In the late 1800s, unions began to rise to prominence. They fought for better pay, better work conditions, and fair benefits. And since a union has the power of a lot, if not most or all, of the workers in a field behind it, the leaders of the union were able to negotiate most effectively for the workers.

You may have seen the stage managers union, Actors’ Equity, in the news over the past year over the lab contract disputes. Lab contracts had been unchanged for years and weren’t written in a way that was really financially beneficially to the actors and stage managers working on them. Equity negotiated with producers for two years to no avail until calling a strike. #notalabrat

The strike worked. Better terms were reached for lab contracts.

America as a whole has been moving away from unions, with membership peaking at almost 35% in 1954 to approximately 11% today. This is kind of surprising because unions really are one of the most effective ways for a smaller group of employees or individuals to make big changes to their workplace. It’s less surprising because corporations and big business hate them and do what they can to get rid of them.

So back, to Equity – as you can see, it’s called the Actors’ Equity Association, so how did stage manager’s wind up there? AEA began in 1913, at a time when everyone was doing a little bit of everything and it wasn’t uncommon for the stage manager to also be an actor. In late 1919/early1920, the first arbitration about a closing date happened between an ASM and producer and Equity stepped in and supported with Assistant Stage Manager. Since then, stage managers have been noted specifically in Equity documents.

One interesting thing about Equity is that it’s wildly difficult to join. While there are Equity Membership Candidate (EMC) point jobs, which allow non-union stage managers to gain experience, they aren’t always clearly marked when job postings are listed. You can find a full list of EMC theaters here.

Other than that, you join Equity by getting an Equity contract job – which are usually reserved for Equity members… you see the Catch-22 here.

But joining hurdle aside, what sort of finances do you need to join Equity?

If you go the Equity Membership Candidate route, you pay $200 when you join the program and then when you complete your 25 weeks**, you have up to five years to join the union.

**You can opt to continue in the EMC Program for an additional 25 weeks, if you’re not ready to join the Union at the end of the first 25 weeks.

You then pay the initiation fee. You have up to two years to pay the full fee, but you have to pay $400 of it immediately to access membership privileges.

Initiation Fee:

- 2019 – $1600

- Effective January 1, 2020 – $1700

- Effective January 1, 2022 – $1800

Deductions towards the initiation fee will come directly out of your salary on a prorated schedule you can find here until the balance is paid off.

If you join Equity through the EMC program, your $200 application fee to that program counts towards your initiation fee, as long as you join within the five years of gaining all your weeks.

On top of your Initiation Fee, you pay Basic Dues billed twice a year in May and November.

Basic Dues:

- 2019 – $172 total ($86 in May and November)

- 2020 – $174 total ($87 in May and November)

- 2021 – $176 total ($88 in May and November)

Then you pay your Working Dues – 2.5% of gross earnings under Equity contract.

And what does this get you?

Primarily, the ability to work on Equity contracts, but also…

Health Care

In the past, healthcare used to be one of the biggest draws to joining the union; however, keep in mind that the healthcare also has hurdles that you have to deal with.

So you’ve finally joined the union, you’re set on healthcare now, right? Especially since you’re paying all those dues and fees?

No.

To qualify for six months of healthcare coverage, you must work at least 11 weeks in 12 calendar months. To qualify for a full year of coverage, you have to work 19 weeks in 12 calendar months.

These weeks are evaluated at the end of each month and there is a two month waiting period before you coverage starts.

So, if you hit your 11th week in the middle of April, your weeks will be evaluated at the end of April (April 30th) and your coverage could start July 1st.

The nice thing is that it’s pretty cheap health coverage. You pay $100 per quarter (as of 2019) – so $400 for the year (Thanks for the updated info, Erin!).

There is an additional dental option you can add on that you do have to pay for. You are also able to add dependents for an additional cost.

The work weeks are a tricky thing because they seem very straightforward. You’ve joined the union. You will now work the Equity contracts.

The fact is that you are still competing against a lot of people for those jobs, so getting to your minimum weeks can be a real problem.

As a matter of fact, the biggest questionable hurdle of joining Equity, in my opinion, is if you choose to get your healthcare through them.

If you’re not worried about hitting your minimum number of weeks, you can make better employment choices. If you are worried about hitting your minimum number of weeks, you may wind up getting taking lower paying gigs than you usually would to make sure you get the weeks.

So, be super, super careful about hitching your healthcare wagon to the Equity post.

Some Equity jobs are great jobs, with long-term prospects, or a certain number of guaranteed weeks. In which case, go for it! That is a good time to look into Equity healthcare.

If you’re freelancing and struggling to make your weeks on a regular basis, alternatives like the healthcare marketplace or even medical sharing ministries are likely to be a wiser financial choice.

Now that we’ve dealt with the healthcare problem, let’s talk about two of the really great things Equity does.

401(k) Fund

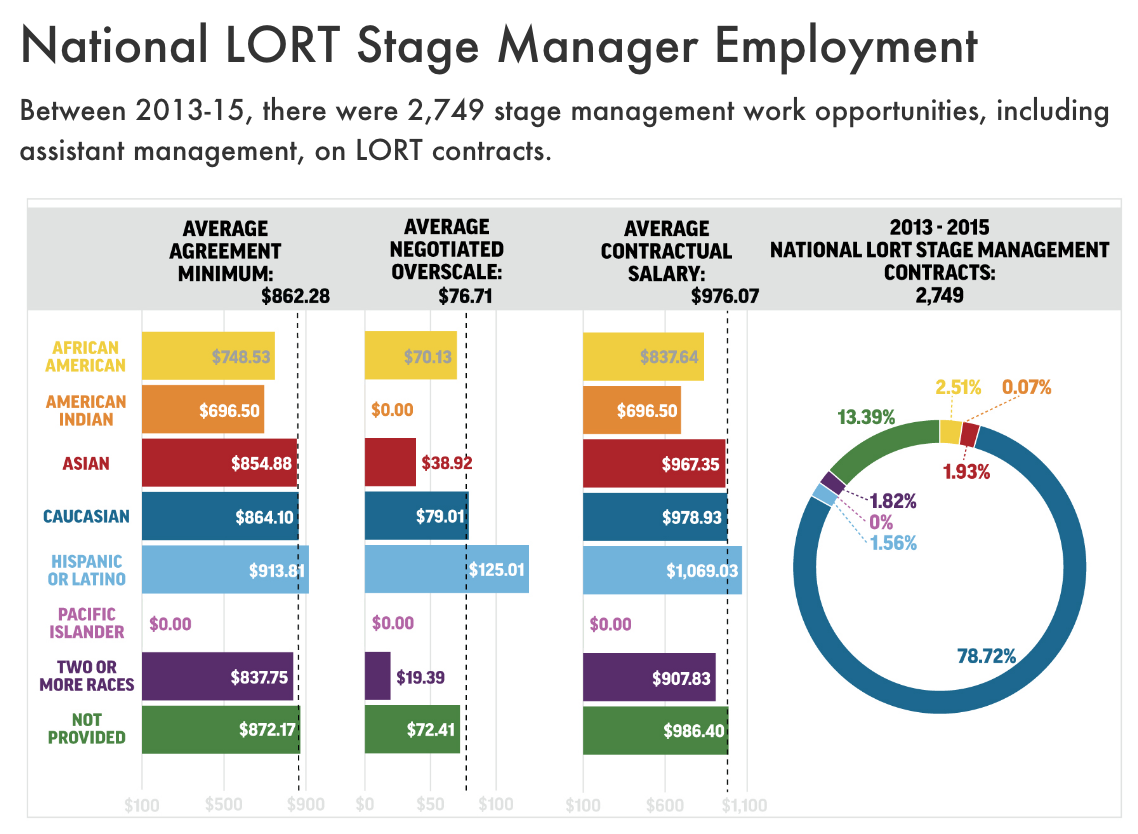

It has a 401(k) plan you can invest in. If you are at the very top tier of stage managing on Production/SETA Contracts, Disney’s Production Contracts, LORT, or WCLO Contracts, your employers contribute a certain percentage of your salary to your 401(k).

Most other contracts do not allow for employer contributions, but you can contribute to your 401(k) and you can do it as an automatic deduction from your paycheck, which doesn’t seem like a big thing, but one of the keys to financial success is to just automate as much as you can.

You can learn more about Equity’s 401(k) program here.

Pension Fund

Equity also provides you with access to a pension fund after a certain number of years with a certain amount of weeks worked each year.

Pensions are amazing and make accounting for your retirementsomuch easier. You can read more about the pension here.

But how about actual work?

As I mentioned above, joining Equity gets you the ability to work on Equity contracts.

If you love plays and musical theater, the best theaters in the country producing the stuff are Equity theaters.

I would also say that a lot of the best stage managers in the business are Equity – especially in those two fields. At the Broadway level, I haven’t met a stage manager yet who isn’t freaking incredible.

Again, though, this is one of the major areas of consideration that you have to stop and think about.

If you come right out of college and onto an Equity job, with no other work experiences or network, you might really struggle to get a second Equity contract when that first one ends.

You will not be allowed to work non-Equity jobs in the theatrical field.

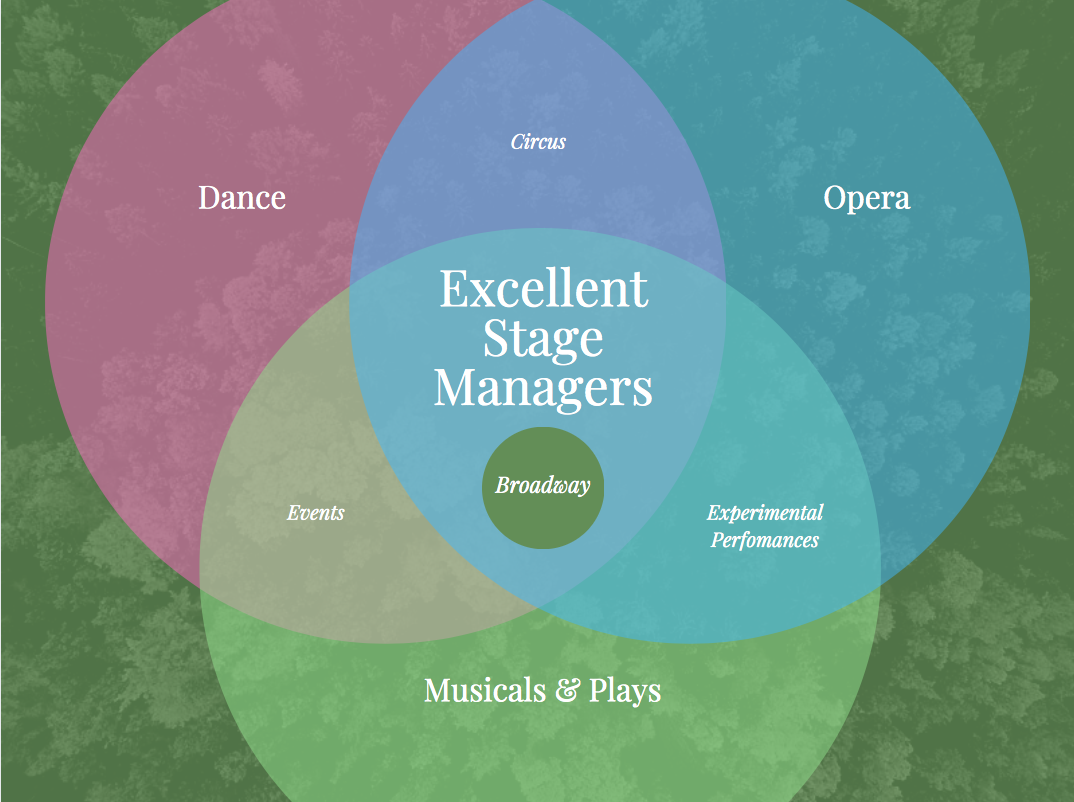

If you’re hellbent on joining Equity, it can really be to your benefit to spend a little while building up a network in areas that are outside Equity jurisdiction like:

- Circus

- Dance

- Events

- Opera

- (Some) Cruise Ships

Having a network you can use in those areas when you can’t find Equity work can keep you afloat financially and keep you in good standing with the union.

If you’ve been working for a while in the non-union world of plays and musicals, your network becomes a lot less useful. Yes, some people you know will have connections in both worlds, but it can be a difficult transition.

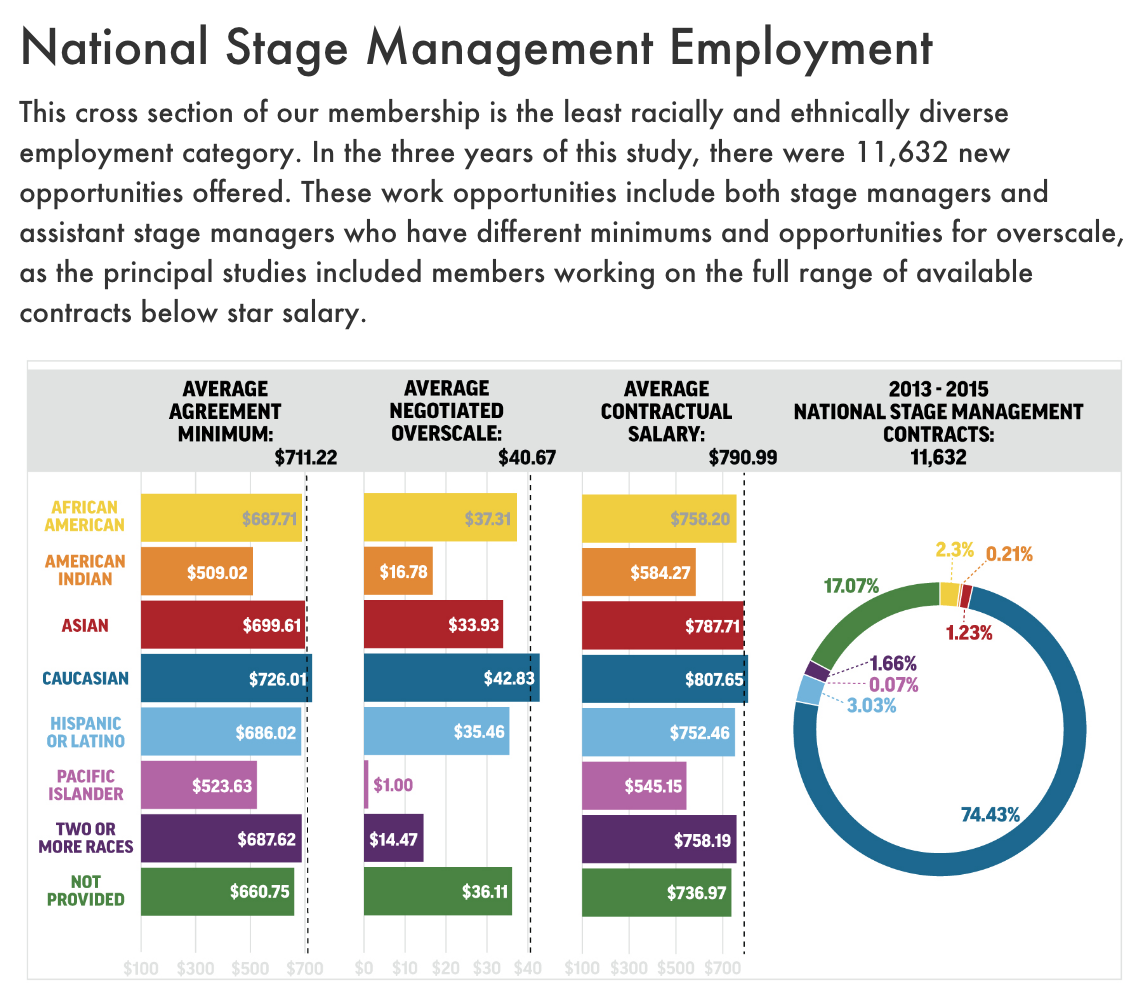

Equity wrote up this great report on a diversity study that you can find here. In it you can see the national wage average and the LORT average for folks in the union (broken down by ethnicity).

I found these wages interesting because they are okay, and better than a lot of stage management wages, but personally, I expected a much larger gap between what I make as a non-union stage manager and what the union stage managers are making.

Even in the non-union world I’ve largely fallen into the same or better wage averages (though we’ll discuss another point in Equity’s favor that relates to this after we get past just wages).

That being said, if you make it to the very top, Broadway stage managers make a minimum of $3,342 a week for musicals or $2,872 for plays. Keep in mind there are 41 Broadway theaters and a varying number of national tours out on Broadway contracts at any time.

The folks making that much money are a small pool of union members.

I honestly think the EMC program is one of the best ways to join Equity because you can build some of those networking connections across several Equity theaters before being restricted to only working for them.

This also brings me to Equity Showcase Codes.

The idea is that it can only be used for showcasing some of a performers talents in an effort to get more work in a theater with less than 99 seats. It has no minimum salaries and no union protections.

It does not count towards your health weeks and is usually wildly underpaid.

How is this financially sustainable for you? It’s probably not.

Ideally, the showcase codes operate as intended and are not abused at all. In reality, they are abused like crazy. So, be wary when you see that denotation on your Equity show. I wouldn’t surprise me if Equity Showcase Codes were largely responsible for dragging those average Equity wages down in the graphs above.

Workplace Protection

One area where Equity gets a win though is in workplace protections.

I’ve been lucky to work a lot of well paying non-union gigs but sometimes that well paying job had 20 hour work days, or work for seven days a week for weeks on end with no extra pay, or I’m actually doing my job, the prop guys job, stagehand work, and ushering.

The only person who can limit what I have to do in these jobs is me – and if I speak up, maybe I’ll just be replaced.

This isn’t true of every company I’ve worked for, but theater certainly does take advantage of us a lot.

If you join Equity, there are restrictions on job duties you can be asked to perform (especially without additional compensation). There are required break and meal times. There are span of day limitations.

These might not sound like much, especially if you’re younger and just bursting with energy, but they are a big deal.

Like many unions, these wins that Equity negotiates on a regular basis do sometimes trickle into the non-union world. We all agree it’s generally unreasonable to think you shouldn’t schedule a meal break into an eight-hour rehearsal day, even if it’s not contractually required.

The nice thing about Equity is that the stage manager has to get the same break. As all of us non-Equity folks know, there is a good chance your director, designers, performers, literally everyone under the sun will keep talking to you and need things from you during breaks.

I can’t even begin to tell you how many non-union production meetings I’ve done during “meal breaks”.

You also have somewhere to complain to if you feel you are in an unsafe working environment, as opposed to non-union gigs where it can be less clear about who and where to file complaint.

NOTE: Depending on what the complaint is and it’s severity, you can always report harassment to the police and unsafe working conditions to OSHA. It doesn’t matter if you are in a union or not.

You DO pay for your Health Insurance. $100 per quarter, plus any dental plan chosen.

LORT and WCLO employers do NOT contribute to the 401K, although the member can divert pre-tax salary to their 401K on those contracts.

Thanks, Ruth! Another member reached out to me about the health care too.

That’s interesting about the 401k, because I thought that, but the link I have from the Equity League 401k has LORT and WCLO listed under Salary Deferral and Employer Contributions, so perhaps they can but don’t? I’ll see if I can find out more and update the info when I hear back.