The long game.

I’m fairly good at the financial long game.

When I buy stocks, the plan is just to hold them… forever? They’re pretty much my last line of retirement defense.

Even when I invest in my retirement accounts like my IRA and 401(k), those are 100% ear marked for retirement.

At 35, that seems pretty darn far away. I mean, at a bare minimum, another 20 years before I can even touch that money without some crazy penalties.

So the long game just seems easy to me. People who panic over a possible impending recession? Doesn’t matter to me, I just keep funneling in that money to those accounts and chugging along.

When I read Kiplinger articles about how to know you picked a loser stock and when to sell, I might as well be reading Greek. It makes about the same amount of sense to me.

One of my cousins loves buying and selling stocks, and she is up a lot more than I am at the moment – though she also invests a lot more. She and her husband think penny stocks are awesome.

I think they might be insane.

Not only is that like a game of roulette to me, that takes so much work.

And I am so lazy.

Like, seriously, so lazy.

The best part of the long game strategy is that you can largely set it and forget it. As someone with variable income my whole adult life, I can rarely set the contributions but other than that, at least once the purchase is made, I’m just done. That ish just sits there for the next few decades, trucking along.

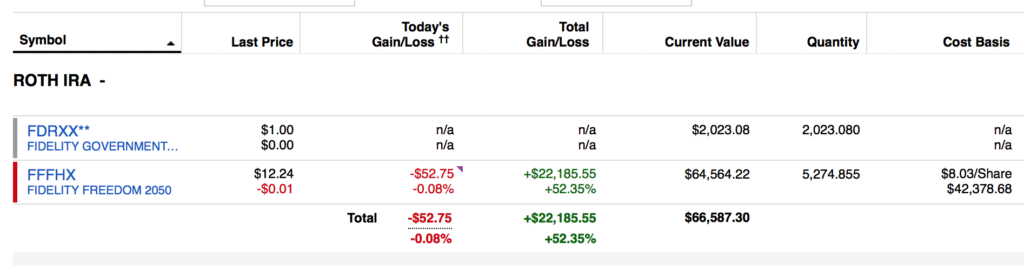

I mean, set it and largely forget it (other than net worth update checks), has netted me, as of writing this post today – $22,185.55 in my IRA. That sucker is up 52.35% – I think the highest it’s ever been.

Political side note: I would trade those gains in a heartbeat for notour current political structure here in the states, but if we’re going to be the laughing stock of the world, and we’re all likely to be bombed to death in the impeding World War III, well, at least I’ll have an awesome portfolio when the big one hits.

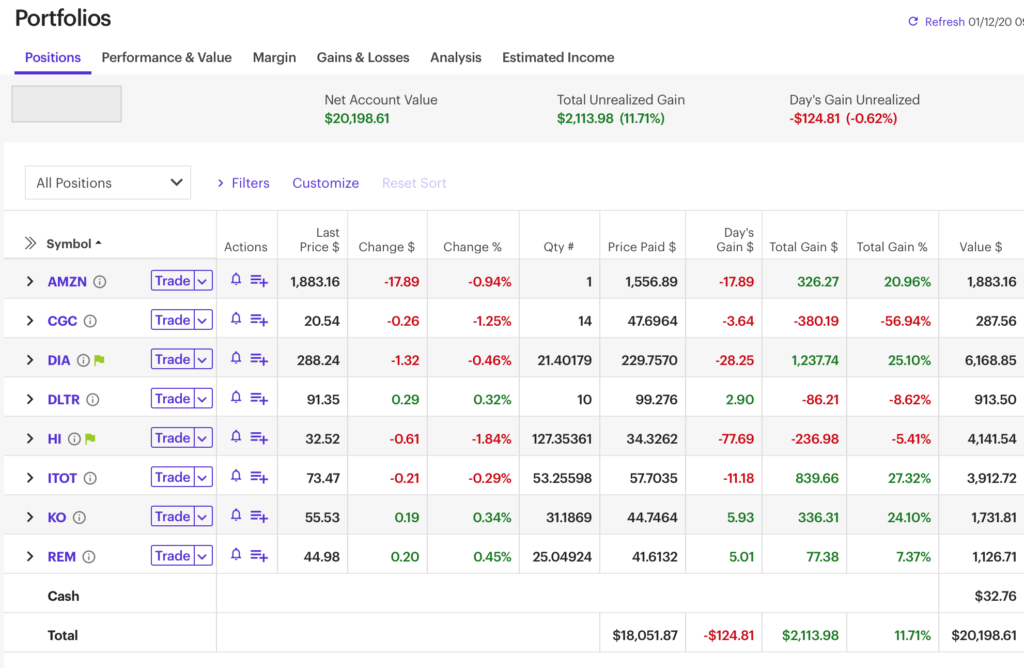

Even my brokerage account is up more than $2,000 at the moment and I’ve never rebalanced the sucker. I don’t really have a clue about rebalancing. If it seems like I have too much of one kind of stock, I just start buying a different one.

Now – is this the most incredibly optimized way to deal with the stock market?

Beats me.

I suspect not.

But for your average, middle-class gal with an average middle-class income, the fact that my investments have made themselves almost $25,000 is kind of a win in itself. I think if I’d gotten bogged down in the way to invest perfectly, I’d be lucky if I even had one account open and anything invested in it.

Analysis paralysis can be real.

I can identify with this approach a lot. I’m lazy when it comes to investing. Now that I’ve at least started doing it and everything is automated, I’m learning that it is OK to be lazy (although maybe I should look into the idea of rebalancing… eventually). However, I don’t even have any bonds in my Roth at this point! There’s nothing to rebalance! I guess it’s because – like you – retirement is so many years off (30?), that I’m ready for the long haul. I’ll look into some bonds once I have more money to protect.

Savvy History recently posted…Why I’m Becoming Less Specific With Numbers

I don’t actively look into bonds at all. My Roth is doing what Fidelity tells it to do for my target year, but I’d say I’m like 10-15 years off from looking into bonds for my own investments that I manage.