**This is a sponsored post – I received a 50% discount on my filing fee in exchange for reviewing this app. All opinions though are entirely my own. And I will happily pay freaking full price for this next year.**

TrupointTax App Review | brokeGIRLrich

It’s like the tax gods heard my plea last week and sent me an awesome new app to check out.

When TrupointTax app reached out to me, the main thing that made my ears perk up for us folks in the arts was:

Flat fee no matter how many states of tax returns you have to do.

That was music to my ears. I still shiver in fear remembering the year I did roughly 26 states of tax returns thanks to working for Feld Entertainment. The H&R Block lady literally did not know what to do with me.

There was also a lot of emphasis on the flat $150 fee… which I was quite skeptical of because heaven knows, my weird freelance life tax papers are never the flat fee kind and I also had to deal with some unusual retirement income.

But hope springs eternal, right? There’s got to be a better way to do this tax nonsense and my TurboTax was coming in around $150 at this point, which is what TrupointTax App was going to charge me too.

Trupoint Tax App Home Screen

I downloaded the app and started by agreeing to a similar waiver that all online tax prep software seems to have promising that I am me and that it’s ok for this tax prep company to help me with my taxes.

From there, I had to scan the back of my driver’s license and it auto-populated the majority of my info into the app – which was a little crazy. I scanned down the form and added the few bits of info that are apparently not linked to that bar code.

Then I hit hurdle one – I accidentally photographed all of my W-2s into the 1099 section and couldn’t figure out how to delete them. I hit the back button, which shot me all the way back to the waiver I had first agreed to upon signing in. Fortunately after agreeing to it again, my driver’s license info was still stored and the W-2 and 1099 sections were magically empty so…. Win? This seems like a thing that could use a little work on the graphic design side of the app. A simple delete option would be great.

There was also a Notes section at the bottom of the license page that I left a little note saying “hey, if there are duplicates of my W-2s, please be aware I am a dork and uploaded them in the 1099 section on my first go. I think I deleted them, but maybe not?”

It turned out that by hitting back, it was submitting my info each time, which is how I wound up with four confirmation emails. When I was emailing with the app developer, he mentioned I was the first person this had happened to (I was also probably the first dork that entered all my documents in the wrong place – your welcome for the beta testing, Trupoint Tax app ;o).

Scanning the documents was super easy. I just took pictures of each one. It honestly took me seconds and I loved it. Piece of cake.

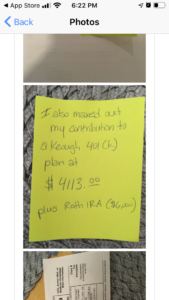

What my phone looked like with some of the documents uploaded (and one of my fancy post-it notes).

There is a section for miscellaneous, so I was able to add a bunch of my other weird forms for this year (like the tax forms from some of my mom’s pension distribution and other exciting things I have learned about estates, forms and death in 2019).

I also did this very classy thing where I slapped a post-it note on a piece of paper to note that I had earned income that I hadn’t received 1099s for.

All in all, it did take me more than 10 minutes, but I have more than a sane person’s quantity of tax forms. I’d say it was roughly a 20 minute project.

At the end you will be asked to scan the rest of your license and your social security card.

I was still fairly skeptical about the whole thing.

But I had to know! The promise of multiple states for the same price?!? This is a holy grail for an American working on tour or freelancing their way across the country every year.

Within 24 hours I received a phone call from one of their accountants and was pleased to find that even with all my weird forms, I still landed within their base rate (literally the first time that has ever happened).

Also, my silly Post-It note system totally made sense to him.

Since a real live human was reviewing my forms, he was able to weed out my duplicates that came through and he asked me some questions that reminded me I had left out two really important forms in my application – my self-employed deductions and the fact that I had already made estimated tax payments! If I were doing it again, I realize I could’ve just taken a picture of the deductions list and added another classy Post-It note mentioning my estimated tax payments.

So I did have to answer the phone and talk to the real live human, but he was actually fairly delightful (thanks, Carter!) and as we walked through my tax submissions (which took a whopping 15 minutes total), he offered various tax tips for next time.

He was literally everything I wanted in a real life tax accountant but could never be bothered to hunt down before.

And he confirmed that I did indeed still qualify for the base rate of $150 at this point and my freelance folks, that was with half a dozen 1099s, two missing foreign income sources that should’ve been essentially 1099s, self-employed deductions, a half dozen W-2s, 1099-INTs and 1099-Rs from my mom’s estate and I needed state tax returns filed in three states, including the nightmare that is New York.

TAKE MY MONEY, TRUPOINTTAX APP!

I had scanned one 1099-INT wrong and he asked me to resend it. I did and the next day he called me back with final totals and a few suggestions about things I could do next year to lessen my taxes as a freelancer.

At this point, once he told me my final refund numbers (federal) and taxes owed (booooooo, New Jersey, but I was expecting that), I confirmed that I wanted Trupoint to file my taxes and that I would pay their fee.

Final icing on the cake, Carter asked me if I had any tax questions and I mentioned I was a little overwhelmed by self-employed 401(k) options, because I had accidentally opened the wrong type this year and I wasn’t sure what I was doing. He said he had to do a little research and he would get back to me.

I had an email in my inbox within an hour, breaking down explanations of different types of self-employed 401(k)s, with an analysis of how much I could’ve saved this year in each kind using the info he had from my tax return, and an additional note about the ones offered by Fidelity, since we had spoken about the fact that I had my other retirement accounts there.

He just gave me that info! I was honestly considering making an appointment with a financial advisor to sort this nonsense out.

Carter and TrupointTax App for all the wins.

If you’re still struggling with your taxes, I cannot recommend this app highly enough and I will totally be using it again next year.

If you’re interested in using TrupointTax app this year, use my referral code BrokeGirlRich to save $25 on your tax return.

The app is available on Android and Apple.

I think I can make use of thanks for sharing 🙂

Pingback: Accountability: March 2020 - brokeGIRLrich