This post is not for those struggling to make ends meet. This is for the lovely step beyond that one where you have a plan and pleasantly find you’ve usually got a few bucks extra each month. If you are totally broke, feel free to check out the earlier posts on this blog. That was where I started, at $30,000 in debt, but you can also take some solace in knowing you’re only a few years away from trying to maximize Starbucks and make-up removing wipe hacks.

I’m talking about the ways you can save more money by spending strategically with your “extra” money.

For me, one of the first times this became clear was through my love of Starbucks. It wasn’t until I started touring that I became firmly addicted to caffeine, though back in my ship days, I did have a routine that involved about six hours of paperwork on the last day of every cruise to setup the next cruise and I would always start it with a trip to the onboard coffee shop.

So I guess I always liked sugary coffee confections well enough.

I’m not some die-hard Starbucks brand lover, it is just conveniently everywhere and one other money hack I’ve found is that loyalty often does pay – in the form of rewards cards, knowing where to look for discounts, etc.

Starbucks was one of the first consistent things that I realized I was probably just going to always keep buying, so if I saw a good deal, why not leap on it?

Good Starbucks deals include:

- Buying giftcards on Raise and transferring them to my gold card. Especially when Raise is having an extra 5% off sale.

- Buying those occasional Starbucks Groupons (even if Groupon is kind of a hot mess) with the extra $5 free that show up a few times a year.

- Reloading my Starbucks card with my AmEx when Starbucks shows up as one of the extra discounts.

Inevitably, they all hit at once, right? When I’ve already got like a $75 balance on my card and not looking to reload it at all.

Nonetheless, I spend $136.74 and now I have an additional $158.33 in coffee to drink.

That’s 5 more sugary ridiculous coffees – or a boatload of plain black coffee for your folks with no souls.

There are two main reasons I know this hack works well:

- I am always going to wind up at Starbucks.

- The money added to my Starbucks gift cards via my app (which then also gives me a free coffee every 125 stars) never expires.

Now $158.33 in coffee might seem ridiculous or excessive, but considering it’s money I would’ve spent anyway over the course of several months, it’s worth the $21.59 in savings.

As for the amount of time and effort it would take to purchase the coffee this way, well that kind of varies too.

At first, it took a lot of effort to hunt down deals. Now I know that when Groupon offers that $5 off coffee deal, my Facebook and Twitter are both gonna explode (at least, it’s an educated guess that they will, since they always have). My friends are also coffee drinkers. My Twitter is full of personal finance bloggers and stage managers.

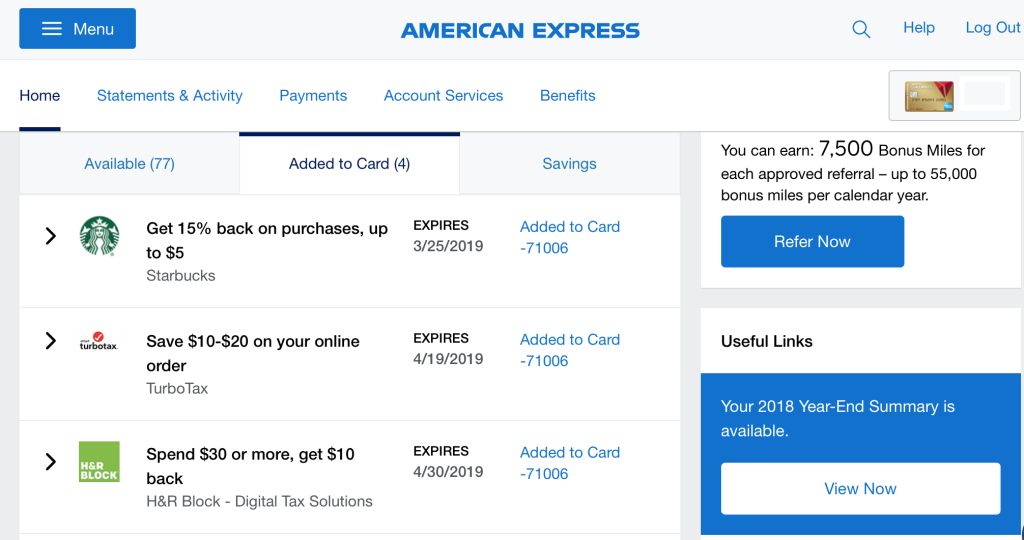

My AmEx I try to scroll through the extra deals at the bottom every time I log in to pay and I just add any to my card that I think I might use. It takes me about a minute.

The Raise one is perhaps the most complicated, but since Raise sends out an email whenever they’re having an extra 5% off sale, that tells me to head over and spend the 5 minutes ordering the new gift card and then transferring it onto my app once I receive it.

There are a lot of ways to apply this, even if coffee isn’t your idea of a good time.

The Raise 5% sales apply to the entire site, so you can always snag a gift card for something you know you buy regularly at an extra 5% off.

I recently booked a few AirBnBs in Europe and New Orleans, before going to the AirBnB site, I bought a $500 gift card off Raise and started out with an $18 savings before I even got to the AirBnB website.

I was able to do that because I had enough extra cash flow to pay for the entire booking outright, rather than just putting a little down and dealing with the balance later.

Probably the oldest trick in the using your extra cash flow book is to stock up when you see a good sale on something.

Here’s a weird one I recently got really excited about. I use Neutrogena make-up removing wipes pretty much every night. They’re about $6-7 a package for 25 of them. I will happily go with the generic equivalent which is still usually about $5 a package.

I found the generic equivalent on sale at the local grocery store for $2.19. I thought it was a misprint. Then I thought something must be wrong with them. I bought one package, used it that night with no issues, and went back and bought the last 6 packages at $2.19 that they had.

What I’m saying is that if you can spend a little more upfront, you can often get more, at a better deal, in the long run. Maybe it’s one of those examples of how the rich get richer, but it’s really pretty accessible, even when you’re just past the first steps of your financial journey.