**This post contains affiliate links.**

Qoins: For Tackling Your Debt | brokeGIRLrich

I stepped up my side hustling game 100% when I was paying off my student loans.

I’ve actually had a substantial chunk of debt twice. When I was finishing up my first set of Master’s degrees, the 2008 recession hit and it really hit my family pretty hard. I was totally spoiled and yes, mom and dad did pay for grad school and my rent back then.

I think they took a clever approach to it though – every month I had to ask for the money. I know that doesn’t sound like much, and I know how lucky I am, but I hated asking.

I hated asking even more when I figured out that my dad wasn’t really working much, because it turns out folks often put off home renovations during recessions. So I started working at Nationwide Insurance agency. I passionately hated it, but thanks to some amazing scholarships and a fairly low tuition rate anyway (and the fact that my rent – with two other roommates in a two bedroom apartment – was $195/month – which still makes me shake my head in awe), I was able to stop asking them for money. But I did graduate with about $9,000 in credit card debt.

The second time I went into debt was to go back to school again but I left with debt to the tune of $30,000 that included a large, interest-free family member loan, a Sallie Mae loan, and another chunk of credit card debt. That was the debt that really changed my outlook on money, took years to pay off, and started my personal finance revolution.

I hustled hard to get rid of that sucker on a salary around $30k a year for the entire time I was paying it off – two and a half years.

I learned every little bit helps – both because literally, every cent helps, and mentally, every little thing you do helps you keep focus and feel like you’re moving forward on the debt repayment journey.

I’ve used three automated “saving” services in the past. Digit and dobot both analyzed my spending patterns and would automatically deduct small amounts from my bank account that they swore I wouldn’t notice.

They were right – even with my wildly varied income, whatever algorithm they use was spot on. I would up saving close to $3,000 with the combination of the two apps over two years, without even noticing.

Acorns is an investing app that linked to some of my credit cards and would round up purchases to the nearest dollar, take that extra change, and invest it. Another pain-free way to add to my net worth. The Acorns amount wasn’t nearly as staggering as the digit and dobot amounts, but it was still a decent chunk of change.

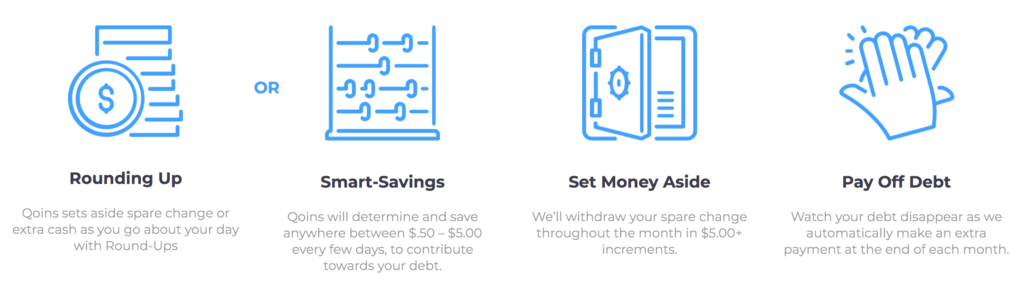

Qoins combined these technologies – which you can pick between – and uses them to apply payments to your debts.

How Qoins Works

The only kicker is that it costs $1.99 every time a debt repayment is sent, which is deducted right from the amount you’ve saved. The app sends out a debt repayment once per month.

If you need to put things on hold for a while, it’s easy to pause Qoins for 30 day intervals. They’ll send you a reminder when it’s about to kick in again.

I can honestly say that if I was still dealing with any debt, I’d sign up for Qoins without a second thought. The crazy savings power that I experienced through digit and dobot being applied to any of my debts would’ve been worth $1.99 a month.