From the lady who brought us Are You Financially Sexy? comes Train Your Way to Financial Fitness (please imagine that in the grand summer blockbuster announcer’s voice).

Or, put another way, my friend Shannon from Financially Blonde wrote a book! Which I think is so incredibly cool. Turns out, the books as awesome as she is.

Once you get into either subject, it’s easy to see there are lots of strong connections between personal finance and personal fitness. Shannon draws on a lot of these comparisons throughout her book as someone who has a strong background in personal finance – she worked as an investment banker for years before starting her own personal finance consulting business (are your finances a mess? You can hire her here). She also struggled with her weight for a while and is familiar with the sort of mindset and work you need to do to keep your body as healthy as your bank account. Or as Shannon put it herself “just as you may have exercises that help build your abs or firm your butt, I have provided exercises to tone and firm your finances.”

I’ve got a bit of a weakness for BzzFeed quizzes and I definitely grew up sharing YM and Seventeen magazines with my friends where we would do all the quizzes and talk about the results for hours (I’m totally dating myself, I don’t think YM is even a magazine anymore).

Something about a personality quiz is fun. Probably because of the total lack of studying necessary… and who doesn’t like a little more insight into themselves? Train Your Way to Financial Fitness opens with a quiz that places you into one of three different financial categories: financially fit, financially skinny or financially fat. Once your categorized, you just read the section for you.

Let me be honest here. I expected to sail through that quiz and right into financially fit. After all, she figures you may be asking what financial fitness is at this point and Shannon responds with “it is the state of financial health where you are capable of achieving your financial hopes and dreams.” I thought – that’s the path I’m on. I mean, I’m not 100% there, but I’m totally on the road to hopes and dreams and crap.

Imagine how pissed off and wrong I thought her quiz was when I came up solidlyfinancially skinny (and mildly irritated that I can be so financially skinny and not actually skinny… sigh). You might think financially skinny is where you want to be, but you’d be wrong. You are aiming for the financially fit classification.

As I started to read the chapter on being financially skinny though, this phrase caught my eye: “I liken the financial fitness process of a Financially Skinny person to the effort of trying to lose the last five pounds out of fifty during a weight loss plan.” So I calmed down a little bit, because, yeah, I don’t have it all as perfect as I thought.

The quiz showed my I definitely ourhealthissues.com/product-category/anti-anxiety/ have a borderline budgeting problem… as in I don’t really (shhh… don’t tell any of the people I tell to make budgets). But for real, a budget probably would help a lot with those “last five pounds.” My current budget is a very vague – one week’s paycheck goes in savings, one week’s paycheck goes to food and fun, two week’s paychecks go to rent and utilities. I could probably squeeze a lot more out of the food and fun paycheck if I broke it down into real categories.

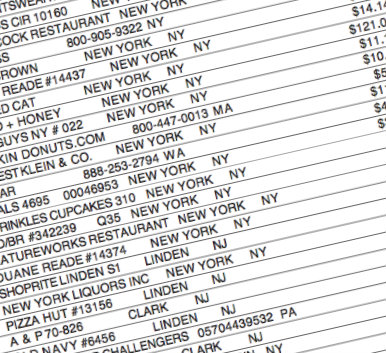

Not surprisingly, Train Your Way to Financial Fitness is full of actual exercises for you to do. One of the first encouraged me to print out all my credit card statements and see where my money is actually going (which I mean, I knew it was going to a lot of eating out, but I didn’t really know – it’s so different to actually look at the numbers in front of you, consider what a homemade lunch would’ve cost and think… this was a poor choice).

I also had the quiz point out to me, repeatedly, that I don’t have much financial freedom to make large purchases, like a home (which is a long term goal I have) or funding my children’s college educations (as I don’t even have a boyfriend these days, I’m not so worried about that one)… granted, the idea behind being able to make these purchases, even if I never need to, is one I’m happy to get onboard with.

So, fine, Shannon, FINE. I’m financially skinny. Crap.

I could be a lot worse off – there’s a lot of talk about the needs/wants debate in my chapter, which I’ve got pretty down… I just blatantly ignore on occasion. And I have to admit I’m likely to start calling my retirement funds my moon money, not only because I love the moon and desperately wanted to be an astronaut for a big part of my childhood, but because I’m down with “considering it as easy to reach as the moon.” It’s also fun. Not much about forking over huge sums of money monthly to future me is actually fun – going to the moon would be fun though. I’d probably save twice as much a month if that were an actual goal I could achieve with just my finances.

Clearly, I don’t want to give away much more about the book – because you should read it! It’s one of those fun and easy to read personal finance books, that’s great for travel, the beach, the gym (ok, total bonus points if you read Train Your Way to Financial Fitness while on a treadmill – you are officially a beast in my book) or anywhere really.

After you read it, stop by and tell me how your quiz turned out! We’ll giggle over it and then talk about how whether we’re going to marry Dawson or Pacey when we grow up.

Mel ? Pacey – 4-evah

Ha ha ha…I was TOTALLY a Seventeen magazine kinda gal and I loved the quizzes too. We actually had this listed as a “test” when I first wrote the book and my editor aptly shared that a quiz sounded more fun, she was probably a Seventeen magazine or YM kinda gal too. And I think there is nothing wrong with being financially skinny, fit or fat for that matter, but I think it’s interesting that that is how you scored. Get on your FitPlan and off to the moon you go! Thanks for reviewing my book, you’re the best!!!

Shannon @ Financially Blonde recently posted…Top Ten Things To Do In New Orleans

I’m going to read it this week on my way to fincon!

I have such a list of books to read, but I have this on there for sure. I’m so excited that it’s by someone I ‘know’ as well. Makes it all the more cool.

I’m very excited to read the book! This was a nice recap of the book. Very curious about the quiz, too. See you at FinCon soon!

Melanie @ My Alternate Life recently posted…Where Does All My Spending Money Go: Results Edition

I need to add this to the list of things to read.

Michelle recently posted…Why I Stopped Checking My Stats and Started Loving My Writing Instead