Resetting on Travel Hacking | brokeGIRLrich

Guys, I love travel hacking.

It is absolutely not for everyone, but if you pay off your credit card balance every month (like, every. single. month.) then it might be awesome for you too.

Travel rewards cards often have astronomic interest rates. If you miss a single monthly payment, it’s not impossible you can knock out all the benefits you get from the card with one or two interest payments.

For the last several years, since I started travel hacking with my FinCon ’14 trip, I’ve pretty much always had a rewards card I’ve been working on churning.

When you churn a card, you use it until you hit the max spend for the bonus points, use the bonus points, and close the card. Then you start over with a new card.

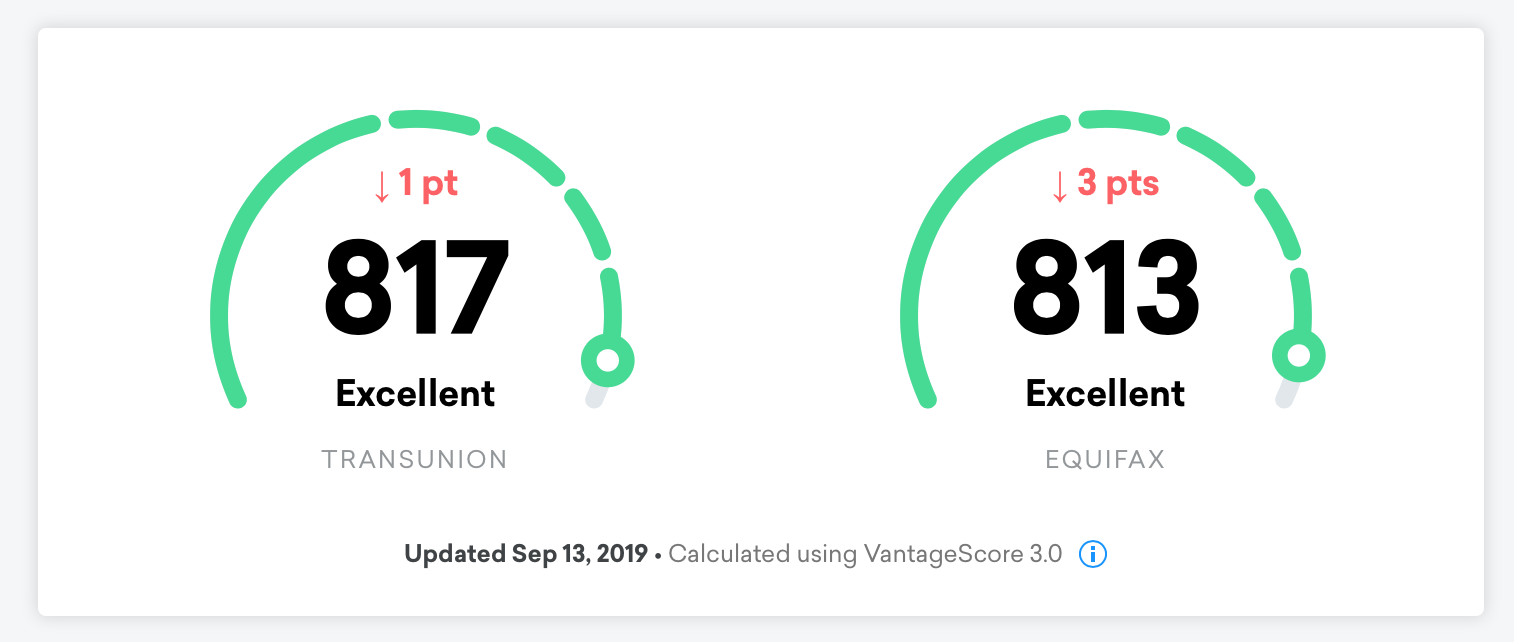

When I started travel hacking in 2014, my credit score was in the 750-775 area. Even with all the credit card opening and closings, my score is over 800 now.

Almost every time I opened a new card, my score would actually go up because despite the little knock from the credit inquiry, I would get a bigger boost for my even lower credit optimization and my overall credit available.

Over the years, I’ve saved money going to New Orleans twice, Hawaii, Iceland, two trips to Universal Studios, Las Vegas, and Montreal. I’ve also occasionally just racked up some cash rewards that helped me squeak through some tougher times like the unemployment winter/spring of 2017.

On a few occasions, I’ve forgotten to cancel in time and had to pay an annual fee, but for the most part, I’ve made way more money than I’ve lost in my hacking days.

And honestly, it’s made a world of difference during some tighter times. I’m really not sure I could’ve sprung for Hawaii without the careful travel hacking plans.

But lately, I’ve been feeling a little overwhelmed by the whole thing. I’m thinking J. Money might be on to something over at Budgets Are Sexy with the whole simplifying his finances idea.

I’ve also found during the course of five years of hacking, some cards I was able to reopen again two or three years later and get the same awesome bonus.

So I’m heading on a credit card purge. My goal is to cancel them all except my oldest card (I opened it during orientation week in college!), a card I use only for work stuff and a personal card.

I’ve been using my no fee Cash Forward Barclaycard as my default card for a while now and been pretty happy with it, but if I’m dropping down to one card, and considering how much I travel, I might be willing to pay an annual fee for a card that comes with enough perks.

Pingback: Activities To Do In The Countryside! - brokeGIRLrich