I am pretty convinced that we’re all climbing the same mountain, just most of us don’t realize it, and the further up the mountain I get, the more convinced of it I am.

A lot of folks spend their whole lives in the foothills of the personal finance mountains and never even start their climb, but once you do, it seems like most people are following the same path.

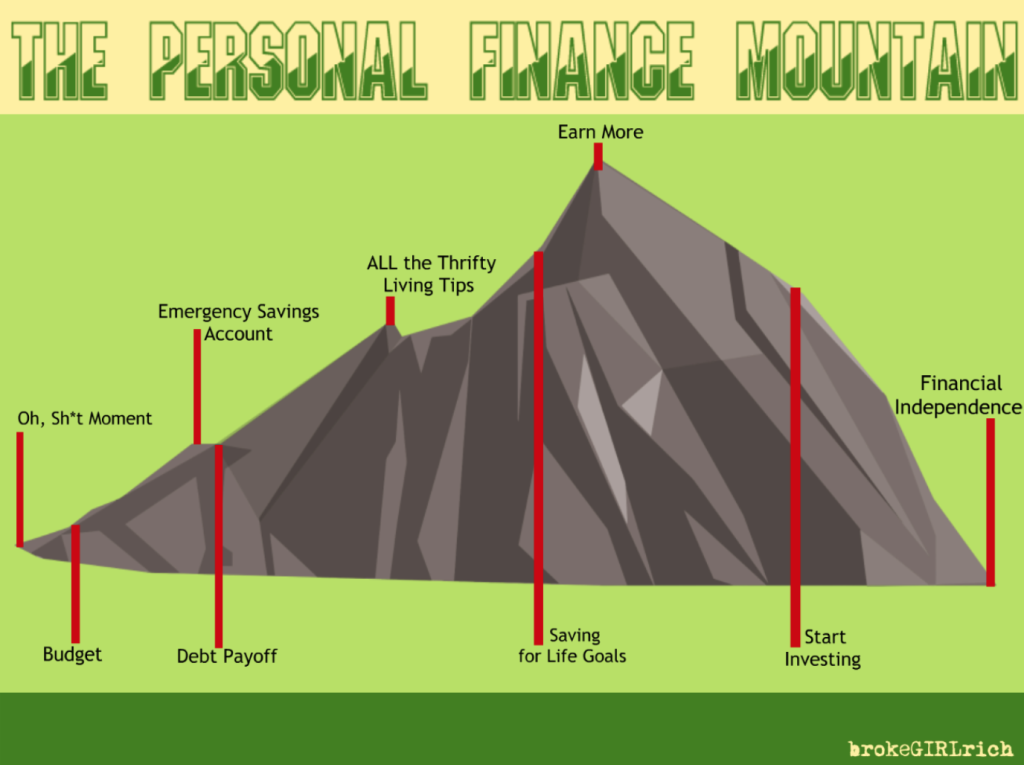

Here’s what I think the personal finance mountain looks like.

**I feel like we need a quick side note here to say that The Personal Finance Mountain is the path I’ve seen a lot of people take on their personal finance journey, that I think I’ve largely followed too, and seems to be the order of steps lots of people take, but a lot of the steps overlap.

If you have a job with a matching 401(k), you should be getting that match – even when you’re working on your debt repayment. You should crunch a few numbers to check out compound interest in an IRA and see if it makes sense to draw out your debt repayment plan a little longer in favor of some retirement savings contributions now. That’s an optimal approach.

You’re probably learning thrifty living tips and how to side hustle all along the journey too. However, those skills seem to really amp up in the points where I’ve noted them on the Mountain.**

-

The Oh, Sh*t Moment

This moment is different for everyone, but it’s the point where you realize you’re not happy in the foothills anymore. For an awful lot of people, it seems to be related to debt.

For me, it was when I really wanted to quit a job I hated, but realized I couldn’t because I still owed a bunch of money in student loans. I hated that feeling and I decided then and there to figure out how to make sure I would never be trapped in a job I hated again because of money.

For some people, it’s a desire to escape the rat race way before the average retirement age.

For others it’s something entirely different.

However you want to slice it, it’s a realization that your money is controlling you, instead of the other way around. And that you’re just not going to put up with that crap anymore.

If that’s where you are, congrats! Welcome to the personal finance mountain.

Some great websites for this stage of the mountain:

-

Budget

This word gets such a bad rap, but a budget is actually empowering! How can you get a job done if you don’t even know what tools you’re working with??

Here’s the deal – grab a bottle of wine or your favorite mocktail or whatever you generally choose to eat/drink your feelings – and just do it.

A budget is breakdown of your monthly and annual expenses.

It’s important to do both because those one time annual expenses like eye doctor visits, contacts, car insurance and registration, etc. can really eff up your monthly budget if you leave them out (I speak from experience).

A monthly budget includes set expenses like rent, loans, car payments, Internet, cell phone bills, etc. It also estimates variable amounts like groceries, electricity, and gas. You also include amounts for occasional items like gifts, medical expenses and entertainment.

You can checkout my monthly budget template here.

You know you best, so adjust the set up so it works for you. If you do most of your spending using a credit card, you can just backtrack a month and add up each expense to get an estimate of what you’re currently spending on each category. If you usually use cash, you’ll have to collect your receipts for the next month so you can see how much you’re spending.

Once you know what you’re spending each month, you can look at your income. If everything is covered, great! If it’s not, you’ll be able to see where you can cut back.

Once you’ve got an outline of your monthly budget, you can do your annual budget, which is usually a little easier. These are your annual expenses that occur a few times a year or less. By figuring them out in advance, you can save a little each month for them so the money is ready to go when you need it.

You can checkout my annual budget template here.

Here’s the great thing about budgeting and the personal finance mountain – at the start of your climb, it’s your best tool. The more carefully you tend to it, the better everything is going to go for you, but as you climb further up the mountain, if you did a good job with your budget back down at base camp, you don’t need to tend to it as much later on.

Here are a few great sites to help you with your budget:

- Mint

- Personal Capital

- Best Free Budget Templates & Spreadsheets at Budgets Are Sexy

- 10 Free Household Budget Spreadsheets at Seed Time

- Free Monthly Budget Template for Excel and Google Sheets by Robert Graham

-

Emergency Savings Account

The next vista in the personal finance mountain is the emergency savings account and let me tell you – once you cross this ridge, it feels like you were carrying an extra 20 pounds of weight in your bag that you get to just drop here.

Emergencies are freaking stressful and even the thought of an emergency can be stressful when you have no savings.

Now, I get it – saving money is hard and after figuring out your budget, you’re likely stretched really thin. But it’s time to go back to that tool and see where you can squeeze out some savings.

Here’s the nice thing about an emergency savings account – you don’t have to cut back forever. If saving is just freaking impossible for you right now – set your emergency savings goal at $500 to start.

Once you hit that, we’re going to increase it to $1,000, but the goal is to hustle you’re a$$ off to get that first $500. Look at how much you’re paying for cable TV or your cell phone bill. Is it worth it to cut the cable for 6 months or switch to a cell phone provider like Republic Wireless for a year to reach that $500?

Can you bump up that time frame by bartending once a week or babysitting on weekends?

It’s not fun. It’s hard. It’s unpleasant and it takes time and sacrifice, but the fact is that most people can do it. Cut everything you can to get that $500 in there and then only use it for an emergency.

Your budget should be covering your other expenses. This is for when your tire blows out and you might lose your job if you can’t get the car fixed to get to work. This is for the emergency root canal or trip to the emergency room.

Even though it’s hard and not fun, you’ll probably manage to get used to it and I highly recommend you keep going till there’s $1,000 in there. If you’re living on a tight budget, paycheck to paycheck, $1,000 in the bank is going to make a huge difference. To get $1,000 in the bank in 1 year, you need to bring in $84 a month or $21 a week.

Get creative, there’s a way. And tell me the weight of a possible emergency off your shoulders isn’t worth all the hassle once it’s in there.

In the long run, you want your emergency account to hold 3-6 months of expenses and enough money to cover any insurance deductibles – but for now, at the start of your climb, aim for $500 and then $1,000 and then keep climbing.

Here are a few great sites to help build your emergency savings:

- Dobot

- A Step-By-Step Guide to Building a Big, Healthy Emergency Fund at The Simple Dollar

- 4 Quick Ways to Build Your Emergency Fund at DaveRamsey.com

-

Debt Payoff

Some lucky climbers are going to breeze right past this section of the mountain and other climbers are going to be dragging themselves through it for a long time, but it needs to be done.

Once you’ve got $1,000 in your emergency fund, it’s time to figure out your debt plan.

Never forget that while you have any debt, someone owns you. The key to climbing the personal finance mountain successfully is to minimize this debt, but here’s another thing to remember.

You need to carry the amount of debt that you feel comfortable with. It you have a really low interest mortgage, a healthy emergency fund and no desire to pay it off early – then don’t.

However, if you’re carrying a ton of credit card debt at 25% interest – that sucker really should go.

Student loans, car loans, personal loans – all of these are drains on your income and possible stress factors in your life.

By this time, hopefully, you’ve mastered your budget. You’ve figured out where to cut back or earn a little more while working on your emergency fund.

Using these tools, you can attack your debt. You can up your hustles or cut back even more on your lifestyle to get rid of your big debts – or all of your debts – maybe you don’t even want a mortgage or low interest federal student loan hanging over your head.

The goal here is to develop a plan – you’ve crested this part of the mountain when your plan is executed. If you want to aggressively pay off all your debt in 5 years, then you’ve crested the mountain when it’s paid off. If you want to pay off your high interest debt in 3 years and you’re happy with paying your mortgage on time for the next 13 years, then you’ve crested it in 3 years when you’ve achieved the part of your goal that’s not a long term plan.

The more of your debt you decide to pay off, the more freedom you have.

Here are some sites with great tools for paying down your debt:

- Debt Repayment Calculator at Credit Karma

- Debt Snowball Calculator at What’s the Cost?

- Debt Avalanche vs. Debt Snowball at Student Loan Hero

- Debt Discipline

-

ALL the Thrifty Living Tips

The cool thing about steps 2 and 3 is that they are concrete and they can be achieved (relatively) fast. Step 4 can take a long time and so, to stay motivated, most people climbing the personal finance mountain become frugal magicians.

I think the reason this happens is because you can see a difference today and it keeps you active in your personal finance journey.

So while you might not know how to bring in any extra money, almost everyone can save a little money somewhere.

Some folks become masters of meal planning and coupon clipping.

Some learn a bunch of cheaper and effective DIY replacements for stuff you’d usually buy.

Some become amazing negotiators and get all their bills down as low as possible by calling the companies or switching to new providers.

Heck, even watering down your soap to get to the bottom of the bottle saves you a few cents, but mostly it makes you feel like you’re doing something to help you towards your goal.

If you’re hardcore on this personal finance climb, trying to pay off debts or build up savings, you’re likely to try some version of almost everything above. And that’s awesome. Learning what you can live without and what’s totally not worth your time to do is really a trial and error experience.

It’s great to develop thrifty living skills. Learning how to sew or repair things is awesome. A lot of skills you learn during this phase will stay in your personal finance toolbox for the rest of your life.

Here are some sites to help you brush up your frugal living skills:

- Win the War on Debt: 80 Ways to Be Frugal and Save Money on The Art of Manliness

- How a Year of Extreme Frugality Changed Us at Frugalwoods

- Mr. Money Mustache

- How to Save Money: 100 Great Tips to Get You Started at The Simple Dollar

-

Saving for Life Goals

You’re rocking your budget, your emergency fund is shored up, and your debt repayment plan is rocking.

Now your thrifty living skills are kicked into high gear and you’ve achieved your debt goals too.

At this point, you need to start looking into your savings goals for the future.

**At this point, I feel like we need a quick side note to say that The Personal Finance Mountain is the path I’ve seen a lot of people take on their personal finance journey and seems to be the order of steps lots of people take, but a lot of the steps overlap.

If you have a job with a matching 401(k), you should be getting that match – even when you’re working on your debt repayment. You should crunch a few numbers to check out compound interest in an IRA and see if it makes sense to draw out your debt repayment plan a little longer in favor of some retirement savings contributions now. That’s an optimal approach.

BUT if you’re feeling overwhelmed by everything and want to move step by step, folks seem to get to saving for retirement and life goals after getting out of debt.**

Let’s say your life goal is to go stage manage in New York City. Great. Set a goal amount to move there an give yourself time to find a job (rough estimate: $5,000: first and last month and security deposit on an apartment, an extra month of rent money and a little over $1,000 spending money till you find a job – assuming you move in with roommates).

Let’s say your goals are less career oriented and more personal. Maybe you want to be able to buy a house. Maybe you want to pay cash for your next car. Maybe you want to start maxing out retirement accounts.

Figure out your goal numbers, break them down into monthly amounts and see how they fit in your budget.

You’ll likely find that the sixth stop on the personal finance mountain leads you into the seventh.

Here are some sites to help you figure out your savings goals:

- Retirement Savings Calculator at Kiplinger

- How to Plan for Medium Term Financial Goals at Stefanie O’Connell

- How to Best Save for a Down Payment On A House at Money Under 30

- How Much to Save for Retirement at Money Crashers

-

Earn More

Guys, when you hit step seven, you’ve made it to the zenith of the mountain.

Let’s be clear though, you don’t really hit step seven when you pick up that shift bartending or an extra babysitting gig here and there.

Step seven on the mountain is really when your mindset shifts. In this regard, step seven and step one are really similar. Lots of people stay in the foothills forever and never even attempt to climb the personal finance mountain, because they can’t wrap their heads around the idea that they can really control their money.

In the same way, step seven is about breaking out the box and seeing that there are really lots of opportunities to increase your income. It can be about investing in stocks that provide dividends. It can be about investing in real estate. It can be a steady stream of side income from AirBnBing your home. It can be setting up a blog and running your own business. It be running a successful Etsy shop that you love in your free time.

Guys, the opportunities to make money are really pretty limitless, but does it take some time and effort to find the right one(s) for you. You’ll know you’re at this point on the mountain though once you know the opportunities are there and once you let go of the idea that the only way to make money is through your 9-to-5 job.

Heck, sometimes even the 9-to-5 job is how you earn more, because you shatter what you thought you could do and start asking for raises and earning promotions or switching to another company that can offer you a much better compensation package.

Another interesting thing about the earn more step on the Mountain is that it works in tandem with the other steps. When you’re back in the foothills or on step one, you might think you’d need hundreds of thousands of dollars to be happy, but after climbing up the mountain through all the other steps, you’ll have a realistic goal number for financial happiness, a strong idea of what matters to you financially and a set path you want to follow as you head down the other side of the mountain.

Here are some ideas and sites to help you earn more:

- Start a Blog. Have a Voice. Make Money. at brokeGIRLrich

- 114 Side Hustles: Ways to Make More Money at brokeGIRLrich

- I Will Teach You to Be Rich

- The Penny Hoarder

- The Rideshare Guy

- Afford Anything

-

Start Investing

Now that your finances are set and you have multiple streams of income coming in, it’s time to learn more about investing. You may have gotten really into this back when you started figuring out how to save for future goals or it might be one of your streams of income from step seven, but if it’s not, now is the time.

Investing can seem really overwhelming because there are just so many options, but if you just start out with learning a few basic things like how to choose mutual funds or ETFs, you can really make your money grow even by just knowing that.

There is a lot of historical evidence that if you hold your stocks for a while, the average annual return is between 6-7%, which beats out any other interest rate and is higher than inflation.

Here are some sites to help you get started investing:

-

Financial Independence

If you start hanging out in the blogosphere for a while, you’ll start hearing the phrase financial independence thrown around a lot. Financial independence is when you have enough money to do what you want. You could retire. You could keep working. You could work part time. You could pursue a passion project.

If you start hanging out in the blogosphere for a while, you’ll start hearing the phrase financial independence thrown around a lot. Financial independence is when you have enough money to do what you want. You could retire. You could keep working. You could work part time. You could pursue a passion project.

You are financially independent.

Some people hustle their tail ends off and try to achieve it by 30. Some folks achieve it at 65. Some never manage it.

The longer you’re climbing the personal finance mountain though, the more appealing it starts to look.

For me, financial independence would mean I could work on any shows I want and not worry about their meager pay. It would mean I could live where I want or travel a ton.

While I’m not hugely on fire to achieve it, I do like knowing the numbers I would need to be financially independent and to keep plodding along. I’m fine with reaching it in my late 50s or 60s, but if hustling a little more gets me there earlier, I wouldn’t turn my nose up at that either.

If you’re interested in what financial independence looks like, check out some of these bloggers who have achieved it or are nearly there:

Like any mountain you’d ever climb, there’s more than one way to the top – but there’s usually a well tread path for a reason. The coolest thing about hiking this mountain though is the folk you’ll meet on your journey. So many people online are so excited about the progress they’ve made and the goals they’re trying to reach and the positive impact on their lives that they just want to help others do the same!

It’s exactly like climbing a mountain, complete with slippery scree bits that send you backwards a bit. I’m still in the foothills, but the ones closest to the main climb!

Woo! Get your climb on, girl!

But you’re so right – my entire spring has been about getting knocked back a few steps and it’s frustrating as all get out. I just keep reminding myself that even when I get sent back a few steps, I’m still miles ahead of where I started the climb and that’s a nice feeling.

Cool analogy! I would say we are somewhere between “saving for life goals” and “earn more”, although we have been investing all along (throughout debt, emergency savings, etc etc). I almost think investing could be an underlying step along the way 🙂

Yeah, I think there are definitely some areas of the mountain that are running under the others, even before you hit them at full force.

I know I opened an IRA years before I even racked up a ton of debt going to grad school, and I still contributed to it during the years I was paying off student loans.

I also started side hustling pretty early on, but it was on a smaller scale until I hit the earn more part of my journey and realized there was a lot more I could be doing.

I like this analogy of the personal finance mountain. Never seen it before! Hopefully the downhill from Start Investing to Financial Independence is as easy as going down a mountain after a long, long hike.

LOL, we’ll see. When I climbed Huayna Picchu, going down was way scarier than going up.But I have hopes that the downhill from Start Investing to Financial Independence will be easier going too.

Fantastic analogy using the mountain and decision/action waypoints along the way. The manner in which you outlined the waypoints actually becomes the framework of a personal business plan. I also appreciate how you provided tools and resources for the reader to to take action and provide them a frame work of support. You explained the pursuit of FIRE very well in this post.

Thanks!!

One if the scariest things is almost falling off the cliff of debt.

After we paid off our consumer debt we almost took 10 steps back by buying a new car. Luckily we realized what we were doing before we did anything. Ultimately I was able to pick up a used car for 1/4 of the price of the one we were looking at

Budget on a Stick recently posted…An Unexpected Gift

Good for you! It’s true that climbing a mountain can be tricky and there’s lots of places that things can go wrong.

On the plus side, if you do fall off this mountain, you can always start again, as opposed to falling off a real mountain… and probably dying.

I have been playing in this sandbox for over 7 years starting with ERE. This article is one of the best to layout the path to FIRE that I have seen. Definitely will bookmark it for my kids!

Nice Job!

Thanks!!

Interesting chronicle. For me, at least, there were two “oh crap” moments. The first came when I realized I had debt and it was killing my life, so I needed to be rid of it. I paid back more than $200k through a lot of hard effort over years. Then, I coasted along until “oh crap” moment #2, which was when I realized that, hey, money can work FOR me more than it is, so I should save for independence as much as I pushed to get out of debt – it’s another level of freedom. And, in my case, it will empower me to live out the dreams I’ve always wanted to.

I’m still working on that second mountain/step: saving up enough to live out the dreams. Saving is a slow process. (And for me, investing was already a fun hobby and came easily enough, especially once I had more reason to pay attention to it.) So now, I’m slowly working towards improving our savings and finding freedom from the day-job grind.

If you want to connect with someone who’s just starting on the financial independence journey, come check me out. I just posted my second-ever financial update…still a long way to climb, but that’s how mountains are climbed: one step at a time!

Finances with Purpose recently posted…Financial Update (June 2017): Inching Towards Success…

You’re totally right – mountains are climbed one step at a time!

And I agree with the levels of freedom. That’s always my motivation to keep going.

Thanks so much for including us on the mountain path! Just like climbing a real mountain, it is humbling.

Done by Forty recently posted…Our Trip to Asia

No problem! You guys are an awesome inspiration! Thanks so much for sharing your stories and tips!

Love the analogy! It does sometimes feel like an impossible climb, but knowing I at least have a few of the basics down (no non-mortgage debt, decent emergency fund, working on much of the rest very consistently) makes it a bit more palatable. 🙂

Dave @ Married With Money recently posted…Naming and Automating Our Way to Savings

I love this so much!!!!

I actually think I followed this pretty much to the step.

NZ Muse recently posted…You can’t always force things to happen on your timeline

Nice analogy, pics, and graphic. We feel like we are over the crest and cruising gently down to financial independence. However I hope we have many other hills to climb afterwards to enjoy and savor the view! We dont view FI as the end of our journey. Cheers!

Mrs. Need2save recently posted…What Does 22 Years of Retirement Investing Look Like?

I assume there are a ton of mountains to climb in life! This is just the personal finance one.

Great analogy! It took me far too long in my life to truly get on the mountain, and so while I am retired, it wasn’t until my sixties. I only wish all these resources had been around when I was a young man.

Gary @ Super Saving Tips recently posted…How Bad Credit Makes Your Life Miserable

My PF mountain, like most things in my life, has these steps out of order, and I’m not sure that FI is my ultimate goal. If it happens, cool, but I have competing personal goals that have it pretty far down my goal list. I’m with the first commenter on the slippery slope thing, too!

But I do think I’m weird and that most people operate the way you’ve outlined.

Femme Frugality recently posted…Using Cashback Rewards for Travel

I just love this illustration. We’re reaching the point in our debt payoff where it’s time to consider next steps. It’s hard to prioritize everything. But this gives me more food for thought.

Jamie @ Medium Sized Family recently posted…5 Ways We’ve Saved Money This Week 81

I really love this infographic! I never thought of personal finance as a mountain before, but the analogy makes so much sense. Right now I am crisscrossing between all the thrifty living tips and investing. One day I will reach FI!

Jax recently posted…Weekly Accountability: The Have We Gone Nuts Edition

I love you tips on stretching the money you have. That really makes a difference in how you feel. You can get a rush thinking you managed to get something cheaper or even free. Then you wonder why you didn’t do this to a long time ago!.

Vickie@Vickie’s Kitchen and Garden recently posted…Frugal Teacher Appreciation Gift A Plant from Your Garden

Wow! This is a bookmark-worthy metaphorical mountain worth climbing. Chock full of resources and I’m honored you included me among them.

Happy Climbing!

-PoF

Physician on FIRE recently posted…When the Hedonic Treadmill hits Ludicrous Speed

Pingback: Smart Thinking On Investing - June 30 - Andrew StotzAndrew Stotz

Pingback: The Sunday Best (7/2/2017) - Physician on FIRE

Nice analogy! As a mountain climber and personal finance geek, I loved your article 🙂

It certainly feels like an endless slog when you’re at the early stages of the climb but if you do the things advised in your post, it slowly gets easier and easier. As some point, you realize you’re flying up the mountain. I reached financial independence at 40 based a lot on what you describe here. The stuff you’re recommending really does work.

Woo! I’m glad to have it verified by some of you in the financial independence club. I haven’t hit there yet. But I do love even just being financially secure. Each step further along the mountain feels better and better.

Wow, what a thorough post and I love the mountain climbing metaphor! I haven’t followed all the steps in this exact order (always a few ups and downs along the way!) but I like the visual of approaching the downslope.

Me too!!