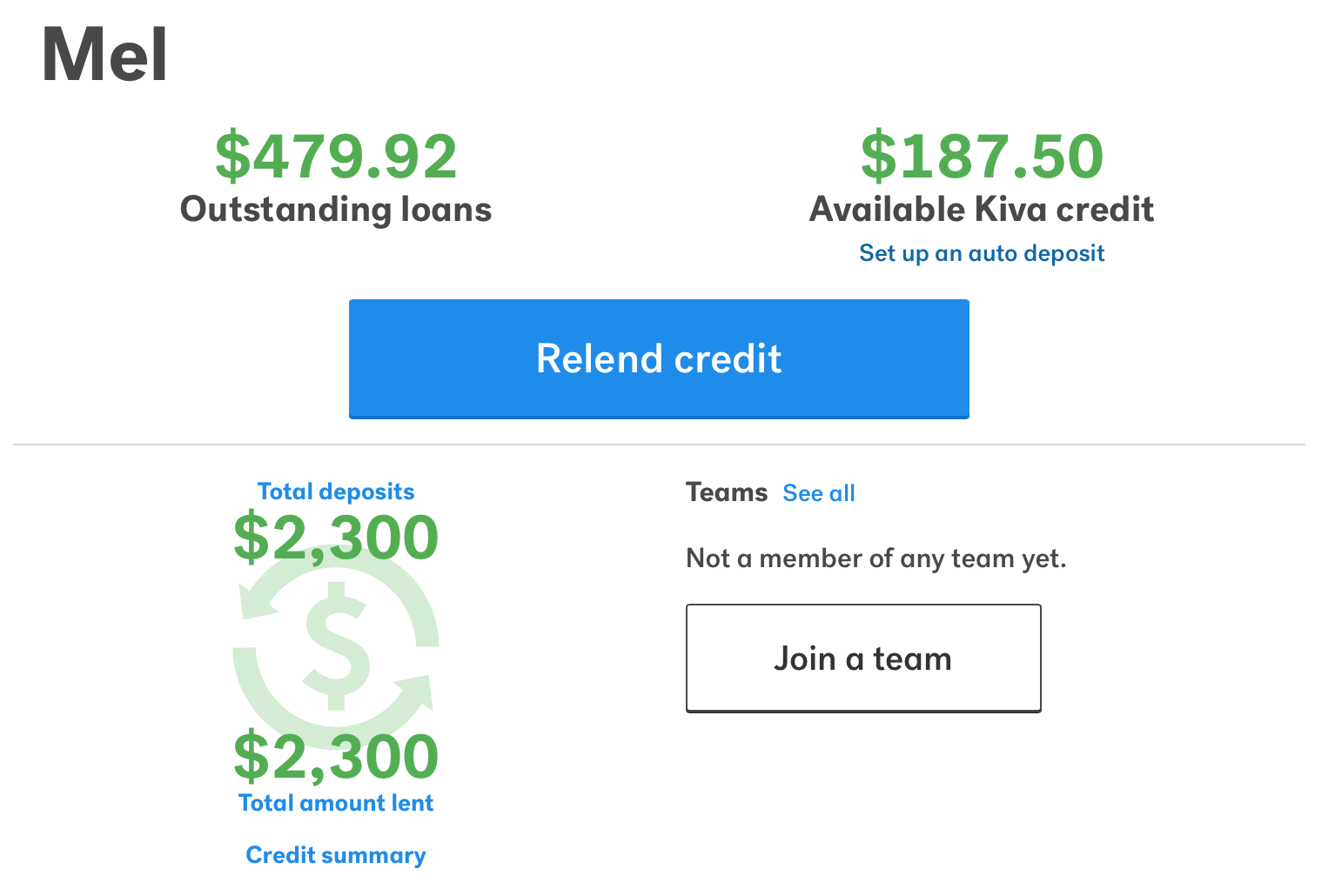

On March 12, 2017, I deposited $2300 using two cards I was trying to churn through PayPal.

On July 17, 2018, I withdrew $1632.58.

I remember being a little concerned initially about whether or not I would get hit with PayPal fees as part of this process, but there were none.

That left an outstanding balance of $667.43 still in my Kiva account after a year.

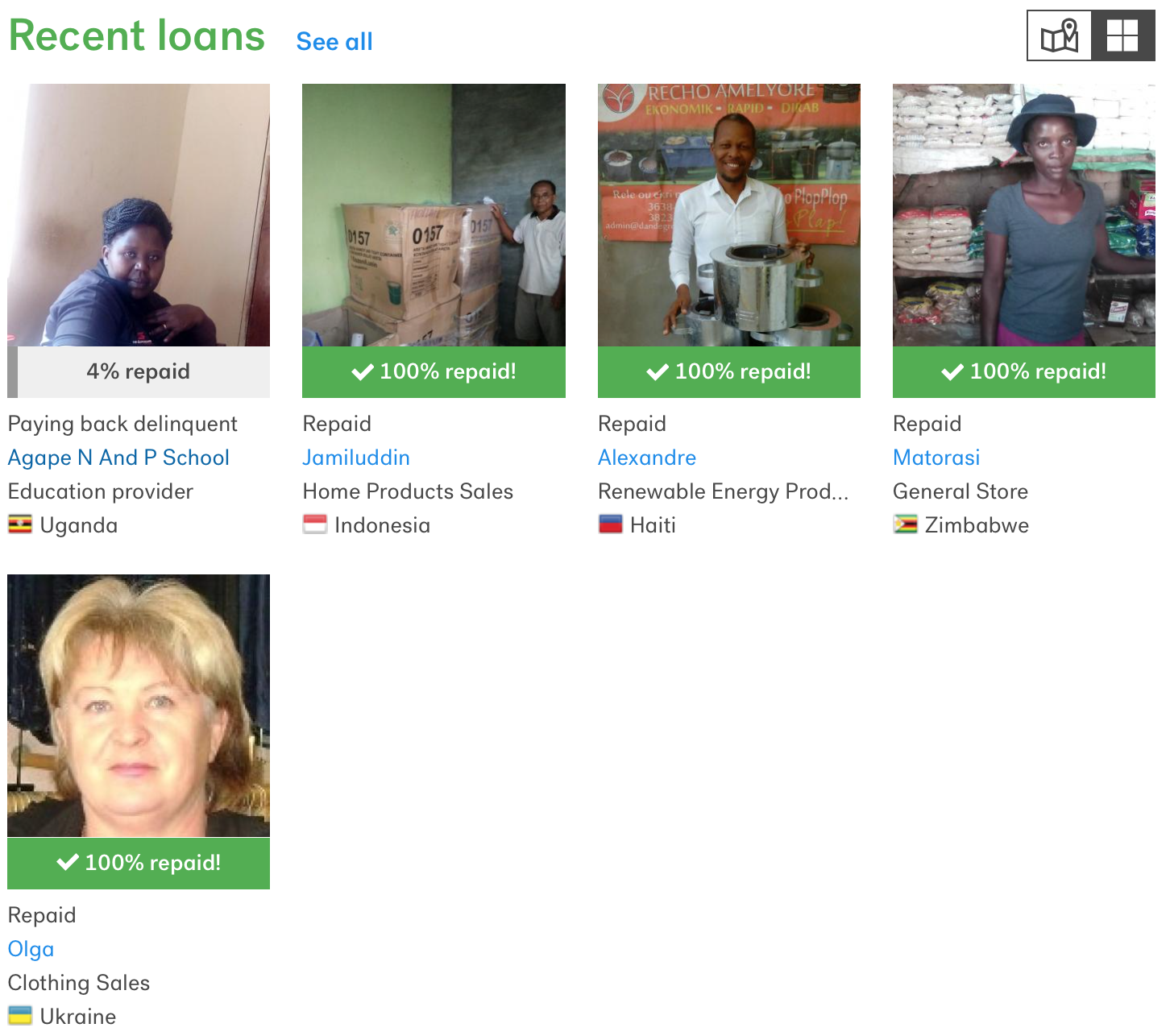

My loan to Olga in the Ukraine was still outstanding and my loan to Agape N and P School was also outstanding at this time. Both were delinquent.

In January of 2019, Olga started making repayments and repaid the entire loan balance.

My Kiva account currently has $187.50 sitting in it, waiting to be transferred out.

My loan to Agape N and P School in Uganda is still outstanding and delinquent at only 4% repaid. We keep getting notices from Kiva that the loan has been extended, though the last notice was in October of 2018.

The loan was originally scheduled to be repaid by December 2018.

My outstanding loan balance is $479.92.

So what did I get for this hassle?

A $500 Barclaycard Arrival+ bonus and $100 statement credit bonus on the Delta Skymiles card.

So my grand total for this crazy scheme as $120.08 in rewards. A serious reduction from the $600 it should’ve been at and it was fortunate I was even working on a large bonus for this particular churn.

What could I have done to improve things? Not much. I picked fairly well rated individuals to lend to on Kiva.

The thing about peer-to-peer microlending is that it is always pretty risky. Kiva is a phenomenal platform and if you’re considering donating money anyway, it can be a way to go and to stretch your donations even further.