And the major pain in the butt it takes to get there.

In my life before being a personal finance blogger, I had one brick and mortar bank account that I opened when I started college, an online bank that held 99% of my money, a single savings account and two credit cards – the first card I ever opened and a rewards card. I also had an IRA.

This was pretty easy to keep track of.

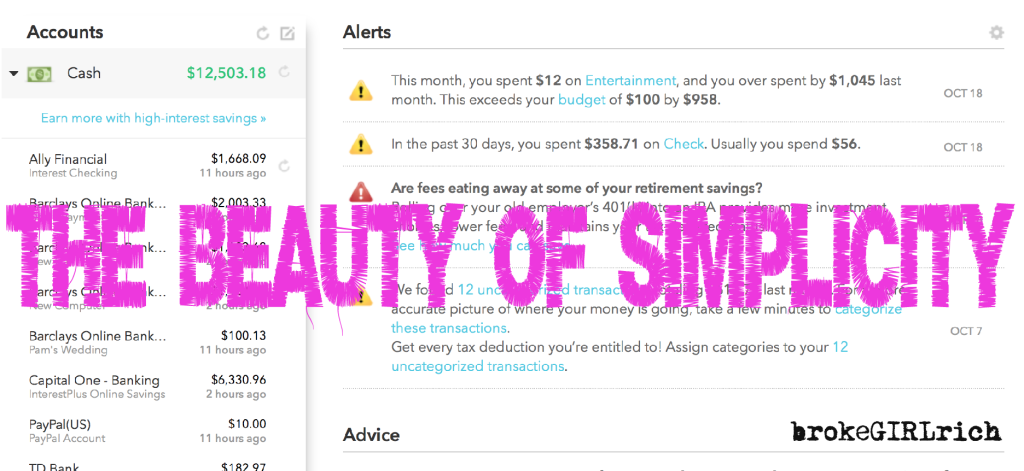

These days I have a dozen credit cards, half a dozen bank accounts and 4 different investment firm accounts.

It’s a bit much. And by a bit much I mean completely overwhelming at times. Many of those things were conscious choices to churn the heck out of some rewards, but I’ve been more and more interested in cutting back to a more tolerable quantity of things to keep track of.

So today I’m crowd sourcing a little – what are your favorite banks? I’m currently torn between keeping TD Bank as a backup, just in case I need to be able to walk into a building and get something bank, and then either Ally or Barclays as my main bank. Ally has been my bank for about 7 years and I really love them, but I’ve got most of my savings accounts over at Barclays and they make it extremely easy to split my savings into different goals and keep track that way. I’m not sure I can give that up.

As for investments, my IRA is over at Fidelity, so I think I’m going to transfer all of my stocks over to them – anyone have any bad experiences with this before that I should be aware of? I also bulk buy stocks only when I have more than $1,000 to invest, so if their trading fee is slightly higher than ShareBuilder, I can still live with it.

Has anyone else really pared down their accounts before? Is there a great bank I’m overlooking that I should consider instead?

I’m crushing on credit unions right now. Both PenFed and CapEd have awesome interest/dividend bearing accounts that anyone can open.

FF recently posted…Why All Women Need Life Insurance

I know the overwhelming feeling you get from having to deal with a lot of accounts. I had six savings accounts, 2 credit cards and 2 investment/pension accounts. Now I have 3 accounts, 2 credit cards and 1 investment/pension account. It is a lot easier to manage now that I have close a few accounts and I think I might close one more savings.

Sylvia @Professioal Girl on the Go recently posted…Net Worth Update: Quarter Three

Definitely – it’s been worth it for all the churning rewards, but it can really start to feel like a bit much sometimes.

For regular bank accounts, I keep things pretty straightforward…1 brick and mortar checking, 1 online savings. IRA’s on the other hand are wherever the rate was best at the time of renewal. And credit cards…well, I practically have a full deck!

Gary @ Super Saving Tips recently posted…Small Is the New Big – Why Bigger Isn’t Always Better

We keep all our personal checking/savings accounts at our local credit union, although after listening to Gary’s woes I’m second guessing that decision. Credit cards are with a couple of national banks. Investments are mostly at Vanguard, except for what I inherited from my mom, which is still with her old broker at Merrill Lynch (I like him). I love Vanguard, but Fidelity would be my next choice.

Emily @ JohnJaneDoe recently posted…Would I Buy It Now? How Stockholders Should Treat Merger News

My mother bless her always kept two different accounts one at a credit union and one at a bank. I guess she felt if one had problems she would have the other. Might be something to consider. The simpler the better although the rewards are nice!

Vickie@Vickie’s Kitchen and Garden recently posted…My Frugal Ways this Past week,What Was On the Dinner Table and My Goals for the Week 10/30/16!