**This post contains affiliate links to some cool services that help you save money.**

Question Your Bills

Once upon a time, in a far away land of New York City, I lived in a tiny, tiny apartment that felt like a mansion after moving there from living on a circus train.

When I was out on that circus train, I had a mobile WiFi hotspot I used to connect to the internet.

When I moved to the apartment in NYC, I suddenly found I had a lot of other, cheaper options to get internet, and so I called to cancel my little hotspot.

And they offered me a much cheaper deal for the next three months to reconsider.

And so, for three months I did, and at the end of that time, I called again to cancel, and they extended the much cheaper deal again.

I did this for nearly a full year before they said they couldn’t anymore – and by that time I was back out on tour again any way and using free hotel internet.

But the moral of the story is, calling your service providers can save you money. Noticeably large portions of money, if you’re really cash strapped.

Now, if you’re super cash strapped and you can find a little time, I recommend taking on this task yourself, setting aside like two hours one day, and calling all your utility providers and telling them you’re thinking about switching to different providers because you found a better deal and see if they can offer anything better than what you’re currently paying.

It’s really easy but a lot of people don’t do it because they’ve either never thought to just ask to pay less or, ya know, personally, I freaking hate making telephone calls.

If you’re not in major crunch mode, but think, who doesn’t love more money? There are actually some companies out there now that do the negotiating for you and their pay is a percentage of what they negotiated on your behalf.

This is literally the five minute version of all the phone calls. If you only have maybe one or two negotiable bills, it might not be for you, but if you’re just getting started on your personal finance journey and have a lot of different utilities and subscription services, you might really benefit from giving them a go.

BillShark lets you use their website to enter your provider and current bill amount and will estimate your savings before you even sign up with their service. The most common bills they can slash are internet, mobile phone, cable TV, satellite radio and home security.

Now, keep in mind, BillShark takes a hefty chunk of your savings – 40% – but if you know you’re the type that just isn’t going to make these phone calls, 60% of savings is better than none, with almost no effort on your part.

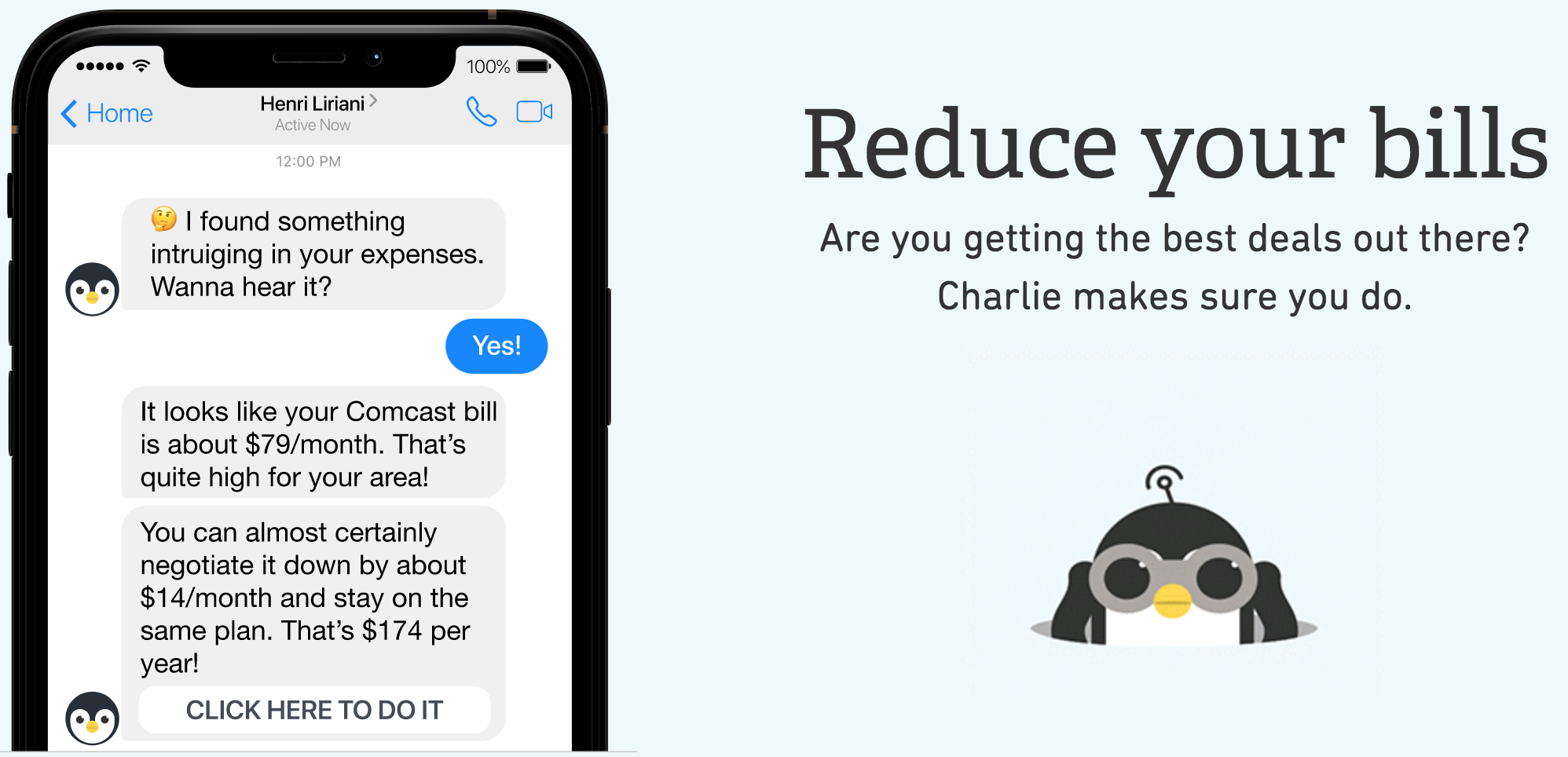

Another company you can use to slash your bills is Charlie – the “money saving prodigy penguin” (I mean, he is pretty cute).

Charlie works through your phone. You decide how much info you want to share with him and from there Charlie makes suggestions about how your can save money on certain bills, sends you warnings before you overdraft, and helps your set and achieve savings goals.

The best thing about Charlie is that it’s free, so you don’t lose anything giving him a try. On the flip side, you are also supplying banking and credit card info to him, so you always want to be careful there. The security measures Charlie uses are on par with other banking and financial services online, but there is always that risk of the company getting hacked that you should be aware of.

Personally, **knock on wood**, I’ve used and tested quite a few different online services like Charlie with no issues yet and I am comfortable with their security standards.

At any rate, the key takeaway here is that it never hurts to question the prices of some things that you might think are “fixed” costs. A lot more can be negotiated than we sometimes suspect.

And if you’re not comfortable doing the questioning yourself, there are some great companies like BillShark and Charlie that can do the questioning for you.