Personal finance just boils down to consciously realizing you’re playing a game of “this or that.”

Getting ahead is realizing you’ve always been playing this game, whether you realized it or not, and it’s probably time to start picking a fair bit of that (unless you’ve always just loved saving, then maybe it is time to live – a little).

And one good way to get ahead in the this or that game is to let go of “them.”

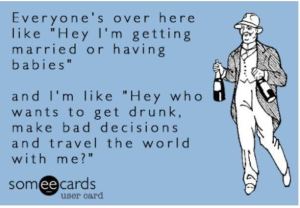

Recently, I’ve been hit with an overwhelming feeling of falling behind all my friends. Most are married. One is buying a house. I’m just gypsy wandering the world on my own – like I have been for the last decade.

House friend is also Hawaii friend, who doesn’t care at all how much we spend on this trip, so I was further overwhelmed by the how on earth do you have all this money feeling? And why don’t I ever feel like I have money?

Prior to focusing way too much on THEM, I was trucking along just fine.

I don’t want a house.

I don’t really want a man.

Both of these things would complicate all the glorious freedom to do whatever the heck I want that I tend to revel in.

The thing is though, there is a small (and sometimes not so small) part of me that just wants all the things, all the time (and is also sick of going to weddings alone, but that’s a disgruntled post for a different sort of blog).

Is that really asking for so much?

Is that really asking for so much?

Committing to this or that can be a bummer sometimes.

Fact is though, life is all about committing to this or that.

Marriage is committing to one kind of that that for the rest of your life.

Buying a home is committing your finances to that for a good chunk of time.

Following a career that makes you happy and pays all your bills is committing to this instead.

Putting away money for retirement every year before spending on other things like vacations is a this.

And while most people are surely making excellent decisions with their money, the fact is that I don’t know what most of my friends and acquaintances are up to and in some cases having money to buy all new furniture (this) might mean they’re not maxing out their retirement savings every year (that). Going on expensive vacations all the time (this), might mean they are racking up an impressive balance they can’t pay down on their credit cards (that).

It’s easy to get caught up in keeping up with the Joneses, even if you refuse to actually spend the money to do it, it can still get you down sometimes.

It’s also easy to forget that someone else’s this, which makes them really happy, might not make you happy at all. Chasing the that is really what’ll work out for you.

So try to let it go and focus on your own “this or that.” Those are really the only numbers that should matter to you anyway and as long as you’re making conscious decisions about where the money is going – you’re probably winning the game.

Great post! I am not yet at the age where my friends are getting engaged/married, but I can’t even imagine what it will be like.

Right now, I am just trying to save as much as I can until that point.

Great post!

Elle @ New Graduate Finance recently posted…Job Hopping: When is Too Soon, and How Much is Too Much?

I totally relate to the “I want all the things” sentiment. FOMO is so real, especially when everyone seems to have the perfect life on FB, IG, etc. Seth Godin recently wrote a piece about how we’re ALWAYS missing out on something, no matter what we do. So it’s useless to think about how we can experience it all and instead we should focus on what we actually want to commit to. Great post!

Lisa recently posted…Q1 2016 Net Worth Update