The is a sponsored post. Please be aware that I have been compensated for this post, but all opinions are my own.

SAVVI Financial Review | brokeGIRLrich

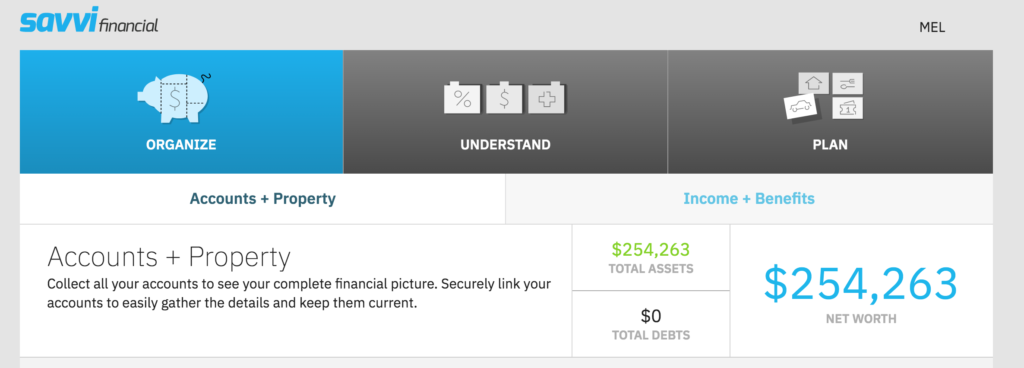

How often do I rave about the fact that tracking my net worth has made a major difference in my finances?

Well, if it’s been a while, tracking my net worth has made a major difference in my finances!

While I stick with the old fashioned excel sheet way, there are some really awesome tools out that there streamline the whole process and make tracking your net worth a breeze.

Today, let’s check out one of the newer ones – SAVVI Financial.

CONS

SAVVI did have some trouble with a few of my accounts. It struggled to link in my Fidelity accounts and my 401(k) through ADP, which is a solid 25% of my net worth between my Roth IRA and SEP 401(k). The option to connect to both Fidelity and ADP is in the system, I just needed some help through SAVVI’s online chat to work out some connectivity issues.

I was able to add it manually, but that sort of defeats the purpose.

I wish I could combine some accounts – for example, my Barclays savings account is split into several subsavings accounts for different goals, but when I’m just checking my net worth, I wish it would combine into one number, and then maybe I could select a way to expand that bar to see each of the account breakdowns.

PROS

SAVVI easily links to a lot of banks and financial institutions.

I like how it subdivides the different credits and debits so clearly.

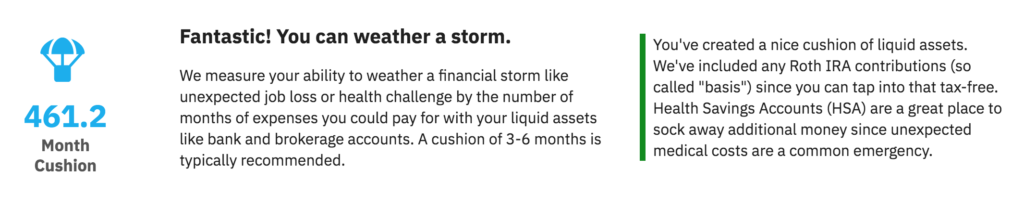

I like that it has a spot for HSAs and FSAs.

It lets you set a few savings goals and then sends you a plan to help you reach them.

For you married folks out there – a cool thing about SAVVI is that it can link up your household, so you and your spouse can track your individual and combined finances using this site.

SAVVI also provides some advice that is “tax-smart,” meaning it includes information from current tax codes in it’s advice, so it asks you a lot of questions about dependents and home ownership to make sure you’re making the best possible tax decisions too.

That was unexpected. And will change quickly if I ever actually buy a house.

I also liked the question about if you use savings accounts to pay some bills – since I pay some bills annually, I do, since I save for them the rest of the year. SAVVI had a way to balance the bank accounts I allocate for those things as those expenses, versus being straight savings accounts.

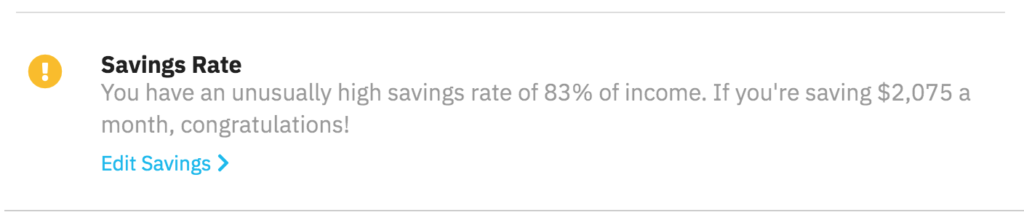

It has some really fun tools that help you understand and track your money even better after you get all the information entered. I really liked the Big Picture section and the Insights were fun. As someone who is currently living at my dad’s with a decent job, I laughed at my stat breakdown and the fact that it kept double and triple checking that I was entering numbers right because apparently 83% in pretty darn high savings rate.

So why would this site help you out for free? Well, there are lots of ads for things you might be in the market for soon – like mortgages, student loans, debt consolidation companies, etc.

I don’t actually think this is the worst thing, because if you’ve entered your numbers accurately, they might be genuinely useful services. That being said, take it with a grain of salt as SAVVI is likely getting a kickback whenever you use one of those services. Check prices with a few similar companies too before just going with the SAVVI suggestions.

That being said, a lot of the companies and products advertised on there were legit companies that I easily recognize from my own time in the PFsphere, so if that’s how SAVVI is funding their tool, it’s well on it’s way to a win-win for everyone.